Capturing Trigger Swaption Trades

A Trigger Swaption is an option on a swap that you can exercise on the exercise date if the trigger index rate is above (or below) the trigger rate. There are two types:

| • | Right to Pay (RTP) — a swap where the buyer pays a fixed interest rate when the trigger index rate exceeds the exercise price. |

| • | Right to Receive (RTR) — a swap where the buyer receives a fixed interest rate when the trigger index rate declines below the exercise price. |

Choose Trade > Interest Rates > Trigger Swaption to open the Trigger Swaption worksheet, from the Calypso Navigator or from the Trade Blotter.

| » | Enter trigger details as described below. |

| » | Then enter more trade details as described in Capturing Swaption Trades. |

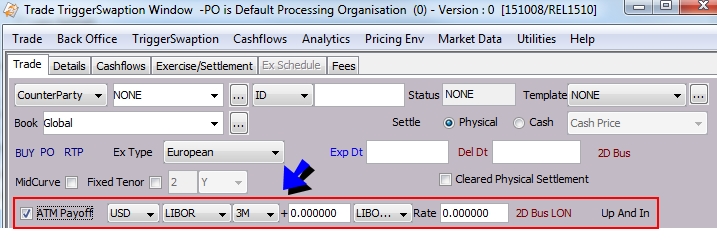

Trigger Details

![]()

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

ATM Payoff |

Check if the swaption should be exercised, if on the exercise date the index rate is equal to the trigger rate. Uncheck otherwise. |

||||||

|

Index |

Enter the index used on the exercise date to compare with the trigger rate. Note that it may be different from the floating index on the underlying swap. The rate index details include the currency, index name, tenor, spread, and source. |

||||||

|

Rate |

Enter the trigger rate. |

||||||

|

Reset Lag |

Double-click the red lag details to enter the offset and holidays. |

||||||

|

Exercise Labels |

The trade worksheet displays the type of exercise according to the following criteria:

|