Capturing Equity Structured Option Trades

An Option is an agreement between two parties to exchange one or more fees based on a Payout Type. The Payout formula typically refers to Underlyings. For example, an option pays out $2 if a particular equity is above a specified level.

To enter an option, the user must provide the following details:

| • | Payout – The desired Payout Type. The Payout Type corresponds to a Payout Formula, which determines the amount and the number of fees. |

| • | Underlying – The Payoff Formula is based upon the underlying instruments, including baskets. |

| • | Expiration Date – The Option expires or has its final Payout on this date. |

The Equity Structured Option Trade Window allows the user to capture trade details for numerous Equity Option Payout types. The available Payout Types are:

| • | Vanilla – Gives the buyer the right, but not the obligation, to buy or sell an equity or equity index at a fixed price on or before a specified date. There are several variations of the Vanilla option. |

| • | Asian/Lookback – An Asian Strike and Rate option, or Asian In and Out, is one where the Strike and/or Final reference level of the option is the average of one or more fixing dates. |

| • | Barrier (Single/Double Barrier, Full/Partial/At Expiry Window, with/without Rebates) – Barrier (or Knock) options are standard options whose value depends on whether a certain barrier is reached. |

| • | Chooser – The Chooser Payoff allows the holder to choose whether to enter into one of two possible options on the Expiration Date. |

| • | Cliquet – A Cliquet is a multi-period option with a single payoff at maturity. |

| • | Compound – An Equity Compound Option is an option on a simple option (which is the underlying). |

| • | Digital (Cash or Asset) – Payout for a Digital is pre-determined at the beginning of the contract and is paid according to whether the spot level is achieved (or not achieved). |

| • | Forex – Trades where the Trade Currency and Settlement Currency are different. |

| • | Performance – Rainbow, Best Of and Worst Of structures are not supported in the Equity Structured Option Trade window. Please use the Pricing Script to model these structures. |

See Pricing Script Examples for details.

See Pricing Script Examples for details.

| • | Structured Vanilla – A Structured Vanilla trade allows the user to create a vanilla trade using features from Forex, Digitial, Asian, Lookback, and Barriers. |

Choose Trade > Equity > Equity Structured Option to open the Equity Structured Option worksheet, from Calypso Navigator or from the Trade Blotter.

|

Equity Structured Option Quick Reference

When you open a worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel. Choose a Payout type. Your choice of Payout determines which panes the application displays in the Payout Parameter area on the right-hand side of the trade window. The application only displays the panes applicable to the style of payout you have selected. Note that the Trade Configuration, Underlying Details, and Trade Settlement panes are common to all Payout types.

Saving a Trade

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. Once saved, a description appears in the title bar of the trade worksheet, a Trade ID is assigned to the trade, and the status of the trade is modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle Equity – Equity Index

You can fix prices that are specific to the current trade only in the Resets tab.

|

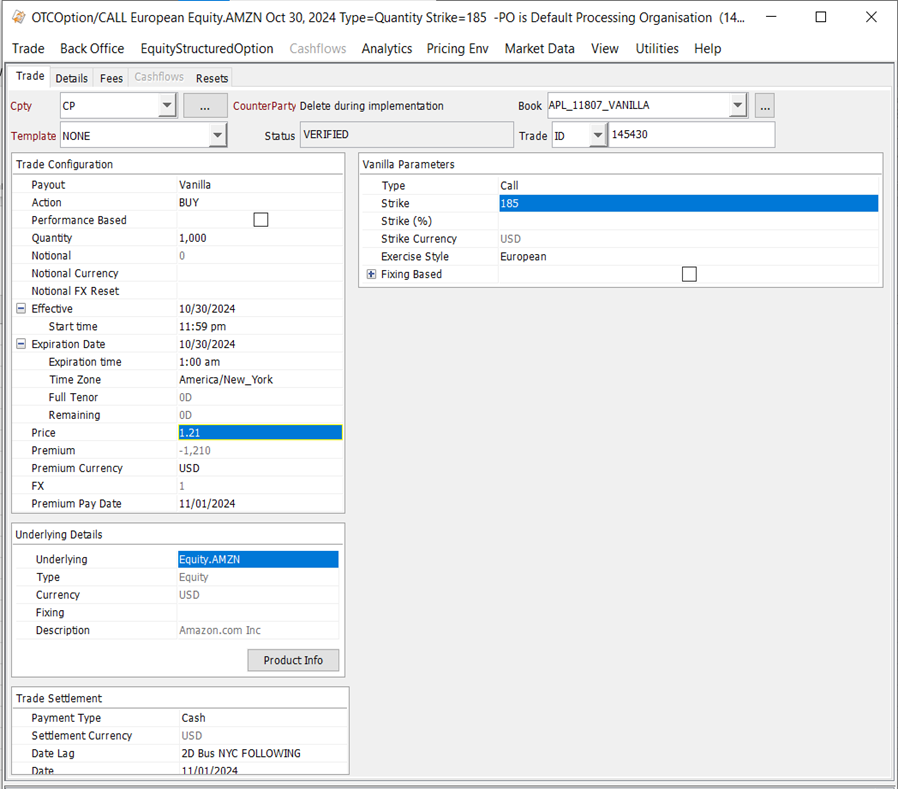

1. Sample Vanilla Equity Structured Option

Equity Structured Option Trade Window - Sample Vanilla Trade

| » | Enter the fields described below as needed. |

1.1 Fields Details

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. The dates will be saved as relative in the trade templates only if the dates are entered as tenors. Effective Date should be a tenor compared to the valuation date. Expiration Date should be a tenor compared to the effective date. Premium Pay Date should be a tenor compared to the effective date. Trade settlement date should be a tenor compared to the expiration date (defined in trade settlement date lag). An automatic roll will be applied on the Effective Date, Expiration Date and Premium Pay Date. The roll convention will be set as FOLLOWING in the trade template. Effective Date and Expiration Date will use the calendar of the Exchange. Premium Pay Date will use the calendar of the underlying currency. |

Trade Configuration

| Fields | Description | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Payout |

Select the Payout. Based on the payout, you will be prompted to select additional details.

|

|||||||||||||||||||||||||||

|

Action |

Select BUY or SELL from the perspective of the processing org. |

|||||||||||||||||||||||||||

|

Performance Based |

The amount of an option can be represented in units of underlying (Quantity) or Notional. Check "Performance Based" to specify the amount in notional, or clear "Performance Based" to specify the amount in quantity. |

|||||||||||||||||||||||||||

|

Quantity |

Enter the number of shares for a non performance-based trade. |

|||||||||||||||||||||||||||

|

Notional |

Enter the notional for a performance-based trade. |

|||||||||||||||||||||||||||

|

Notional Currency |

Select the notional currency for a performance-based trade. |

|||||||||||||||||||||||||||

|

Notional FX Reset |

Select the FX rate reset for a performance-based trade. FX rate resets are defined from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions. |

|||||||||||||||||||||||||||

|

Effective |

Enter the start date. Start time - Enter Start Time. The Effective Date and Time is in Expiry time zone. |

|||||||||||||||||||||||||||

|

Expiration Date |

Enter the last exercise date for American or Bermudan options, or the exercise date for European options. You can double-click the Expiration Date label to specify view additional parameters:

|

|||||||||||||||||||||||||||

|

Price |

Enter the option price in units or percentage. |

|||||||||||||||||||||||||||

|

Premium |

Displays the premium amount. It generates a fee of type PREMIUM by default. Otherwise, you can specify the type of the fee in the domain EquityStructuredOptionPremiumType. |

|||||||||||||||||||||||||||

|

Premium Currency |

Select the settlement currency of the premium. |

|||||||||||||||||||||||||||

|

FX |

Enter the FX rate if the premium settles in a different currency. |

|||||||||||||||||||||||||||

|

Premium Pay Date |

Select the payment date of the premium. |

Underlying Details

| Fields | Description |

|---|---|

|

Underlying |

Select the underlying: It can be an equity, an equity index or a basket. You can also type in the underlying's name. You cannot select a basket underlying for the payouts Chooser and Compound. Ⓘ [NOTE: A performance-based trade does not accept baskets weighted in quantity as underlying] Ⓘ [NOTE: Only baskets of equity and equity index are supported] You can click Product Info to view the details of the underlying. |

|

Type |

Displays the type of underlying. |

|

Currency |

Displays the currency of the underlying. |

|

Fixing Date Roll |

Choose a roll convention to be applied on basket components when defining the fixing date/s. The roll convention will be the same for all basket components but the Holiday of each component (defined on the Exchange level) will be respected separately. |

|

Fixing |

This field is no longer used. You can select an equity reset or set the fixing price in the Resets panel.

|

|

Description |

Displays the name of the underlying. For a basket, it displays the number of components in the basket. |

Trade Payment Details

| Fields | Description |

|---|---|

|

Payment Type |

Select whether the payment occurs in cash or physical delivery. Ⓘ [NOTE: Physical settlement on ESO with Basket or Equity Index underlying is not supported. Physical settlement on Performance based ESO with any type of underlying is not supported] |

|

Settlement Currency |

Displays the currency of the underlying equity, equity index or basket. |

|

Date Lag |

Specify the trade date lag for calculating the delivery date. The default value is 2 business days following the expiration date. To modify this value, click … to define the date lag adjustment. |

|

Date |

Displays the payment date for a European style option. You can modify as needed. |

|

Auto Exercise |

You can check the “Auto Exercise” checkbox if you want the option to be to automatically exercised when the AUTOMATIC_EXERCISE scheduled task is run and the option is in-the-money. |

Vanilla Details

| Fields | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Type |

Select the option type: PUT or CALL. |

|||||||||

|

Strike / Strike (%) |

Enter the strike price of the option in units. You can also enter a percentage of spot. |

|||||||||

|

Exercise Style |

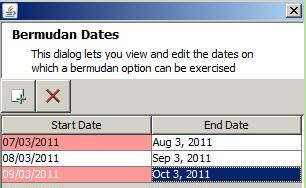

Select the exercise style.

You can enter the first exercise date in the First Ex Date field. It defaults to the effective date of the trade.

You can enter the exercise dates in the Bermudan Dates field. It brings up the Bermudan Dates dialog.

Click |

|||||||||

|

Fixing Based |

For a forward starting option. Check to specify the forward setting date of the spot price in the Fixing Date field. Forward Starting Option A Forward Starting Option begins in the future and expires on a date further in the future. The buyer receives a put or call option. Because the initial fixing price of the underlying is unknown at trade creation, the strike price is set in %. That strike price can set the option at the money initially, or some percentage in the money or out of the money. The absolute strike price becomes known when the option is activated (at Fixing Date). |

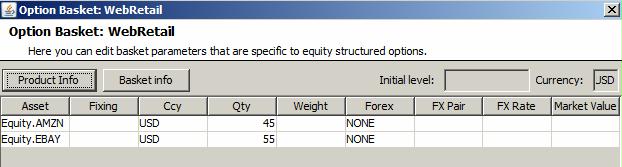

1.2 Basket Components

When you select a basket as the underlying instrument, you can click Product Info to view the basket components.

Ⓘ [NOTE: It is not possible to use a weighted basket as an underlying of a quantity based trade]

Ⓘ [NOTE: Only baskets of equity and equity index are supported]

Basket Components Details

| » | You can click Basket info to bring up the Basket Definition window - Help is available from that window. |

| » | You cannot set the fixing price for each component in this window. Please use the Resets tab instead. |

The fixing price is loaded from the market data if available. Otherwise, you can select the fixing type "Specific Reset" and set the fixing price in the Value field.

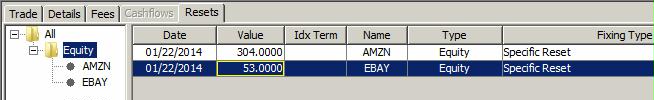

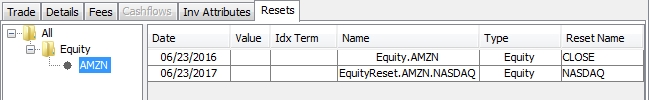

2. Resets Details

You can select the Resets panel to display Resets details for the various legs.

You can select an equity reset from the Reset Name field. The fixing quote should be set for the quote name in the form "EquityReset.<equity name>.<reset name>". If you do not select an equity reset, CLOSE is selected by default. The fixing quote is the spot quote in that case.

You can also select "Specific Reset" and enter a manual fixing quote in the Value field.

Equity resets are defined in the Equity Definition or Equity Index Definition.

It is recommended to use Equity Reset which would provide the correct Reset risk.

3. Option Exercise / Expiration

We recommend the following process for exercising / expiring options.

Ⓘ [NOTE: For Barrier options, you first need to process the barriers, as described in the Barrier Options documentation, prior to exercising / expiring the options]

See Barriers Processing for details.

See Barriers Processing for details.

Monitoring Exercise and Expiration

In order to monitor options for exercise and expiration, you need to run the Option Lifecycle analysis with the configuration "EQD.Exercise".

You can also refer to Calypso Option Lifecycle documentation for setup details.

You can also refer to Calypso Option Lifecycle documentation for setup details.

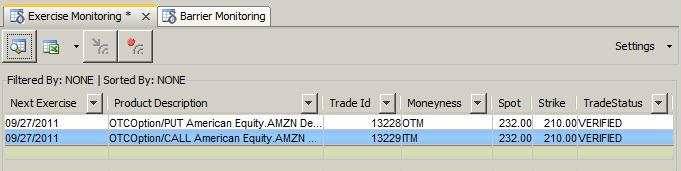

Sample Option Lifecycle analysis - Exercise Monitoring

In this example, the second option is in-the-money and can be exercised.

Processing Exercise and Expiration

You can right-click the trades you want to exercise / expire and choose Exercise / Expire as applicable.

If you want more control over the exercise process, you can also bring up the trades in the Option Exercise window and perform the exercise from there - Help is available from that window.

4. Messages and Confirmations

4.1 Confirmation messages

Calypso provides ISDA confirmation templates as defined in:

http://isda.org/publications/isdaequityderivdefconfir.aspx

The HTML Calypso templates can be configured in the Calypso Back Office system. (Message Configuration).

For Equity Structured Option confirmation messages, some message keywords allow displaying basket information.

Please refer to Calypso Message Templates documentation for details.

Please refer to Calypso Message Templates documentation for details.

4.2 Settlement messages

Calypso provides the ability to generate SWIFT messages for rate reset and pricing fixing, payment advices and order of payment with its existing Back Office configuration.

to add a date row then edit the start and end dates as needed. Repeat for each exercise date.

to add a date row then edit the start and end dates as needed. Repeat for each exercise date.