Capturing Forex Equity Structured Options

The purpose of Forex, or multi-currency, options is to allow trading on an underlying that is quoted in an underlying currency into a different settlement currency. Note that this also applies to baskets (the basket components can be quoted in a currency different from the basket currency). In the case of baskets, the settlement currency of the options is the basket currency. For Forex Quanto options, the FX rate applied in the payoff formula is fixed when entering the trade, i.e., FX0. Where FX0 is the fixed exchange rate between local and foreign currency, determined at trade entry. The strike is defined in the asset currency.

This applies to vanilla options, as well as to more exotic options, and for a given "payoff" we have the following payoff definitions for the equivalent quanto payoff, at maturity:

Forex payoff = (FX0 * payoff)

The user can choose either a Quanto, a Flexo, or a Compo FX treatment for trades whose Payoff Currency is not equal to the Underlying Currency:

| • | A Quanto trade uses a Fixed FX rate. This is defaulted to 1, but it can be set by the user. The Strike is denominated in the underlying currency. |

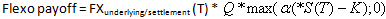

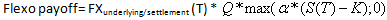

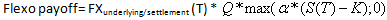

| • | A Flexo trade will convert the Payout from the Asset currency to the Settlement currency using the Prevailing FX Reset on the Expiration date. The Strike is denominated in the underlying currency. |

| • | A Compo trade will convert the Payout from the Asset currency to the Settlement currency using the Prevailing FX Reset on each fixing date. The Strike is denominated in the settlement currency: |

Forex is available as a standalone Option or as part of a Structured Vanilla option.

Choose Trade > Equity > Equity Structured Option to open the Equity Structured Option worksheet from Calypso Navigator or from the Trade Blotter.

| » | Select the Forex payout. |

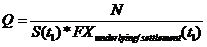

Equity Structured Option Trade Window - Sample Forex trade

See Capturing Equity Structured Options for general details.

See Capturing Equity Structured Options for general details.

Multi Currency Details

| » | Enter the fields described below as needed. |

| Fields | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Settlement Currency |

Select the settlement currency. |

|||||||||

|

Forex |

Select the type of FX rate you want to use if the settlement currency is different from the underlying currency:

For Baskets, it is the type of FX rate set at the component level. FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions. |

|||||||||

|

Fixed Rate |

Enter the fixed rate for a Quanto Forex, or select an FX Rate Definition for a Flexo Forex. |

The FX rate applied to the payoff formula is determined by payout type and flavors chosen:

| • | Flexo: where the foreign exchange rate applied in the payoff formula is floating, i.e., FXunderlying/settlement (T) |

| • | Quanto: where the FX rate applied in the payoff formula is fixed when entering the trade, i.e., FX0 |

| • | Compo: where the foreign exchange rate applied in the payoff formula is floating, i.e., FXunderlying/settlement (T) |

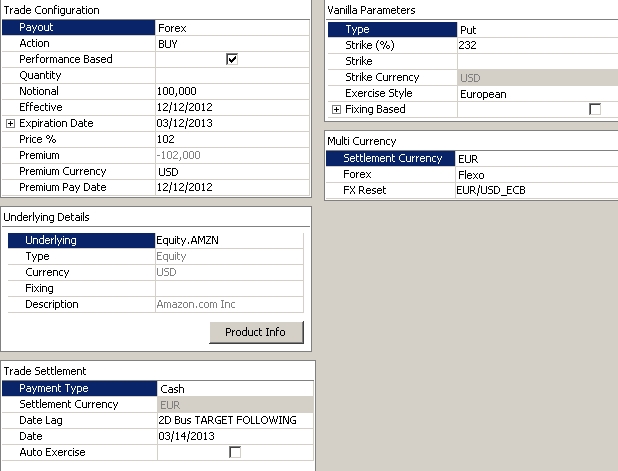

Quantity Based Trades

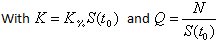

Non Forward Starting

Composite payoff =

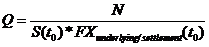

Forward Starting

with

Composite payoff =

with

Performance Based Trades

Non Forward Starting

Composite payoff =

and

and

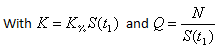

Forward Starting

Composite payoff =

and

and