Capturing Digital Equity Structured Options

The two types of Digital options are the cash-or-nothing and the asset-or-nothing. Payout for a Digital is pre-determined at the beginning of the contract. The cash-or-nothing option pays a fixed amount of cash if the option expires in-the-money, while an asset-or-nothing pays the value of the underlying security.

Digitals can be Cash or Physical. The processing for Digitals is a manual process where the user will Exercise or Expire them. If Physical, then a Stock Trade is created. If Cash, then a Fee is created.

Ⓘ [NOTE: Physical settlement is only supported on asset-or-nothing quantity based options with a single equity underlying - not an equity index or basket]

Choose Trade > Equity > Equity Structured Option to open the Equity Structured Option worksheet, from Calypso Navigator or from the Trade Blotter.

| » | Select the Digital payout. |

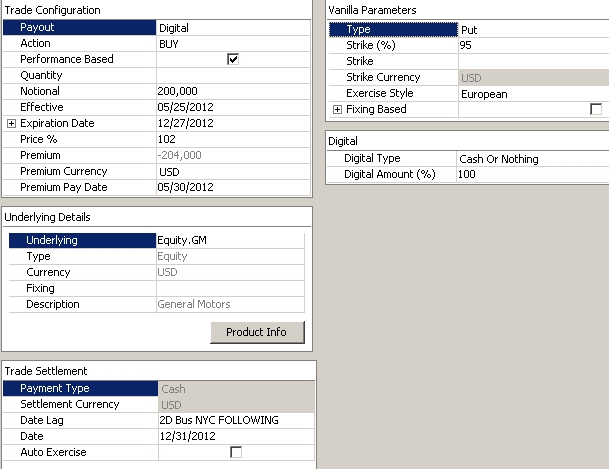

Equity Structured Option Trade Window - Sample Digital trade

See Capturing Equity Structured Options for general details.

See Capturing Equity Structured Options for general details.

Digital Details

| » | Enter the fields described below as needed. |

| Fields | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Digital Type |

Select the type of digital:

|

||||||||||||

|

Digital Amount / Digital Amount (%) |

Enter the payout quantity / percentage. |