Capturing Barrier Equity Structured Options

Barrier (or Knock) options are standard options whose value depends on whether a certain barrier is reached.

Options can be knocked-in or -out.

| • | "In" Barrier options are paid for today but first come into existence if the underlying price hits the barrier before expiration. |

| • | "Out" Barrier options begin as standard options except that the option is knocked out, or becomes worthless, if the barrier is hit. |

It is possible to include a previously specified cash rebate, which is paid out if an "In" option is never knocked in, or an "out" option is knocked out.

There are standard closed form pricing formulas for knock options whose knock window extends over the life of the knock. If the knock window extends over part of the life of the option, it must be calculated using a lattice or Monte Carlo.

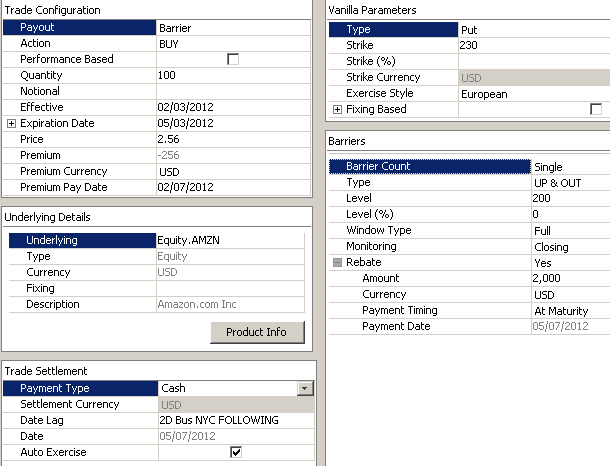

The following example illustrates the entry of an At The Money call option with a Knock Up and Out barrier of 120% of the Strike with a $15 rebate.

1. Trade Capture

Choose Trade > Equity > Equity Structured Option to open the Equity Structured Option worksheet, from Calypso Navigator or from the Trade Blotter.

| » | Select the Barrier payout. |

Equity Structured Option Trade Window - Sample Single Barrier trade

See Capturing Equity Structured Options for general details.

See Capturing Equity Structured Options for general details.

Barrier Details

| » | Select the Barrier Count: Single (single barrier upper or lower) or Double (upper and lower barrier). |

| » | Then enter the fields described below as needed. |

Single Barrier

| Fields | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Type |

Select the type of barrier: UP & IN, DOWN & IN, UP & OUT, DOWN & OUT.

|

||||||||||||

|

Level / Level (%) |

Enter the barrier level in price or percentage. In the case of Forward Starting Barrier option, the barrier can only be entered in percentage. |

Double Barrier

| Fields | Description |

|---|---|

|

Up Barrier Type |

Select the type of the upper barrier: In or Out. |

|

Upper Level / Upper Level (%) |

Enter the upper barrier level in price or percentage. |

|

Down Barrier Type |

Select the type of the lower barrier: In or Out. |

|

Lower Level / Lower Level (%) |

Enter the lower barrier level in price or percentage. |

Additional Fields

| Fields | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Window Type |

Select the type of barrier:

|

|||||||||

|

Monitoring |

Select the type of quote you want to use to monitor the barrier:

The barrier is hit if UP BARRIER < CLOSE or DOWN BARRIER > CLOSE.

The barrier is hit if UP BARRIER < HIGH or DOWN BARRIER > LOW. |

|||||||||

|

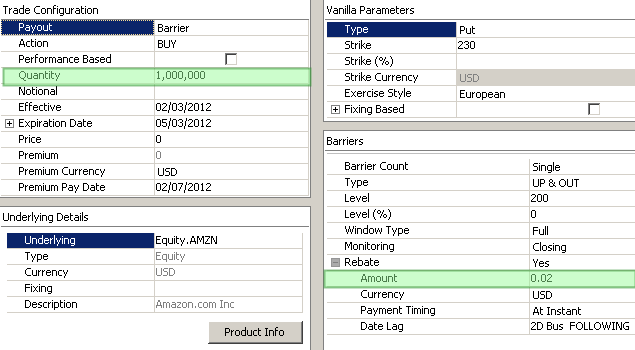

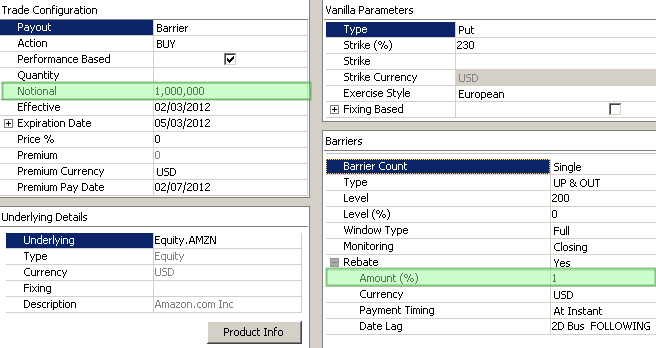

Rebate |

Select Yes if there is a rebate payout, or No otherwise. For quantity based options, the rebate fee is computed from the rebate unit amount and the quantity. The formula is "fee = unit amount * trade quantity". For performance based options, the rebate fee is computed from the rebate percentage and the notional. The formula is "fee = rebate percentage * trade notional / 100". If there is a rebate, you can set the following parameters:

For "At Instant", you can define a payment date lag. For "At Maturity", the payment date is displayed. |

Example: Calculating Quantity Based Option Rebate

In the example above, the rebate fee would be 1 million multiplied by 0.02.

Example: Calculating Performance Based Option Rebate

In the example above, the rebate fee would be 1 multiplied by 1 million divided by 100.

2. Barriers Processing

The process to knock-in / knock out equity derivatives barriers is a manual process.

We recommend the following process for processing barriers.

Exercise / expiration activity can be performed after processing the barriers, as applicable.

You can knock-in barriers manually of using the KNOCK_IN scheduled task.

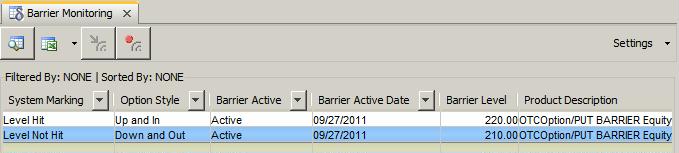

2.1 Monitoring Barriers

In order to monitor barriers, you need to run the Option Lifecycle analysis with the configuration "EQD.Barrier".

Ⓘ [NOTE: Make sure that the proper monitoring quotes are set based on the Monitoring type of the barrier]

You can also refer to Calypso Option Lifecycle documentation for setup details.

2.2 Manual Knock-in

You can load the trades you want to knock in the Trade Blotter, and apply the actions from there (recommended for bulk processing). Or you can apply the actions from the Option Exercise window.

Once the options are loaded in the Option Exercise window, the checkboxes Up Barrier Hit or Down Barrier Hit are checked based on the underlying's monitoring quotes.

Depending on the type of option (In or Out), you can knock-in / knock-out the barrier by applying the corresponding action.

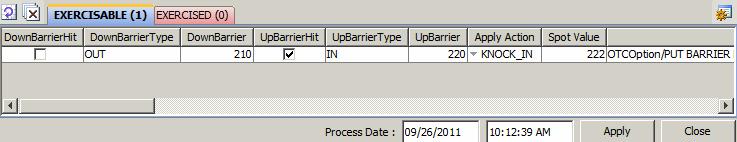

Option Exercise Window - Sample Knock-in

| » | Select the applicable action. |

| » | For a KI option , Create Underlying must be checked as well. |

| » | Then click Apply. |

Recommended Workflow Setup

|

Origin Status |

Action | Resulting Status | Rule | Comments |

|---|---|---|---|---|

|

KNOCKED_IN |

UN-KNOCK_IN |

VERIFIED |

UnexerciseOption |

Trade undo knock in. |

|

KNOCKED_IN |

UNEXERCISE |

VERIFIED |

UnexerciseOption |

|

|

KNOCKED_OUT |

UN-KNOCK_OUT |

VERIFIED |

UnexerciseOption |

Trade undo knock out. |

|

KNOCKED_OUT |

UNEXERCISE |

VERIFIED |

UnexerciseOption |

|

|

VERIFIED |

KNOCK_IN |

KNOCKED_IN |

|

|

|

VERIFIED |

KNOCK_OUT |

KNOCKED_OUT |

|

|

Processing Results

| • | The status of the trade on which the action is performed will be changed to the status associated with the action in the workflow. |

| • | A fee corresponding to the rebate is generated: |

| – | When a KO barrier is hit. |

| – | When a KI trade is expired without having been knocked-in. |

| • | For KI options, a trade is generated that has the same characteristics as the parent trade, expect it has no KI barrier, and the effective date of the trade equal to the event process date. All other trade attributes on the generated trades are the same as those on the parent trade: |

| – | Notional / Quantity |

| – | Underlying |

| – | Maturity |

| – | Strike |

| – | etc. |

| • | In addition, trade Termination keywords are populated on both the parent and child trades. |

| – | On the parent trade: |

| TerminationDate | Event Process Date |

| TerminationPayIntFlow | true |

| TerminationTradeDate | Event Process Date and Time |

| TerminationType | UpBarrierOUT / DownBarrierOUT / UpBarrierIN / DownBarrierIn |

| – | On the child trade: |

| ExercisedOption | Parent Trade_ID |

| TransferDate | Parent Trade Maturity Date |

| TransferFrom | Parent Trade_ID |

| TransferTradeDate | Parent Trade Maturity Date and Time |

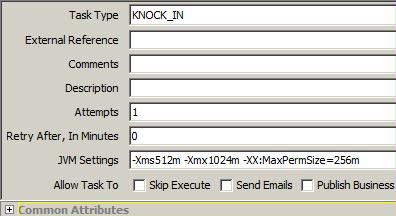

2.3 KNOCK_IN Scheduled Task

You can also knock-in barriers using the KNOCK_IN scheduled task.

Choose Calypso Navigator > Configuration > Scheduled Tasks and select the KNOCK_IN task type.

This scheduled task does not have any specific attributes. Select a trade filter as applicable, and schedule the task for execution.

If the trade has hit the KI level, the trade status changes from VERIFIED to KNOCKED_IN after the scheduled task has run.