Capturing Credit Default Swaption Trades

This document describes how to capture Credit Default Swaption trades using the Credit Default Swaption worksheet.

A credit default swaption is an option on a credit default swap.

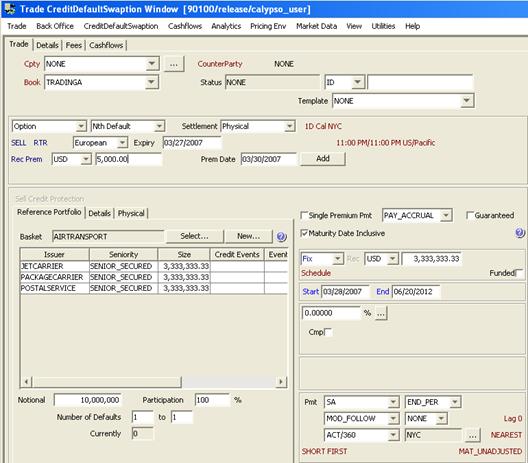

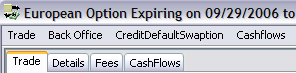

Choose Trade > Credit Derivatives > Credit Default Swaption to open the Credit Default Swaption worksheet, from Calypso Navigator or from the Trade Blotter.

|

Credit Default Swaption Quick Reference

When you open a Credit Default Swaption worksheet, the Trade panel is selected by default. Entering Trade Details

Enter trade details in the Trade panel. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. You can also hit F12 to save the trade using any action available in the workflow, or choose Trade > Save Action. You will be prompted to select an action. A description will appear in the title bar of the trade worksheet, a trade Id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

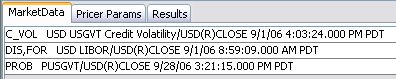

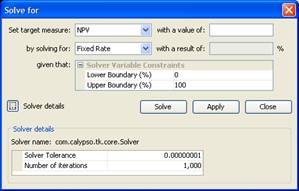

Select a target pricer measure and enter the target value. Then select the value to solve for (fixed rate, upfront fee, or notional), and click Solve. You can click Apply to set the value to solve for on the trade. Then click Price to obtain the target value. You can modify the solver variables and details as needed. Trade Lifecycle

|

1. Sample Credit Default Swaption Trade

| » | Enter option details in the Trade panel - They are described below. |

| » | The enter more trade details as described in the documents below, based on the CDS type: |

| – | Capturing CDS Trades for a Single Name credit default swaption. |

| – | Capturing CDS Nth Default Trades for a Nth Default credit default swaption. |

| – | Capturing CDS NthLoss Trades for a Nth Loss credit default swaption. |

2. Trade Panel - Fields Description

Option Details

|

Fields |

Description |

|---|---|

|

Trade Type |

Select the type of trade from the first field: Option, Extendible, or Cancellable. |

|

CDS Type |

Select the type of CDS from the adjacent field: Single Name, Nth Loss, or Nth Default. |

|

Fields |

Description |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Settlement |

Select the settlement type: Cash or Physical. |

|||||||||

|

1D Bus NYC (delivery lag) |

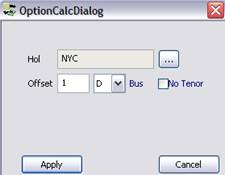

Double-click the delivery lag to specify the number of days between the expiration date and the delivery date. It brings up the OptionCalcDialog.

Days lag “D” can be business days or calendar days. Double-click the Bus label to switch to Cal as needed. For months lag “M” and years lag “Y”, the system uses calendar days only. The “No Tenor” checkbox only applies to days lag, when you enter more than 31 days. If you check the “No Tenor” checkbox, the offset will not be converted to a tenor, as shown below for 35D.

Otherwise it will be converted to a tenor. Note that the conversion is for display only. The system always stores 35D.

|

|||||||||

|

BUY/SELL |

Direction of the trade from the book’s perspective. Double-click the BUY label to switch to SELL as applicable. |

|||||||||

|

RTP/RTR/Straddle |

Direction of the option. Double-click the RTP label to switch to RTR or Straddle as applicable.

|

|||||||||

|

Ex Type |

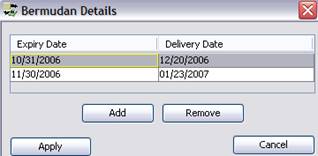

Select the exercise type: European, Bermudan, or American. European The option can only be exercised on the expiration date.

Bermudan The option can be exercised according to a user-defined schedule.

Click Add to add an exercise date as needed, and enter the expiration date and the delivery date. Then click Apply. American The option can be exercised within a date range.

|

|||||||||

|

Expiry Time |

The red label next to the Expiry date displays the expiry time and timezone. Double-click to bring up the Exercise Timing Details window. You can also choose CDS Index Option > Exercise Timing Details.

|

|||||||||

|

Rec Prem/Pay Prem |

Direction of the option’s premium fee from the book’s perspective. Double-click the “Rec Prem” label to switch to “Pay Prem” as needed.

|

|||||||||

|

Prem Date |

Enter the payment date of the option’s premium fee. Then click Add to create the option’s premium fee. It is displayed in the Fees panel.

The premium fee is a fee of type PREMIUM. Such a fee needs to be defined in Calypso Navigator > Configuration > Fees, Haircuts, & Margins > Fee Definition.

|

|||||||||

|

Auto Exercise |

Check the “Auto Exercise” checkbox to allow automatic exercise. Options can be automatically exercised using the AUTOMATIC_EXERCISE scheduled task, provided they are in-the-money. Otherwise, choose Back Office > Exercise to exercise the option. Help is provided from that window. |

|||||||||

|

Knockout/Acceleration |

Select the method for handling credit events:

|

2.1 Payout Value

On the expiration date, the swaption can be exercised either into a physical CDS or settled for cash. For cash settlement, the value of the swaption is, if for the right to pay premium:

CD Swaption Payout = Max[(Current CDS NPV) – (Swaption Underlying CDS NPV), 0)

Because the underlying CDS has the same value of credit default leg (reference asset leg) no matter what the current CDS spread, the swaption value only depends on the net value of its premium leg. The premium leg is valued for a CDS by discounting each cashflow using the risk-free curve and multiplying by the probability that the cashflow will be paid, i.e., that the reference asset has not defaulted. If the current credit spread is S and the strike K then a swaption to pay premium has:

Here N is the notional amount, ai the accrual time of the ith cashflow, and B(ti) is the "risky" discount factor, the riskless discount factor times the survival probability. The computation of the risky discount factor is the same as done when pricing a credit default swap.

2.2 Pricing Method

There is a standard method for pricing European credit default swaptions using a formula analogous to the Black-Scholes formula for pricing of European interest-rate swaptions. Currently Calypso only implements the Black-Scholes-style formula, as described in this document.

This method is only applicable to swaptions:

| • | European exercise |

| • | Underlying CDS has a fixed premium leg (not floating) |

| • | Underlying CDS is a single-name asset (not a basket). |

| • | The Calypso class that implements this method is PricerCreditDefaultSwaption. |

2.3 Pricing Formula

If one assumes lognormal volatilities for CDS spreads, the Black-Scholes equation can be used with little modification. The differences from the evaluation of interest-rate swaptions are:

| • | The annuity factor, the sum of the discounted cashflows per unit interest rate, is computed using the risky discount factors, as described above. |

| • | The forward rate is calculated for the underlying credit default swap using the valuation method in PricerCreditDefaultSwap. |

| • | The volatility is obtained from a volatility surface for CDS spreads. |

The formula for a swaption to pay premium is then:

See also -

See also -