Capturing CDS Nth Loss Trades

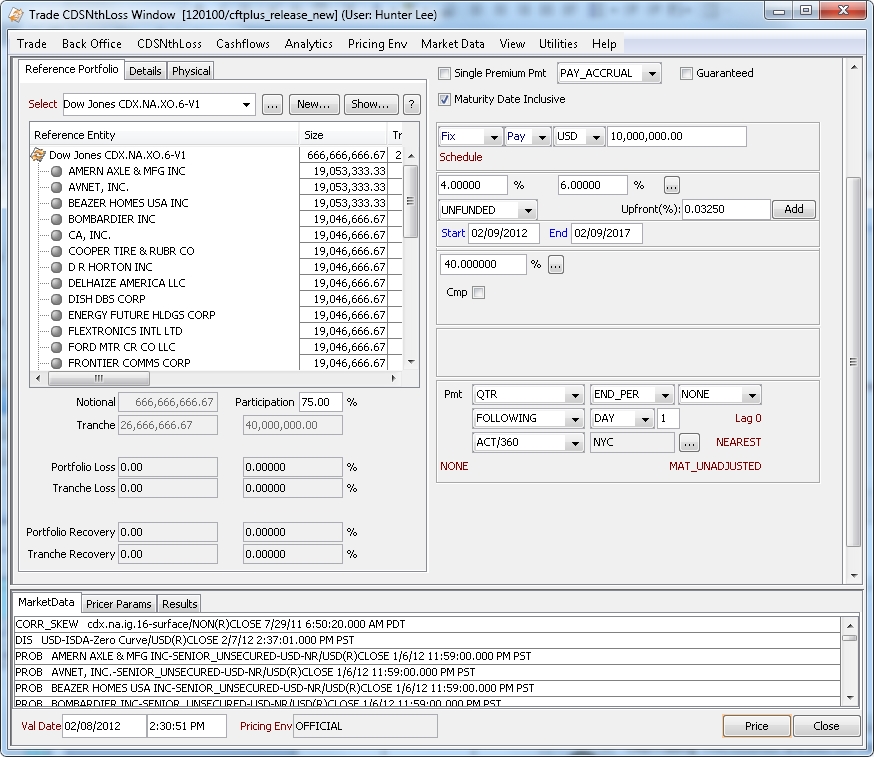

A CDS Nth Loss trade is a CDS on a basket of assets with a range of losses.

Choose Trade > Credit Derivatives > Nth Loss Basket to open the Nth Loss worksheet, from Calypso Navigator or from the Trade Blotter.

|

CDS NthLoss Quick Reference

When you open a CDS NthLoss worksheet, the Trade panel is selected by default. Entering Trade Details

Or you can enter the trade fields directly. They are described below. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. You can also hit F12 to save the trade using any action available in the workflow, or choose Trade > Save Action. You will be prompted to select an action. A description will appear in the title bar of the trade worksheet, a trade Id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

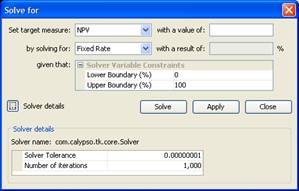

Select a target pricer measure and enter the target value. Then select the value to solve for (fixed rate, upfront fee, or notional), and click Solve. You can click Apply to set the value to solve for on the trade. Then click Price to obtain the target value. You can modify the solver variables and details as needed. Trade Lifecycle

|

1. Sample Nth Loss Basket Trade

1.1 Partial Termination

When a CDSNth Loss Trade is partially terminated, the tranche notional is adjusted depending on the percentage entered for start loss and end loss at the beginning.

For example, Basket notional 1000, tranche 5-10%, prem notional 50. After you partially terminate 10% or 5 of premium notional, basket notional changes to 900, tranche remains 5-10% and premium notional is 45.

1.2 Using Correlation Quotes for Nth loss Deals

| » | Set the USE_CORRELATION_QUOTES pricing parameter to true and set the quote that the pricer is asking for. The type of the quote (Yield, Spread, etc.) is not important as long as you know how this type is used in the user interface (if it is yield and you have typed "20", then the correlation will be 0.2, etc.). |

| » | If USE_CORRELATION_QUOTES is set to Yes, the Correlation Quote will be used. If this is set to No, the Issuer-Issuer Correlation matrix is used. |

2. Trade Panel - Fields Description

Trade Details

|

Fields |

Description |

|---|---|

|

Role/Cpty |

The first two fields of the worksheet identify the trade counterparty. The first field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field, provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book, provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade Id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade Id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

|

Sell Credit Protection / Buy Credit Protection |

Direction of the trade from the book’s perspective. Double-click the Sell Credit Protection to switch to Buy Credit Protection as needed. |

Reference Portfolio Panel

|

Fields |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Select Basket |

Click ... to select an existing basket or tranche. You can also select a basket from the “Select Basket” field directly if you have set up favorite baskets. To set up favorite baskets, double-click the “Select Basket” label and add favorite baskets. You can click New to create a new basket or tranche – It brings up the Reference Entity Basket window. You can click Show to display the selected basket. Ⓘ [NOTE: The credit events are set at the basket level] |

||||||||||||

|

Notional |

The total size of the basket. |

||||||||||||

|

Participation |

Enter the participation of the trade in the basket in %. |

||||||||||||

|

Tranche |

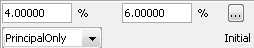

Enter the tranche of the basket against which you are buying or selling protection. You can enter the tranche in amount or in percentage.

In percentages, usually five decimal places are considered, but you can change the number of decimal places to maximum 10 using User Defaults. You can enter the type of tranche. Choose FUNDED, UNFUNDED, InterestOnly or PrincipalOnly.

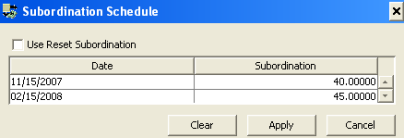

You can click ... to define a subordination schedule. The Subordination Schedule dialog will appear.

You can define a reset subordination or an ad hoc subordination.

|

||||||||||||

|

Portfolio Loss |

Percentage of loss in the basket. |

||||||||||||

|

Tranche Loss |

Percentage of loss in the tranche. |

||||||||||||

|

Portfolio Recovery Tranche Recovery |

These fields only appear when the amortization type is set to Senior. Percentage of recovery in the portfolio and in the tranche. |

Details Panel

|

Fields |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

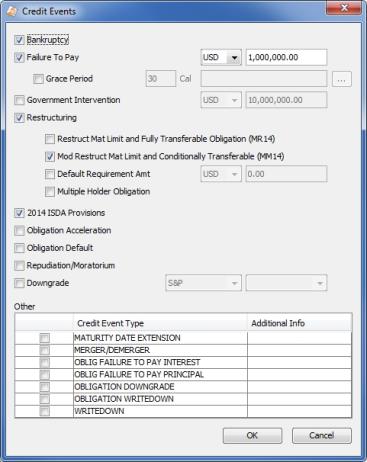

Credit Events |

Ⓘ [NOTE: For CDS Nth Default trades and CDS Nth Loss trades, the credit events are specified at the basket level] Click ... to select credit events. It brings up the Credit Events window.

If you do not see a credit event type, add it to the domain creditEventType. |

||||||||||||

|

Obligation Category |

Select the obligation category. |

||||||||||||

|

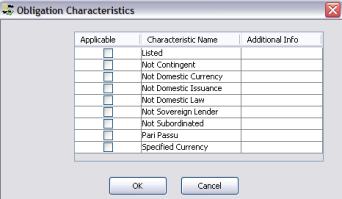

Characteristics |

Click ... to define the details of the obligation category. It brings up the Obligation Characteristics window.

If you check “Specified Currency”, you can select Standard, or a given currency.

|

||||||||||||

|

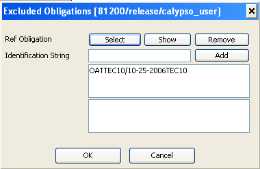

Excluded Oblig |

Click ... to select any obligations to be excluded.

|

||||||||||||

|

Additional Provisions |

Click ... to select additional settlement provisions. Additional provisions are defined in the domain cdsAdditionalProvisions. |

||||||||||||

|

Conv Oblig Supplement |

Check to specify that the ISDA Convertible Obligation Supplement is applicable to this trade. |

||||||||||||

|

Dispute Resolution |

Check to specify that Dispute Resolution is applicable to this trade. |

||||||||||||

|

Successor and Credit Event Supplement |

Check to specify that the ISDA Successor and Credit Event Supplement are applicable to this trade. |

||||||||||||

|

Monoline Supplement |

Check this box to indicate that a monoline supplement is applicable. |

||||||||||||

|

Restructuring Supplement |

Check to specify that the ISDA Restructuring supplement is applicable to this trade. |

||||||||||||

|

All Guarantees |

The trade refers to all Guarantees and not a specific guarantee. |

||||||||||||

|

Calc Agent |

Click ... to select a calculation agent. The calculation agent is a legal entity of role Calc_Agent. It is used for DTCC integration. |

||||||||||||

|

City |

Select the city of the calculation agent. Calculation agent cities are defined in the domain calcAgentCityCode. |

||||||||||||

|

Credit Event Notice |

Check to specify the notifying party.

|

||||||||||||

|

ISDA |

Select the year of ISDA standards in effect. |

||||||||||||

|

Notice of Publicly available information applicable |

Check to specify public sources and number.

|

||||||||||||

|

Settlement |

Select the settlement method: CASH, CUSTOMER_OPTION, or PHYSICAL.

See Settlement Details below. |

||||||||||||

|

Hol |

Click ... to select payment holiday calendars. |

||||||||||||

|

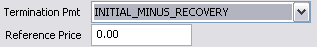

Termination Pmt |

Select INITIAL_MINUS_RECOVERY and enter a reference price.

Or select PAR_MINUS_RECOVERY. |

||||||||||||

|

AT_DEFAULT AT_MATURUTY |

Select whether the settlement is done when a default occurs (AT_DEFAULT) or at maturity (AT_MATURITY). If you select AT_DEFAULT, double-click the Settle Lag Desc label to switch to Settle Lag as applicable. Settle Lag Desc

Settle Lag

|

||||||||||||

|

Cap on Settlement |

Only appears for PHYSICAL and CUSTOMER_OPTION. Check to specify the number of days within which the settlement has to be done.

|

||||||||||||

|

Financing Rate |

Enter the financing rate of the settlement lag. |

Settlement Details

Settlement details depend on the selected Settlement Type in the Details panel.

| • | AUCTION - The Auction panel is displayed |

| • | CASH - The Cash panel is displayed |

| • | CUSTOMER_OPTION - The Cash panel and the Physical panel are displayed |

| • | PHYSICAL - The Physical panel is displayed |

Premium Details

See Premium Details.

See Premium Details.