Capturing CDS Nth to Default Trades

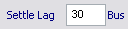

A CDS Nth to Default trade is a CDS on a basket of assets with a number of defaults.

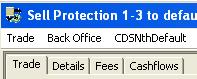

Choose Trade > Credit Derivatives > Nth to Default Basket to open the Nth to Default worksheet, from Calypso Navigator or from the Trade Blotter.

|

CDS NthDefaults Quick Reference

When you open a CDS NthDefault worksheet, the Trade panel is selected by default. Entering Trade Details

Or you can enter the trade fields directly. They are described below. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. You can also hit F12 to save the trade using any action available in the workflow, or choose Trade > Save Action. You will be prompted to select an action. A description will appear in the title bar of the trade worksheet, a trade Id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

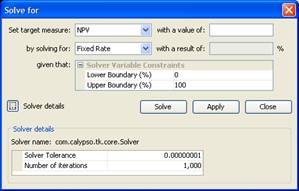

Select a target pricer measure and enter the target value. Then select the value to solve for (fixed rate, upfront fee, or notional), and click Solve. You can click Apply to set the value to solve for on the trade. Then click Price to obtain the target value. You can modify the solver variables and details as needed. Trade lifecycle

|

1. Sample CDS Nth to Default Basket Trade

2. CDS Nth Default Pricer Measures

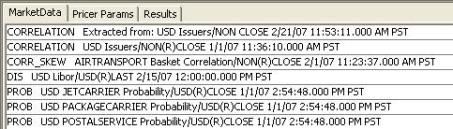

The pricing measures for CDS Nth Default are:

| • | DEFAULT_EXPOSURE — Measures the amount of money lost in case of default. A positive number indicates a loss and a negative number indicates a profit. The definition of Default Exposure is for Bonds: NPV (Market Value), and for CDS: NPV (Market Value) + Notional. The Default Exposure takes NPV, Notional, Recovery and Accrual into account. For Basket trades, it calculates the Per Name Default Exposure, which takes the change in NPV and Cash Settlement into account. (3 components – notional, recovery rate and accrual) |

| • | PVO1_CREDIT — The spread sensitivity. The underlying CDS spreads are increased by 1bp and the change in NPV is calculated. |

| • | PV01_CREDIT_BETA — Calculates a PV01_CREDIT adjusted using an extra coefficient BETA. This is calculated by bumping the credit curve by an amount equal to Beta. Beta is specified as a Quote. For example, if Beta is equal to 5, the credit curve will be bumped by 5bp and the change in NPV will be equal to PV01_Credit_Beta. For small values of beta, PV01_Credit_beta will be close to beta * PV01_Credit. |

For credit derivatives products, it is PV01_CREDIT * BETA. The BETA factor is entered as a quote named “BETA.<currency>.<issuer_code>.<seniority>”. The seniority can be set as “ANY” if the seniority of the issuer is not specified.

| • | NOTIONAL_EQUIVALENT — This is the 5 year equivalent trade which will have the same credit sensitivity as the current trade. |

| • | PV01_CORRELATION — This correlation sensitivity measure for CDS basket shifts the correlation matrix by multiplying every off-diagonal element by 1.01. The PV01_CORRELATION is: |

NPV(1.01 * correlations) - NPV(original correlations)

| • | IMPLIED_CORRELATION — Gives the constant correlation that reproduces the NPV of the trade, so it is an "average pair wise correlation". |

The parameter CORRELATION can be manually entered by the user, and this will override the correlation matrix from the market data; it will be used to find the NPV. (This is analogous to entering a manual volatility on an option trade to override a volatility surface.)

| • | PV01_PER_REF_NAME — You can examine PV01 and Hedge Ratio per name using the pricer measure PV01_PER_REF_NAME. |

| • | AGGREGATE_SPREAD — Sum of the breakeven spreads of the un-defaulted reference assets. |

| • | AVG_SPREAD — Weighted average of the spreads of the un-defaulted reference assets. |

| • | BE_PCT_OF_AGG — Ratio of the breakeven rate to the AGGREGATE_SPREAD, expressed as a percent. |

3. Trade Panel - Field Description

Trade Details

|

Fields |

Description |

|---|---|

|

Role/Cpty |

The first two fields of the worksheet identify the trade counterparty. The first field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field, provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book, provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade Id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade Id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

|

Sell Credit Protection / Buy Credit Protection |

Direction of the trade from the book’s perspective. Double-click the Sell Credit Protection to switch to Buy Credit Protection as needed. |

Reference Portfolio Panel

|

Fields |

Description |

|---|---|

|

Select Basket |

Click ... to select an existing basket. You can also select a basket from the “Select Basket” field directly if you have set up favorite baskets. To set up favorite baskets, double-click the “Select Basket” label and add favorite baskets. You can click New to create a new basket – It brings up the Reference Entity Basket window. You can double-click a row to bring up the selected basket. Ⓘ [NOTE: The credit events are set at the basket level] |

|

Notional |

The total size of the basket. |

|

Participation |

Enter the participation of the trade in the basket in %. |

|

Number of Defaults |

Enter the number of defaults that the protection covers, for example, 1st to default: enter 1 to 1, 2nd to default: enter 2 to 2, 2nd to default and 3rd to default: enter 2 to 3. |

|

Currently |

Displays the number of credit events that have already occurred on the trade. |

Details Panel

|

Fields |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

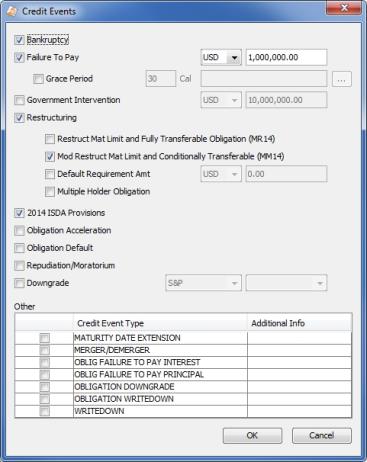

Credit Events |

Ⓘ [NOTE: For CDS Nth Default trades and CDS Nth Loss trades, the credit events are specified at the basket level] Click ... to select credit events. It brings up the Credit Events window.

If you do not see a credit event type, add it to the domain creditEventType. |

||||||||||||

|

Obligation Category |

Select the obligation category. |

||||||||||||

|

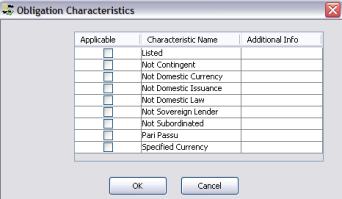

Characteristics |

Click ... to define the details of the obligation category. It brings up the Obligation Characteristics window.

If you check “Specified Currency”, you can select Standard, or a given currency.

|

||||||||||||

|

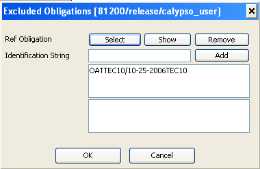

Excluded Oblig |

Click ... to select any obligations to be excluded.

|

||||||||||||

|

Additional Provisions |

Click ... to select additional settlement provisions. Additional provisions are defined in the domain cdsAdditionalProvisions. |

||||||||||||

|

Conv Oblig Supplement |

Check to specify that the ISDA Convertible Obligation Supplement is applicable to this trade. |

||||||||||||

|

Dispute Resolution |

Check to specify that Dispute Resolution is applicable to this trade. |

||||||||||||

|

Successor and Credit Event Supplement |

Check to specify that the ISDA Successor and Credit Event Supplement are applicable to this trade. |

||||||||||||

|

Monoline Supplement |

Check this box to indicate that a monoline supplement is applicable. |

||||||||||||

|

Restructuring Supplement |

Check to specify that the ISDA Restructuring supplement is applicable to this trade. |

||||||||||||

|

All Guarantees |

The trade refers to all Guarantees and not a specific guarantee. |

||||||||||||

|

Calc Agent |

Click ... to select a calculation agent. The calculation agent is a legal entity of role Calc_Agent. It is used for DTCC integration. |

||||||||||||

|

City |

Select the city of the calculation agent. Calculation agent cities are defined in the domain calcAgentCityCode. |

||||||||||||

|

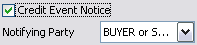

Credit Event Notice |

Check to specify the notifying party.

|

||||||||||||

|

ISDA |

Select the year of ISDA standards in effect. |

||||||||||||

|

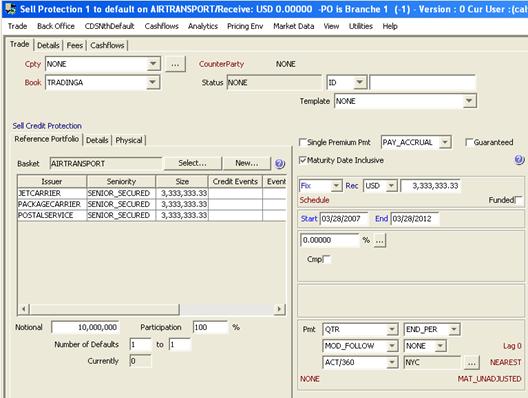

Notice of Publicly available information applicable |

Check to specify public sources and number.

|

||||||||||||

|

Settlement |

Select the settlement method: CASH, CUSTOMER_OPTION, or PHYSICAL.

See Settlement Details below. |

||||||||||||

|

Hol |

Click ... to select payment holiday calendars. |

||||||||||||

|

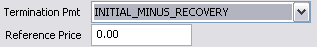

Termination Pmt |

Select INITIAL_MINUS_RECOVERY and enter a reference price.

Or select PAR_MINUS_RECOVERY. |

||||||||||||

|

AT_DEFAULT AT_MATURUTY |

Select whether the settlement is done when a default occurs (AT_DEFAULT) or at maturity (AT_MATURITY). If you select AT_DEFAULT, double-click the Settle Lag Desc label to switch to Settle Lag as applicable. Settle Lag Desc

Settle Lag

|

||||||||||||

|

Cap on Settlement |

Only appears for PHYSICAL and CUSTOMER_OPTION. Check to specify the number of days within which the settlement has to be done.

|

||||||||||||

|

Financing Rate |

Enter the financing rate of the settlement lag. |

Settlement Details

Settlement details depend on the selected Settlement Type in the Details panel.

| • | AUCTION - The Auction panel is displayed |

| • | CASH - The Cash panel is displayed |

| • | CUSTOMER_OPTION - The Cash panel and the Physical panel are displayed |

| • | PHYSICAL - The Physical panel is displayed |

Premium Details

See Premium Details.

See Premium Details.