Capturing Commodity OTC Option Trades

To capture Commodity OTC Option Trades, please use the Pricing Sheet - Commodity Vanilla.

Choose Trade > Commodities > OTC Options to open the Commodity OTC Option worksheet, from Calypso Navigator or from the Calypso Workstation.

|

Commodity OTC Option Quick Reference

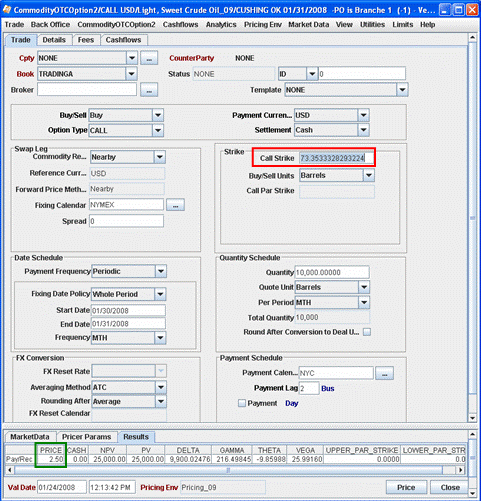

When you open a Commodity OTC Option worksheet, the Trade panel is selected by default. Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. The description is in the form of ProductType/OptionTypeOptionStyle/UnderlyingCommodityMaturityDate Strike Pricing a Trade

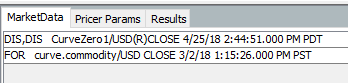

Note that a cross-currency commodity otc option also requires an FX curve, an FX rate, and an FX reset.

Trade Lifecycle

|

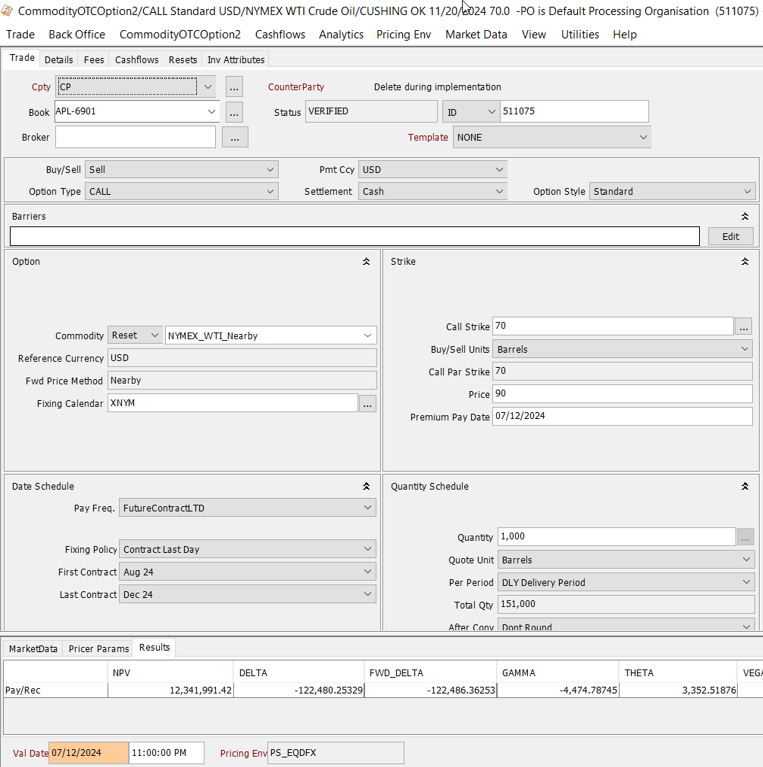

1. Sample Commodity OTC Option Trade

2. Commodity Option Types Table

| Option Type | Number of Strikes | Strike | Components of Option Structure | |

|---|---|---|---|---|

| Buy | Sell | |||

|

Put |

1 |

x |

Buy Put Option with Strike x |

Sell Put Option with Strike x |

|

Call |

1 |

x |

Buy Call Option with Strike x |

Sell Call Option with Strike x |

|

Put Spread |

2 |

x,y, where x>y |

Buy Put Option with Strike x and Sell Put Option with Strike y |

Sell Put Option with Strike x and Buy Put Option with Strike y |

|

Call Spread |

2 |

x,y, where x<y |

Buy Call Option with Strike x and Sell Call Option with Strike y |

Sell Call Option with Strike x and Buy Call Option with Strike y |

|

Straddle |

1 |

x |

Buy Call Option with Strike x and Buy Put Option with Strike x |

Sell Call Option with Strike x and Sell Put Option with Strike x |

|

Strangle |

2 |

x,y, where x>y |

Buy Call Option with Strike x and Buy Put Option with Strike y |

Sell Call Option with Strike x and Sell Put Option with Strike y |

|

Risk Reversal |

2 |

x,y, where x>y |

Buy Call Option with Strike x and Sell Put Option with Strike y |

Sell Call Option with Strike x and Buy Put Option with Strike y |

|

Synthetic Forward |

1 |

x |

Buy Call Option with Strike x and Sell Put Option with Strike x |

Sell Call Option with Strike x and Buy Put Option with Strike x |

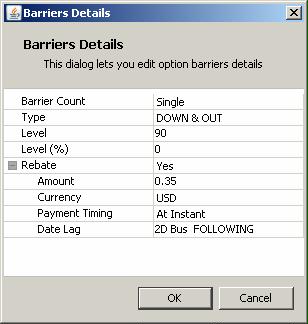

3. Barriers

You are able to add a barrier (knock-in or knock-out) to a cash settled OTC Commodity Option. The barrier is active for the entire life of the option, or until triggered. To set the Barrier details, click the Edit button next to the Barrier field.

The Barriers Details window is then displayed.

The Barrier is considered when calculating cashflows.

| • | Type UP & IN, cashflows will be paid/received only if the barrier is hit |

| • | Type UP & OUT, cashflows will be paid/received until the barrier is hit |

| • | Type DOWN & IN, cashflows will be paid/received only if the barrier is hit |

| • | Type DOWN & OUT, cashflows will be paid until the barrier is hit |

|

Field |

Description |

|---|---|

|

Barrier Count |

The default setting is 'No Barrier'. Click in this field and select 'Single' to add a barrier to the option. |

|

Type |

Select the type of barrier: 'UP & IN', 'UP & OUT', 'DOWN & IN', 'DOWN & OUT' |

|

Level |

This is the absolute price level of the barrier. This price is understood to be quoted in the option strike units per option settlement currency. |

|

Level % |

This field is not yet implemented. |

|

Rebate |

A rebate can be paid if an option is knocked out. To include a rebate, set this field to 'Yes'. |

|

Amount |

The amount of the rebate per commodity unity. The rebate is entered in amount per strike unit. For example, a rebate may be entered as "0.35 per barrel" by entering 0.35 in this field. |

|

Currency |

The currency of the rebate. This should always be equal to the settlement currency of the option. |

|

Payment Timing |

The payment schedule of the rebate. This can be paid at the original option maturity (At Maturity) or on a date relative to the knock out event (At Instant). |

Note: The commodity barrier option is compatible with the

4. Fields Description

|

Field |

Description |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Role/Cpty |

The first two fields of the worksheet identify the trade counterparty. The first field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. |

||||||||||||||||||

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

||||||||||||||||||

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

||||||||||||||||||

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

||||||||||||||||||

|

Broker |

Displays the broker if a broker fee is captured in the Fees panel. |

||||||||||||||||||

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

||||||||||||||||||

|

Broker |

Displays the broker if a broker fee is captured in the Fees panel. | ||||||||||||||||||

|

Buy/Sell |

Specify whether the processing organization is buying or selling the option. | ||||||||||||||||||

|

Option Type |

Select PUT or CALL. Or you can select one of the following Commodity Option Strategy types: Put Spread, Call Spread, Straddle, Strangle, Risk Reversal, Synthetic Forward. | ||||||||||||||||||

|

Payment Currency |

Select the currency in which the payments occur. If the payment currency is different than the reference currency, you can enter details for the FX Conversion, as described below. |

||||||||||||||||||

|

Settlement |

You can select the exercise type for settling the option: CASH – generates an exercise fee that attaches to the trade. PHYSICAL – generates a Commodity Forward trade. The Option Type can only be PUT or CALL. |

||||||||||||||||||

|

Option Style |

Choose a subtype for the option. The choices are:

|

|

Option |

|

|

Commodity Reset |

Select the commodity reset for the trade. |

|

Reference Currency |

Displays the reference currency as defined in the commodity reset definition. This field cannot be modified. |

|

Fwd Price Method |

Displays the forward price method as defined in the commodity reset definition. This field cannot be modified. |

|

Fixing Calendar |

Displays the calendar(s) to use when calculating the fixing dates. These default from the commodity reset definition. You can modify the calendars. Click ... to select the calendars. |

|

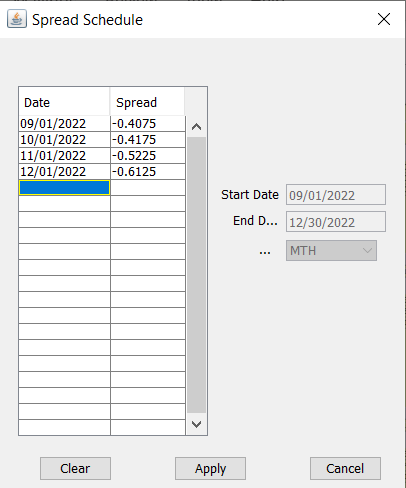

Spread |

Optional. Enter a spread based on the delivery location. The spread should be entered as a straight percentage rate. It is possible to specify a Spread Schedule by clicking the ellipsis button. This action displays a Spread Schedule window where you can designate specific spread for each time period. Note: Spread schedule is supported for Periodic, FutureContractFND, FutureContractLTD, Daily, Daily Rule and Third Wednesday Pay frequency only.

|

|

Strike The input fields vary depending on the Option Type that you select. See Commodity Option Types above for descriptions of the option types. See Sample Commodity Option Strategy Trades below for examples of the trades. |

|

|

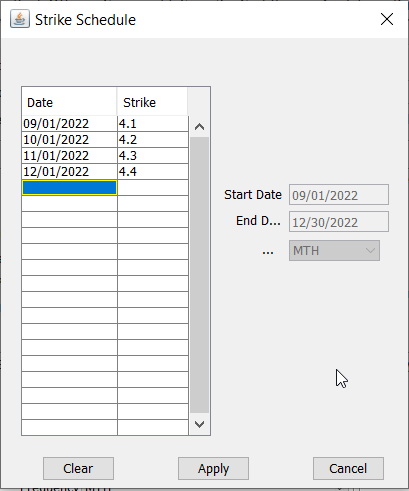

Strike |

Enter the price per unit. You can enter as many decimal places as needed to get the payments to the desired amount. There is no rounding of the strike when calculating the payments. It is possible to specify a Strike Schedule by clicking the ellipsis button. This action displays a Strike Schedule window where you can designate specific strike for each time period. Note: Strike schedule is supported for Periodic, FutureContractFND, FutureContractLTD, Daily, Daily Rule and Third Wednesday Pay frequency only.

|

|

Buy/Sell Units |

Specifies the quote unit, which defaults from the commodity reset definition. However, you can select a different unit. |

|

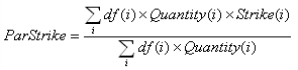

Par Strike |

The Single Fixed Strike denominated in DealCurrency per StrikeUnit which would result in the same PV as the Strike(i).

|

|

Date Schedule Define the fixing dates for the floating prices, settlement dates, and how many optionlets (option periods) are valued over the life of the option. |

|

|

Pay Freq. |

See Payment Frequencies for details. |

|

Fixing Policy |

See Fixing Policies for details. |

|

Intraday Policy |

See Intraday Policies for details. |

|

Indexation |

See Gas Oil Indexation Swap for details. |

|

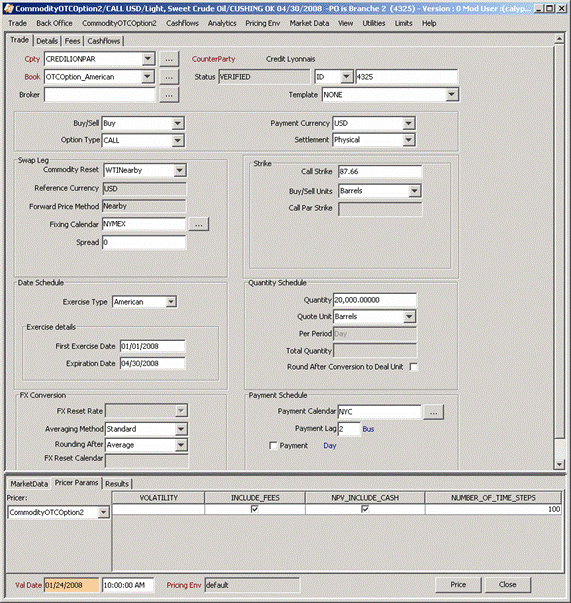

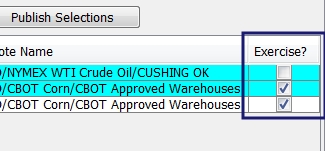

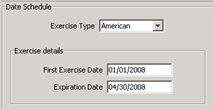

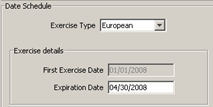

Option Expiry Panel — Physical Settlement When the settlement type is physical, select the exercise type and enter the exercise details. Physical options expiry does not take into account the time on the reset. |

|

|

American Exercise |

Select the American Exercise type, and enter a date range when you can exercise the option. The Binomial model is used to price.

See Sample Exercised Trades below for some examples. |

|

European Exercise |

Select the European Exercise type, and enter the expiration date when you can exercise the option. The Black model is used to price, which is the same as pricing a financial-settled Bullet Option.

|

|

FX Reset Cal |

Displays the calendar(s) used to determine business days for the FX reset. The calendars are defined in the FX rate definition. You cannot modify this field. |

|

Quantity Schedule Specify the details about the deal quantity schedule. Details about the deal quantity and the reference quantity can be viewed in the Cashflows. |

|

|

Quantity |

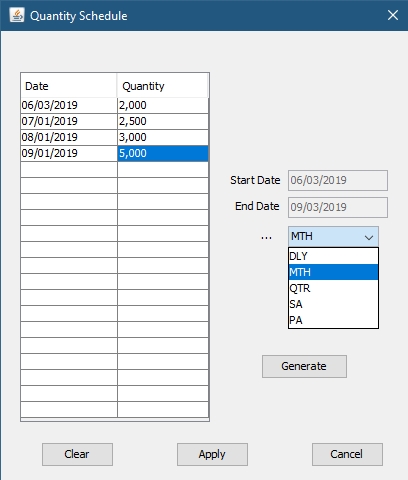

Specify the deal quantity to trade for a specified frequency. It is possible to specify a Quantity Schedule by clicking the

Click Generate to generate the dates after selecting the frequency from the drop-down menu. After entering the quantities, click Apply. When a Quantity Schedule is in place, an * will appear next to the Quantity field. Bullet payment frequency is not supported with this feature. |

|

Quote Unit |

Unit of measure that the deal quantity represents. |

|

Per Period |

Specify the frequency that the deal quantity is traded. 'DLY - Future Contract Delivery Period' can also be selected in ‘Per Period’ drop-down in addition to the existing options, when Date Schedule Pay Frequency is FutureContractLTD or FutureContractFND. |

|

Total Qty |

The total deal quantity traded for the swap. |

|

After Conv |

Set to ‘Round’ to indicate that the reference unit to deal unit conversion of the price should be rounded prior to calculating the amount for the cash flow. The default is ‘Don't Round’, which means the rounding occurs after the amount is calculated. |

|

FX Conversion The FX Conversion is required when the payment currency is different than the reference currency. You can select the rounding method for both cross currency and single currency deals in the FX Conversion panel. |

|

|

FX Reset Rate |

Select the FX Reset to use for conversion of prices from the reference currency to the payment currency. |

|

Avg Method |

See Averaging Methods for details. |

|

Rounding After |

See Rounding Policies for details. |

|

FX Reset Cal |

Displays the calendar(s) used to determine business days for the FX reset. The calendars are defined in the FX rate definition. You cannot modify this field. |

|

Payment Schedule Define when the payment occurs for each optionlet. |

|

|

Calendar |

Click ... to select the holiday calendar(s) used to determine the business days when calculating the payment date. |

|

Payment Lag |

Specify lag days from the end date of the swaplet (in business or calendar days) for the actual payment to take place. Enter N days for the payment to occur N days after the swaplet end date. Enter 0 for the payment to occur on the swaplet end date. Enter –N days for the payment to occur N days before the swaplet end date. |

|

Payment |

Select to enter payment details. This makes a field available next to the Day label where you can specify which day the payment should take place. For example, enter “5” to specify that the payment date occurs on the 5th of the month following the swaplet end date. Double-click the Day label to switch to Rule and select a date rule for determining the payment date if required. Click ... to select the payment date rule.

|

|

Date Roll |

Select the date roll convention to roll the payment dates when they fall on business days. The payment calendar is used to determine business days. Date roll conventions are described under Calypso Navigator by choosing Help > Date Roll Conventions. |

5. Sample Exercised Trades

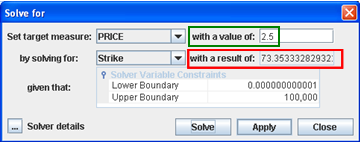

Solving for a Strike Given a Target PRICE

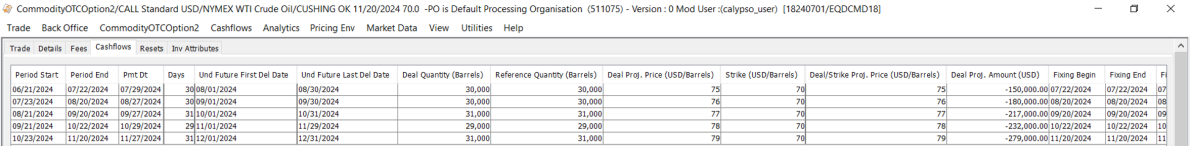

5.1 Cashflows

The cashflow column ‘Days’ is modified to store number of days in Delivery Period i.e. days in between cashflow column 'Und Future First Del date' and 'Und Future Last Del date' including first and last date in the period when Date Schedule Pay Frequency is FutureContractLTD or FutureContractFND and Per Period - 'DLY - Future Contract Delivery Period' is selected.

See also -

See also -

. This action displays a Quantity Schedule window where you can designate specific quantities for each time period.

. This action displays a Quantity Schedule window where you can designate specific quantities for each time period.