Capturing Commodity Swap Trades

To capture Commodity Swap Trades, please use the Pricing Sheet - Commodity Swap.

Choose Trade > Commodities > Swap to open the Commodity Swap worksheet, from Calypso Navigator or from the Calypso Workstation.

|

Commodity Swap Quick Reference

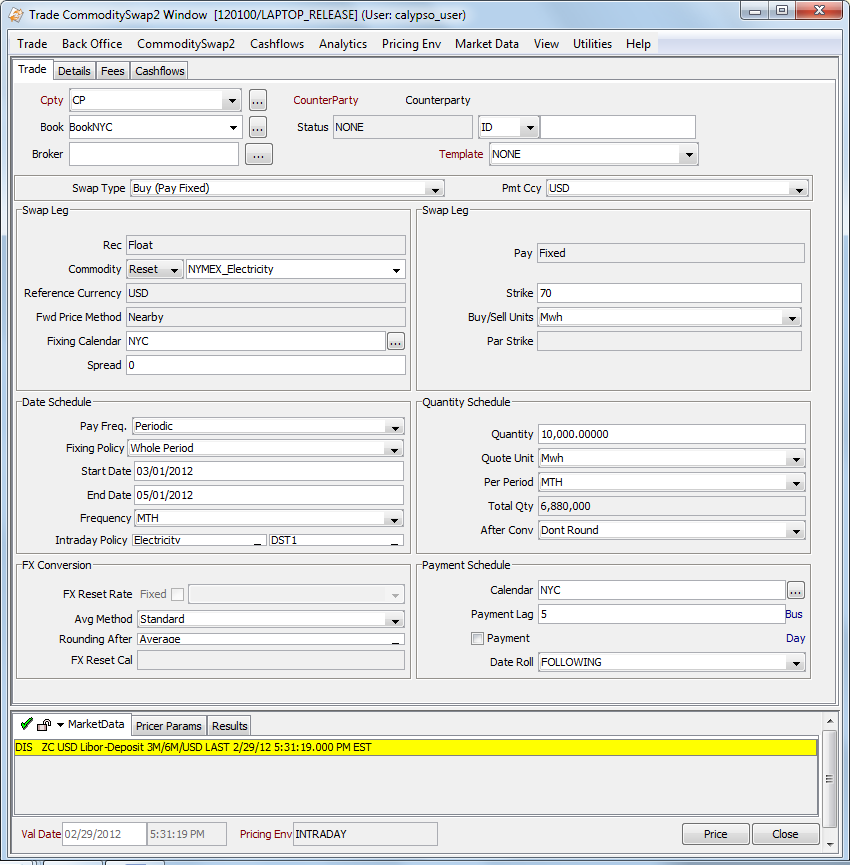

When you open a Commodity Swap worksheet, the Trade panel is selected by default. Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Note that a cross-currency commodity swap also requires an FX curve, an FX rate, and an FX reset.

Trade Lifecycle

|

1. Commodity Swap

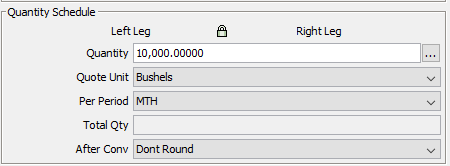

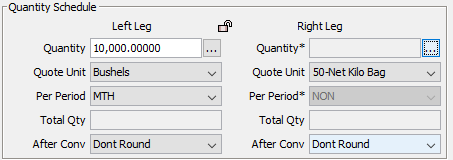

| » | When both legs are floating, the details for the Date Schedule, FX Conversion, Quantity Schedule, and Payment Schedule can either be the same for each floating leg, or you may define different details for each floating leg. |

The locked padlock icon indicates both legs are the same.

| » | Click the padlock icon to turn it to the unlocked position, and the trade worksheet opens separate entry fields for the left leg and the right leg, respectively. You can specify different details for each leg. |

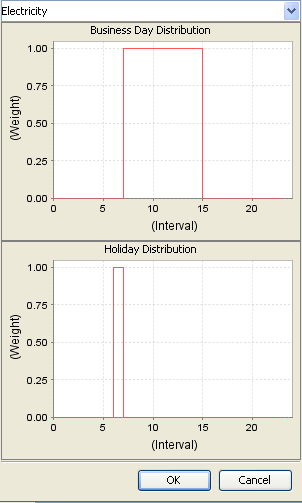

2. Electricity Swap

| » | View the Business Day and Holiday distributions when you pull down Electricity from the Intraday Policy menu. See Intraday Policies for details. |

| » | With Electricity swaps, you are also able to select a Daylight Savings Time rule. The purpose of this rule is to compensate for the hour that is gained or lost during spring and fall on an electricity swap that has hourly resets. |

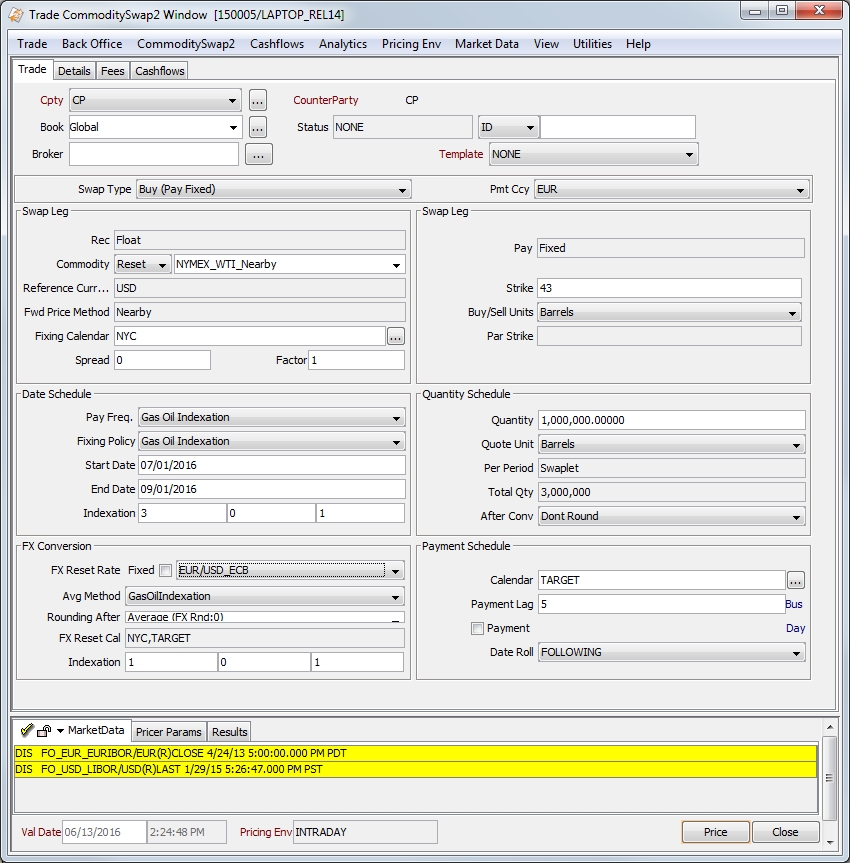

3. Gas Oil Indexation Swap

Unlike other policies where the fixing dates are always within the range of the start and end date, fixing for natural gas is in the start and end date range of the days on which natural gas is delivered. Because of this, natural gas trades need to have their own fixing policy, payment frequency and averaging method.

The fixing dates for natural gas are generally offset by one day or by calendar month increments. A day-ahead trade will have fixing dates offset from the delivery dates by on one business day. A month-ahead trade will have fixing dates offset from the deliver dates by 1 calendar month. The number of fixing dates will not necessarily equal the number of delivery dates. Gas often prices every delivery day using the average of the prices for a calendar month. The total quantity of a gas swap is often expressed per day. The number of days refers to the number of delivery days, not fixing days.

It is also common in Natural Gas contracts to price against the oil market. In this case, fixing dates can be several months prior to the delivery period. For example in [3,0,3] pricing, each month is priced using the average of three months average prices for three months prior to delivery. So a year-16 swap would have:

Jan-16, Feb-16 and Mar-16 pricing on average of Oct-15, Nov-15 and Dec-15 prices,

Apr-16, May-16 and Jun-16 pricing on average of Jan-16, Feb-16 and Mar-16 prices,

Jul-16, Aug-16 and Sep-16 pricing on average of Apr-16, May-16 and Jun-16 prices,

Oct-16, Nov-16 and Dec-16 pricing on average of Jul-16, Aug-16 and Sep-16 prices.

| » | The Gas Oil Indexation Payment Frequency specifies that there is a cash flow for every calendar month. It is possible that several calendar months will have the same payment due date. When using the Gas Oil Indexation Payment Frequency, the only Fixing Policy available is Gas Oil Indexation. |

| » | When the Gas Oil Indexation Fixing Policy is selected, the trade window displays three additional Indexation fields for the Averaging Period, Time Lag and Recalculation. These are all required integer values with no default. Additionally, the settlement period must be monthly. |

| » | The Gas Oil Indexation Averaging Method causes the commodity price fixings to be averaged for each calendar month. After that, the month averages are averaged. If the trade is settling in a different currency from the index currency, an FX Averaging Period, FX Indexation Lag and FX Recalculation are required. The FX resets are averaged in a similar way. Finally, the averaged commodity price is converted using the averaged FX rate. |

4. Fields Description

|

Fields |

Description |

|||||||||

|

Role / Cpty |

The first two fields of the worksheet identify the trade counterparty. The first field identifies the trade counterparty's role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field, provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. |

|||||||||

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|||||||||

|

Id |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. |

|||||||||

|

Ext Ref Int Ref |

You can load an existing trade by typing the trade id into this field and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|||||||||

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|||||||||

|

Broker |

Displays the broker if a broker fee is captured in the Fees panel. |

|||||||||

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

|||||||||

|

Swap Type |

Select the type of fixed/floating convention for the swap.

|

|||||||||

|

Payment Currency |

Select the currency in which the payments occur. If the payment currency is different than the reference currency, you can enter details for the FX Conversion, as described below. |

|||||||||

|

Floating Swap Leg |

||||||||||

|

Rec / Pay Pay / Rec |

The application automatically sets these labels based on the selected Swap Type. |

|||||||||

|

Commodity Reset / Future |

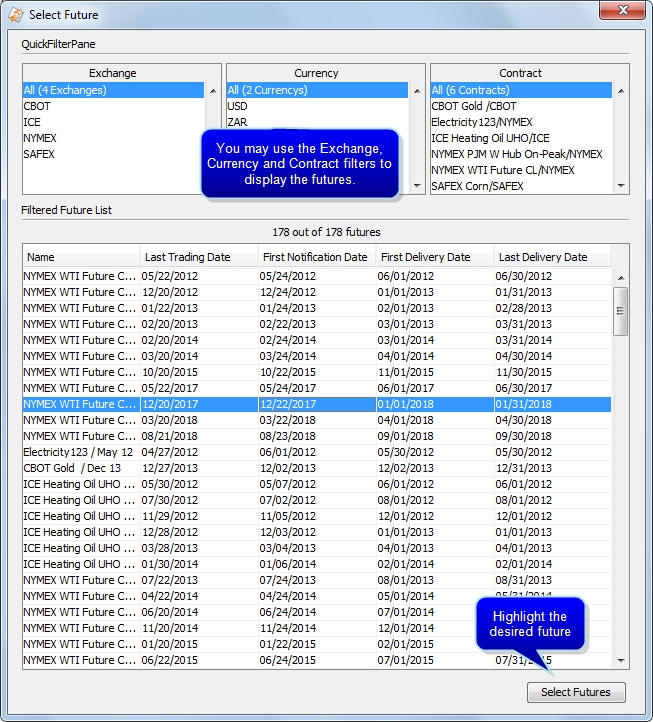

Select either the commodity reset or future for the trade. When Reset is selected, you may select from available resets in the drop-down box to the right. When Future is selected, click the

|

|||||||||

|

Reference Currency |

Displays the reference currency as defined in the commodity reset definition. This field cannot be modified. |

|||||||||

|

Fwd Price Method |

Displays the forward price method as defined in the commodity reset definition. This field cannot be modified. |

|||||||||

|

Fixing Calendar |

Displays the calendar(s) to use when calculating the fixing dates. These default from the commodity reset definition. You can modify the calendars. Click ... to select the calendars. |

|||||||||

|

Factor |

This allows multiple swap legs to be structured to create a pricing formula with varying contributions from multiple index prices. |

|||||||||

|

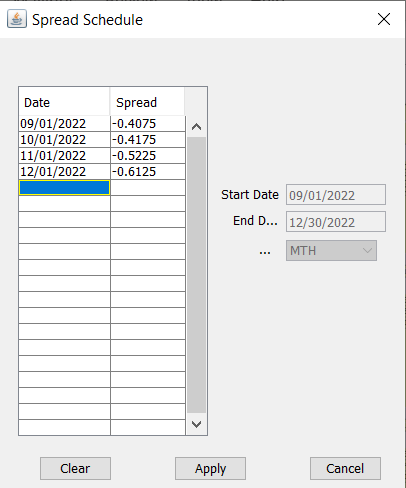

Spread |

Optional. Enter a spread based on the delivery location. This spread is added directly to the fixing price in Payment CCY. The spread amount appears in the Spread Adjusted Price Diff column of the Cashflows tab of the trade window. The spread should be entered as a straight percentage rate. It is possible to specify a Spread Schedule by clicking the ellipsis button. This action displays a Spread Schedule window where you can designate specific spread for each time period. Note: Spread schedule is supported for Periodic, FutureContractFND, FutureContractLTD, Daily, Daily Rule and Third Wednesday Pay frequency only.

|

|||||||||

|

Fixed Swap Leg |

||||||||||

|

Rec / Pay |

The application automatically sets the Rec/Pay labels based on the selected Swap Type. |

|||||||||

|

Strike Ccy |

When Swap type is Buy (Pay Fixed)/Sell (Rec Fixed) and the Commodity Type is Reset or Future,this drop-down is available when the Payment currency selected is different from the Reference currency. The default value is the Reference currency. The drop-down menu consists of the Reference and Payment currencies. When the Payment currency is the same as the Reference currency, the Strike Currency is the Payment currency. If Swap type is Buy(Pay Fixed)/Sell(Rec Fixed) and Commodity Type is Future, the Strike Currency is the Payment Currency. |

|||||||||

|

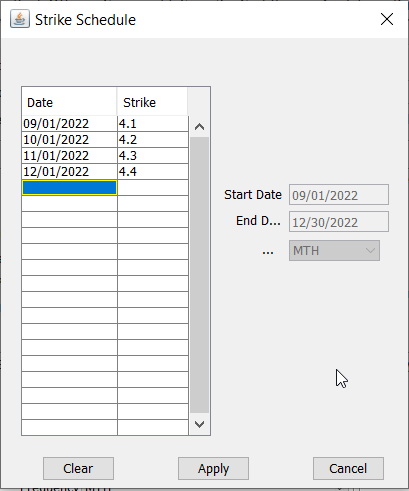

Strike |

Enter the price per unit. You can enter as many decimal places as needed to get the payments to the desired amount. There is no rounding of the strike when calculating the payments. It is possible to specify a Strike Schedule by clicking the ellipsis button. This action displays a Strike Schedule window where you can designate specific strike for each time period. Note: Strike schedule is supported for Periodic, FutureContractFND, FutureContractLTD, Daily, Daily Rule and Third Wednesday Pay frequency only.

|

|||||||||

|

Buy/Sell Units |

Specifies the quote unit, which defaults from the commodity reset definition. However, you can select a different unit. |

|||||||||

|

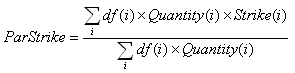

Par Strike |

The Single Fixed Strike denominated in DealCurrency per StrikeUnit which would result in the same PV as the Strike(i).

|

|||||||||

|

Date Schedule Define the fixing dates for the floating prices, settlement dates, and how many swaplets (swap periods) are valued over the life of the swap. |

||||||||||

|

Pay Freq. |

See Payment Frequencies for details. | |||||||||

|

Fixing Policy |

See Fixing Policies for details. | |||||||||

|

Intraday Policy |

See Intraday Policies for details. This field is displayed for swaps with Electricity resets. You need to enter an intraday policy for this type of swap, because resets can be at various times of the day, depending on the peak hour schedule. |

|||||||||

|

Quantity Schedule Specify the details about the deal quantity schedule. Details about the deal quantity and the reference quantity can be viewed in the Cashflows. |

||||||||||

|

Quantity |

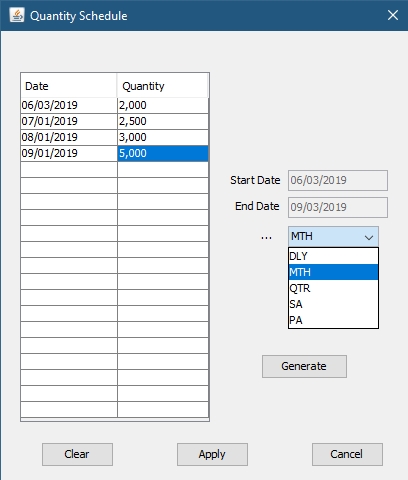

Specify the deal quantity to trade for a specified frequency. It is possible to specify a Quantity Schedule by clicking the

Click Generate to generate the dates after selecting the frequency from the drop-down menu. After entering the quantities, click Apply. When a Quantity Schedule is in place, an * will appear next to the Quantity field. Bullet payment frequency is not supported with this feature. Ⓘ [NOTE: For a Float/Float commodity swap, the quantity is displayed in absolute value, regardless of the trade direction] |

|||||||||

|

Quote Unit |

Unit of measure that the deal quantity represents. |

|||||||||

|

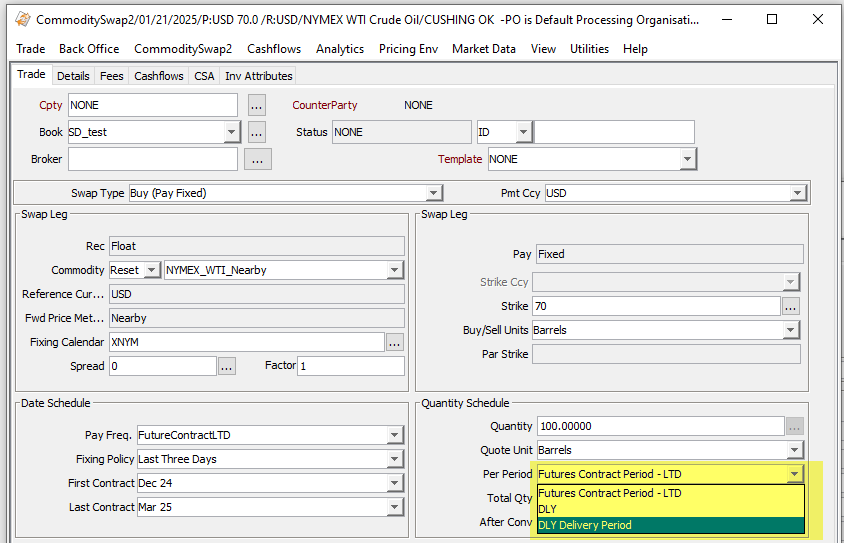

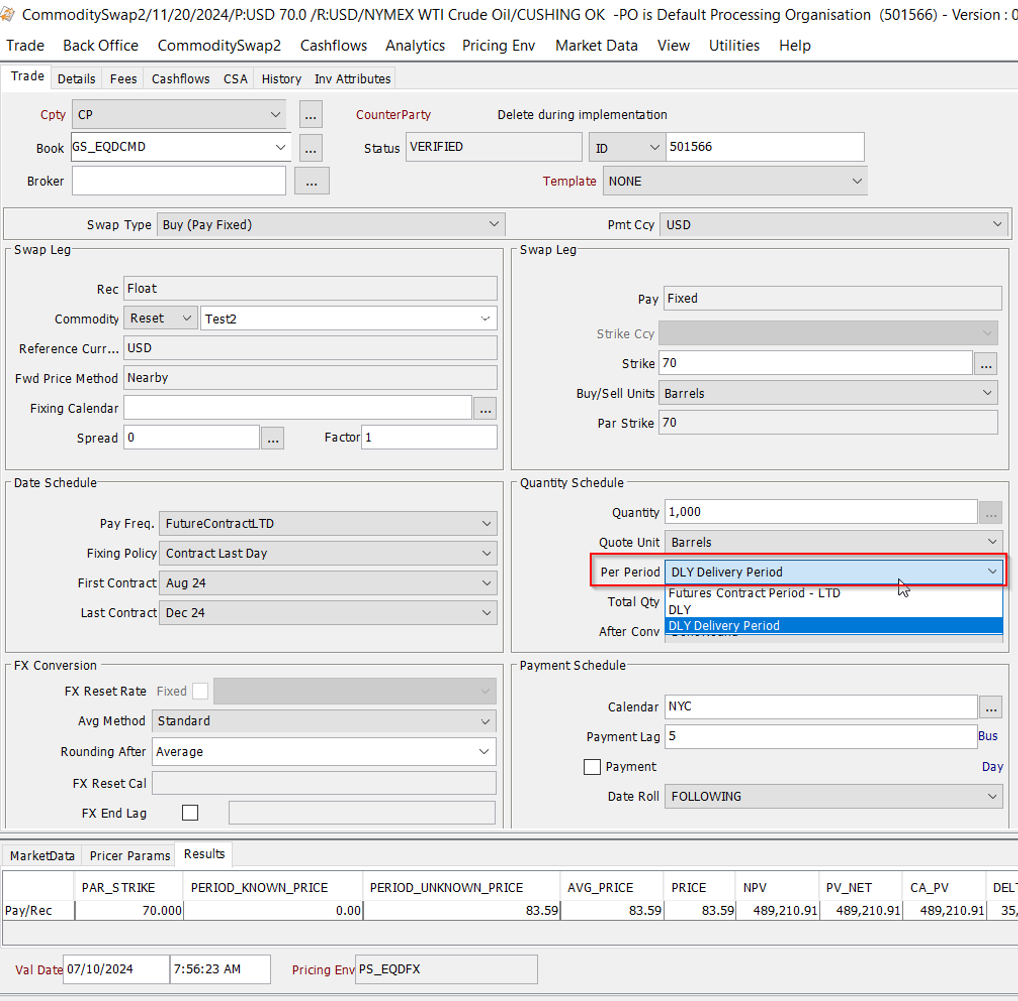

Per Period |

Specify the frequency that the deal quantity is traded. For Pay Frequency – Future Contract LTD/FND, user can select below options for ‘Per Period’:

|

|||||||||

|

Total Qty |

The total deal quantity traded for the swap. |

|||||||||

|

After Conv |

Set to ‘Round’ to indicate that the reference unit to deal unit conversion of the price should be rounded prior to calculating the amount for the cash flow. The default is ‘Don't Round’, which means the rounding occurs after the amount is calculated. |

|||||||||

|

FX Conversion The FX Conversion is required when the payment currency is different than the reference currency. You can select the rounding method for both cross currency and single currency deals in the FX Conversion panel. |

||||||||||

|

FX Reset Rate |

Select the FX Reset to use for conversion of prices from the reference currency to the payment currency. |

|||||||||

|

Avg Method |

See Averaging Methods for details. | |||||||||

|

Rounding After |

See Rounding Policies for details. | |||||||||

|

FX Reset Cal |

Displays the calendar(s) used to determine business days for the FX reset. The calendars are defined in the FX rate definition. You cannot modify this field. |

|||||||||

|

FX End Lag |

Used to price a quanto swap where the commodity average is calculated in the commodity reference currency and then converted to the settlement currency using a single FX reset observed on a date which is relative to the last commodity fixing date. The FX lag is the business day lag with respect to the last fixing date in the fixing period. All fixing days during this period will take this FX fixing.

|

|||||||||

|

Payment Schedule Define when the payment occurs for each swaplet. |

||||||||||

|

Calendar |

Click ... to select the holiday calendar(s) used to determine the business days when calculating the payment date. |

|||||||||

|

Payment Lag |

Specify lag days from the end date of the swaplet (in business or calendar days) for the actual payment to take place. Enter N days for the payment to occur N days after the swaplet end date. Enter 0 for the payment to occur on the swaplet end date. Enter –N days for the payment to occur N days before the swaplet end date. |

|||||||||

|

Payment |

Select to enter payment details. This makes a field available next to the Day label where you can specify which day the payment should take place. For example, enter “5” to specify that the payment date occurs on the 5th of the month following the swaplet end date. Double-click the Day label to switch to Rule and select a date rule for determining the payment date if required. Click ... to select the payment date rule.

|

|||||||||

|

Date Roll |

Select the date roll convention to roll the payment dates when they fall on business days. The payment calendar is used to determine business days. For a description of date roll conventions, from Calypso Navigator, choose Help > Date Roll Conventions. |

|||||||||

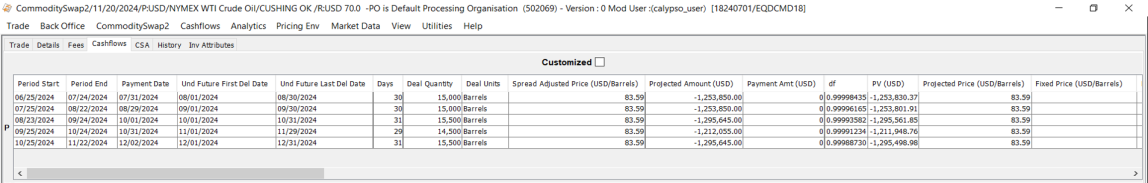

4.1 Cashflows

The cashflow column ‘Days’ is modified to store number of days in Delivery Period i.e. days in between cashflow column 'Und Future First Del date' and 'Und Future Last Del date' including first and last date in the period when Date Schedule Pay Frequency is FutureContractLTD or FutureContractFND and Per Period - 'DLY - Future Contract Delivery Period' is selected.

See also -

See also -  to display the Select Future window and choose the future desired future.

to display the Select Future window and choose the future desired future.

. This action displays a Quantity Schedule window where you can designate specific quantities for each time period.

. This action displays a Quantity Schedule window where you can designate specific quantities for each time period.