Capturing Future Option Trades

The Future Option trade worksheet is the same for all types of future options.

Prior to trading future options, you need to create future option contracts and generate future option products.

See Defining Future Option Contracts for details.

See Defining Future Option Contracts for details.

Ⓘ [NOTE: For Listed Derivatives Clearing, please refer to Calypso ETD Clearing documentation for information on fees and trade capture]

|

Future Options Quick Reference

Entering Trade Details

Or you can enter the trade fields directly. They are described below. Ⓘ [The trade counterparty must be a clearer, so you must have defined a legal entity of role Clearer - See Specifying Clearers for details] Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description appears in the title bar of the trade worksheet, a trade id is assigned to the trade, and the status of the trade is modified according to the workflow configuration. Ⓘ [NOTE: Even though the subtype is not visible on the trade window, the subtype is set to the contract name] Pricing a Trade

Note that the pricing parameters NUMBER_OF_TIME_STEPS and USE_CONTROL_VARIATE affect PricerFutureOptionMM. If you use, PricerFutureOptionMMBpVol, you need to provide a bp volatility surface (simple or derived), or a transient bp volatility.

The options on dividend futures are European only. You can define a vol surface for the underlying product (EquityIndex) of a FutureOptionEquityIndex product in Product Specific for VOL usage. When pricing from quotes (NPV_FROM_QUOTE=true), the volatility depends on the pricing parameter USE_IMPLIED_VOL. If USE_IMPLIED_VOL is set to true, the system computes the implied volatility of the price. In this case, you do not need a volatility surface to price the trade. The system uses an upper boundary and a lower boundary to find a solution for the price: pricing parameters MAX_IMPLIED_VOL (default is 1000%) and MIN_IMPLIED_VOL (default is -1000%). If USE_IMPLIED_VOL is set to false, the volatility is retrieved from the volatility surface. Ⓘ [NOTE: For Greeks computation, if NPV_FROM_QUOTE is set to true, USE_IMPLIED_VOL must be set to true as well] Trade Lifecycle

|

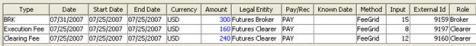

1. Sample Bond Future Option Trade

From the Calypso Navigator, navigate to Trade > Fixed Income > Listed Future Options.

The following pricer measures are calculated.

|

Pricer Measures |

Bond Future Option |

|

NPV Delta Vega Gamma Theta |

For European options, the NPV and Greeks are calculated using the Black 76 model. For American options, NPV is calculated using the CRR binomial model is used. Greeks for American options are not available yet. All Greeks are multiplied by the quantity, tick value and nominal of the underlying future. |

|

Price |

Equal to calculated NPV. |

|

Break Even |

Corresponds to the price of the underlying. The price of the underlying is directly picked up from future quote or calculated. It depends of pricing parameters specified in Pricing Environment (FUTURE_FROM_QUOTE and/or BOND_FROM_QUOTE). |

|

Implied Vol |

Implied Volatility. |

|

Notional |

Quantity * Contract Size. |

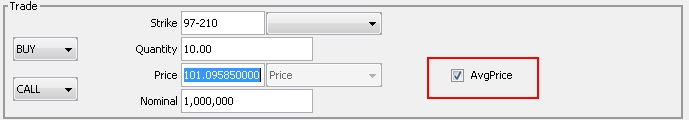

Average Price

You can select the AvgPrice checkbox to preserve the trade price without rounding, regardless of the Quote Type or Quote Decimals specified on the given Future Option contract. Any trade price based calculations, including Nominal and relevant pricer measures, will use the full decimals of the trade price.

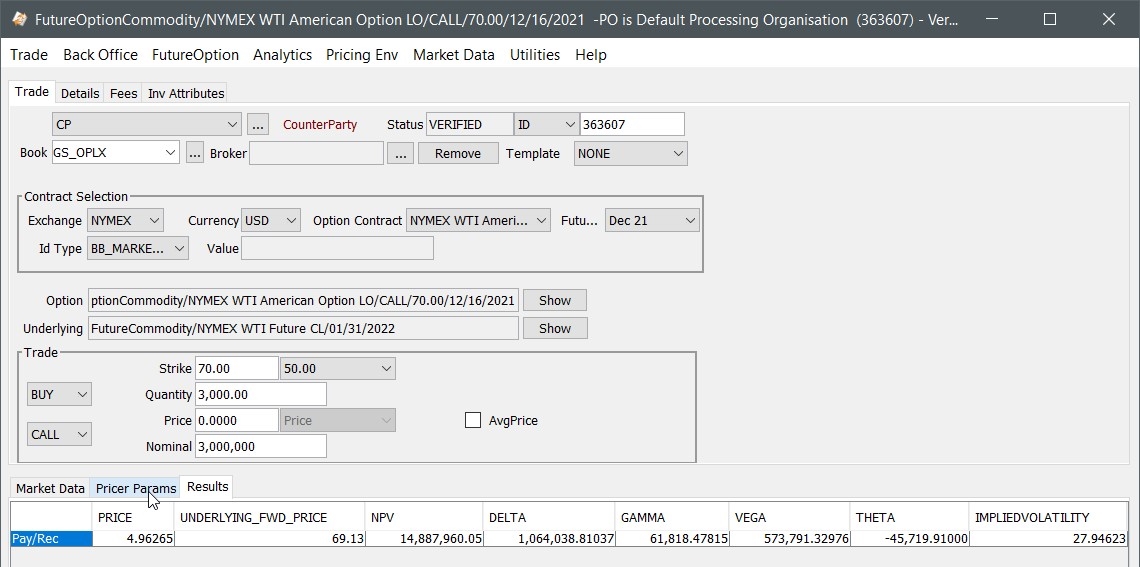

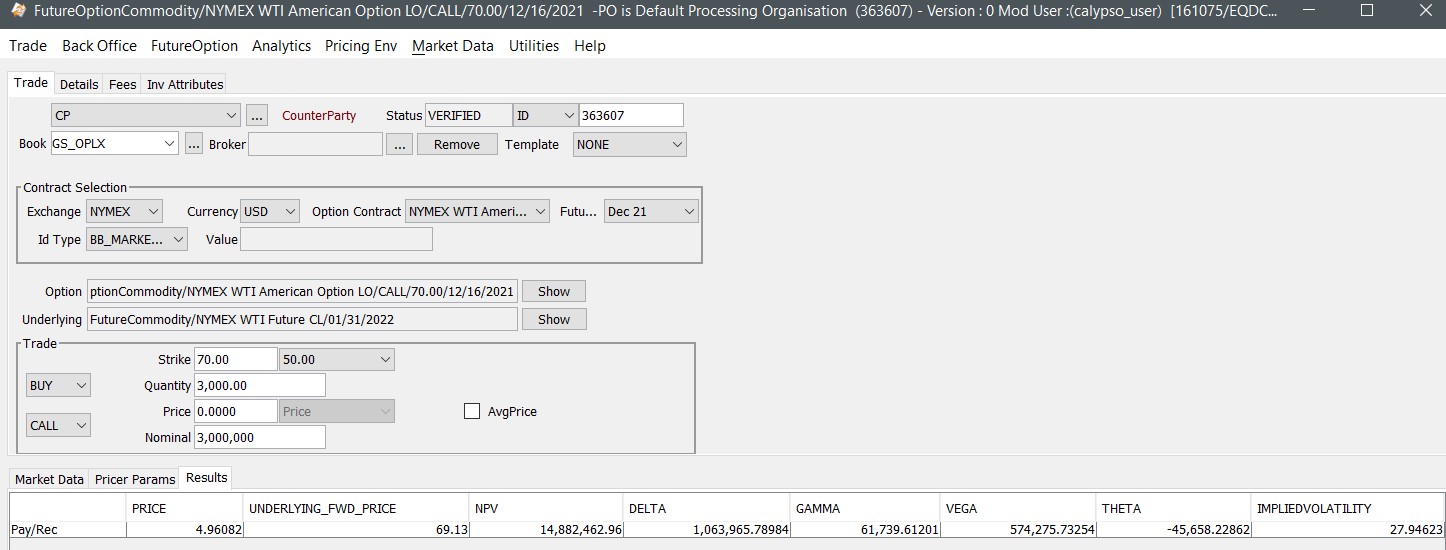

2. Sample Commodity Future Option Trade

From the Calypso Navigator, navigate to Trade > Commodities > Listed Future Options.

The following pricer measures are calculated.

|

Pricer Measures |

Commodity Future Option |

|

NPV Delta Vega Gamma Theta |

For European options, the NPV and Greeks are calculated using the Black 76 model. For American options, NPV is calculated using the CRR binomial model. All Greeks are multiplied by the quantity, tick value and nominal of the underlying future. |

|

Price |

Equal to calculated NPV. |

|

Break Even |

Corresponds to the price of the underlying. The price of the underlying is directly picked up from quote or calculated. It depends of pricing parameters specified in Pricing Environment used (FUTURE_FROM_QUOTE). |

|

Implied Vol |

Implied Volatility. |

|

Notional |

Quantity * Contract Size. |

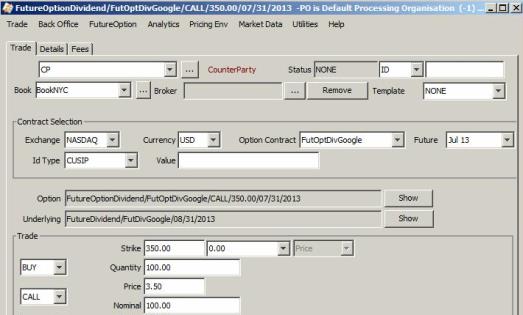

3. Sample Dividend Future Option Trade

From the Calypso Navigator, navigate to Trade > Equity > Listed Future Options.

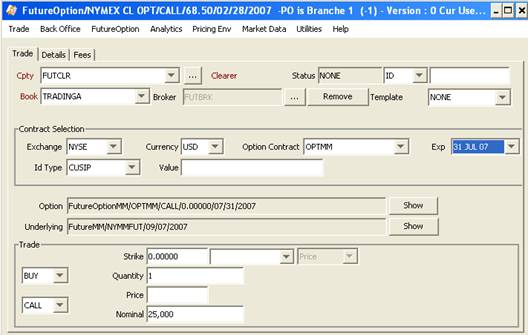

4. Sample Money Market Future Option Trade

From the Calypso Navigator, navigate to Trade > Money Market > Interest Rate Future Options.

The following pricer measures are calculated.

|

Pricer Measures |

MM Future Option |

|

NPV Delta Vega Gamma Theta |

For European options, the NPV and Greeks are calculated using the Black 76 model. For American options, NPV is calculated using the CRR binomial model is used. Greeks for American options are not available yet. All Greeks are multiplied by the quantity, tick value and nominal of the underlying future. |

|

Price |

Equal to calculated NPV. |

|

Break Even |

Corresponds to the price of the underlying. The price of the underlying is directly picked up from quote or calculated. It depends of pricing parameters specified in Pricing Environment used (FUTURE_FROM_QUOTE). |

|

Implied Vol |

Implied Volatility. |

|

Notional |

Quantity * Contract Size. |

5. Fields Details

Trade Details

|

Fields |

Description |

|

Role/Cpty |

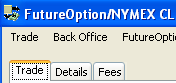

The first two fields of the worksheet identify the trade counterparty: legal entity and role. The role of the trade counterparty for a future trade should be set to Clearer. You can either choose Utilities > Set Default Role to set the default role to Clearer, or double-click the CounterParty label and select the role Clearer. Then select a legal entity of role Clearer. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. Automatic Fees You can define automatic fees for the Clearer. Define the fee types with the default calculator FeeGrid – Define a fee grid – Set the rule AutomaticFees on a trade workflow step (for example PENDING – AUTHORIZED – VERIFIED). Refer to the Calypso Futures User Guide for complete details. Sample fees – Automatic fees are created upon saving the trade.

|

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

Broker |

You can select a broker after you have selected the contract. Click ... to select a broker. A broker is a legal entity of role Broker. Automatic Fees You can define automatic fees for the Broker. Define the fee BRK with the default calculator FeeGrid – Define a fee grid – Set the rule AutomaticFees on a trade workflow step (for example PENDING – AUTHORIZED – VERIFIED).

|

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

Contract Selection

| Fields | Description |

|---|---|

|

Exchange Currency Option Contract Exp / Future |

A future option product is uniquely identified by an exchange, a currency, a contract name and an expiration month. Select an exchange, a currency, a contract name and an expiration month to select a future option product. Future option products are created using Configuration > Listed Derivatives >

Future Options from the Calypso Navigator (menu action |

|

Id Type Value |

Defaults to the product code selected in the User Defaults, and displays its value if any. The values are set on the Future Option products. You can select another product code as applicable. |

Products

| Fields | Description |

|---|---|

|

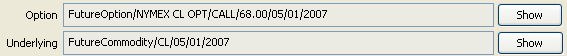

Option |

Displays the description of the selected future option product. You can click Show to display the future option’s details. |

|

Underlying |

Displays the description of the underlying future of the selected future option product. You can click Show to display the future’s details. |

Trade

| Fields | Description |

|---|---|

|

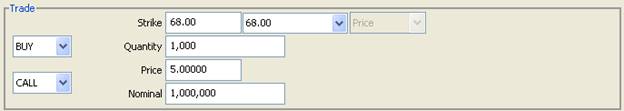

Buy / Sell |

Select the direction of the trade from the book’s perspective: BUY or SELL. |

|

Call / Put |

Select the direction of the option from the book’s perspective: CALL or PUT. |

|

Strike |

You can select a strike from the future option products already existing, or you can enter a strike, and the corresponding future option product will be created on-the-fly. |

|

Quantity |

Enter the number of options and the nominal will be calculated accordingly. Or enter the nominal and the quantity will be calculated accordingly. |

|

Price |

Enter the unit price of the option. |

|

Nominal |

Enter the nominal and the quantity will be calculated accordingly. Or enter the quantity and the nominal will be calculated accordingly. |

| AvgPrice (Average Price) |

Select the AvgPrice checkbox to preserve the trade price without rounding, regardless of the Quote Type or Quote Decimals specified on the given Future Option contract. Any trade price based calculations, including Nominal and relevant pricer measures, will use the full decimals of the trade price. Selecting this checkbox populates the "Trade Average Price" trade attribute with the value for the average price. |

6. Sample Precious Metal / FX Option Trade

Precious Metal Option trades and FX Option trades are captured using the Pricing Sheet.

Please refer to Calypso Pricing Sheet - "Future Option FX" documentation for details

Please refer to Calypso Pricing Sheet - "Future Option FX" documentation for details