Defining Clearers

The legacy methods for computing variation margins will be deprecated in an upcoming release. It is recommended to use the scheduled task CLEARING_VM_CALC instead, along with the associated account structure and clearing statement, as described in the Calypso ETD Clearing Setup Guide.

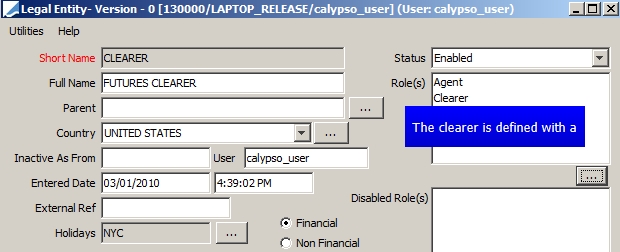

A clearer is the legal entity that holds the processing org’s clearing accounts on a given market place. It is also the trade’s counterparty for future and future option trades.

The role Agent is used to generate margin calls and account statements, and the role Clearer is the trade’s counterparty and is used to compute clearing fees and execution fees.

1. Legal Entity Setup

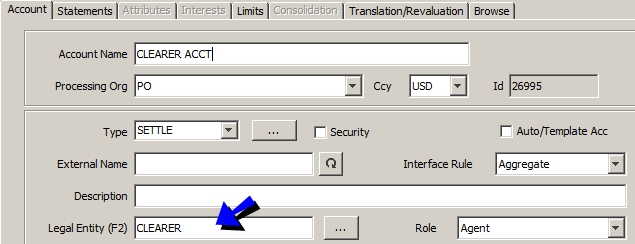

2. Account Setup

You need to define a SETTLE account with the account holder set as the clearer.

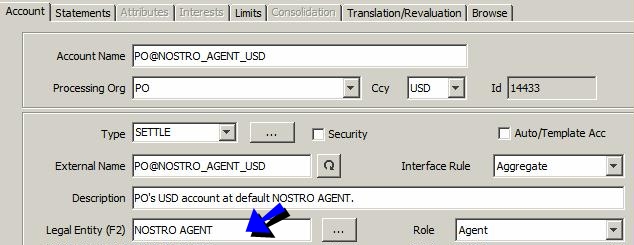

You also need a Nostro account for the processing org.

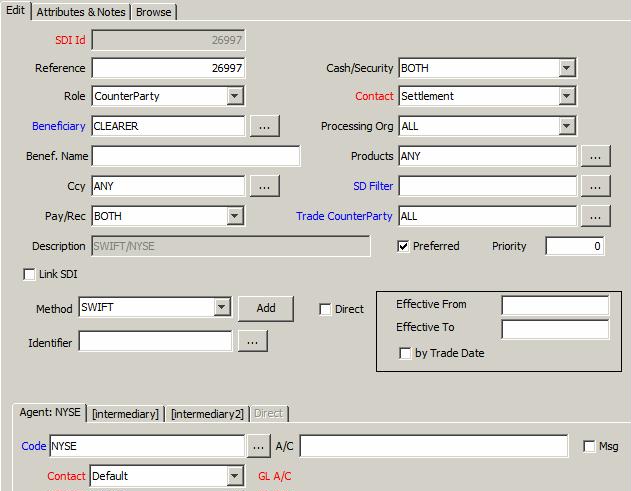

3. Settlement Instructions

The settlement instructions should be setup as follows.

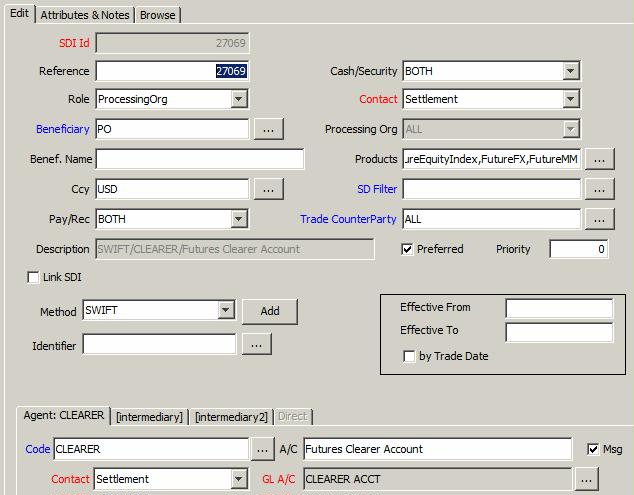

3.1 Processing Org

| • | Beneficiary = Processing org (example PO, role ProcessingOrg) |

Agent = Clearer (example CLEARER)

GL Account = PO settlement account at clearer

The transfers settled using this SDI will be registered in the account "CLEARER ACCT"

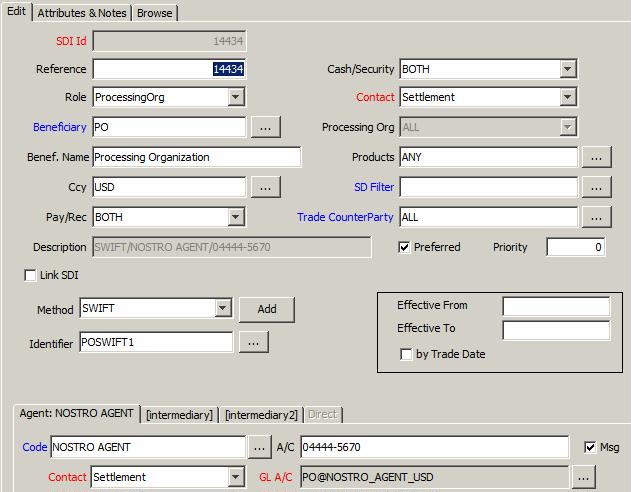

| • | Beneficiary = Processing org (role ProcessingOrg) |

Agent = Nostro (role Agent)

Account = PO settlement account at Nostro

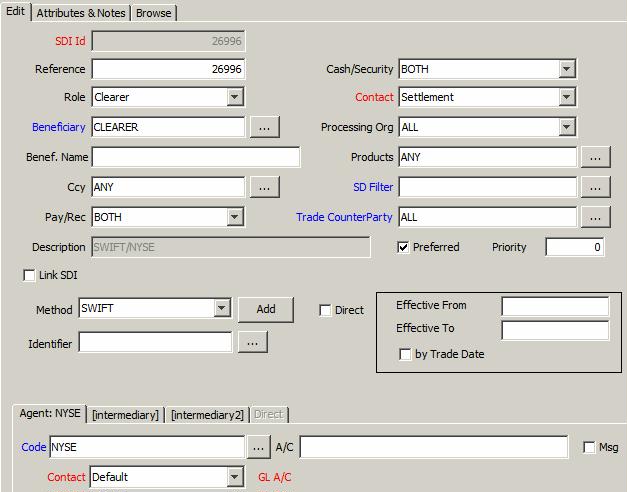

3.2 Clearer

| • | Beneficiary = Clearer (role Clearer) |

Agent = Market place or Agent (example NYSE)

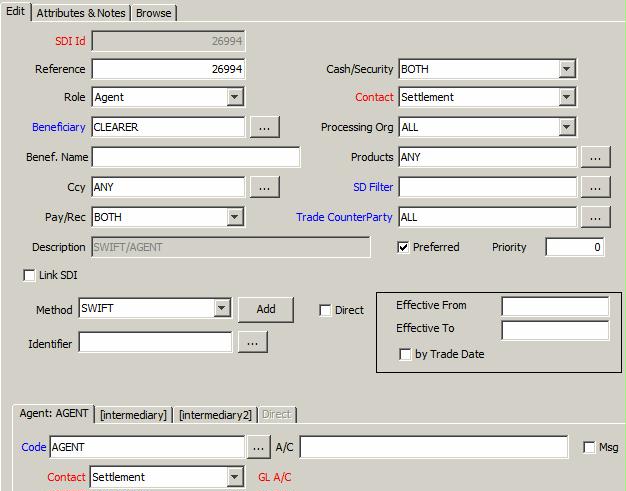

| • | Beneficiary = Clearer (role Agent) |

Agent = Clearer’s agent

| • | Beneficiary = Clearer (role CounterParty) |

Agent — Market place or Agent (example NYSE)