Defining Future Option contracts

A future option contract is a collection of future option products traded on a given exchange at a given expiry month. The future option products can be traded.

|

Quick Reference Creating future option contracts and products is a two-step process:

|

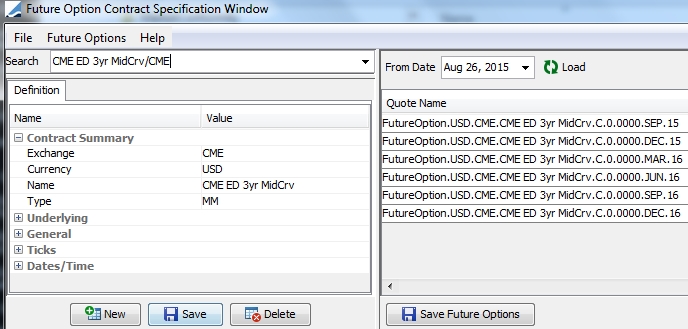

1. Editing and Creating Future Option Contracts

From the Calypso Navigator, navigate to Configuration

> Listed Derivatives > Future Option Contracts (menu action refdata.FutureOptionDefinitionWindow) for

creating future option contracts.

| » | To create a new contract, click New. Then enter the fields described below: Contract Summary and Definition. |

| » | To load and edit an existing contract, type in a few letters in the Search field. All contracts that contain those letters will appear. You can select a contract from the list. You can then edit the fields described below as needed. |

| » | Click Save to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry, provided that "FutureContract" has been added to the "classAuthMode" domain.

Enter the details of the contract.

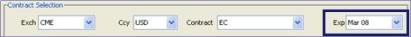

Contract Summary

|

Fields |

Description |

|---|---|

|

Exchange |

Select the exchange where the contract is traded. An exchange is a legal entity of role MarketPlace. |

|

Currency |

Select the currency in which the contract is traded. |

|

Name |

Enter the contract name. Note that a unique contract is defined by its combination of Name, Exchange and Currency, so that you cannot have an MM future option contract and a bond future option contract with the same name and currency on the same exchange. |

|

Type |

Select the type of future: Bond, Commodity, Dividend, EquityIndex, FX, MM (Money Market), Swap. |

Underlying

The underlying is a future contract - Future contracts are created using Configuration > Listed Derivatives > Future Contracts from the Calypso Navigator.

|

Fields |

Description |

||||||

|---|---|---|---|---|---|---|---|

|

Exchange |

Select the exchange where the underlying future contract is traded. |

||||||

|

Currency |

Select the currency in which the underlying future contract is traded. |

||||||

|

Name |

Select the name of the underlying future contract. You can choose Future Options > Show Underlying Future to view the corresponding future contract. |

||||||

|

Underlying Dates |

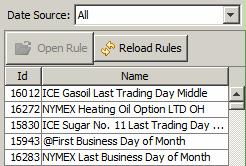

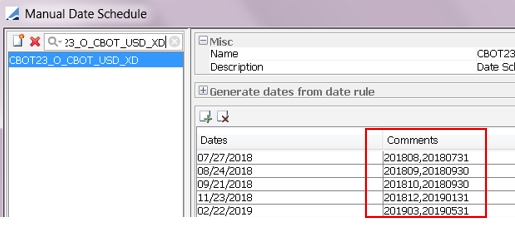

You can select from the following. Underlying Add Months Use this feature when the underlying future has a different maturity than the option expiration. Enter the number of months you want to add to the standard expiry months of the underlying future to link the future to the future option. Underlying Date Schedule Use this feature to map future options to special underlying futures. For example, the convention for LME Vanilla Exchange Traded Options is for monthly option expiration occurring on the first Wednesday of the month with physical exercise into the Future with a delivery date of the Third Wednesday of the month. For most future option contracts, this is no problem, because the monthly option expirations match the monthly future expirations. However, due to the fact that the LME base metal future contracts have daily expirations, while the options have the monthly exercise described above, there needs to be a link between the future option to the correct underlying future. You can select a date rule, or you can select a manual date schedule.

Date rules are created using Configuration > Definitions > Date Schedule Definitions > Date Rule from the Calypso Navigator - Help is available from that window. Manual date schedules are created using Configuration > Definitions > Date Schedule Definitions > Manual Date Schedule from the Calypso Navigator - Help is available from that window. Add Months on Product Use this feature to add months to each product individually using the product code UAM. If you select a manual date schedule for the expiration date schedule and enter the reference date in the Comments of the manual schedule in the form yyyyMMDD, the product code UAM will be set accordingly. If you use both “Prompt Month” and “Add Months on Product”, the Comments of the manual schedule must be set in the form <prompt month date>,<UAM date>.

|

General Fields

|

Fields |

Description |

|||||||||||||||||||||||||||

|

Quote Type |

Select the quote type of the future option’s price. For Future32 and Future64, the format is HHH-TTF.

|

|||||||||||||||||||||||||||

|

Quote Decimals |

Define the decimal precision at the contract level. The system uses this decimal precision in the Price field in the trade window and in quote rounding when calculating the NPV. |

|||||||||||||||||||||||||||

|

Exercise Type |

Select the exercise type: American or European. You can also select Asian - It behaves as the European exercise type. It is only used for SPAN calculations in the context of ETD Clearing. Exercise types are defined in the domain "ExerciseType". |

|||||||||||||||||||||||||||

|

AutoExercise |

Not applicable to future options. |

|||||||||||||||||||||||||||

|

Settle Type Option |

Select the settlement type of the underlying product: Cash or Physical. |

|||||||||||||||||||||||||||

|

No. of Option Contract |

Enter the total number of future option products traded in the contract. |

|||||||||||||||||||||||||||

|

Attributes |

Optional. Click Select... to add attributes to the contract definition. Out-of-the-box Attributes

Other available formats:

Ⓘ [NOTE: For the nominal calculator SFEFutureNominalCalculator, the DateFormat attribute must be set to "MMM yy"]

|

|||||||||||||||||||||||||||

|

Fungible with |

Select a contract that can be liquidated with the current contract, if any. |

|||||||||||||||||||||||||||

|

Future Option Name Month |

Select the reference date to identify the contract name:

|

|||||||||||||||||||||||||||

| Long Name |

Contract long name. |

|||||||||||||||||||||||||||

| Exchange Clearing Ticker |

For ETD Clearing - Market standard contract symbol used by the exchange and trade interface. |

|||||||||||||||||||||||||||

| Premium Payment Convention |

Type of premium:

If an exchange is defined in the FutureLiffeModel domain, then the variation margin method is used. Following are the possible combinations and the pricing model that is used.

|

Ticks

| Fields | Description |

|---|---|

|

Tick Type |

Select the tick type: Fixed or Variable. When Variable is selected, a nominal calculator needs to be specified. See below. |

|

Nominal Calculator |

Only applies to variable ticks. The nominal calculator is used for computing the contract size. For NZD / AUD future options, specify the nominal calculator as "SFEFutureNominalCalculator." Otherwise, you need to implement a custom calculator for computing the contract size. To implement a custom calculator, create a class named |

|

Minimum move (ticks) |

Enter the minimum allowable price fluctuation for the contract, as defined by the exchange, in decimal format. |

|

Tick Value |

Only applies to fixed ticks. Enter the change in value of one contract, given a change in the contract’s price equal to the Minimum Move (one tick). Tick Value = Contract Size / Tick Size |

|

Tick Size |

The Tick Size is the denominator of the fractional representation of the Minimum Move. For instance, a minimum move of 0.01, or 1/100, gives a Tick Size of 100. You can add tick size values to the dropdown menu through the domain "tickSize". |

Dates/Time

|

Fields |

Description |

||||||

|---|---|---|---|---|---|---|---|

| Date Format |

Select the date format for the quote names of the future option products:

Ⓘ [NOTE: So called "Flex" options - bespoke products allowed by some exchanges for trading and clearing by the clearinghouse, and which sometimes have multiple expiration dates - are referenced by a day, month, and year to conform to date formatting conventions in quotes. To match formats, you can use the Daily setting for the Date Format and then specify the appropriate day/month/year arrangement by using the DateFormat contract attribute. See Attributes above.] |

||||||

|

Last Trading Time |

Enter the time of day that trading will end on the last trading day. Use twenty-four hour time notation (for example 16:30 is four-thirty in the afternoon). |

||||||

|

Time Zone |

Select the time zone of the trading time. |

||||||

|

Expiration Date Schedule Last Trade Date Schedule First Delivery Date Schedule Last Delivery Date Schedule |

Type in a few letters (at least 2) in a date schedule field. All date schedules that contain those letters will appear. You can select a date schedule from the list. A date schedule can be a date rule or a manual date schedule. Date rules are created using Configuration > Definitions > Date Schedule Definitions > Date Rule from the Calypso Navigator - Help is available from that window. Manual date schedules are created using Configuration > Definitions > Date Schedule Definitions > Manual Date Schedule from the Calypso Navigator - Help is available from that window. |

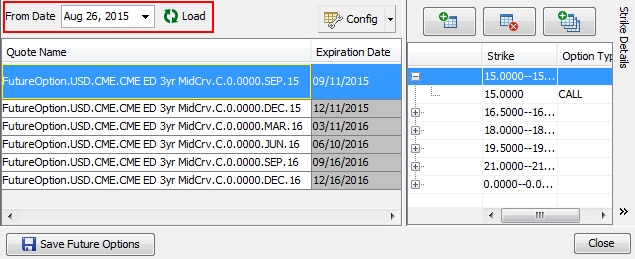

2. Generating Future Option Products

Load a contract from the Search field. Then select a start date and click Load on the right-hand side.

| » | In the Strike Details panel, click  to generate a set of strikes for each future option expiration. You can generate strikes between 2 values, or ATM strikes. A future option product is created for each combination of expiration and strike. to generate a set of strikes for each future option expiration. You can generate strikes between 2 values, or ATM strikes. A future option product is created for each combination of expiration and strike. |

You can also click  to add strike rows as needed, and enter the strike and option type.

to add strike rows as needed, and enter the strike and option type.

| » | The product code Prompt Month is populated by the Comments of the manual expiration schedule if Future Option Name Month = "Prompt Month". |

| » | If "Underlying Dates = Add Months on Product" on the Future Option Contract, you can add months to each product individually using the product code UAM. |

| » | You can click Select... in the Attributes column to view the attributes of the future option contracts. |

| » | Click Save Futures Options to save the actual future option products that can be traded. |

| » | You can select Config > Open Column Configurator to configure the layout. Then you can select Config > Save Current Column Config to save the layout, otherwise it will be lost upon closing the window. |

Details on Dates Generation

The dates of the Future Option products are set by default as follows - You can modify them as needed.

| • | First Trade Date: Set to the Expiration Date. |

| • | Last Trade Date: Set to the previous date generated by "Last Trade Date Schedule", or to the Expiration Date if no schedule is set. |

| • | First Delivery Date: Set to the next date generated by "First Delivery Date Schedule", or to the Expiration Date if no schedule is set. |

| • | Last Delivery Date: Set to the next date generated by "Last Delivery Date Schedule", or to the Expiration Date if no schedule is set. |

For details on quote types used by the system, see

For details on quote types used by the system, see