Best Practices for Exercise and Expiration

This document recommends best practices for FX Options exercise/expiration processing. In brief, the following activities need to be done for each expiration cut in the trading day:

| • | Update FX Spot Quotes and Reset Schedules |

| • | Perform Strike Fixing for Forward Starting Options |

| • | Perform Barrier and Trigger Processing |

| • | Perform Exercise Processing |

| • | Perform Expiration Processing |

| • | Reconcile actions taken |

Contents

- Overview

- Recommended Exercise and Expiration Process

- Recommended Barrier Management Process

- Expiration Processing using a Scheduled Task

- Barrier Processing using a Scheduled Task

1. Definitions

Inactive Pricing - A pricing state wherein the FX option pricing infrastructure detects that the trade has expired, and will value the associated option as the value of any fee whose delivery date is in the future.

Expired Active Pricing - A pricing state wherein the FX option pricing infrastructure does not detect that the trade has expired, and will value the associated option as the value of its expected payoff in addition to any fees.

2. Overview

On the expiration date if a European FX option, the trader must make a decision to exercise or expire the option based on the market conditions just prior to the cut time. Calypso reflects these decisions by applying lifecycle actions to the expiring trades; these trades are managed using the Option Lifecycle Analysis (OLA) report in the Calypso Workstation (CWS).

The need for the exercise lifecycle action is obvious: the option has to be exercised to create the new spot trade or cashflow. The need for the expiry lifecycle action is less obvious, but still important: all lifecycle actions need to amend the trade to ensure that the option pricing infrastructure correctly values the option after its exercise or expiry. Specifically, Calypso's FX option pricing infrastructure requires the presence of certain trade keywords, which are applied during the lifecycle action processing, to properly value option trades after the expiration date.

Implications for Post-Expiry Option Valuation

Option cut times normally occur in the middle of the trading day while the markets are active (e.g. 3 p.m. Tokyo, 10 a.m. New York). Decisions on which options to exercise will frequently be made and acted upon very close to this cut time. Given this, what should happen to the option valuation during the window between the cut time and the conclusion of the lifecycle housekeeping? If delegated to the underlying option model, the valuation and risk would fall off a cliff because the model would detect that the expiry time had passed.

In order to provide a trader with an accurate view of the risk of their portfolio during this window, Calypso's FX option pricing infrastructure relies on workflow events and keywords applied during workflow events. In short, the trade is valued as if it were live until the trade is exercised or expired. After this point, the trade is no longer assumed active, and will only be valued as the value of its attached fees.

This exercise or expiry process in Calypso needs to be done immediately after the status of all expiries is confirmed (this will generally be after the cut time, but can be sooner). If the trades are left unexpired or unexercised in the system after the time cut, then the changing spot rate may bring OTM trade back into the money, or ITM trades back out of the money, even though those trades should have been exercised and the corresponding delta positions locked in. Leaving trades unexpired will lead to incorrect positions and P&L for traders, making it impossible for them to correctly hedge their risk.

The OLA-Exercise report is the recommended tool for the exercise management.

Barrier Management

Barrier and touch options are managed similarly, but with less discretion granted to the trader. Market standards dictate that if the spot trades at or through the barrier level in a "market amount" on the main platform of that currency - typically €5mio on EBS in EURUSD, $5mio on Reuters in AUDUSD or the equivalent - the barrier is considered triggered.

Equally, barriers and touches need to be triggered as soon as their levels are breached in the spot market. Leaving them intact, even for a short period of time, means that if spot drops back through the barrier, the option will be priced as though the barrier had not been touched, which would lead to the traders' positions and the P&L being incorrect.

The OLA-Barrier report is the recommended tool for barrier management.

3. Recommended Exercise and Expiry Process

Step 1 - Update FX Spot Quotes and Reset Schedules

At expiration time, save current FX spot quotes to the proper Quote Set. This must be done to set a reasonable spot quote value for Expired Active pricing. If your quotes are mapped to a real-time price feed, this can be accomplished by configuring the SAVE_QUOTES scheduled task to run daily at each exercise cut time. Do not update FX spot quotes again until exercise and expiry housekeeping has been fully completed.

Asian, Lookback and cash-settled options require quote values to be updated in their associated reset schedules. If the reset schedule is mapped to a real-time price feed, they will be updated in the SAVE_QUOTES scheduled task; otherwise, they can be updated them manually in the Quote window.

Step 2 - Fix Strikes on Forward Starting Options

Forward starting options must have their Strikes fixed on fixing date. This is done using the FX Rate Reset window.

Step 3 - Exercise and Expiry Processing

The OLA-Exercise view is the recommended way to handle exercise and expiry processing. It allows the real-time monitoring of which options are ITM and OTM, and also allows one-click bulk exercise and expiry.

The following table describes the option types and lifecycle actions that should be processed with the Option Lifecycle analysis - Barrier View.

See Option Lifecycle Analysis for detailed instructions.

See Option Lifecycle Analysis for detailed instructions.

| Option Type | Action | Description |

|---|---|---|

|

Barrier (KI, KIKO) |

Knock In |

Knocking in a barrier whose in barrier has been breached will create a new vanilla option or a KO barrier (if KIKO Type B). This action can be done on any date within the barrier window. |

|

Barrier (KO) |

Knock Out |

Knocking out a barrier whose out barrier has been breached will terminate the option. This action can be done on any date within the barrier window. |

|

Barrier (KO) |

Exercise |

Exercising a barrier option whose knock-out barrier has not been breached will create the appropriate payoff. This action can be done only after expiration time. Knock In barriers will have been knocked in to a vanilla; therefore KI exercise is not valid. |

|

Barrier (KI, KO & KIKO) |

Expire |

Expiring a barrier option whose in barrier has not been breached or a barrier option whose out barrier has not been breached will terminate the option. This action can only be done after expiration time. |

|

Digital (OT, OTNT) |

Trigger In |

Triggering in a digital option whose in trigger has been breached will create a payoff in the form of an exercise fee, or will create a no touch digital (if one touch, no touch Type B). This action can be done on any date within the trigger window. |

|

Digital (NT) |

Trigger Out |

Triggering out a no touch digital option whose out trigger has been breached will terminate the option. This action can be done on any date within the trigger window. |

|

Digital (at Expiry) |

Exercise |

Exercising a digital at expiry option will create a payoff in the form of an exercise fee. |

|

Digital (NT) |

Exercise |

Exercising a no touch digital at expiration time will create a payoff in the form of an exercise. A one touch digital option will have been triggered in, so the exercise action is not valid. |

|

Digital (OT, OTNT & at Expiry) |

Expire |

Expiring a one touch or one touch, no touch whose in trigger has not been breached will terminate the option. Expiring an at-Expiry digital will terminate the option. |

|

Digital with Barrier (OT, OTNT) |

Trigger In |

Triggering in a digital with barrier whose in barrier has been breached will create a digital at expiry or a NT digital with barrier (if OTNT Type B). This action can be done on any date within the barrier window. |

|

Digital with Barrier (NT) |

Trigger Out |

Triggering out a no touch digital with barrier will terminate the option. This action can be done on any date within the trigger window. |

|

Digital with Barrier (NT) |

Exercise |

Exercising a no touch digital with barrier option whose out trigger has not been breached will create the appropriate payoff. This action can be done only after expiration time. One touch digital with barrier will have been triggered in to a digital at expiry; therefore OT exercise is not valid. |

|

Digital with Barrier (OT, NT & OTNT) |

Expire |

Expiring a OT or OTNT digital with barrier option whose in barrier has not been breached or a NT digital with barrier option whose out barrier has not been breached will terminate the option. This action can only be done after expiration time. |

4. Recommended Barrier Management Process

Step 1 - Stream live spot quotes with the Market Data Server

Barrier management - and the OLA-Barrier report itself - relies on up-to-date market data. The OLA-Barrier report uses the high and low rates from the market data quotes to determine whether or not a Barrier has been triggered, so these need to be populated as close as possible to real-time. The Market Data Server is the recommended way to supply up-to-date market data to the reports.

Step 2 - Trigger and Knock Out using OLA-Barrier

When the barrier gets triggered, the option's delta changes immediately by an amount that can be many times larger than the notional of the option itself. This stepwise change in delta is only incorporated when the spot rate is through the barrier, and will disappear and reappear in the trader's position as the pot swings back and forth through the barrier level, unless it is locked in by triggering the trade with the associated barrier.

To prevent the swinging effect, the trade should be triggered as soon as possible after the barrier is triggered, immediately if possible. They should be triggered in bulk as soon as a level has been confirmed to have been hit, because this causes the least disruption to traders' positions. OLA-Barrier allows this triggering to be done in bulk.

See Option Lifecycle Analysis for detailed instructions.

See Option Lifecycle Analysis for detailed instructions.

Alternatively, you can use the Option Exercise window.

See OTC Option Exercise for detailed instructions.

See OTC Option Exercise for detailed instructions.

The following table describes the option types and lifecycle actions related to Exercise and Expiration.

| Option Type | Action | Description |

|---|---|---|

|

Vanilla (American and European |

Exercise |

Exercising a vanilla option will generate the appropriate payoff. European options may only be exercised after the expiration time. American options may be exercised on any date between the first exercise date and the expiration date. |

|

Vanilla (American and European) |

Expire |

Expiring a vanilla option will terminate the option. Vanilla options may only be expired after the expiration time. |

|

Asian |

Exercise |

Exercising an Asian option will generate the appropriate payoff. |

|

Asian |

Expire |

Expiring an Asian option will terminate the option. This action can only be done after expiration time. |

|

Fader |

Exercise |

Exercising a Fader will generate the appropriate payoff. |

|

Fader |

Expire |

Expiring a Fader will terminate the option. This action can only be done after expiration time. |

|

Forward Starting |

Exercise |

Exercising a Forward Starting option will generate the appropriate payoff. |

|

Forward Starting |

Expire |

Expiring a Forward Starting option will terminate the option. This action can only be done after expiration time. |

|

Lookback |

Exercise |

Exercising a Lookback option will generate the appropriate payoff. |

|

Lookback |

Expire |

Expiring a Lookback option will terminate the option. This action can only be done after expiration time. |

|

Range Accrual |

Exercise |

Exercising a Range Accrual option will generate the appropriate payoff. |

|

Range Accrual |

Expire |

Expiring a Range Accrual option will terminate the option. This action can only be done after expiration time. |

| European Range Binary |

Exercise |

Exercising a European Range Binary option will generate the appropriate payoff. |

|

European Range Binary |

Expire |

Expiring a European Range Binary option will terminate the option. This action can only be done after expiration time. |

|

Volatility Forward |

Exercise |

This is actually a volatility fixing rather than an exercise. “Exercising” a volatility forward will create the appropriate payoff. |

5. Expiration Processing using a Scheduled Task

Unlike equity options, FX options do not lend themselves to automated expiration processing. Market practice in the OTC FXO market is for option buyer to have complete control over the exercise process. This includes the right to partially exercise the option, lapse an ITM option, or exercise an OTM option. In all cases, the option buyer has the right to do whatever is necessary to suit their book.

However, there may be some cases where a scheduled task is needed. These are:

| • | If a Pricing Script product is being used, and/or |

| • | As an end-of-day clean up. |

In this case, the PROCESS_EXPIRY scheduled task can be used to complete the expiration process. This task will expire any option eligible to be expired at the date and time the task is run. If the scheduled task is used, it is essential to ensure that all exercise actions have been processed before the scheduled task is run, otherwise trades that should have been exercised will be incorrectly expired.

The scheduled task should be run on demand rather than be run automatically by the Calypso Scheduler.

See Calypso Scheduler for details.

See Calypso Scheduler for details.

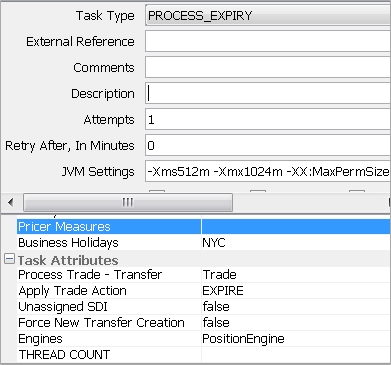

The configuration of the PROCESS_EXPIRY scheduled task is pictured below.

6. Barrier processing using a scheduled task

Calypso strongly recommends against using a scheduled task for barrier processing.

As mentioned above, the OTC FXO market standards dictate that a barrier is triggered when a spot prints in a "market amount" on the main platform for a relevant currency (typically EBS or Reuters). In most circumstances, the "market amount" high and low will correspond to the actual high and low.

It is possible for the high and low published on the market data feed to differ from the "market amount" high and low. This can happen when one bank runs out of credit with another; in this situation, the bank with little credit will be forced to trade through the best practice is they want to execute.

EX: A large bank (London) is defending a huge barrier in the EUR at 1.30 and is offering EUR $1bio on EBS at 1.2999 in defense of that barrier. There are no other offers at 99. All other offers are above that figure in anticipation of the barrier getting pinged. The next best offer is at 1.3001 from a large bank in Frankfurt.

A small bank (Auckland) needs to buy EUR $1mio for a customer, but they have run out of limits with the large bank in London. The small bank can not trade on the large bank's 99 offer, and EBS will not allow trading without credit limits. The best offer they can pay is the 01 offer from the large bank in Frankfurt. The small bank pays the Frankfurt bank at 1.3001, and that becomes the new high on the EBS feed.

The high on the market data feed is 1.3001, but 01 only traded in €1mio, and the London bank was offering 99 the entire time. The real high is 99, and the London bank's 1.3000 barrier should not be triggered despite the EBS feed.

Incorrect barrier triggering can have dire consequences. Multi-million dollar cashflows can be paid out incorrectly, and significant discrepancies in the trader's positions. Associated fictional costs of "rewinding" any hedges that had been unwound based on the barrier triggering can be accrued. For this reason, Calypso recommends against automating the FXO barrier triggering process.

7. Reconciliation

Once the exercise process is completed, the tick-back reconciliation may be performed to ensure that all actions were properly executed. A Trade Browser or Trade Blotter report, filtered by expiry date, can be used for this purpose.