OTC Option Exercise

![]() Download PDF - Expiration and Exercise

Download PDF - Expiration and Exercise

The Option Exercise window allows exercising or expiring options manually.

From the Calypso Navigator, navigate to Trade Lifecycle > Expiration & Exercise > Option Exercise, or choose Back Office > Exercise from the trade window.

You can also run the Option Lifecycle analysis and the OPTION_EXERCISE scheduled task.

Ⓘ [NOTE: Future Options and ETOs are exercised and expired under Trade Lifecycle > Expiration & Exercise > Future Option / ETO Exercise]

You can consult Best Practices for Exercising and Expiring FX Options.

You can consult Best Practices for Exercising and Expiring FX Options.

Contents

1. Setup Requirements

1.1 Workflow Setup

Make sure that your trade workflow has the following transitions to exercise/expire and un-exercise/un-expire options.

| • | VERIFIED - EXERCISE - EXERCISED |

| • | EXERCISED - UNEXERCISE - VERIFIED, workflow rule: UnexerciseOption |

| • | VERIFIED - EXPIRE - EXPIRED |

| • | EXPIRED - UNEXPIRE - VERIFIED, workflow rule: UnexerciseOption |

For partial exercise, a trade is created with the residual un-exercised amount. If you add the workflow rule CancelRemainderOfPartialExercise on the VERIFIED - EXERCISE - EXERCISED transition, the trade for the residual amount will be in status CANCELED, otherwise it will be in status VERIFIED.

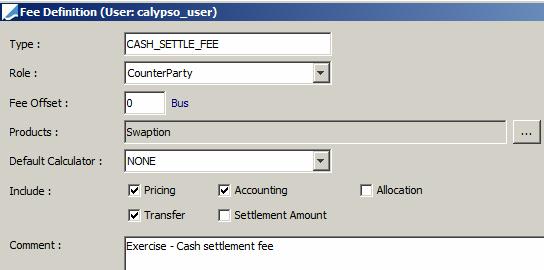

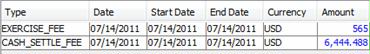

1.2 CASH_SETTLE_FEE

You can compute the fee CASH_SETTLE_FEE for cash settled swaptions. It corresponds to the settlement amount upon exercise.

Define the fee as follows:

Sample fee:

2. Exercising Options

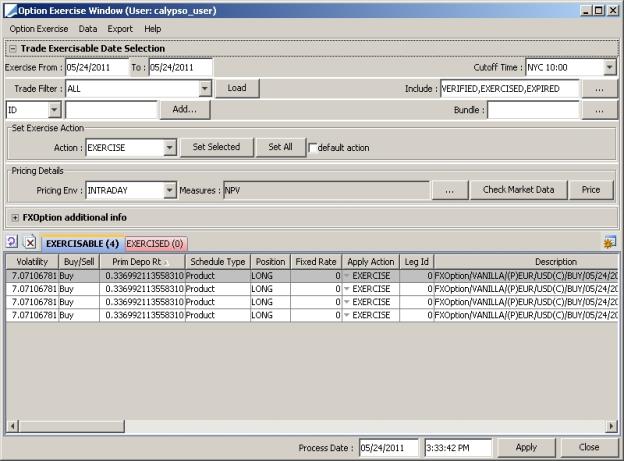

Option Exercise window

The EXERCISABLE panel displays the options that may be exercised or expired.

The EXERCISED panel displays the options that have been exercised or expired. Options may be un-exercised or un-expired from this panel.

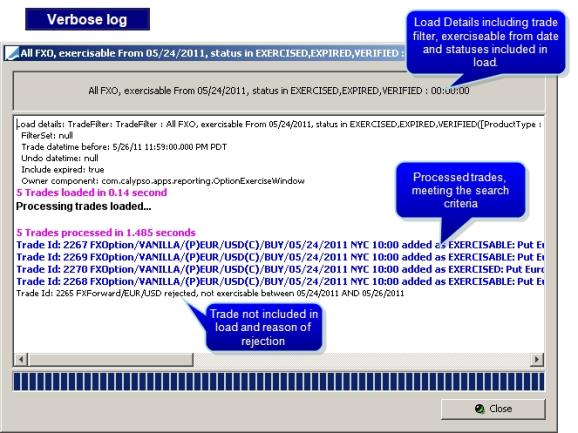

Step 1 - Enter search criteria as needed and click Load to load the corresponding options. The search criteria are described below.

When loading the options, a log file displays during the load. After the options are loaded, you are able to view this log file by selecting Option Exercise > Show Log Progress. If you would like to see a more detailed log, select the toggle Verbose Log Progress under the Option Exercise menu. This must be selected prior to loading if you wish to view the detailed log.

You can double-click an option to view its details.

You can configure the display using Data > Configure Columns or click ![]() .

.

Search Criteria

|

Fields |

Description |

|

Exercise From / To |

Enter the exercise date range for loading the exercisable options. The default dates are today. |

|

Process Date / Time |

Specifies the date and time that you are processing the options. Defaults to the current date and time. The system uses the process date and time as the trade date and time for physically settled options. |

|

Cutoff Time |

Optional. For FX Options, you can select a expiry to use as the cutoff time. All options that are less than or equal to the selected time, or only equal to the selected time will be loaded in the Option Exercise Window. The default value is not to use a cutoff time. |

|

Include |

Options with these workflow statuses will be loaded in the Option Exercise Window. Click ... to remove statuses from the list or add statuses to the list. Statuses listed in the right panel in the pop-up window are included in the criteria. The statuses are tied to the workflow. See the Workflow Configuration. |

|

Trade Filter |

Select a trade filter to use when loading the options. Only options included in the trade filter will be loaded. |

|

ID |

You can load a specific trade by entering the trade id in this field and pressing [Enter]. You can also load a specific trade by the external or internal reference. Select Ext Ref or Int Ref, respectively, from the drop-down menu. Enter the reference in the adjacent field and press [Enter] to load the trade. You can click Add to load multiple trades according to the attributes defined in the Trade Selector Window. |

| Bundle |

You can load trades that belong to the same trade bundle. Click ... to select a trade bundle for loading the corresponding trades. |

Step 2 - Complete the details of any required fields in the options. For example, for cash-settled options, you can enter the Settlement Rate.

Product-specific details are described below.

Step 3 - Select the pricer measures you want to compute, a pricing environment and click Check Market Data to check that all required market data are available.

Then click Price to price the options.

For cash-settled options, the application calculates the settlement amount.

The application displays the pricing results in the pricer measure columns.

Step 4 - Select the action to be applied upon exercise as needed.

The actions are tied to the trade workflow.

You can click Set Selected to set the action on the trades selected in the option table, or click Set All to set the action on all of the trades displayed in the option table.

You can also check "default action" to apply the the first compatible action in the workflow.

For swaptions, the default action is EXERCISE if the option is in-the-money, (e.g. the market rate is greater than the strike price in the case of calls), or the expiry action from domain "tradeExpiryAction" otherwise.

Step 5 - Select an FX Reset for FX Options as needed.

|

Fields |

Description |

||||||||||||

|

FX Reset |

To use the FX reset:

|

||||||||||||

|

Auto Exercise |

Use this feature to flag options for automatic exercise. The AUTOMATIC_EXERCISE scheduled task automatically exercises in-the-money options. The scheduled task does not support Bermudan or American Swaptions.

The application sets the "Auto Exercise" checkbox on the selected options(s). |

Step 6 - Select the options that you would like to exercise/expire and click Apply.

For cash settlement exercise, an exercise fee is attached to the option trade, and the trade moves to status EXERCISED.

For physical exercise, a trade is created for the underlying product, and the option trade moves to status EXERCISED.

| • | The ExercisedUnder trade keyword is set on the option trade. It contains the trade id of the trade generated for the underlying product. |

| • | The ExercisedOption trade keyword is set on the trade generated for the underlying product. t contains the trade id of the option trade. |

For expiration, the trade moves to EXPIRED.

The trade keyword ExercisedAmount contains the partial amount entered upon partial exercise. For full exercise, it contains the exercised quantity for quantity-based trades or the exercised notional otherwise.

Mode details are provided by product type below.

2.1 Commodity Options Exercise

The Option Exercise window should only be used to excise physically-settled commodity options.

For cash-settled commodity options, which are cashflow based, you need to use the Price Fixing function. It will fix the cashflows and create the necessary transfers to affect payment.

The following table describes product-specific details for exercising Commodity Options.

|

Option Type |

Description |

||||||

|

Commodity OTC Option 2 |

Select the Settlement type Physical. Physical Settlement The application automatically selects the Create Underlying checkbox when you select the Physical Settlement type. The exercise generates the Commodity Forward trade.

The Commodity Forward has the following details: Quantity = option deal quantity. Price = option strike price. Units = option deal units. Payment Currency = option deal currency. Settle Date = delivery date = CO2 final payment maturity date. Trade Date = option 'Exercise' date. Commodity = underlying commodity of the option commodity reset. Forward Price Method = option forward price method. Fixing Holidays = option fixing holidays. Payment Details = option payment details. Buy if the option is Buy-Call or Sell-Put. Sell if option is Buy-Put or Sell-Call. |

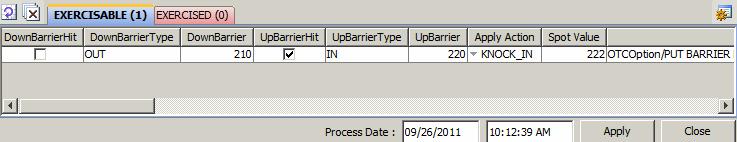

2.2 Equity Derivatives Barrier Processing

The process to knock-in / knock out equity derivatives barriers is a manual process.

You can use the Option Exercise window or the Option Lifecycle analysis to process barriers.

Once the options are loaded in the Option Exercise window, the checkboxes Up Barrier Hit or Down Barrier Hit are checked based on the underlying's monitoring quotes.

Ⓘ [NOTE: Make sure that the proper monitoring quotes are set based on the Monitoring type of the barrier]

Depending on the type of option (In or Out), you can knock-in / knock-out the barrier by applying the corresponding action.

Option Exercise Window - Sample Knock-in

| » | Select the applicable action. |

| » | For a KI option, Create Underlying must be checked as well. |

| » | Then click Apply. |

Exercise / expiration activity can be performed after processing the barriers, as applicable.

Available Actions

| Action | Description |

|---|---|

| Knock In (KI) |

Knocking in a barrier whose in barrier has been breached will create a new vanilla option or a KO barrier (if KIKO Type B). This action can be done on any date within the barrier window. |

| Knock-In (KIKO) |

Knocking in a barrier whose KI barrier has been breached will create a new Vanilla option (KIKO type A). This action can be done on any date within the barrier window. |

| Knock Out (KO) |

Knocking out a barrier whose out barrier has been breached will terminate the option. This action can be done on any date within the barrier window. |

| Knock-Out (KIKO) |

Knocking out a barrier whose KO barrier has been breached will terminate the option. This action can be done on any date within the barrier window. |

| Exercise (KO) |

Exercising a barrier option whose knock-out barrier has not been breached will create the appropriate payoff. This action can be done only after expiration time. Knock In barriers will have been knocked-in to a Vanilla; therefore KI exercise is not valid. |

| Expire (KI, KIKO) |

Expiring a barrier option whose KI barrier has not been breached or a barrier option whose KO barrier has not been breached will terminate the option and generate a rebate fee. This action can only be done after expiration time. |

Recommended Workflow Setup

|

Origin Status |

Action | Resulting Status | Rule | Comments |

|---|---|---|---|---|

| KNOCKED_IN | UN-KNOCK_IN | VERIFIED | UnexerciseOption | Trade undo knock in. |

| KNOCKED_IN | UNEXERCISE | VERIFIED | UnexerciseOption | |

| KNOCKED_OUT | UN-KNOCK_OUT | VERIFIED | UnexerciseOption | Trade undo knock out. |

| KNOCKED_OUT | UNEXERCISE | VERIFIED | UnexerciseOption | |

| VERIFIED | KNOCK_IN | KNOCKED_IN | ||

| VERIFIED | KNOCK_OUT | KNOCKED_OUT |

Processing Results

| • | The status of the trade on which the action is performed will be changed to the status associated with the action in the workflow. |

| • | A fee corresponding to the rebate is generated: |

| – | When a KO barrier is hit. |

| – | When a KI trade is expired without having been knocked-in. |

| • | For KI options, a trade is generated that has the same characteristics as the parent trade, expect it has no KI barrier, and the effective date of the trade equal to the event process date. All other trade attributes on the generated trades are the same as those on the parent trade: |

| – | Notional / Quantity |

| – | Underlying |

| – | Maturity |

| – | Strike |

| – | etc. |

| • | In addition, trade Termination keywords are populated on both the parent and child trades. |

| – | On the parent trade: |

| TerminationDate | Event Process Date |

| TerminationPayIntFlow | true |

| TerminationTradeDate | Event Process Date and time |

| TerminationType | UpBarrierOUT / DownBarrierOUT / UpBarrierIN / DownBarrierIn |

| – | On the child trade: |

| ExercisedOption | Parent Trade_ID |

| TransferDate | Parent Trade Maturity Date |

| TransferFrom | Parent Trade_ID |

| TransferTradeDate | Parent Trade Maturity Date and Time |

2.3 FX Options Exercise

Ⓘ [NOTE: The 5PM New York Rule impacts the processing of FX Options in the Option Exercise Window. The close of business for the trading day is 4:59:59 pm New York time when the book attribute DayChangeRule is set to FX. The new trading day starts at 5PM New York time]

The following table describes product-specific details for exercising FX Options.

|

Option Type |

Description |

||||||||||||||||||||||||||||||

|

Vanilla |

Select the Settlement type Cash or Physical. The default value is the settlement type selected in the Vanilla option. Cash Settlement The quote set associated with the selected Pricing Environment requires the Spot Value. Click Price to calculate the Settlement Amt, which is the amount for the exercise fee. Also, you can manually enter the fee in the Settlement Amt column. Following are examples of the settlement amount calculation. Call on the primary currency: Settlement Amt in Secondary Currency = (Spot Value – Strike) * Primary Amount Put on the primary currency: Settlement Amt in Secondary Currency = (Strike – Spot Value) * Primary Amount The exercise fee attaches to the FX Option trade. Physical Settlement The application automatically selects the "Create Underlying" checkbox when you select the Physical Settlement type. The exercise generates the FX trade.

|

||||||||||||||||||||||||||||||

|

Asian |

Cash Settlement The Settlement type is Cash. The exercise fee attaches to the trade.

|

||||||||||||||||||||||||||||||

|

Barrier |

The following columns in the exercise window are related to Barrier options:

Physical Settlement The application automatically selects the "Create Underlying" checkbox when you select the Physical Settlement type. The exercise generates the FX trade.

Cash / Physical Settlement The rebate fee, if applicable, attaches to the exercised Barrier option. |

||||||||||||||||||||||||||||||

|

Digital |

Cash Settlement The Settlement type is Cash. The Settlement Amt column displays the payout. The exercise fee attaches to the trade. The following columns in the exercise window are related to Digital options:

|

||||||||||||||||||||||||||||||

|

Lookback Fixed Strike |

Cash Settlement The system calculates the payout based on the difference between the strike set in the option and either the minimum or maximum rate fixed on the reset schedule. Following are examples of the calculations. Call on the primary currency: Settlement Amt in Secondary Currency = (Maximum Rate – Strike) * Primary Amount Put on the primary currency: Settlement Amt in Secondary Currency = (Strike – Minimum Rate) * Primary Amount |

||||||||||||||||||||||||||||||

|

Lookback Floating Strike |

Cash Settlement The system calculates the payout based on the difference between the floating strike (either the minimum or maximum rate fixed on the reset schedule) and the spot rate from the FX reset index. Following are examples of the calculations. Call on the primary currency: Settlement Amt in Secondary Currency = (Spot – Minimum Rate) * Primary Amount Put on the primary currency: Settlement Amt in Secondary Currency = (Maximum Rate – Spot) * Primary Amount Physical Settlement The application automatically selects the "Create Underlying" checkbox when you select the Physical Settlement type. The following examples show how the system derives the spot rate for the generated FX trade. Call on the primary currency: Spot rate on the FX trade is the Minimum Rate fixed on the reset schedule. Put on the primary currency: Spot rate on the FX trade is the Maximum Rate fixed on the reset schedule. The exercise generates the FX trade.

|

||||||||||||||||||||||||||||||

|

Range Accrual |

Cash Settlement The application automatically calculates the Settlement Amt using the number of fixing dates whose rates meet the range accrual conditions. For example, if there are 4 fixing dates, the PayOut is 4M USD, and the rate on the fixing dates is within the range on 3 of the fixing dates, then the Settlement Amt is 3M USD. The exercise fee attaches to the trade. |

||||||||||||||||||||||||||||||

|

Volatility Forward |

Cash Settlement Enter the agreed upon Volatility. By default, the Volatility column displays the volatility from the FX volatility surface. The exercise generates the premium fee, which attaches to the trade. Premium = Notional * Vega * (Fixed Volatility on trade date – agreed Volatility on exercise date) |

2.4 Cancellable Swaps

Following table describes the fields available in Option Exercise Window for Cancellable Swaps.

| Fields | Description |

|---|---|

| Do Interest Cleanup |

|

| Pmt Lag on Int Clean-Up |

This field will provide users with the ability to use Pmt Lag of the swap leg to be applied on Pmt Dt of Interest Clean-up cashflow. It will only have an impact when Interest Clean-up is checked (i.e. set to TRUE). When the trade is exercised with Interest Clean-up set to true and the flag (on Pmt Lag) is checked, Pmt Date of interest clean up transfer = Delivery Date + Pmt Lag of the Swap Leg. The transfer settles on this Pmt Date. When the trade is exercised with Interest Clean-up set to true and the flag (on Pmt Lag) is un-checked, Pmt Date of interest clean up transfer = Delivery Date. The transfer settles on this Pmt Date.

Default value of this flag in Option Exercise Window is as below:

Ⓘ NOTE: The flag can be manually checked or unchecked by users according to their requirements.

To summarize, If trade cashflows use a Pmt Lag, the same lag will now by default get applied to the settle date of Interest Clean Up transfers created from exercise. If the Interest Clean Up transfer should be paid on the Delivery dt, users must now set the flag to false. |