Capturing FX NDF Trades

This document describes how to capture FX NDF trades using the FX NDF trade window.

From Calypso Navigator, choose Trade > Foreign Exchange > FX Deal Station to bring up the FX Deal Station window.

| » | An FX Non-Deliverable Forward (FX NDF) trade is a cash-settled forward. There is no physical transfer of the principal amount in this trade. The forward contract is often on a thinly traded or non-convertible currency. The settlement is in a fully convertible currency, which accounts for any difference between the agreed forward rate and the actual exchange rate on the agreed forward date. |

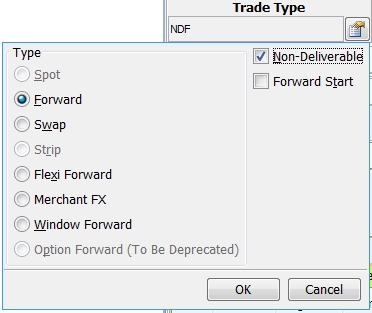

| » | To configure a NDF trade, either select an NDF currency as part of your currency pair, or choose NDF in the Trade Type Selection window. |

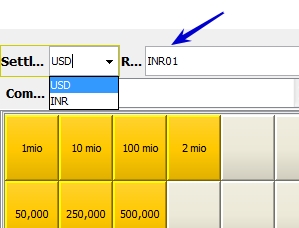

| » | In an NDF trade between two deliverable currencies, you are able to choose the settlement currency from the Settle Ccy drop down |

| » | A user attribute called FXNDF Default Negotiated Ccy can be used to designate the default negotiated currency as either the PL display currency or the non-PL display currency. This attribute can be found in Configuration > User Access Control > User Defaults > Attributes. If no choice is made for this attribute, the default negotiated currency is loaded based on the opposite of the PL Display Ccy in the Currency Pair definition. |

| » | The trade can be settled in a third currency, other than one of the currency pair. This currency is called the Quanto Currency. When the quanto currency and the associated reset (Fixing Index) is selected, the settlement amount in the original ‘Settle Ccy’ is then converted to the specified Quanto Currency based on the quanto fixing. |

| » | FX NDF and FX NDF Swap trades do not create positions. NDFs carry unique characteristics, such as reset information, that is lost when aggregating to positions. NDF positions only provide notional information and are therefore insufficient from a full risk perspective. NDFs are handled as individual trades. Analysis like the Forward Ladder load and process NDF information by loading the respective trades rather than positions. |

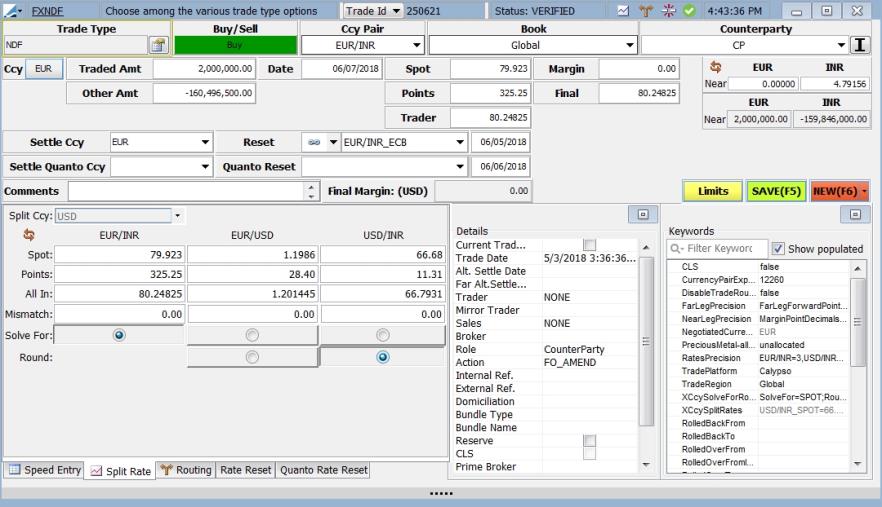

1. Sample FX NDF Trade

| » | See Capturing FX Forward Trades for complete details on entering trade details. |

| » | Select the FX Rate definition to reset the FX rates. FX Rate definitions are created from Calypso Navigator, by choosing Configuration > Foreign Exchange > FX Rate Definitions. |

| » | You can reset the FX rates by choosing Trade Lifecycle > Reset > FX Rate Reset from Calypso Navigator. |

Note:

| • | Spot |

| • | Points |

| • | Trader |

| • | Margin |

| • | All In, Mismatch, Spot and Points in the Split Rate panel |

2. Split Fixing

An NDF trade can split its reset, if desired. The split happens automatically, based on established reset definitions. It can also be manually done, by selecting either split or non-split from the reset area. Proper configuration must be set up.

See Reset Pair Management for more information.

You are able to split quanto resets as well.

Note: For an FX NDF trade with split fixing, the triangulated reset rate is rounded as per the quote rounding defined in the Currency Pair Defaults for that currency pair. The rounded quote is used as a settlement rate for the ISDA formula to calculate the settlement amount.

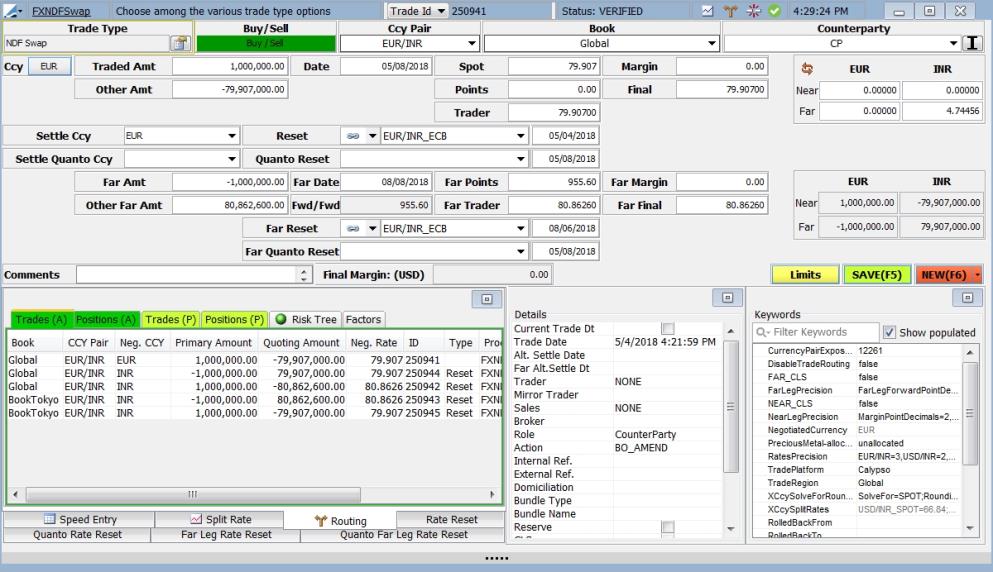

3. FX NDF Swap Trade

In an FX NDF Swap trade, you are able to select the FX Rate Definition for the near leg and for the far leg. FX Rate definitions are created by choosing Configuration > Foreign Exchange > FX Rate Definitionsfrom Calypso Navigator.

4. Pricing 3rd Currency Quanto

The pricing of a NDF trade using a 3rd currency for settlement is described in the example below.

Example using 3M EUR/USD NDF forward settling in BRL.

| • | Two FX curves are used, one for EUR/USD and one for USD/BRL as well as the USD/BRL Discount curve |

| • | The USD cash flow = Notional * (Forward EURUSD FX rate – Trade FX rate) |

| • | The BRL cash flow = (cash flow in USD) * (Forward USDBRL FX rate) |

| • | PV(Cash flow in BRL) = (BRL discount factor) * (Cash flow in BRL) |

The pricer used is an FX Forward pricer.

5. Importing Quanto Settled Trades

Quanto settled trades are supported for trade import. The .csv columns are:

|

Column |

Description |

|---|---|

|

Split Reset Flag Quanto |

This should be set to Y if the quanto fixing is split. This follows the same pattern for NDF split fixing. |

|

Split Ccy Quanto |

This should be populated with the split currency for the quanto fixing, if the quanto fixing is split. The quanto currency pair (and fixing) is formed from the NDF fixing settle currency (Near Leg Settle Ccy or Far Leg Settle Ccy) and the quanto settlement currency (Near Leg Settle Ccy Quanot or Far Leg Settle Ccy Quanto) therefore, there is a need to specify the split currency if the quanto fixing is split. Near Leg Settle Ccy Quanto and Far Leg Settle Ccy Quanto, if left blank, indicate that there is no quanto settlement on the deal. If this is the case, all other quanto fields will be ignored during import. |

|

Near Leg Settle Ccy Quanto |

Quanto settlement currency of FXNDF or near leg of FXNDFSwap |

|

Near Leg Reset Quanto |

FX reset name for the quanto fixing of the FXNDF or near leg of the FXNDFSwap. This is not populated if the quanto fixing is split. |

|

Near Leg Split Reset Quanto |

If the quanto fixing is split, this represents the FX reset pair name. |

|

Near Leg Reset Date Qunato |

Quanto fixing date for the FXNDF or near leg of the FXNDFSwap |

|

Far Leg Settle Ccy Quanto |

Quanto settlement currency for far leg of FXNDFSwap |

|

Far Leg Reset Quanto |

FX reset name for the quanto fixing of the far leg of the FXNDFSwap. This is not populated if the quanto fixing is split. |

|

Far Leg Split Reset Quanto |

If the quanto fixing is split, this represents the FX reset pair name. |

|

Far Leg Reset Date Quanto |

Quanto fixing date for the far leg of the FXNDFSwap |

6. Undo Rate Reset

When a trade or series of trades are reset either manually or using the scheduled task process, the reset trades are stamped with the relevant reset rate, the settlement cash flows are calculated and the back office confirmation and payment messages are generated.

In the event that a mistake has been made and the incorrect reset rate has been applied, you are able to re-run the scheduled task or in the case of a manual reset, update the rates in the rate reset window and reapply them. This recalculates the settlement cash flow and results in an update to the FXNDF Fixing confirmation and payment message.

But, there are times when completely undoing the rate reset may be necessary. This may be because an incorrect reset date was entered on the trade initially. In these cases, you may either run the scheduled task action UNDO_RATERESET or applying a manual UNDO_RATERESET.

When this action takes place, the following will happen:

| • | The main and , if applicable, split rate details reset details will zero out |

| • | An amended FXNDF Fixing Confirmation and Rate Reset Notice is generated referencing the previous confirmation where the rate reset was confirmed |

| • | The payment message is cancelled |

You cannot apply the UNDO_RATERESET action on trades that do not have RATE_RESET status.

You cannot apply the UNDO_RATERESET action on trades that have a settlement date of <Today.