Defining Currencies and Currency Pairs

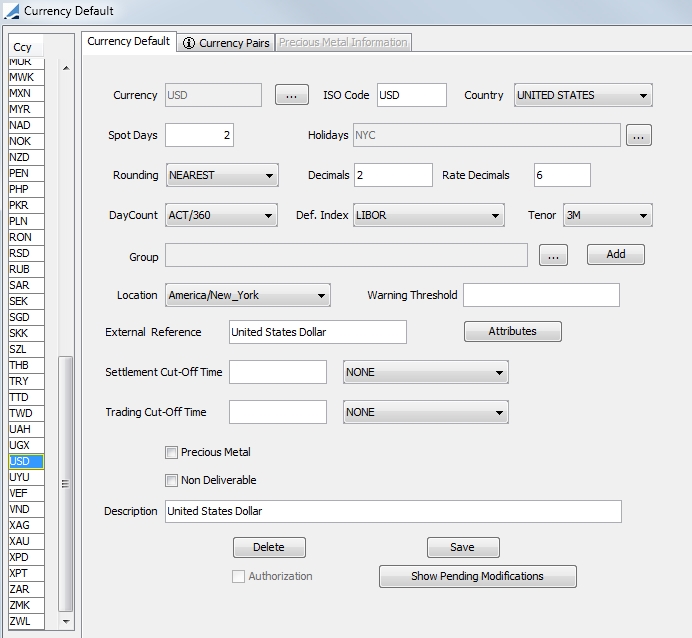

From the Calypso Navigator, navigate to Configuration > Definitions > Currency Defaults (menu action refdata.CurrencyDefaultJFrame) to define currencies and currency pairs.

Currencies

| » | A currency is identified by a currency code throughout the system. Select the Currency Default panel to define currencies and their associated static data. |

| » | You can specify user-defined attributes for selection and reporting purposes. |

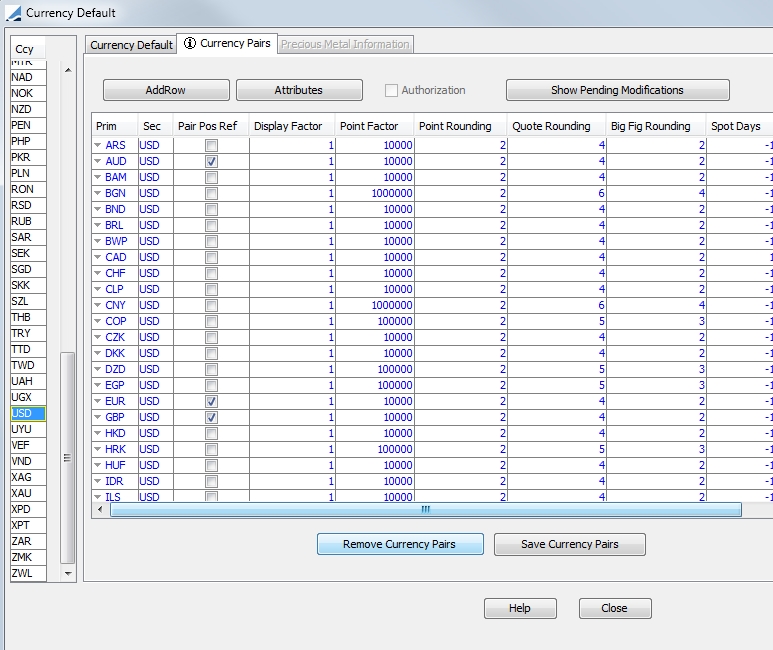

Currency Pairs

Select the Currency Pairs panel to define currency pairs and their associated static data.

| » | You can specify user-defined attributes for selection and reporting purposes. |

1. Creating a Currency

Select the Currency Defaults panel to define a currency and its associated static data.

| » | Click ... next to the Currency field to add a currency code to the Ccy list. Once the currency code has been created, select it from the Ccy list on the left hand-side of the window. |

The selected currency code will appear in the Currencyfield. Enter the other fields as described below.

| » | Click Save to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

Fields Details

|

Fields |

Description |

||||||

|---|---|---|---|---|---|---|---|

|

Currency |

Displays the currency code when you select it from the Ccy list. The currency code will identify the currency throughout the system. You can click ... to add or remove currencies from the Ccy list. |

||||||

|

ISO Code |

Enter the standard ISO abbreviation for the currency (International Organization for Standardization). Used in Swift messages in the environment property USE_CCY_ISO_CODE is set to true (payment messages and MT940/MT950 messages). |

||||||

|

Country |

Select the country of the currency. This information is used to calculate country risk, as well as positions and limits by country. |

||||||

|

Spot Days |

Enter the number of business days between the trade date and settlement (or start) date. |

||||||

|

Holidays |

Click ... to select holiday calendars that apply to this currency for calculating business days. |

||||||

|

Rounding |

Select the rounding convention: NEAREST, UP, or DOWN. Rounding conventions are described under Help > Rounding Methods. |

||||||

|

Decimals |

Enter the number of decimals used to display amounts according to the rounding convention. |

||||||

|

Rate Decimals |

Enter the default number of decimals used to display rates expressed in this currency. However, if you set Rate Decimals to -1 here, the Rate

Decimals specified in User Defaults will be used instead. See Configuration > User Access Control

> User Defaults (menu action |

||||||

|

Day Count |

Select the default daycount convention for financial instruments expressed in this currency. |

||||||

|

Def. Index |

Select the default reference index for financial instruments expressed in this currency (for example, Swap USD will be derived by default with LIBOR). |

||||||

|

Tenor |

Select the default tenor for the default reference index. |

||||||

|

Group |

Click ... to select groups of currencies to which this currency belongs, such as CLS, EMU or ILLIQUID. The groups of currencies are user-defined. You can click Add to add currency groups to the currencyGroup domain. Currency groups are used by the CheckSTPCurrency workflow rule. |

||||||

|

Location |

Select the timezone for the currency. |

||||||

|

Warning Threshold |

Applies to repo trading only. Enter a nominal amount that will trigger a warning when entering a repo trade. |

||||||

|

External Reference |

Enter an external reference code for the currency as applicable. This is for information purposes only. |

||||||

|

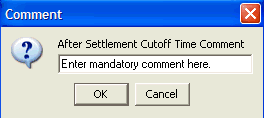

Settlement Cutoff Time |

Enter the settlement cutoff time for evaluating today FX Spot trades. A trade entered after this time requires that you enter a mandatory comment in order to save the trade. Select the timezone that corresponds to the cutoff time from the adjacent field.

The keyword AfterSettlementCutoffTime attaches to the trade. |

||||||

|

Trading Cutoff Time |

This field is used to determine the first available trade date for a currency and currency pair in eDealing. The first available date for a currency is:

The first available date for a currency pair is the greater of the first available date of each currency in the currency pair. If this date falls on a holiday for any of the two currencies, then the next business day at the currency pair level is chosen. Select the timezone that corresponds to the cutoff time in the adjacent field. |

||||||

|

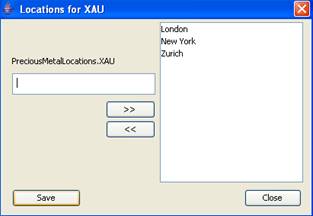

Precious Metal |

Check the Precious Metal box to indicate that the currency is a precious metal, XAU gold for example.

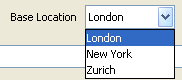

You can also define the locations where the precious metal trades, as the spot price differs between locations. Set the base location by selecting a user defined location from the drop-down menu. This will be the default location in the trade entry window. Click Locations to add location names.

Enter the location name in the text field, click >> to add it to the list, and click Save. Select the base location from the drop-down menu.

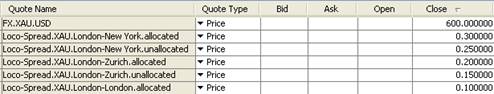

When you save the currency, the system creates Loco-Spread quotes in the quote set.

The system creates both allocated and unallocated quotes for the locations. However, the base location does not have an unallocated quote, as the spread is zero.

When you use the FX Spot, FX Forward, or FX Swap trade windows to capture precious metal trades, you can set the location details in the Location panel.

Select the location from the drop-down menu. The application automatically uses the unallocated spread from the quote set. Select Allocated to use the allocated spread.

|

||||||

|

Non Deliverable |

Check the Non Deliverable box to specify that the currency is a non-deliverable currency in FX trading.

Then you will be able to save a trade with that currency as an FX NDF trade. Ⓘ [NOTE: The Non Deliverable setting in User Defaults takes precedence over the comparable setting in Currency Defaults] |

||||||

|

Description |

Enter any description or comment if desired. |

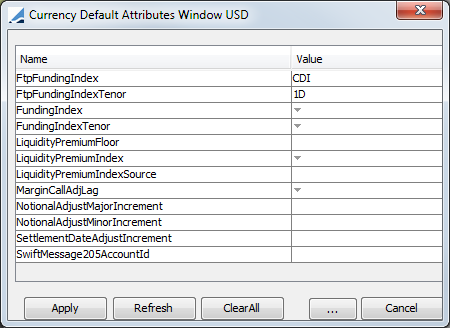

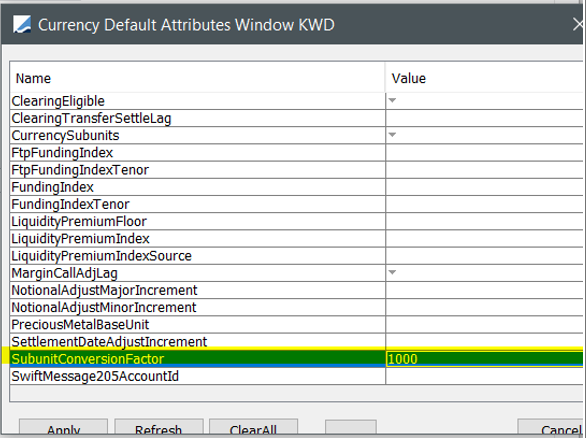

2. Defining Currency Attributes

Currency attributes can be used for selection and reporting purposes.

Load a currency then click Attributes.

| » | Click ... to add attributes. |

Then double-click a Value cell to set a value for the corresponding attribute.

| » | Click Apply. |

| » | Then click Save to save your changes. |

Ⓘ Note:Added a new domain ‘SubunitConversionFactor’ as an Out of the Box attribute to provide support for currency with more than 100 sub-units.

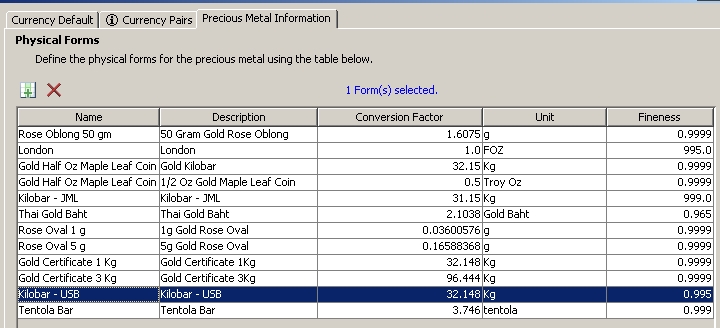

3. Precious Metal Currency Information

An additional tab appears in the Currency Definition window when you are defining a precious metal called Precious Metal Information. This tab allows you to define various forms for each precious metal.

To define a new form, click ![]() , enter the name of the form and click OK. A new row will then be created, allowing you to enter the information to define the new physical form of the precious metal.

, enter the name of the form and click OK. A new row will then be created, allowing you to enter the information to define the new physical form of the precious metal.

|

Fields |

Description |

|---|---|

|

Name |

The name for the physical form. |

|

Description |

A description of the physical form. |

|

Conversion Factor |

The factor required to convert one unit of this form to troy ounces. |

|

Unit |

The unit of the form. |

|

Fineness |

Percentage of the precious metal in the defined form. This is only for description purposes. |

When you have entered the details for the precious metal physical form, click the Save Physical Forms button to save the data.

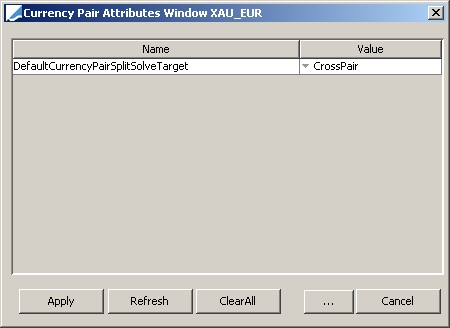

| » | For every currency with which you trade a precious metal, other than USD, you must set the DefaultCurrencyPairSplitSolveTarget attribute (accessed by clicking the Attribute button in the Currency Pairs tab) to CrossPair. With this setting, the system will solve for the forward points of the cross pair in an FX trade. |

| » | A Triangulation rule should be set up so that all of your trades with a precious metal and a currency other than USD are triangulated through USD. This is done through the Triangulation Currency Rule Manager. |

See Triangulation Currency Rule Manager for details.

See Triangulation Currency Rule Manager for details.

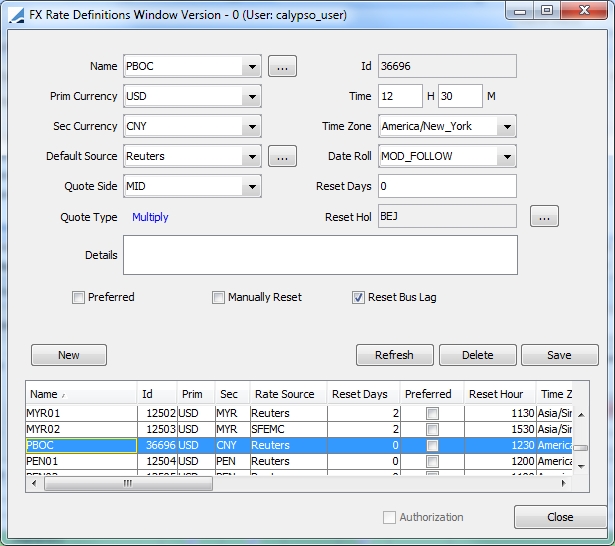

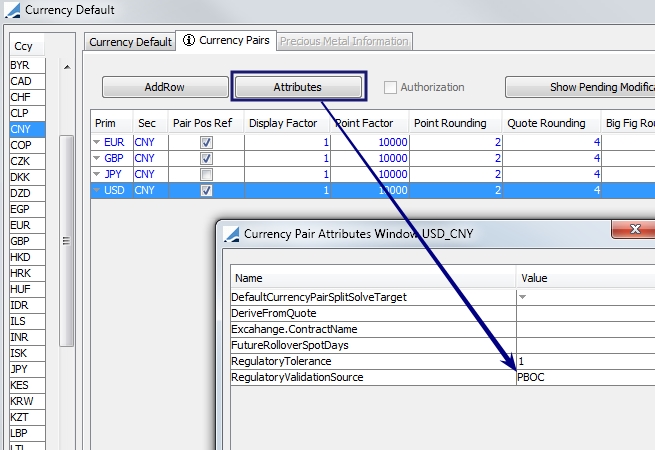

4. Chinese Yuan (CNY) Currency Information

The Chinese Yuan is a highly regulated currency. The People's Bank of China (PBOC) publishes the FX quote for CNY and it produces the MID rate for USD/CNY. PBOC regulates the trading of USD/CNY spot rate and restricts the spread to be greater than 0% and less than or equal to 1%. These rates are input manually.

Calypso validates the USD/CNY quote at two levels, in the Quote window and upon trade entry.

Step 1 – Define a rate reset in the FX Rate Definition window for USD/CNY and set the quote side to MID. To display the FX Rate Definition window, navigate to Configuration > Foreign Exchange > FX Rate Definitions.

Step 2 – In the Currency Definition window (Configuration > Definitions > Currency Defaults), select USD/CNY and enter a Regulatory Tolerance of 1 and the Regulatory Validation Source as PBOC.

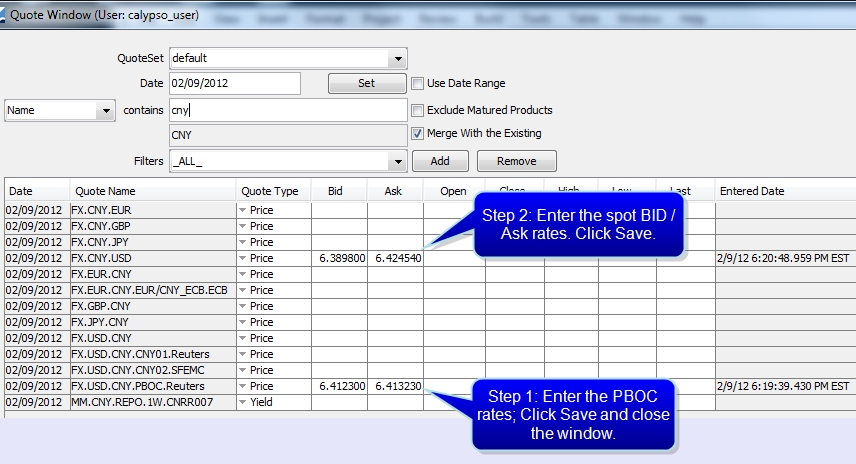

Step 3 – Open the Quote window (Market Data > Market Quotes > Quotes). Enter the PBOC BID/ASK rates. These are the same rate, which is the MID rate published by the PBOC. Then, save and close the Quote window. Re-open the Quote window and enter the Spot BID / ASK rates. When you click Save, the validation is performed. These steps must be completed in this order.

Step 4 – The remaining steps are required for trade window validation.

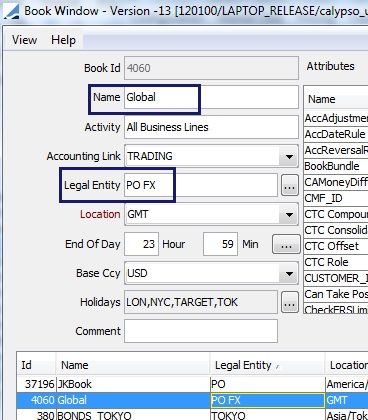

Display the Book window for the book that you would like to use for the USD/CNY trade. Identify the legal entity associated with the book (Configuration > Books & Bundles > Trading Book).

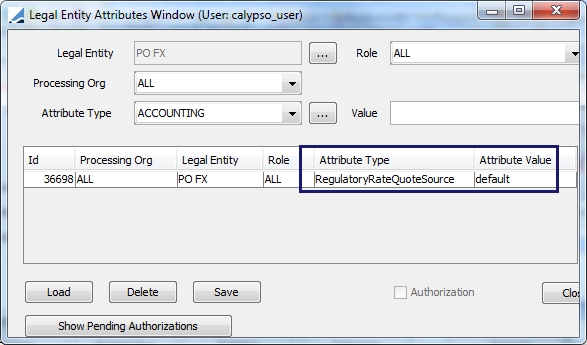

Step 5 – Open the Legal Entity window for this legal entity and click the Attributes button. Enter the Attribute Type RegulatoryRateQuoteSource and set the value to the Quote Set Type used in Step 3, then save.

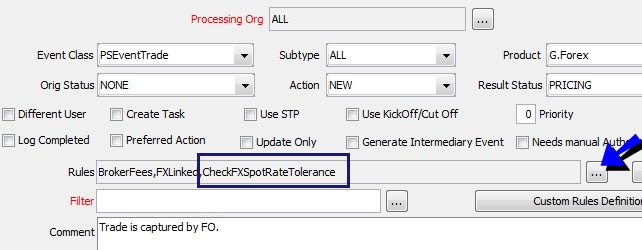

Step 6 – In the Workflow window, add the rule CheckFXSpotRateTolerance to each NEW and AMEND action.

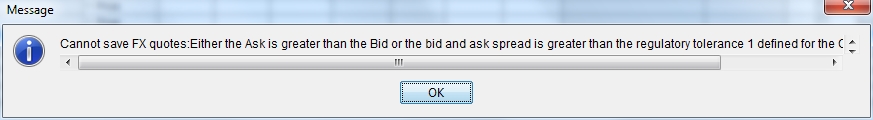

If during either validation, the spread is >0% and <=1%, the quote or trade will be saved. If the rate is out of the required range, an error message appears like that below.

| • | The computation for validation is: |

(HIGHEST ASK - LOWEST BID)/ TODAY'S PBOC MID RATE.

| • | The Highest Ask and Lowest Bid are dynamic based on the latest data from the trades done throughout the day. The first validation check is based on the initial static FX rates manually input in the morning in the Quote window. Dynamic implies that if a trade is done which is still in the 1% range but the quote is lower than the BID rate on the quote window or higher than the ASK rate, these then become the Highest Ask and the Lowest Bid for the next trade validation check. |

| • | Each time the trade is amended, or goes through a trade life cycle action, it must comply with the above validation check. |

5. Modifying a Currency

Ⓘ [NOTE: If you modify a currency, it will impact the whole system]

Select the Currency Defaults panel to modify a currency.

| » | Select a currency from the Ccy list on the left to show its defaults. |

Make changes as applicable.

| » | Click Save to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

6. Deleting a Currency

Ⓘ [NOTE: If you delete a currency, it will impact the whole system]

Select the Currency Defaults panel to delete a currency.

| » | Select a currency from the Ccy list on the left, and click Delete. |

You cannot delete a currency in use.

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

7. Displaying Currency Pending Modifications

Select the Currency Defaults panel.

| » | Select a currency from the Ccy list on the left, and click Show Pending Modifications to display any currency pending authorization. This only applies if the Authorization mode is enabled. |

8. Creating a Currency Pair

Currency pairs are used for quoting FX rates and trading FX products. You can set quoting conventions for currency pairs. If you enter a trade using a currency pair that does not have default values defined, then the system uses the system default values.

However, you can define your own default values for the point factor and quote rounding. Set the environment properties CCY_PR_DEFAULT_PT_FACTOR and CCY_PR_DEFAULT_QT_ROUNDING respectively.

To add a currency pair:

| » | Select a currency from the Ccy list on the left, and select the Currency Pairs panel. |

| » | Then click Add Row. The selected currency will be considered as the secondary currency. |

| » | Select a primary currency, then enter the fields described below. |

| » | Click Save Currency Pairs to save the currency pairs currently displayed. Note that if you select another currency from the Ccy list on the left, without saving, you will loose your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

Fields Details

|

Fields |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Primary/ Secondary |

The secondary currency is the currency selected from the Ccy list on the left. Select the primary currency. For the EUR/USD currency pair, 1 EUR = x USD. Therefore in the quote set, you will enter a quotation for the product FX [EUR/USD]. If you enter 2, it would mean: 1 EUR = 2 USD. |

||||||||||||

|

Pair Pos Ref |

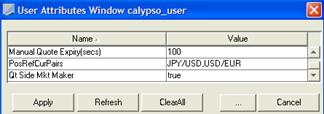

You can define two currency pairs CCY1/CCY2 and CCY2/CCY1 but there is a single FX Position, combining the trades in both currency pairs. Check Pair Pos Ref only for the currency pair used to represent the FX Position. Ⓘ [NOTE: The FX Volatility Surface uses the pair position reference. For example, if USD/JPY is the pair position reference, the surface is always saved as USD/JPY. It saves a surface set up as JPY/USD as USD/JPY] At the user level, you can set the opposite currency pair as the position reference currency pair. Set the PosRefCurPairs user attribute in the User Defaults. Example:

The Pos Ccy Pair attribute can be added on a trade report style that displays the currency pair as per the Pair Pos Ref attribute. This attribute is directly linked to the Currency Pair trade attribute. The implementation is as follows:

|

||||||||||||

|

Display Factor |

This number allows you to specify how you would like the FX rate for the currency pair to be displayed. For example, for the currency pair JPYCHF the FX Rate in the Deal Station would be displayed as 0.0110; if you set a Display Factor to 100, the FX rate would be displayed as 1.11, which is 0.0110 * 100. The Display Factor is used for the specified currency-pair when displaying the FX market rate, trade/dealt rate and holding cost. |

||||||||||||

|

Point Factor |

Format of forward points (difference between Spot FX Rate and Forward FX Rate) displayed in FX Forward and FX Swap trade windows. If point factor = 10000, and you enter 25 forward points, then the actual difference between Spot FX Rate and Forward FX Rate is 0.0025. |

||||||||||||

|

Point Rounding |

Round the forward points to this number of decimal places. If you enter 10.12345 for the points, and the Point Rounding is 1, then the point value displayed should be 10.1. |

||||||||||||

|

Quote Rounding |

Used for FX Rate Display purposes only. Mainly used to display Cross Rate calculated by triangulate method.

|

||||||||||||

|

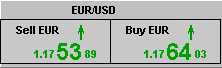

Big Fig Rounding |

You can set the big figure for each currency pair. Enter which figure after the decimal point is the big figure. The next two figures display as the significant figures in the quotes window. Following are examples.

|

||||||||||||

|

Spot Days |

|||||||||||||

|

Max Spot Days |

Maximum number of days allowed between the trade date and the settlement date of FX trades to determine spot FX trades. The max spot date is calculated at currency pair level. Example: If Max Spot Days = 5, the user can enter a spot FX trade for any trade with "settlement date = trade date" up to "settlement date = trade date + 5 days". Ⓘ [NOTE: It is not currently possible to add forward points to product type FX] |

||||||||||||

|

3rd Holidays |

Check if you want to take into account holiday calendars in addition to the holiday calendars of each currency, or clear otherwise. |

||||||||||||

|

3rd Calendar |

You can select holiday calendars in addition to the holiday calendars of each currency. |

||||||||||||

|

Active From |

Enter the date from which the secondary currency belongs to a Currency family. Applies to the EURO zone. |

||||||||||||

|

Active to |

Enter the date from which the secondary currency will no longer belong to a Currency Family. |

||||||||||||

|

Ccy Family |

You can select a currency family to which the secondary currency belongs to during the "Active From" and "Active To" date range. When a currency family is selected, if the settlement date of a trade falls between the "Active From" and "Active To" date range, the trade cashflows are converted to the currency family. You can enter a fixed conversion rate using the fields Fixed and Fixed Rate. The market's FX rate is used otherwise. |

||||||||||||

|

Family Rounding |

Not used. |

||||||||||||

|

Fixed |

Only applies if a currency family is selected. Check to define a fixed rate, or clear otherwise. |

||||||||||||

|

Fixed Rate |

Only applies if a currency family is selected. Enter a fixed FX rate if Fixed is checked. |

||||||||||||

|

Risky Ccy |

Used in FX and FX Options. Primary or Secondary. Default is Secondary. Indicates which currency of the two should be considered as riskier by the system. The Risky Ccy should be set based on the following order:

|

||||||||||||

|

Delta Display Ccy |

Set the default display currency for Delta and Gamma measures in the risk reports and Pricing Sheet: primary or secondary currency. The default value is the secondary currency. The Delta Display Ccy should be primary currency if Pair Pos Ref is true; otherwise it should be secondary currency. |

||||||||||||

|

PL Display Ccy |

Set the default display currency for NPV and Vega measures in the risk reports and Pricing Sheet: primary or secondary currency. The default value is the secondary currency. The PL Display Ccy should generally be the secondary currency, unless the secondary currency is non-deliverable, in which case it should be the primary currency. If both currencies are non-deliverable, it should be the secondary currency. |

9. Setting Up Cross Currency Pairs

The system uses a currency triangulation rule set for calculating cross currency trades. This rule set must be manually set up in the Triangulation Currency Manager window, accessible via Configuration > Definitions > Triangulation Ccy Rule. If this rule set is not set up, currency triangulation will not work.

See Triangulation Currency Rule Manager for details.

See Triangulation Currency Rule Manager for details.

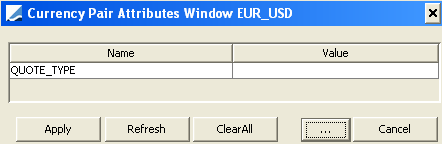

10. Defining Currency Pair Attributes

Currency pair attributes can be used for selection and reporting purposes.

Select a currency pair, then click Attributes. The Attributes dialog will appear.

| » | Click ... to add attributes. |

Then double-click the Value cell to set a value for the corresponding attribute.

| » | Click Apply. |

| » | Then click Save Currency Pairs to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

11. Modifying a Currency Pair

Ⓘ [NOTE: If you modify a currency pair, it will impact trades and pricing]

Select the Currency Pairs panel to modify a currency pair.

| » | Select a currency from the Ccy list on the left to show the currency pairs for which the selected currency is a secondary currency. Then select a currency pair and changes as applicable. |

| » | Click Save Currency Pairs to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

12. Deleting a Currency Pair

Ⓘ [NOTE: A currency pair in use cannot be deleted]

Select the Currency Pairs to delete a currency pair.

| » | Select a currency from the Ccy list on the left to show the currency pairs for which the selected currency is a secondary currency. |

Then select a currency pair and click Remove Currency Pairs.

You cannot delete a currency pair in use.

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

13. Displaying Currency Pair Pending Modifications

Select the Currency Pairs panel.

| » | Select a currency from the Ccy list on the left to show the currency pairs for which the selected currency is a secondary currency. |

Then select a currency pair and click Show Pending Modifications to display any currency pair pending authorization. This only applies if the Authorization mode is enabled.

14. Note on Environment Properties

The following environment properties apply to currencies:

| • | CCY_PR_DEFAULT_PT_FACTOR |

| • | CCY_PR_DEFAULT_QT_ROUNDING |

The Spot Days field applies spot days at the currency pair level. To apply the spot days at currency level, set the currency pair Spot Days as “-1” and specify spot days at the currency level.

When counting days for spot date calculation, the system uses both currencies holidays and counts only days that are business days for both currencies. Intermediate non-weekend soft holidays, if any specified in domain “FXCcyPairSoftHolidays”, are counted.

The log category “CcyPairDateCalcs” can be used to get information on spot date calculations.

BBA Convention

The FX convention follows the BBA convention for the most part, except for the NYC Memorial Day - See below.

Recommended Setup

However, if you have specified NYC as a soft holiday, then even in the third holiday context, that holiday will be considered soft. This is OK for all NYC holidays, except for Memorial Day which is treated by the markets as a hard holiday (due to the fact that it coincides with a London holiday and thus obeys the BBA convention). To handle this case, you should create a NYC_MEMORIAL calendar that only contains Memorial Day.

You have two choices: