FX Deal Station Spot / Forward Window

|

FX Deal Station Spot / Forward Quick Reference Entering Trade Details

Saving a Trade

|

1. Sample FX Trade

There are different types of layouts for the Spot/Forward trade window, depending on which Role and Persona are selected. Below are sample windows as well as a description of the fields in the Dealer role and layout.

Each role opens up fields that are specific to the needs of the user for that role. Additional roles are discussed below.

1.1 Trader / Sales / Back Office Role

There are two types of displays for a Spot or Forward Trade window, when a Trader Role is selected. Below are some examples of these windows.

The Deal Entry Layout for Trader, Sales and Back Office are all alike. Also, the Deal Investigation Layout for Trader, Sales and Back Office are all alike.

Trader/Sales/Back Office Deal Entry Layout

Trader/Sales/Back Office Deal Investigation Layout

1.2 Precious Metal Role

You are able to trade precious metals through FX Deal Station. You can create the following types of Precious Metal trades while in the Precious Metal role:

| • | Forward |

| • | Swap |

| • | Cross Forward |

| • | Cross Swap |

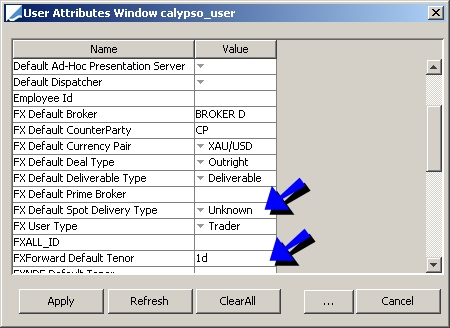

Note: If you are mostly doing Precious Metal trades, you can configure your trade window to default to a spot or forward default tenor automatically. To do this, from Calypso Navigator, select Configuration > User Access Control > User Defaults and click Attributes. In the User Attributes window that is displayed, enter an FXForward Default Tenor to be 'spot' or any forward tenor such as '1M' or '1Y'. Note that you must set the FX Default Spot Delivery type to 'Unknown' for all Precious Metal trade fields to be displayed in the Deal Station regardless of tenor.

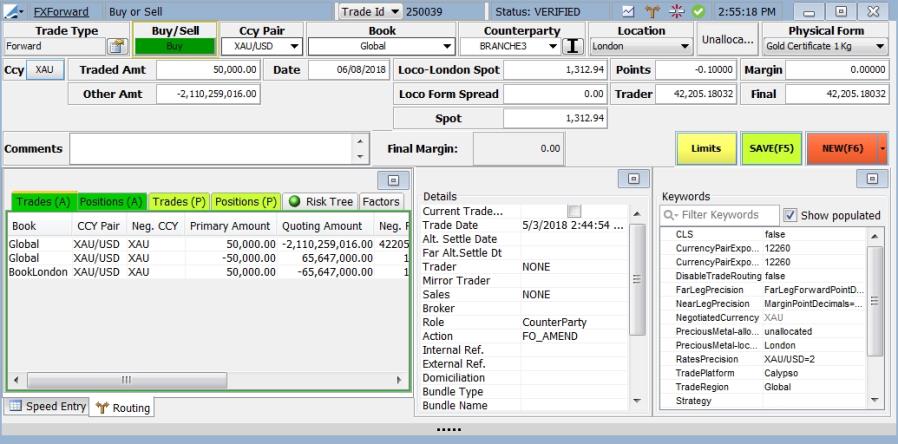

Positions can be generated by form by using the trade keyword PreciousMetal-form. This keyword must be added to the PostionKeeping.TradeKeywordsToPropagate domain value and selected in the position keys.

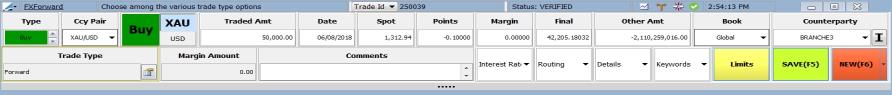

Precious Metal / Deal Entry Layout

Precious Metal / Deal Entry Simple Layout

Precious Metal / Deal Investigation Layout

Click here for more information on the business background of precious metals

Click here for more information on the business background of precious metals

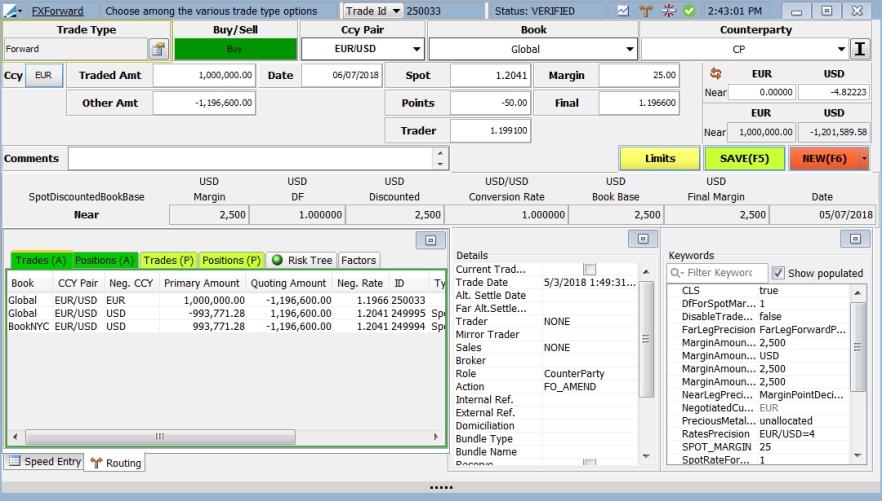

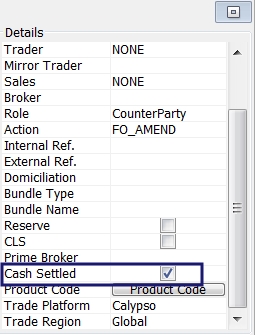

2. Cash Settled FX Forward Trades

FX Forward trades can be processed as Cash Settled. To designate the trade in this manner, select Cash Settled in the

Details panel of the trade window.

Once the FX Forward trade has been marked as Cash Settled, it behaves like an FX NDF trade from a Back Office point of view:

| • | The FX NDF message template is used for the confirmation message, fxndfconfirmation.html. |

| • | The transfer requires fixing on the fixing date, and a fixing confirmation is sent to the conterparty, fxndffixingconfirmation.html. |

| • | The FX NDF accounting events can be used on the FX Forward cash settled trade |

An FX Forward trade may be converted into a cash settled forward any time before its original settle date. To convert the trade, select the Cash Settled flag on the trade. The Fixing and Quanto information is then displayed for input. The default Fixing date is the original Settlement Date, minus the spot days. The Settlement Date remains the same.

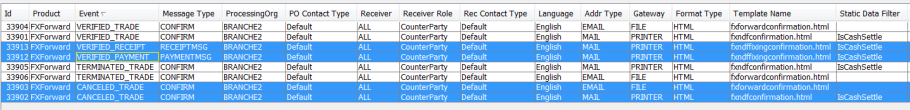

3. Back Office Messaging Setup

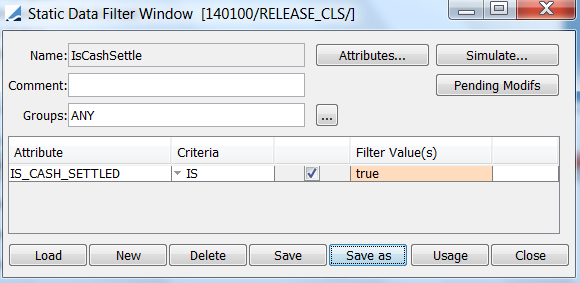

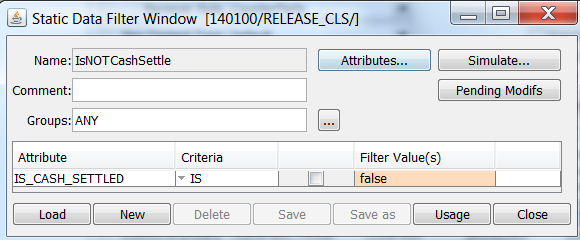

Static Data Filter

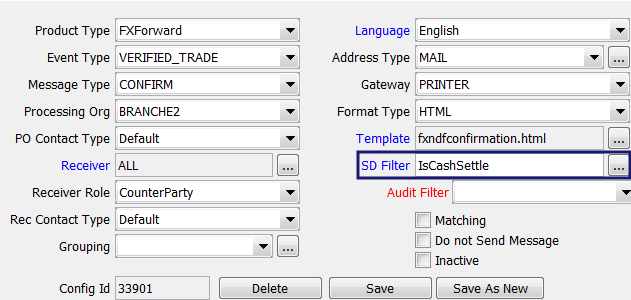

The following Static Data Filter can be used for the message configuration in order to generate a confirmation type fxndfconfirmation.html only when the FXForward IS_CASH_SETTLED = True.

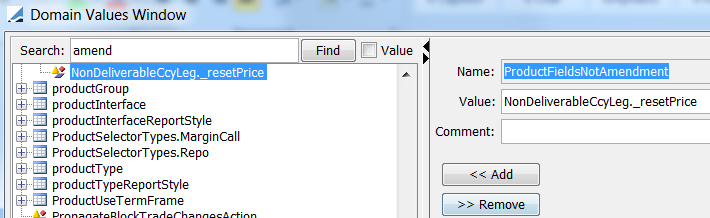

Domain Values: ProductFieldsNotAmendment

The following domain value prevents the generation of new AMEND confirmation messages after the Price fixing (FX Rate Reset) of the trade.

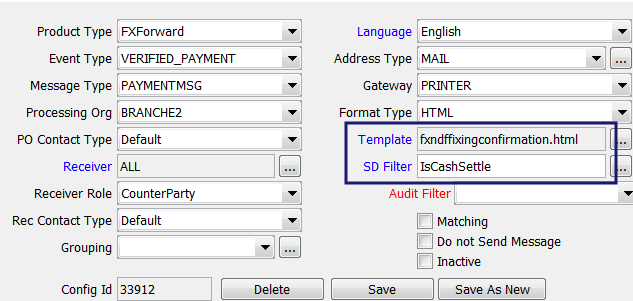

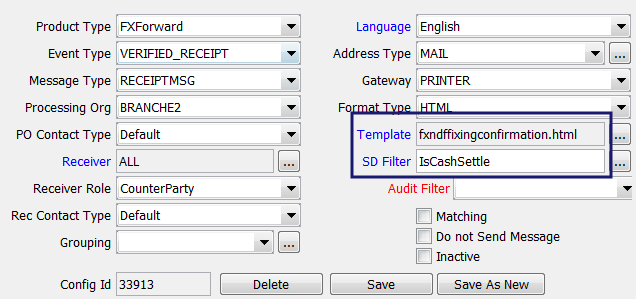

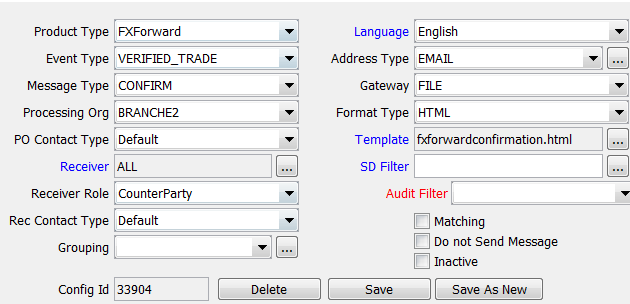

Message Setup

An example of message configuration for confirmations is shown below.

Below is an example of a message configuration for fixing confirmations.