Capturing FX Swap Trades

1. FX Swap Trade

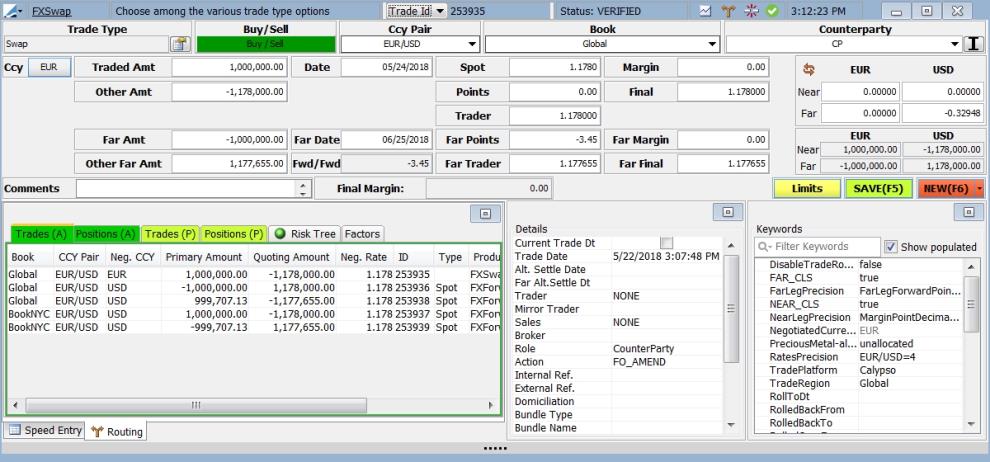

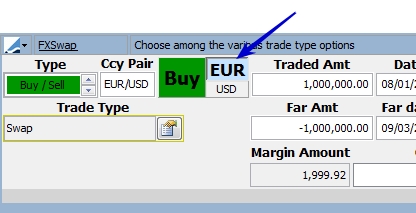

Below is an example of an FX Swap trade.

Sample Deal Entry Layout

Sample Deal Investigation Layout

Ⓘ FX Spot margin points are applied to both legs to ensure the final spot rates are the same for both near and far sides of the swap. The calculation of the final spot rate is based on the dominant leg, with the larger negotiated notional for an FX uneven swap. For an FX even swap, the calculation is based on the buy side of the swap.

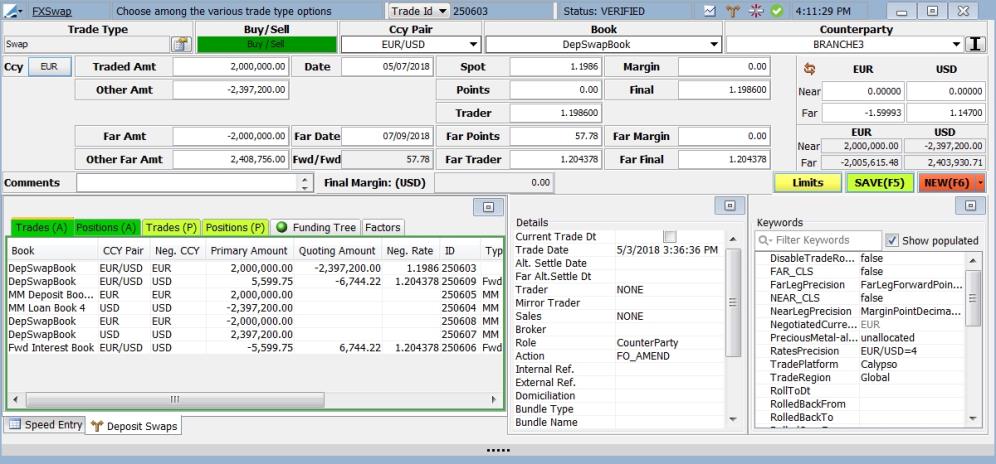

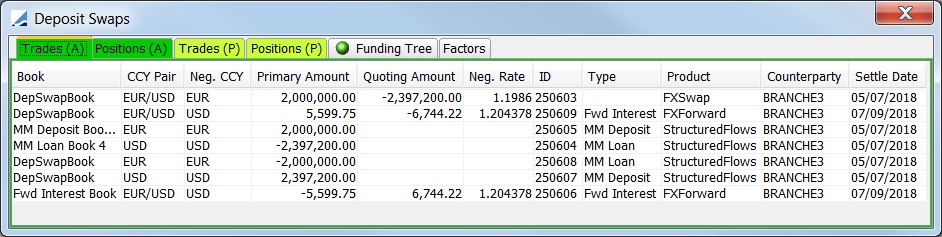

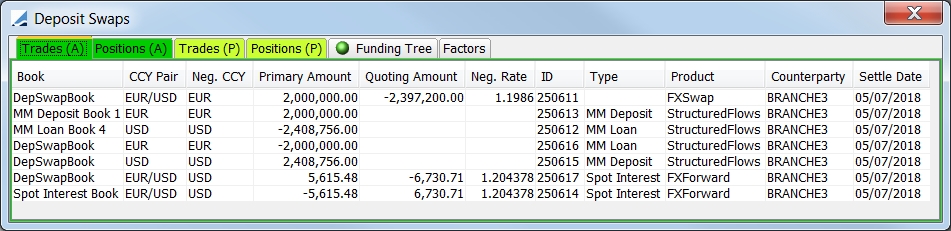

2. FX Deposit Swap Trade

The FX Deposit Swap solution involves routing FX and Structured Flows trades. The creation of routed trades (FX & Structured Flows) and the positions from the FX trades involved are all part of the same Position Keeping Server transaction. They are all successful together, or they all roll back together.

If the routing transaction is successful, the position generation for the Structured Flows trades involved in the routing structure are handled separately via the Position Engine. Generation of the cash positions for the Structured Flows trades involved is not part of the Position Keeping Server routing transaction.

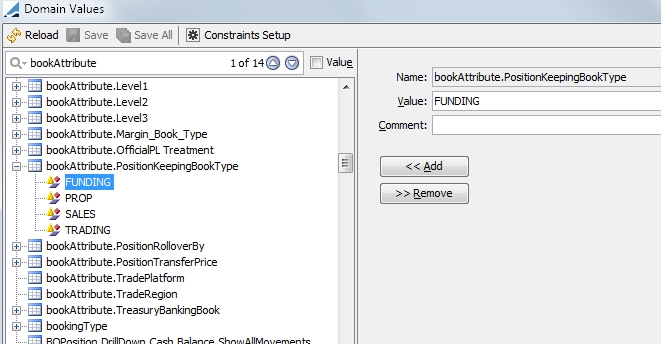

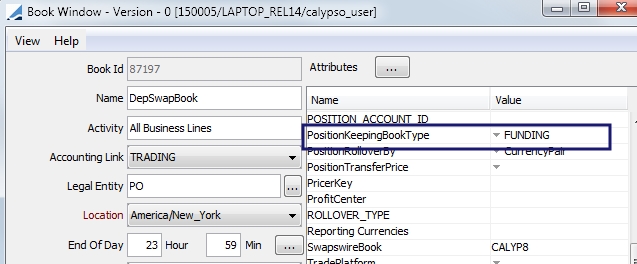

Deposit Swaps can be executed by using a book that has FUNDING listed as its Position Keeping Book Type attribute and setting up the appropriate routing in the Currency Funding Exposure Ownership panel of the Position Keeping Configuration Editor.

FUNDING must be added to the bookAttribute.PositionKeepingBookType domain value.

When the trade is executed, a number of trades will be generated. These trades include a Loan and Deposit trade, both with matching values and maturity dates, as well as an FX trade (a spot, forward or swap). The cashflows, P&L and accounting entries from all of the trades net out to zero.

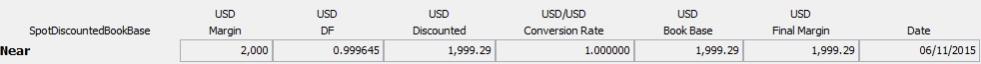

By default, the interest is paid on the Forward date, i.e. the far leg of the swap. Choosing Spot Discounted in the Factors panel of the Routing section, changes the interest amount to be paid on the near leg of the swap instead. The actual amount of the interest that is paid is equivalent to the Forward interest amount discounted to the near leg settle date.

3. Swap Field Descriptions

Field descriptions pertinent to the FX Swap trade are detailed below.

|

Field |

Description |

||||||

|---|---|---|---|---|---|---|---|

|

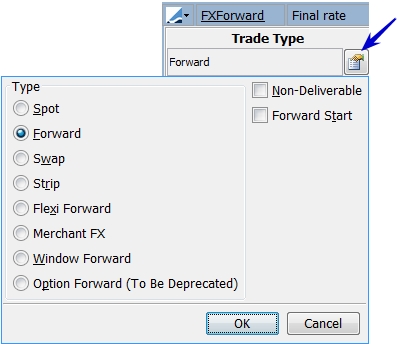

Trade Type |

This field displays the type of trade displayed in the Deal Station window. Click on the button to make your selection.

|

||||||

|

Ccy Pair |

Enter the Currency Pair for the trade in this field. You may type in the currency pair in a variety of ways and the system can automatically detect the correct pair, provided that the pair has been created under Configuration > Definitions >Currency Definitions which can be accessed through Calypso Navigator. You may also enter a currency pair mnemonic which has been configured in the Currency Pair Shortcuts window. From Calypso Navigator, select Configuration > Foreign Exchange > Currency Pair Shortcuts to display the Currency Pair Shortcuts window. |

||||||

|

Book |

Enter the book for the trade. This field auto completes based on your designated favorite books. (From Calypso Navigator, Configuration > Favorites > Books). You may also hit CTRL F to search all books. |

||||||

|

Buy / Sell Type |

Buy/Sell is indicated by a green box. Sell/Buy is indicated by a red box.

Choose either Buy/Sell

|

||||||

|

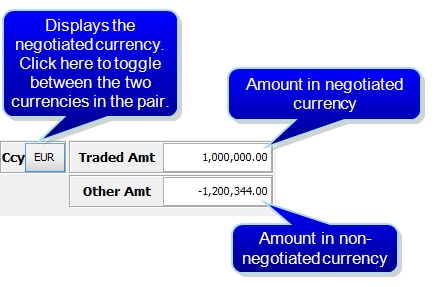

Ccy |

This area displays the negotiated currency and the amount for each currency in the pair.

|

||||||

|

Traded Amount |

Enter the amount for the trade in the negotiated currency. |

||||||

|

Other Amount |

The notional amount of the non-negotiated currency |

||||||

|

Far Amount |

This is the swap far leg notional amount of the negotiated currency. |

||||||

|

Other Far Amount |

This is the swap far leg notional amount of the non-negotiated currency. |

||||||

|

Date |

Enter the trade date. The date by default is spot. |

||||||

|

Far date |

Value date for the far leg of the swap. You can enter a date shortcut or use the up and down arrows on your keyboard to select the date. |

||||||

|

Fwd / Fwd |

The far forward points minus the near forward points. |

||||||

|

Spot |

This is the spot rate for the currency pair which automatically comes the feed. You may hit F10 in this field to display the Split Currency window. |

||||||

|

Points |

Displays the forward points from the pricing environment. The forward points could be from the FX curve or zero curves depending on how you set up the pricing environment. You can manually adjust the points in this field.unless the trade is using a spot date.When the points are edited, the change is reflected in the Final field. (Assuming that the Spot field is designated as 'locked'.) You may hit F10 in this field to display the Split Currency window. |

||||||

|

Far Points |

These are the forward points for the far leg of the swap. You can manually adjust the points in this field unless the trade is using a spot date. When the points are edited, the change is reflected in the Far Final field. (Assuming that the Spot field is designated as 'locked'.) You may hit F10 in this field to display the Split Currency window. |

||||||

|

Trader |

This is the trader rate, spot plus points. |

||||||

|

Far Trader |

This is the trader rate for the far leg, spot plus far points. |

||||||

|

Margin |

Enter the margin points. For Precious Metal trades, the Margin is in the unit of the Physical Form and in the quoting currency. Default sales margins can be configured in the Sales Margin Configuration window. |

||||||

|

Far Margin |

Enter the margin points for the far leg. For Precious Metal trades, the Margin is in the unit of the Physical Form and in the quoting currency. Default sales margins can be configured in the Sales Margin Configuration window. |

||||||

|

Final |

This field specifies the forward rate of the trade, which is the spot rate +/- the forward Points. This field is editable. If this field is edited, the Points are adjusted, assuming that the spot field is designated as 'locked'. Ⓘ FX Spot margin points are applied to both legs to ensure the final spot rates are the same for both near and far sides of the swap. The calculation of the final spot rate is based on the dominant leg, with the larger negotiated notional for an FX uneven swap. For an FX even swap, the calculation is based on the buy side of the swap. You may hit F10 in this field to display the Split Currency window. |

||||||

|

Far Final |

This is the Spot rate +/- the Far Points. This field is editable. If this field is edited, the Far Points are adjusted, assuming that the spot field is designated as 'locked'. You may hit F10 in this field to display the Split Currency window. |

||||||

|

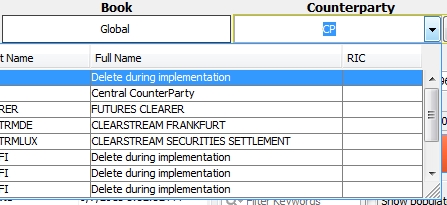

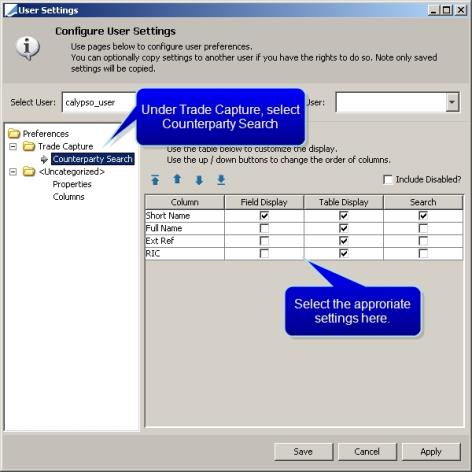

Counterparty |

Select a counterparty. If you know the name of the counterparty you are searching for, begin typing it in this field. The first counterparties that begin with the typed letters are displayed. To scan through the other counterparties, use the up and down arrows on your keyboard, or select the counterparty that you desire. .If you would like to see the Short Name, Full Name, External Reference and RIC of the selected counterparty, click the down arrow next to the field.

You are able to search for and/or display the counterparty using the Short Name, Full Name, Ext Ref or RIC. To designate how you search and display, go to Configuration > User Access Control > User Settings.

|

||||||

|

Rate Information |

This area displays the rate for each currency in the near and far legs of the swap. See Rate Locking Default for more information.

|

||||||

|

Margin Amount / Final Margin |

This is the final margin amount that will be attached to the margin fee. Depending on the calculator defined, this amount will be either the initial margin amount (no discounting), the discounted margin amount (spot/today discounted) or margin amount in book base currency. For Precious Metal trades, the margin is always in the unit of the Physical Form and quoting currency. To view detailed Margin information in Deal Entry mode, from this field, hit F10.

|

||||||

|

Keywords |

Click here to view available keywords for the trade and enter information for them as desired. |

||||||

|

Limits |

Click here to check the limits for the trade, if limits have been established through Calypso ERS Limits. If limits are established, when this button is clicked, a window is displayed indicating how much limit is left. If the limit is exceeded, a violation window is displayed. A trade that exceeds the limits can still be saved. A trade in FX Deal Station is automatically reflected on the Limit portfolio in ERS. For more information, refer to Calypso ERS documentation. | ||||||

|

Deal / Save (F5) |

Click here to save the trade. When the button looks like this |

||||||

|

New / Copy New (F6) |

You may click the arrow in this field to display either New or Copy New.

|

Pricing Parameter

When the parameter NPV_EXCL_INITIAL_PRINCIPAL is set to True, the near leg of an FX swap is ignored and only the far leg is considered for pricing. The default setting is False.

or Sell/Buy

or Sell/Buy  . One of these choices will change the layout to a swap layout.

. One of these choices will change the layout to a swap layout.

, the trade hasn't been saved yet. After the trade has been saved, the button looks like

, the trade hasn't been saved yet. After the trade has been saved, the button looks like  and you may click it to amend the trade.

and you may click it to amend the trade.  to clear out the trade screen to enter a new trade. You can also display a new trade by hitting the F6 key.

to clear out the trade screen to enter a new trade. You can also display a new trade by hitting the F6 key.