Defining Margins

Ⓘ [NOTE: The settings described in this document do not apply to the Deal Station]

For the Deal Station, default sales margins can be configured. These margins populate automatically in the trade when a group of constraints are met.

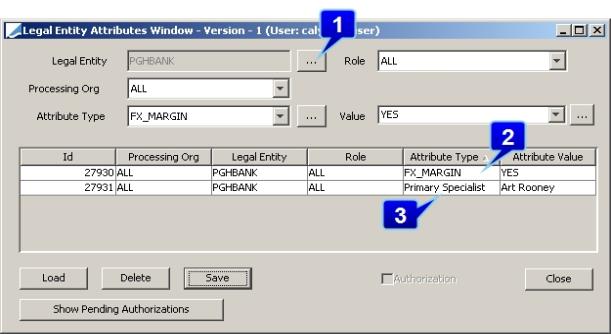

1. Margin Owner

From Calypso Navigator, choose Configuration >

Legal Data > Attributes (menu action refdata.BOLegalEntityAttributeWindow).

| » | Click … to select the legal entity. |

| » | Set attribute type FX_MARGIN to YES, and click Save. The trade capture window displays a Margin field when the selected counterparty has the attribute FX_MARGIN=YES. |

| » | Select the Attribute Type Primary Specialist. Click … to add it to the list if it is not available. Enter the sales person name in the Value field and click Save. |

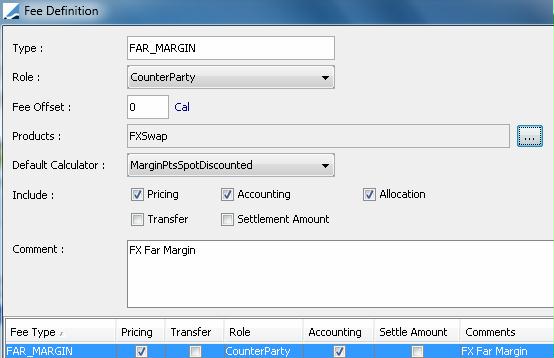

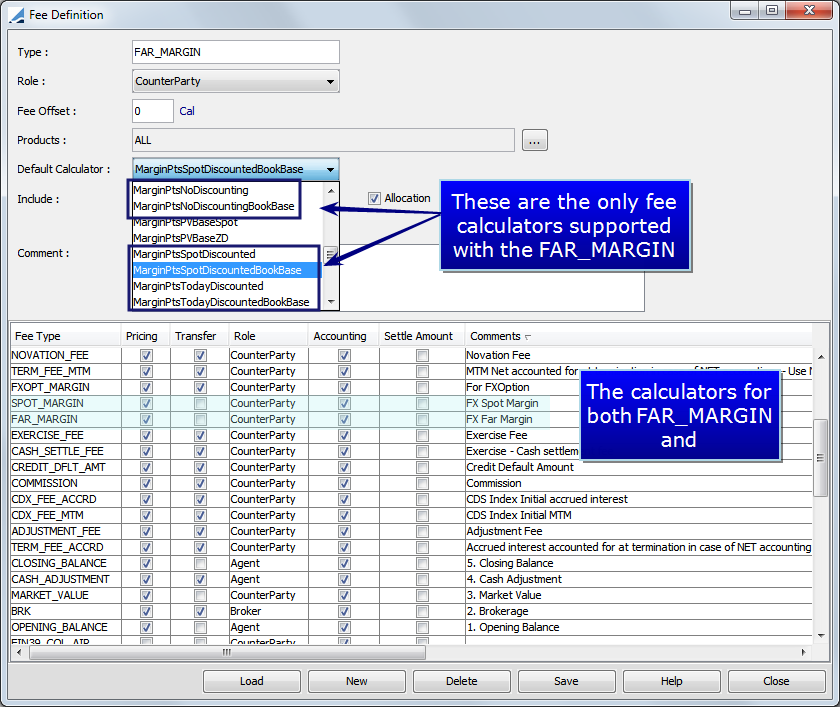

2. Fee Definitions

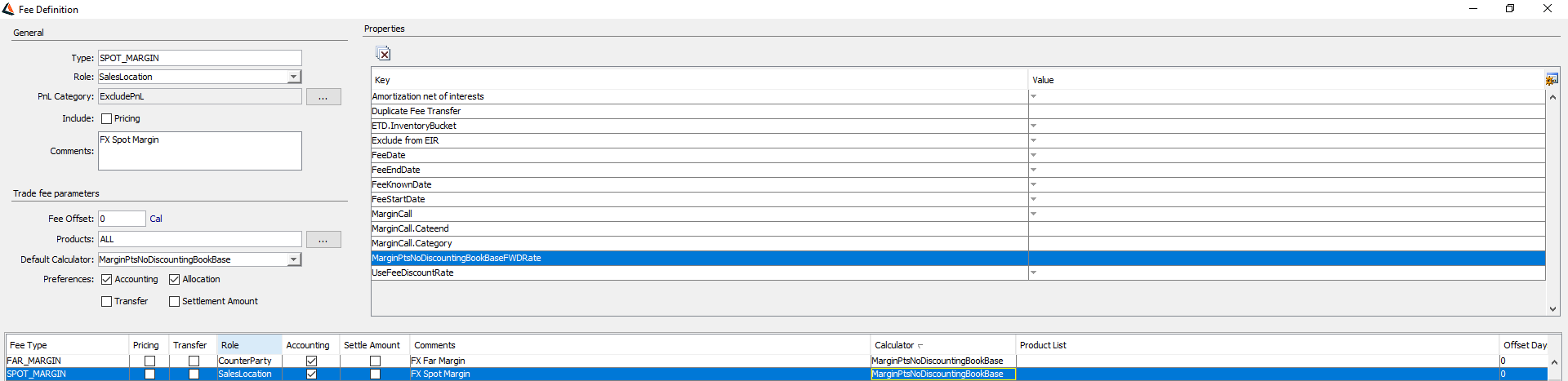

Create fee definitions for the SPOT_MARGIN and FAR_MARGIN fee types - For FX Options, the fee type is FXOPT_MARGIN.

FX products use the SPOT_MARGIN fee type. Before configuring the margin, check that the SPOT_MARGIN fee type has the role "CounterParty", and that the calculator is set in the Fee Definition window.

From Calypso Navigator, choose Configuration >

Fees, Haircuts, & Margin Calls > Fee Definition (menu action trading.FeeDefinitionWindow).

You can also use the following calculators. The calculators provide variations to the default calculation:

| • | If Fee ccy = Trade Quote Ccy, then Fee Amount = [input value] * Quantity (that is, Trade Base Amount). |

| • | If Fee ccy <> Trade Base Ccy, then Fee Amount = [input value] * Quantity (that is, Trade Basis Amount = Trade Base Amount converted using the Trade Spot Price). |

Available calculators:

| • | MarginPtsNoDiscounting - Computes the amount as the above computed margin basis amount and sets the margin date as the trade settle date. |

| • | MarginPtsNoDiscountingBookBase - Converts the above computed margin basis amount to the book base currency and sets the margin amount as the same. |

The margin date is set as the trade settle date.

Equivalent to the sales user creating a forward for the basis amount against the base currency.

| • | MarginPtsNoDiscountingBookBaseFWDRate - Introduction of a new Key on the Fee Definition Property field with the name MarginPtsNoDiscountingBookBaseFWDRate. |

| • | Property Name - MarginPtsNoDiscountingBookBaseFWDRate |

| • | Property Values - BLANK, TRUE & FALSE |

| • | Default Property value = BLANK |

| • | NOTE - Blank = False. When Property value is BLANK or FALSE the computation is done via Market SPOT RATE & When Property value is TRUE the computation is done via Market FORWARD rate that is (Market SPOT RATE + Market FWD POINTS). |

| • | MarginPtsSpotDiscounted - Computes the margin as the spot discounted amount of the above computed margin basis amount. |

The margin date is set as the spot date of the trade currency pair.

| • | MarginPtsSpotDiscountedBookBase - Computes the margin as the spot discounted amount of the above computed margin basis amount against the base currency. |

The margin date is set as the spot date of the trade currency pair.

Equivalent to the sales user selling the spot risk against the base currency for the margin basis amount.

The margin basis amount is first discounted to spot of the currency pair and then converted to the base.

| • | MarginPtsTodayDiscounted - This calculator computes the margin as the today discounted amount of the above computed margin basis amount. |

The margin date is the spot date of the trade currency pair.

| • | MarginPtsDiscountedBookBase - Computes the margin as the today discounted amount of the above computed margin basis amount against the base currency. |

The margin date is set as today.

Equivalent to the sales user doing a trade today against the margin basis amount currency/base currency pair for the discounted margin basis amount.

The FX Swap far leg requires the FAR_MARGIN fee definition as in the example below. You must use the same calculator that is used for the SPOT_MARGIN fee definition.