Defining Sales Margins

Sales margins can be automatically added to trades in the Pricing Sheet and the FX Deal Station based on Sales Margin Configurations.

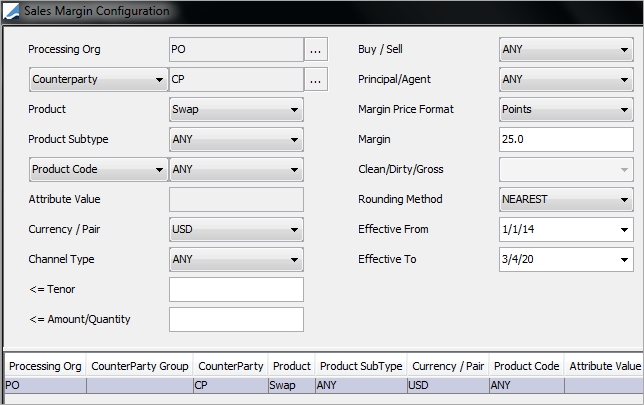

1. Configuring Sales Margins

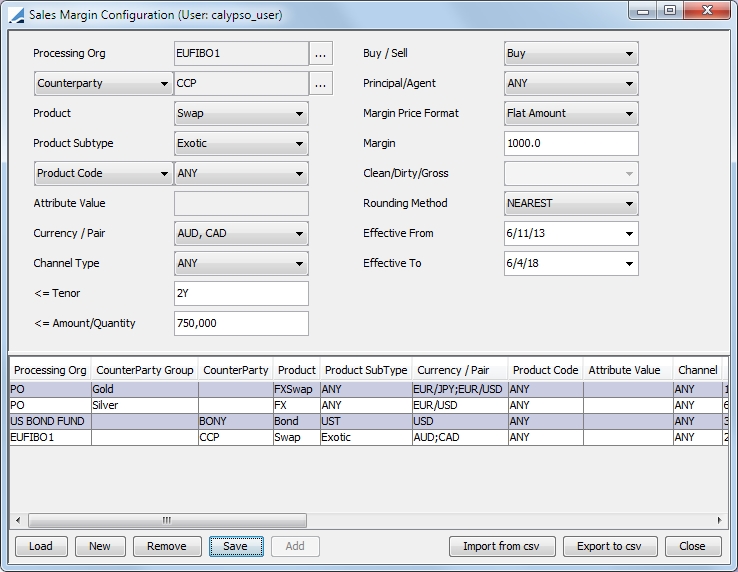

From the Calypso Navigator, navigate to Configuration > Fees, Haircuts & Margin Calls > Sales Margin Configuration to configure Sales Margins. Menu action refdata.SalesMarginConfigurationWindow.

| » | Enter the fields described below as needed, and click Save. |

The default sales margin can be configured based on the following fields:

|

Fields |

Description |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Processing Org |

The processing organization assigned to the trade. (Required field) |

|||||||||||||||

|

Counterparty / Margin Group |

Select either a trading Counterparty or a Margin Group.

|

|||||||||||||||

| Product |

Select the product to which the sales margin applies. (Required field) |

|||||||||||||||

| Product Subtype |

Select a product subtype related to the specified product if desired. |

|||||||||||||||

|

Product Code / Trade Keyword |

Select either a product code associated with the product or a trade keyword. |

|||||||||||||||

| Attribute Value |

Enter a trade attribute or keyword for the product depending on the selection of the Product Code/Trade Keyword field. |

|||||||||||||||

|

Currency / Pair |

Choose currencies or currency pairs depending on the product selected. (required field) |

|||||||||||||||

|

Channel Type |

This is the platform for the trade. This is set in the salesMarginChannelType domain. |

|||||||||||||||

|

<= Tenor |

Enter a tenor for which the margin is valid for trades with a value date up until or equal to the tenor date. |

|||||||||||||||

| <= Amount/Quantity |

The specified margin is valid for trades up to or equal to this amount or quantity. For FX swaps, this is the near leg notional amount. |

|||||||||||||||

| Buy / Sell |

Specify whether the trade has to be a buy or sell, or either. |

|||||||||||||||

| Principal / Agent |

This is required for bonds, displayed on Pricing Sheet only. |

|||||||||||||||

|

Margin Price Format |

Depending on the product selected, then choose the format of the margin price.

|

|||||||||||||||

|

Margin / Margin Breakdown |

Amount of margin. Margin Breakdown can be selected when the Product is FX Forward, FX Swap or FX NDF. When selected, Margin Breakdown adjust Margin entry to dual entry for Spot Margin and Points Margin. If a trade is entered in FOWS Quick Trade Entry or Deal Station Quick Deal Entry that fulfills the parameters designed in the Sames Margin Configuration, the designated margin for spot and/or points will populate the QTE or QDE fields automatically. |

|||||||||||||||

|

Clean / Dirty / Gross |

Select the Clean Price, Dirty Price or Gross Price. Required for bonds, displayed on Pricing Sheet only. |

|||||||||||||||

|

Rounding Method |

Select the rounding method to be used for the margin. |

|||||||||||||||

|

Effective From |

Enter the date from which the margin rule is valid. |

|||||||||||||||

|

Effective To |

Enter the expiration date of the margin rule. |

2. Configuring Margin Groups

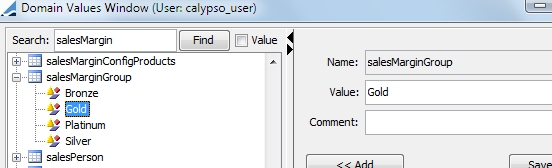

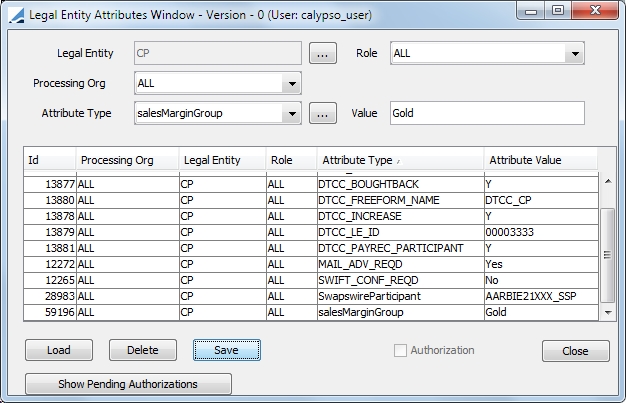

A margin group allows you to include many counterparties in one group for the purpose of assigning sales margins. A margin group is defined through a domain value and added as an attribute in the Legal Entity window.

Assign the margin group name to the domain salesMarginGroup.

Then add the attribute type and value to the desired counterparty in the Legal Entity Attributes window.

3. Applying a Default Sales Margin

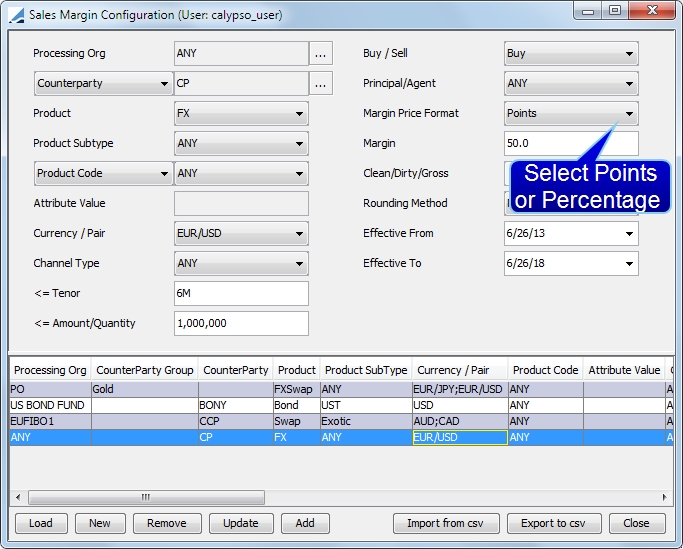

The sales margin can be applied in FX Deal Station and the Pricing Sheet using either a Points or Percentage format.

Below are example for how to apply default sales margins in the FX Deal Station and the Pricing Sheet.

3.1 Sales Margin in FX Deal Station

Sample Sales Margin Configuration

In the FX Deal Station, when you enter a trade that fulfills the parameters designated in the Sales Margin configuration, the margin amount will automatically populate in the Margin field.

You can override the margin amount.

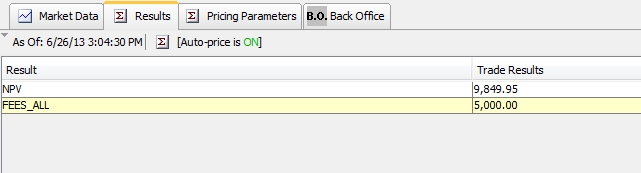

After the trade is saved, the fee amount is displayed in the Results panel.

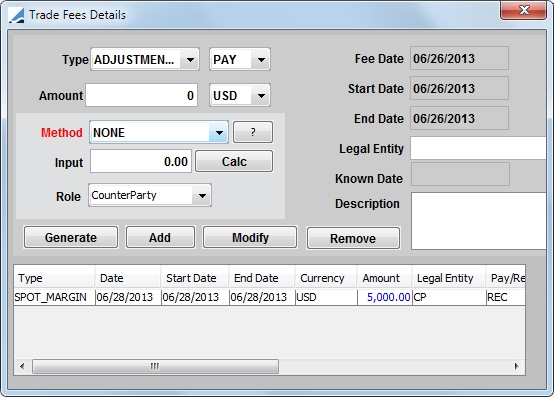

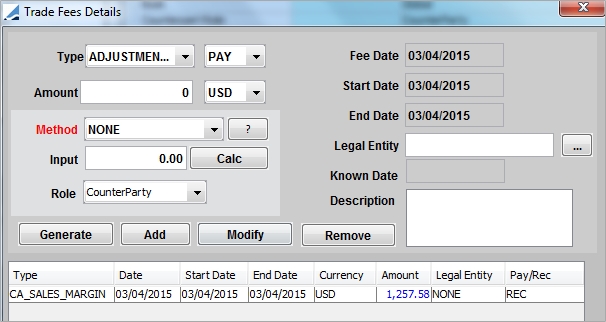

You are also able to see the fees in the Fee Details window. This window can be displayed by selecting Trade > Fee Details from the Title Bar drop-down menu.

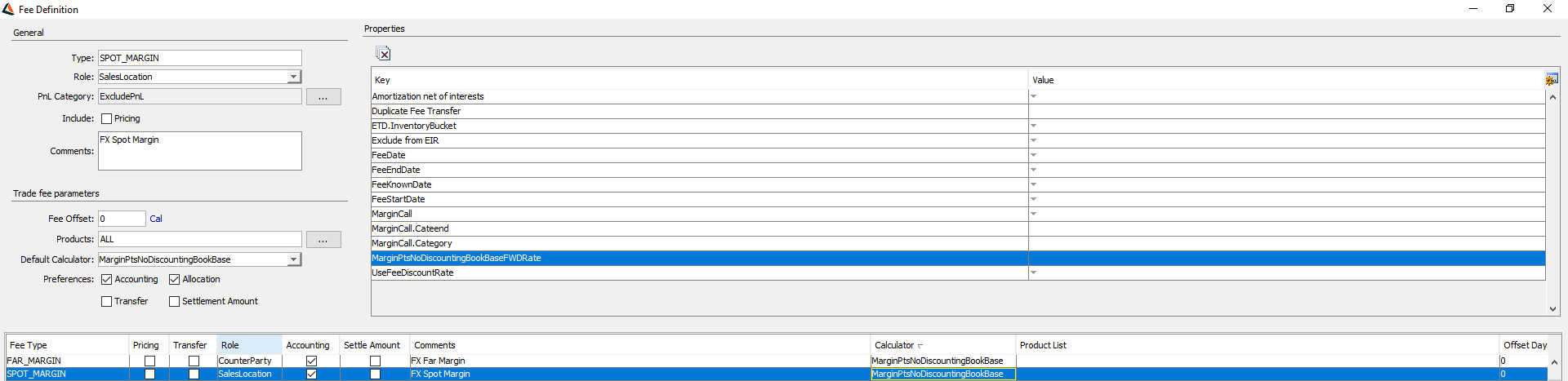

For the FX Deal Station, only the FAR_MARGIN and SPOT_MARGIN fee types are supported. You can configure the calculators used for these fee types in the Fee Definition window.

The calculators provide variations to the default calculation:

If Fee ccy = Trade Quote Ccy, then Fee Amount = [input value] * Quantity (that is, Trade Base Amount).

If Fee ccy <> Trade Base Ccy, then Fee Amount = [input value] * Quantity (that is, Trade Basis Amount = Trade Base Amount converted using the Trade Spot Price).

The supported calculators are:

| • | MarginPtsNoDiscounting - Computes the amount as the above computed margin basis amount and sets the margin date as the trade settle date. |

| • | MarginPtsNoDiscountingBookBase - Converts the above computed margin basis amount to the book base currency and sets the margin amount as the same. |

The margin date is set as the trade settle date.

Equivalent to the sales user creating a forward for the basis amount against the base currency.

| • | MarginPtsNoDiscountingBookBaseFWDRateProperty - Introduction of a new Key on the Fee Definition Property field with the name MarginPtsNoDiscountingBookBaseFWDRate. |

| • | Property Name - MarginPtsNoDiscountingBookBaseFWDRate |

| • | Property Values - BLANK, TRUE & FALSE |

| • | Default Property value = BLANK |

| • | MarginPtsSpotDiscounted - Computes the margin as the spot discounted amount of the above computed margin basis amount. |

The margin date is set as the spot date of the trade currency pair.

| • | MarginPtsSpotDiscountedBookBase - Computes the margin as the spot discounted amount of the above computed margin basis amount against the base currency. |

The margin date is set as the spot date of the trade currency pair.

Equivalent to the sales user selling the spot risk against the base currency for the margin basis amount.

The margin basis amount is first discounted to spot of the currency pair and then converted to the base.

| • | MarginPtsTodayDiscounted - This calculator computes the margin as the today discounted amount of the above computed margin basis amount. |

The margin date is the spot date of the trade currency pair.

| • | MarginPtsTodayDiscountedBookBase - Computes the margin as the today discounted amount of the above computed margin basis amount against the base currency. |

The margin date is set as today.

Equivalent to the sales user doing a trade today against the margin basis amount currency/base currency pair for the discounted margin basis amount.

Ⓘ [NOTE: The calculators used for FAR_MARGIN and SPOT_MARGIN must be the same]

3.2 Sales Margin in Pricing Sheet

Sample Sales Margin Configuration

In the Pricing Sheet, when you enter a trade that fulfills the parameters designated in the Sales Margin configuration, the margin amount will automatically populate in the Sales Fee field.

You can override the margin amount.

After the trade is saved, the fee amount is displayed in the Trade Fees Details window. This window can be selected by right clicking in the trade leg (or legs) and selecting Trade Details > Trade Fees. You can also click Ctrl + F.

The fee type depends on the product types: FXOPT_MARGIN for FX options, SPOT_MARGIN and FAR_MARGIN for FX, and CA_SALES_MARGIN for all other product types.

4. Viewing Sales Margins

For sales margin fee reporting, you can use the Fee report window which is accessed through the Calypso Navigator under Reports > Fees & Settlements > Fee Report.

See Trade Fees Report for details.

See Trade Fees Report for details.

You can also use the Sales Margin analysis which configured in the Analysis Designer.

Please refer to Sales Margin Analysis documentation for details.

Please refer to Sales Margin Analysis documentation for details.

See

See