Capturing Capped Swap Trades

A Capped Swap is a swap with a cap floor on the floating leg. The trade can be fixed-floating or floating-floating.

Choose Trade > Interest Rates > Capped Swap to open the Capped Swap worksheet, from the Calypso Navigator or from the Trade Blotter.

You can also choose Trade > Interest Rates > Swap to open the Swap worksheet, and define an exotic structure for the cap / floor on the swap.

| » | Enter the swap details as described in Capturing Swap Trades. |

| » | Enter the fields described below to define the cap / floor. |

Inflation Index

If the rate index is an inflation index, please see "Capturing Inflation Swap Trades" for details.

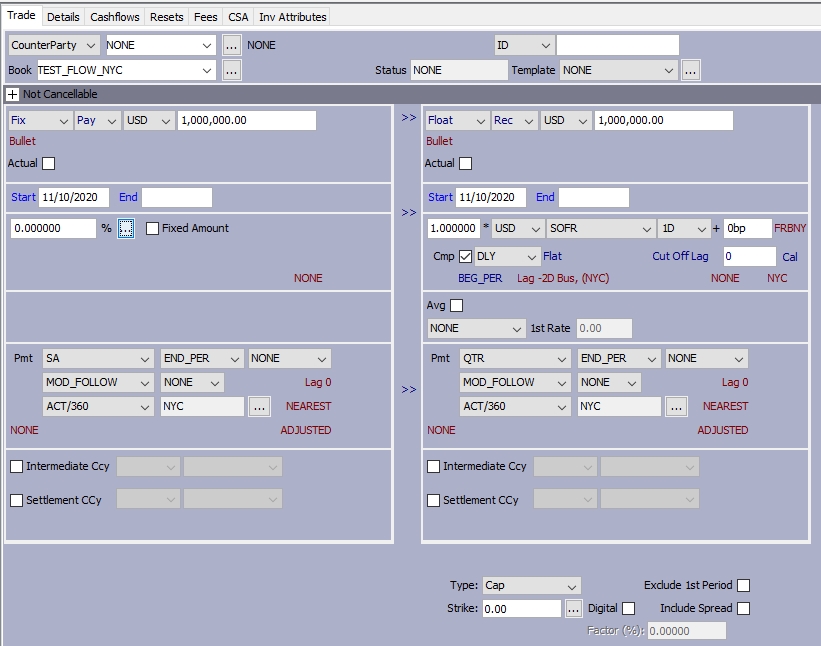

Cap Floor Details

| Fields | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Type |

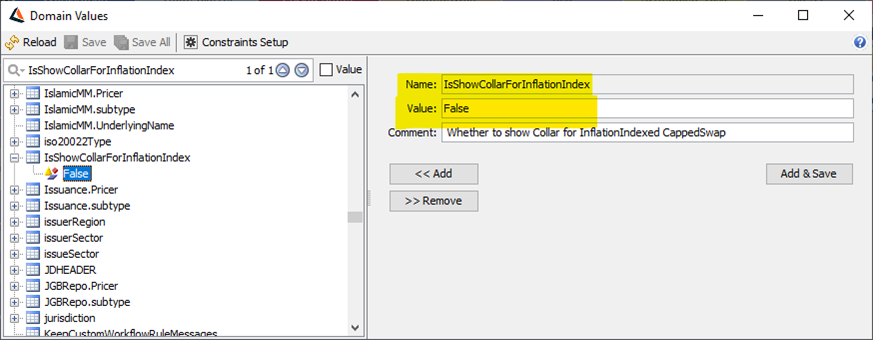

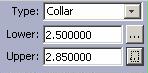

Select the type of cap floor: Cap, Floor, or Collar. Ⓘ Note: When a Float Leg is using a Rate Index of Type = Inflation, remove the dependency on the “IsShowCollarForInflationIndex. domain and add “Collar” to the dropdown for option Type.

For an inflation index, you can only select Cap or Floor.

|

|||||||||||||||

|

Exclude 1st Period |

Check the “Exclude First” checkbox to exclude the first caplet/floorlet from the cashflows. When doing a Copy/Paste Cap to Swap: If “Exclude First” is checked, copying the Cap to a Swap will ignore that flag. In order to copy the flag, set the environment property OLD_CAPTOSWAP_PASTE to true. |

|||||||||||||||

|

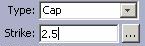

Strike |

Only appears for trade types Cap and Floor.

You can also click ... to define a strike schedule.

Or select the schedule frequency from the Frq field.

|

|||||||||||||||

|

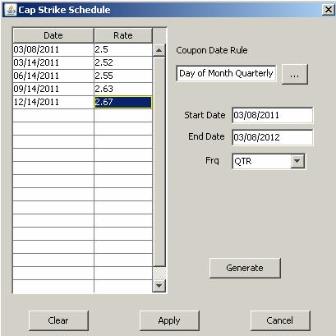

Upper Lower |

Only appears for trade type Collar.

You can also click ... to define a lower schedule, and an upper schedule. |

|||||||||||||||

|

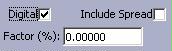

Digital |

This checkbox does not apply to inflation indices. You can check the Digital checkbox so that you can specify payoff details.

However, you can enter variable digital factors for some or all caplets/floorlets in the trade. In the Cashflows panel, check the Customized checkbox, and edit the Payoff Factor(%) column for each individual caplet/floorlet. The payoff for a digital caplet/floorlet will be calculated as follows: If Reset Rate > Strike, payoff = Notional * Period * Factor (Payoff Spread). Otherwise, payoff = Zero.

|

When an Inflation CappedSwap trade is booked, the underlying CapFloor subtrade will be broken down into its Cap and Floor components. The CapFloorInflationBlack pricer only supports pricing of inflation cap or floor trades.

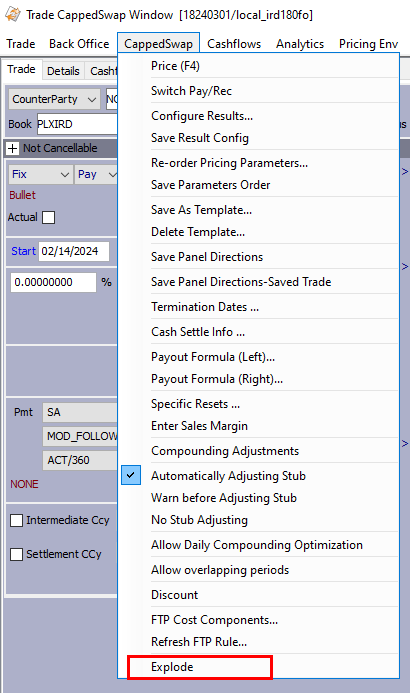

The Explode feature of CappedSwap will be show 3 subtrades when Collar is selected:

| • | Swap |

| • | Cap |

| • | Floor |

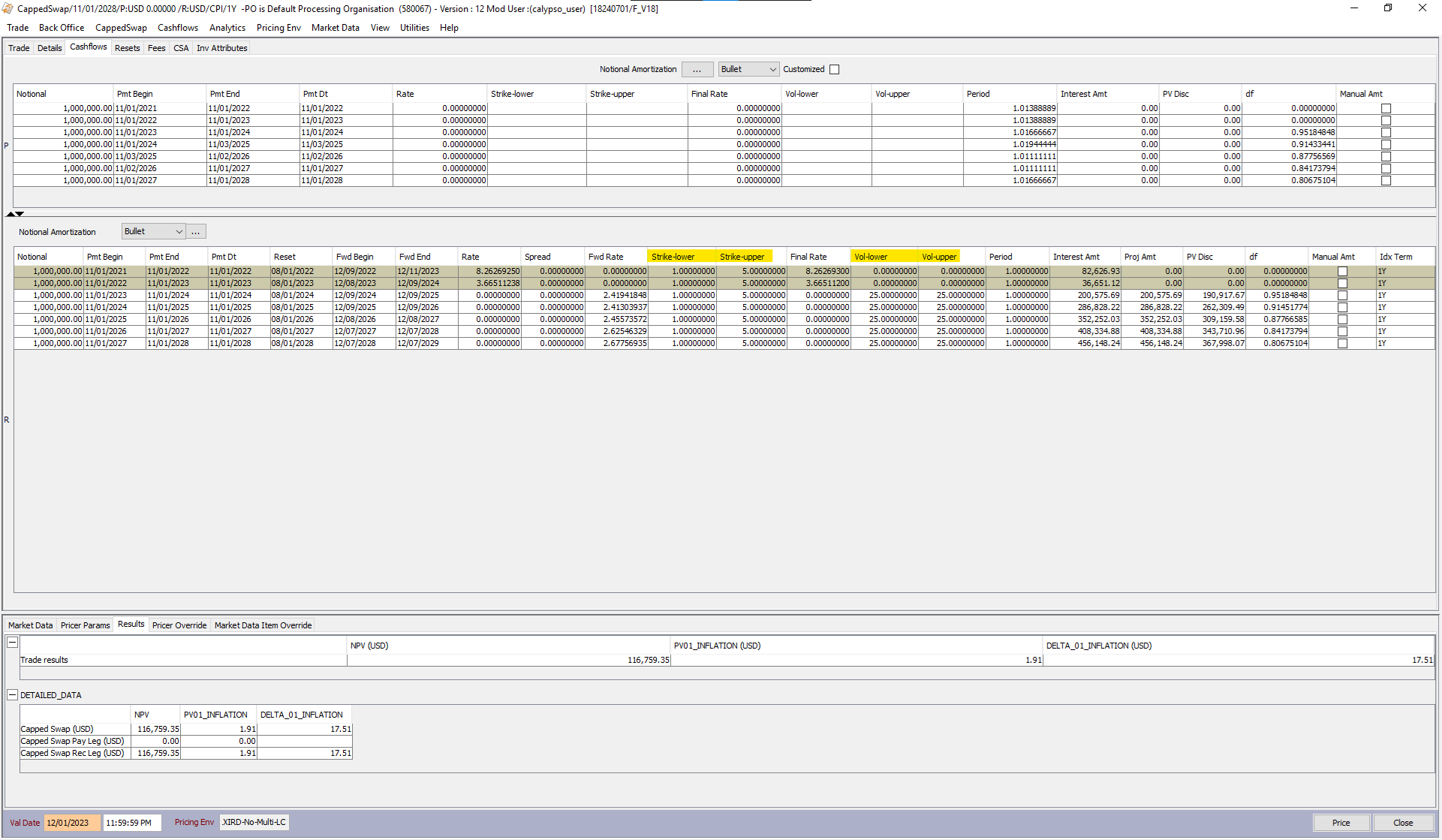

When Collar is selected the following cashflow columns will be displayed and correctly calculated:

| • | Strike-upper |

| • | Strike-lower |

| • | Vol-upper |

| • | Vol-lower |

The following pricer measures should be validated to confirm both the Cap and Floor are incorporated in the inflation CappedSwap pricing:

| • | NPV |

| • | ACCRUAL |

| • | ACCRUAL_REALIZED |

| • | PV01_INFLATION |

| • | DELTA_01_INFLATION |

| • | PV01 |

| • | DELTA_01 |

| • | IMPLIEDVOLATILITY |

| • | ACCRUAL_REALIZED |

| • | CUMULATIVE_CASH |

| • | DETAILED_DATA |

CappedSwapNonDeliverable

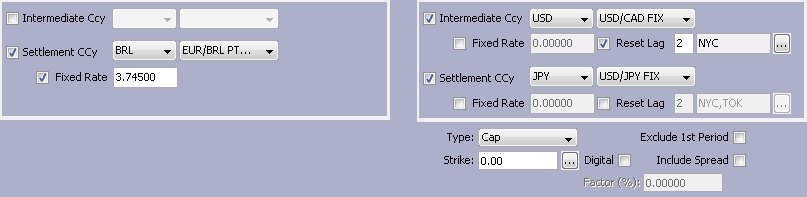

The Capped Swap trade window also supports settlement with non-deliverable currencies, just as the standard SwapNonDeliverable product. Whenever the Notional Ccy differs from Settlement Ccy on either leg, Capped Swap is automatically changed to the Capped Swap Non-Deliverable trade.

Settlement Ccy and Intermediate Ccy fields are the same as those available to SwapNonDeliverable.

For details on these fields, see Capturing Non-Deliverable Swap Trades.

For details on these fields, see Capturing Non-Deliverable Swap Trades.

Pricing

| • | Both PricerCappedSwap and PricerCappedSwapInflationBlack are compatible with Capped Swap Non-Deliverable trades. |

| • | CappedSwapNonDeliverable also supports the pricing parameter USE_NATIVE_CURRENCY, used for computing pricer measures in native currency when set to True. When False, which is the default, pricer measures are computed in settlement currency. |

| • | PricerCappedSwap can calculate projected cashflows and NPV when USE_NATIVE_CURRENCY = false and FORECAST_FX_RATE = true. |

Ⓘ [NOTE: Pricer measures for Greeks (DELTA, GAMMA, THETA, VEGA) currently do not support settlement ccy and can only be calculated in notional ccy.]