Capturing Non-Deliverable Swap Trades

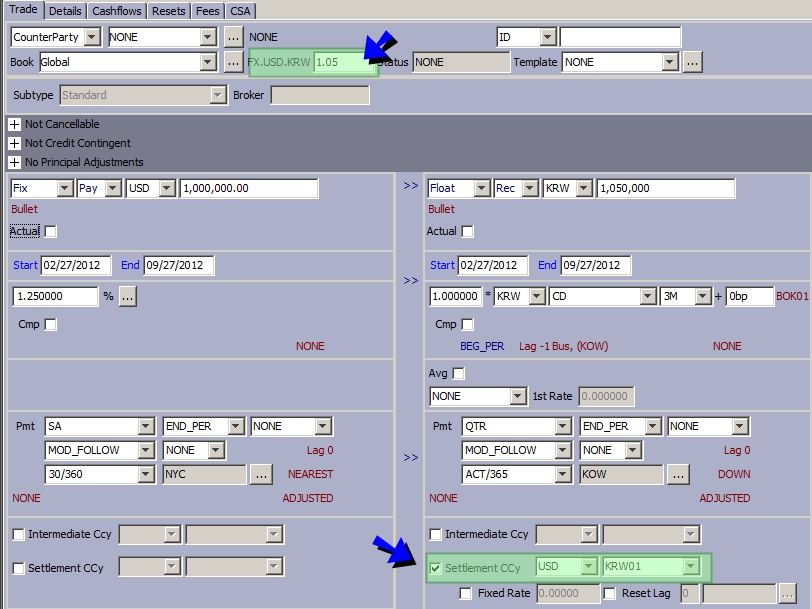

A Non-Deliverable Swap is an agreement between two parties to exchange a stream of interest payments and the notional principal in one currency for a non-deliverable currency, or both sides are in a non-deliverable currency.

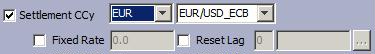

The payments of the non-deliverable currency are made in a user-defined settlement currency based on a fixing between the non-deliverable currency and the settlement currency.

Choose Trade > Interest Rates > Swap to open the Swap worksheet, from the Calypso Navigator or from the Trade Blotter, and simply select a settlement currency.

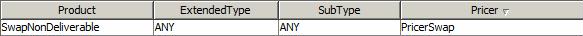

Pricer Setup

For Non-Deliverable Cross Currency Swap, the product type is set to SwapNonDeliverable. It uses PricerSwap.

| » | Enter the fields described below as needed. |

| » | Then enter more trade details as described in Capturing Swap Trades. |

Ⓘ [NOTE: The trade is saved with product type SwapNonDeliverable]

Fields Details

| Fields | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

FX Rate |

Enter the rate between both currencies in the field "FX.<currency>.<currency>". |

||||||||||||||||||

| Intermediate Ccy |

Check to capture an intermediate currency as needed between the principal amount's currency and the settlement currency.

The FX rate reset is between the principal amount's currency and the intermediate currency. FX rate resets are defined from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions.

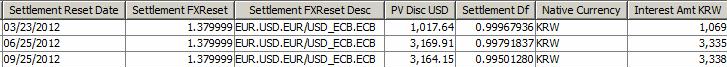

The following columns have been added to the cashflows:

|

||||||||||||||||||

| Settlement Ccy |

Check to capture the settlement currency when an intermediate currency is specified, or if the settlement currency is different from the principal amount's currency. When you select a settlement currency, the trade becomes a non-deliverable trade.

The FX rate reset is between the settlement currency and the intermediate currency (if specified), or between the settlement currency and the principal amount's currency. FX rate resets are defined from using Configuration > Foreign Exchange > FX Rate Definitions.

The following columns have been added to the cashflows:

|

Cashflows

If you select an intermediate currency, the amounts are computed in the intermediate currency and in the settlement currency. Otherwise, they are computed in the settlement currency.

By default, the FX reset date is based on cashflow Pmt Date. You can set Value = true in domain "OffsetFXResetfromPmtEnd" - In this case, the FX reset date is based on cashflow Pmt End Date instead of Pmt Date.

Pricing

SwapNonDeliverable trades use pricer Swap.

By default, all pricer measures are computed in settlement currency. You can set the pricing parameter USE_NATIVE_CURRENCY to true to return the following pricer measures in native currency:

| • | ACCRUAL |

| • | ACCRUAL_FIRST |

| • | ACCRUAL_PAYMENT |

| • | ACCRUAL_PAYMENT_FIRST |

| • | ACCRUAL_REALIZED |

| • | NPV |

| • | NPV_NET |

| • | NPV_NO_PRINCIPAL |