Defining FX Rate Fixings

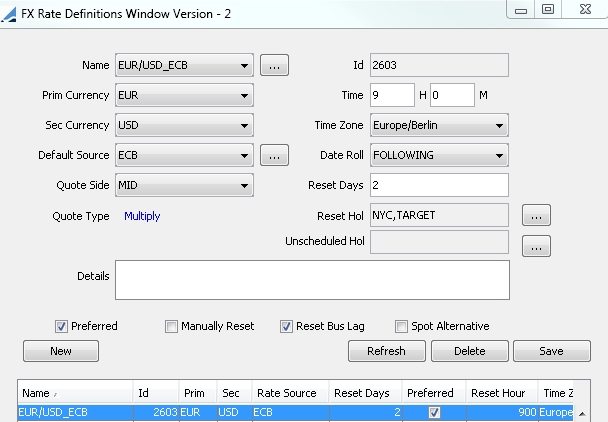

The FX Rate Definitions window allows defining where, when, and how FX rates will be fixed (or reset) for a given currency pair.

The actual FX rates values are fixed using Trade Lifecycle > Reset > FX Rate Reset, or using the FX_RATE_RESET scheduled task.

From the Calypso Navigator, navigate to Configuration > Foreign Exchange > FX Rate Definitions.

| » | To create an FX rate definition, click New, complete the details described in the table below, and click Save. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry. Click Show Pending Authorizations to display any definitions pending authorization.

| » | To view an existing definition, select the definition in the table. |

Fields Details

|

Fields |

Description |

|||||||||

|

Name |

Select a name for the fx rate definition. To add a new name to the drop-down menu, click ... to add a name to the "fx_rate_option" domain. Ⓘ [NOTE: You can add multiple rate sources for a rate index. Just add the source to the name so each rate definition has a unique name. For example, create rate definitions named AUD/USD Reuters and AUD/USD Telerate] |

|||||||||

|

Id |

When you save the definition, the system assigns it a unique id, and displays it in this field. |

|||||||||

|

Prim Currency Sec Currency |

Select the primary and secondary currencies in the currency pair. |

|||||||||

|

Time Time Zone |

Enter the time at which the rate is published in the selected time zone. Select the time zone in which the rate is published. |

|||||||||

|

Default Source |

Select the default quoting source from the list of... to add a source to the "fx_rate_source" domain. |

|||||||||

|

Date Roll |

Select the default date roll convention to roll non-business days. Date roll conventions are described under Help > Date Roll Conventions. |

|||||||||

|

Quote Side |

Select which quote to use: MID, BID, or ASK. |

|||||||||

|

Reset Days |

Enter the number of days for the reset lag. |

|||||||||

|

Quote Type |

Select Multiply to use the quoting convention that 1 unit of primary currency = x units of the secondary currency. |

|||||||||

|

Reset Hol |

Click ... to select default reset holiday calendars. |

|||||||||

| Unscheduled Hol |

Click ... to select an unscheduled holiday calendar for a Non-Deliverable Swap trade. Unscheduled Holiday is defined by ISDA as "a day not considered a business day, and one of which the market was not aware (by way of public announcement or other publicly available information) until a time later than 9:00 a.m. local time in the Principal Financial Center(s) of the Reference Currency two Business Days prior to the Scheduled Valuation Date". The holiday could be due to unforeseen events or unexpected occurrences that alter normal business days.

By default the maximum is set to 14 days (even though the field will appear empty before adding a value).

|

|||||||||

|

Details |

Enter a description of the rate definition to be used in confirmations. |

|||||||||

|

Preferred |

Select to indicate that the definition is the default one if more than one definition exists for the currency pair. |

|||||||||

|

Manually Reset |

Select if no publicized rate is available and reference banks or similar will have to be used to calculate a rate. |

|||||||||

|

Reset Bus Lag |

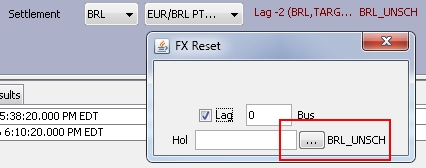

Select to indicate that the Reset Days lag is measured in business days, or uncheck for calendar days. |

|||||||||

| Spot Alternative |

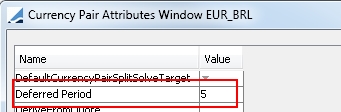

Select to enable the BRL Dirty Cupom Curve to pick up the PTAX rate for use as a base instead of the FX spot rate. For a given currency pair, only one FX reset can be designated as "Spot Alternative." The curve window uses the generator parameter "Use FX Reset" on the Quotes tab to determine whether the curve picks up the FX spot or takes the PTAX rate as the spot alternative. |

For details on adding new holiday calendars, see

For details on adding new holiday calendars, see