Bond Spread Adjustment

You can view issuer, issue spread and funding cost on bond products. Spreads are stored in the bond product definition and are used to discount cashflows. Issue spread is stored in the legal entity attribute table. You must first define a spread on a bond to use Configuration > Fixed Income > Spread from the Calypso Navigator, in order to manipulate a spread to a bond for pricing.

Adjusting issue spreads expresses credit risk on a bond issue as well as an issuer. In order to price a trade or position, base points can be adjusted for the notes. Issuer and issue adjustment spreads are summed for the total spread. Spreads can be manually overwritten for pricing.

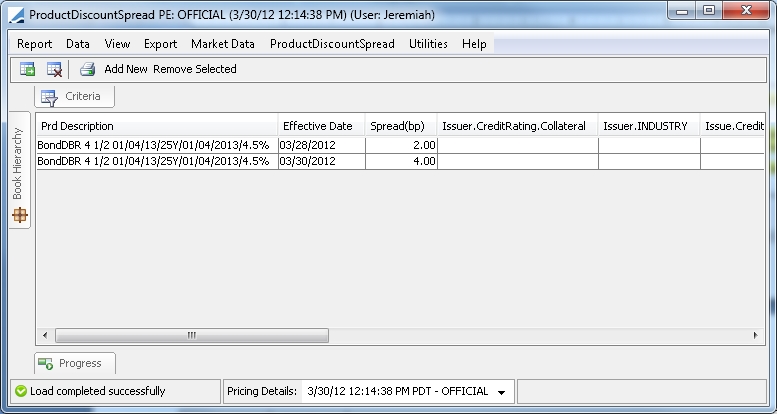

From the Calypso Navigator, navigate to Reports > Securities Reports > Bond Discount Spread (menu action reporting.ReportWindow$ProductDiscountSpread) to navigate to the window.

Contents

See Defining Bond Products for more details.

See Defining Bond Products for more details.

See Bond Spread for more details.

See Bond Spread for more details.

1. Defining an Issuer Spread

Bond Discount Spread window

1.1 Add a Product

You can define a spread by loading a bond product and adding base points. Hover over Criteria to enable the search panel.

Product Search panel

From here you can search by date and product. Click ... to bring up the product chooser panel.

1.2 Add a Spread

You can select ProductDiscountSpread from the menu or click Add New in the tool bar.

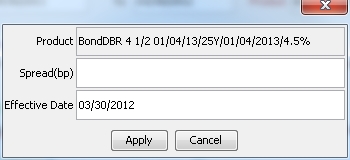

Add Spread window

Add a spread or modify the effective date for the product.

2. Configuring the Window

You can configure the report in the viewer.

- You can click Data and select configure data columns.

- You can click View and select a table view, frame and layout. You can save a layout as a template. Click Save as Default Layout.

- You can save your configuration as a template. Click Save as Template and choose a name.

- You can export your report to .xls, .csv, etc.

Hover over the Progress tab to view job progress running in the engines.

3. Calculations

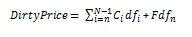

Spreads are adjusted according to the following calculations:

| • | N is the total number of cashflows generated |

| • | N - 1 ≥ n ≥ 0 is the index of the last coupon payment time |

| • | Ci is the coupon payment for the time index 'i' |

| • | F is the face value (redemption principal) |

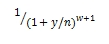

| • | dfi is the discount factor for the time index 'i', which discounts a cashflow from the time 'i' to the given settle date. It is in the form of- 'i', whole payment period in the time interval between the valuation date to the cashflow payment date, and 'w'- remaining fractional period not covered by the whole periods for odd coupons. |