Defining Bond Spreads

Bond spreads are used as underlying instruments for generating interest rate curves. A bond spread is basically a swap on a bond.

To define a bond spread product, navigate to Configuration > Fixed Income > Spread (menu action product.BondSpreadWindow) from the Calypso Navigator.

You can also manually change a spread on a bond when pricing.

See Bond Discount Spread for more details.

See Bond Discount Spread for more details.

Contents

- Adding a Spread to an Underlying

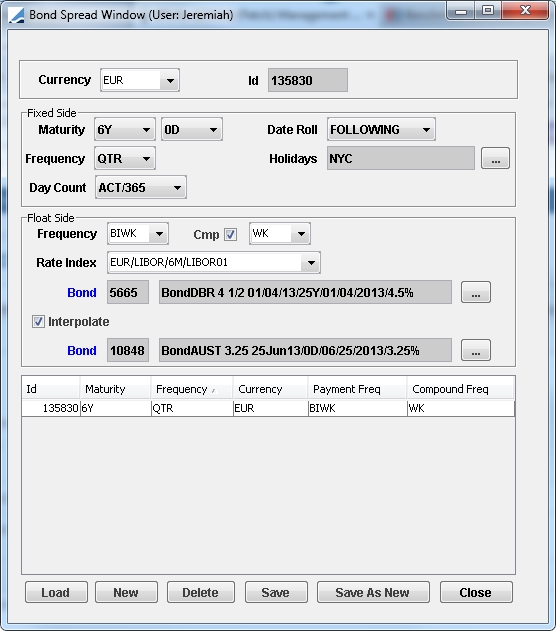

Bond Spread Window

| » | Click Load to load the existing bond spreads. |

Select a bond spread and modify the fields described below as applicable.

| » | Click New and enter the fields described below to create a new bond spread. |

| » | Click Delete to delete a spread. |

| » | Click Save to save your changes. |

You can also click Save As New to save the bond spread as a new bond spread.

1. Fields Details

Enter a currency for the spread. Loading a saved spread will populate the currency and Id fields.

(Fixed Side)

|

Fields |

Description |

|---|---|

|

Maturity |

Select the maturity of the swap. The first field corresponds to the number of years, and the second to the number of months. For example, a 2.5 years maturity will be defined as:

|

|

Date Roll |

Select the date roll convention to apply when the maturity date falls on non business days. |

|

Frq |

Select the payment frequency of the swap. |

|

Holidays |

Click ... to select the payment holiday calendar. |

|

Day Count |

Select the daycount convention for calculating the interest rate. |

(Float Side)

|

Fields |

Description |

|||

|

Maturity |

Select the maturity of the swap. The first field corresponds to the number of years, and the second to the number of months. For example, a 2.5 years maturity will be defined as:

|

|||

|

Date Roll |

Select the date roll convention to apply when the maturity date falls on non business days. |

|||

|

Frq |

Select the payment frequency of the swap. |

|||

|

Cmp |

Compounding frequency schedule. Click the checkbox and choose an interval from the drop down menu. |

|||

|

Holidays |

Click ... to select the payment holiday calendar. |

|||

|

Day Count |

Select the daycount convention for calculating the interest rate. |

|||

|

Id |

Unique id given by the system when the bond spread is saved. |

|||

|

Rate Index |

Select the reference index of the swap. |

|||

|

Bond |

Click ... to select the bond underlying the bond spread. |

|||

|

Interpolate |

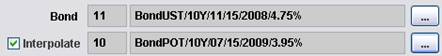

Check the Interpolate checkbox to specify a second bond and interpolate the interest rate between the two maturities. You will be prompted to select a second bond as shown below.

|

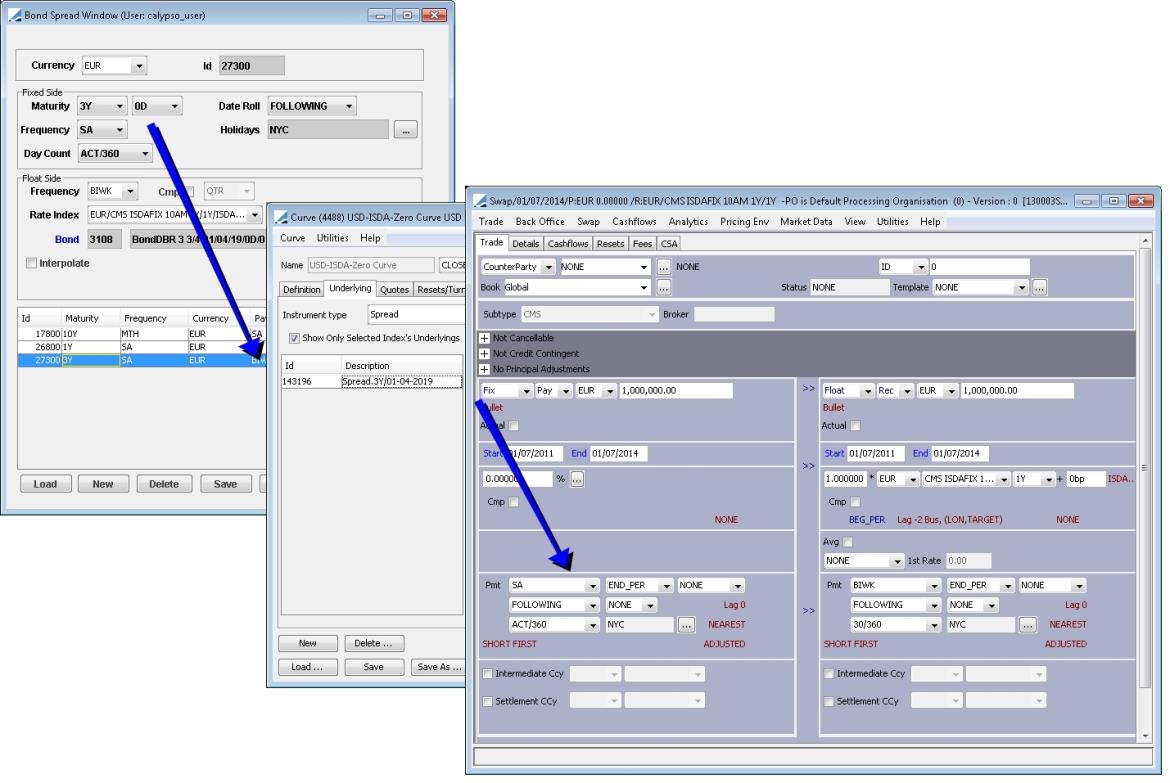

2. Adding a spread to an Underlying

You can open the swap the spread is on by double-clicking and holding ctrl in the curve window. The swap used to generate the spread will open.

| » | Define a bond spread in the Bond Spread Window. Add fixed/float details. |

| » | Open a curve in a Curve Window. In the underlying tab, add instrument type "Spread" from the drop down. |

| » | Select the defined spread with Id and double-click while holding the ctrl button. A swap window with the fixed/float details will open. |