Capturing Equity Swap Trades

An equity swap can have multiple flavors:

| • | Amortizing swap: equity / equity index / future equity index against interest rate |

| • | Basket against equity |

| • | Basket against interest rate |

| • | Equity / equity index / future equity index against equity / equity index / future equity index |

| • | Equity / equity index / future equity index against interest rate |

For equity, equity index, future equity index, and basket legs, the swap can be:

| • | Total return – The return is based on performance and dividend |

| • | Price return – The return is based on performance only |

| • | Dividend – The return is based on dividend only |

Ⓘ [NOTE: If you want to capture a dividend swap against a fixed amount instead of an interest rate or another asset, you can use the Dividend Swap worksheet - See Capturing Dividend Swaps for details]

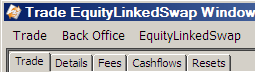

Choose Trade > Equity > Equity Swap to open the Equity Linked Swap (ELS) worksheet from Calypso Navigator or from the Trade Blotter.

|

Equity Swap Quick Reference

When you open a trade worksheet, the Trade panel is selected by default. Underlying Configuration

|

||||||||||||

|

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Ⓘ [Note: the Trade Date is entered in the Details panel]

|

||||||||||||

|

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. |

||||||||||||

|

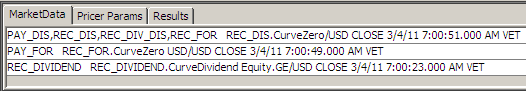

Pricing a Trade

An equity linked swap trade requires the following market data: a discount curve, forecast curve, dividend curve, quote for the underlying product, the first rate reset.

If the payment currency is a different currency than the product currency, then an FX rate is also required. |

||||||||||||

Accrual pricing approach defines the ELS value by recognizing only the unrealized performance and financing based on today's value of the underlying asset. Future flows are not considered while pricing. NPV = Unpaid performance + Unpaid incomes-Financing Costs If the deal can be terminated at any time without taking future flows into account Accrual pricing methodology should be used. Added the pricing parameter FIXING_DATE_ACCRUAL. True or False. Determines when a cash flow is no longer included in the NPV of the swap. True so that cash flow realization is based on the fixing date. False so that the cash flow realization is based on the payment date. Default is false.

|

||||||||||||

|

Trade Lifecycle

|

1. Sample Trade

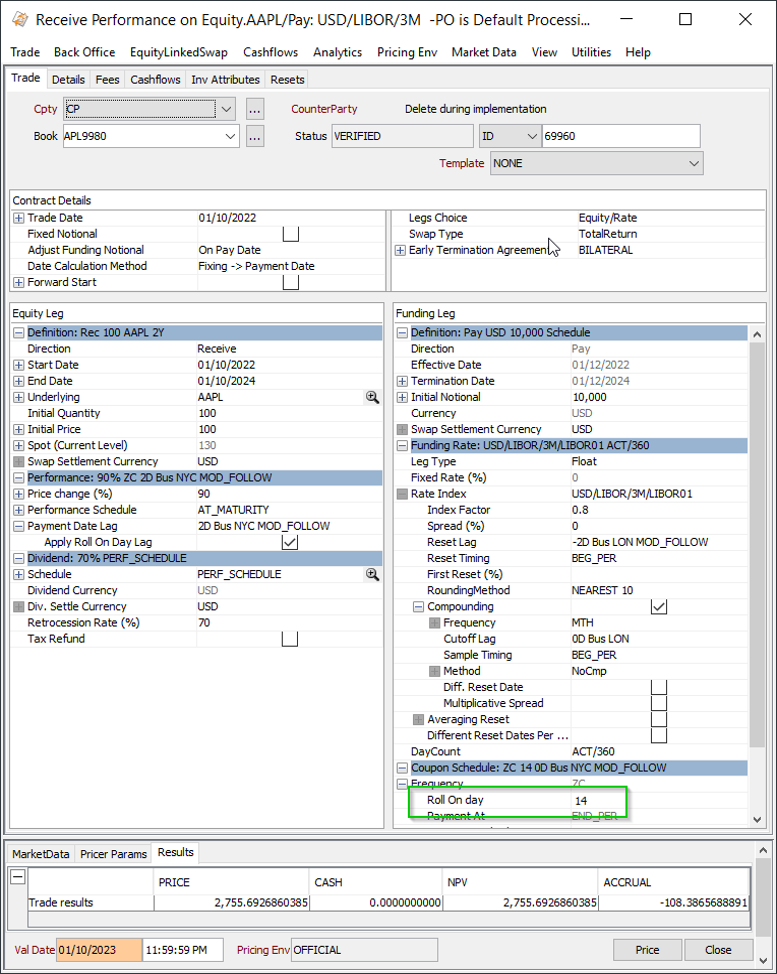

1.1 Total Return Swap on Equity

Equity Swap - Sample Total Return Trade

Equity Swap - Sample Total Return Cashflows

| » | The interest rate part of the trade generates interest cashflows. |

| » | The performance part of the trade generates PRICE_CHANGE cashflows based on the performance schedule – They correspond to price fixings. |

These cashflows are generated for TotalReturn and PriceReturn swaps.

| » | The dividend part of the trade generates DIVIDEND cashflows based on the dividend schedule – They correspond to realized dividends. |

These cashflows are generated for TotalReturn and Dividend swaps.

For an underlying basket, there would be one DIVIDEND cashflow for each component of the basket as applicable.

See Cashflows Details for a description of the most relevant columns.

See Cashflows Details for a description of the most relevant columns.

1.2 Fields Description

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

Contract Details

| Fields | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Trade Date |

The trade date defaults to the current date. Modify as applicable. You can double-click the Trade Date label to specify the trade time in the Trade Time field. You can also check the Current checkbox to save the trade with the most current trade date and time. |

|||||||||||||||

|

Fixed Notional |

Check for notional-based equity swap. Only available for Equity/Rate equity swaps. When Fixed Notional is checked, you can enter an Initial Notional on the funding leg, and the Quantity is calculated as Initial Notional / Initial Price. The field Forward Start Type is set to Notional Based. |

|||||||||||||||

|

Adjust Funding Notional |

Only available if Fixed Notional is not checked. Select the notional adjustment method:

|

|||||||||||||||

|

Adjust Quantity |

Only available if Fixed Notional is checked. It is set by the system based on the selected Date Calculation Method:

|

|||||||||||||||

|

Date Calculation Method |

Select the Date Calculation Method:

|

|||||||||||||||

|

Forward Start |

Check for a forward starting trade.

Performance cashflows (price change and dividend) are foretasted using the quantity = notional/FORWARD price at the fixing date. If the settlement currency is different from the underlying currency, the "Initial FX Rate" field can be empty. It can be entered manually, or retrieved from the market data. The scheduled task UPDATE_ELS_FORW_START updates the trades when the price is known on the start date: Price = quote and Initial Quantity = Initial Notional/Initial Price. When checked, you can select if the trade is Notional Based or Quantity Based. Notional Based = The notional of the funding leg is known on the trade date and the quantity is calculated based on the fixing as of the Start Date of the Performance leg. Quantity Based = The quantity is known on the trade date and the notional will be calculated based on the fixing as of the Start Date of the Performance leg. |

|||||||||||||||

|

Legs Choice |

Select the type of swap you want to perform:

Each type of leg is described below. |

|||||||||||||||

|

Swap Type |

The following subtypes are included out-of-the-box:

You can extend the list of subtypes in the EquityLinkedSwap.subtype domain. |

|||||||||||||||

|

Early Term Agreement |

Select the type of early termination agreement:

You can double click the "Early Termination Agreement" label and enter a lockout date as applicable in the Lockout Date field. During the lockout period (between the start date and the lockout date), neither party can terminate the contract. The NPV of the deal is only made up of the accrued interest. |

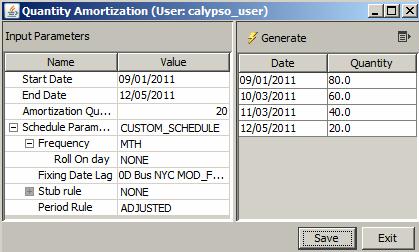

Amortizing Details

The Amortizing Swap is similar to an Equity Swap (Equity / Equity Index against Interest Rate) except that the quantity is amortized over the life of the trade. The amortization can either be a fixed number of shares, or manually entered by the user. The amortization is applied based upon the amortization schedule defined by the user in the Quantity Amortization window.

Amortizing Swaps pay a dividend on the Amortized Quantity and use an average as the Fixing Level of the Performance leg, which is based on the Reset Frequency. The Fixing Level used for performance flow calculation is the average of the Fixing Price for each reset.

The equity details of the Amortizing Swap contain the following additional fields.

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Amortization Quantity |

You can enter a quantity for a fixed amortizing schedule. Click

You can modify the date / quantity as needed in the generated schedule. The quantity is the remaining quantity as of a given date.

|

||||||

|

Remaining Quantity |

Remaining quantity as of the valuation date. |

||||||

|

Averaging Method |

Select Simple or Weighted (based on amortized quantity) for computing the performance. |

The cashflows reflect the amortized quantity.

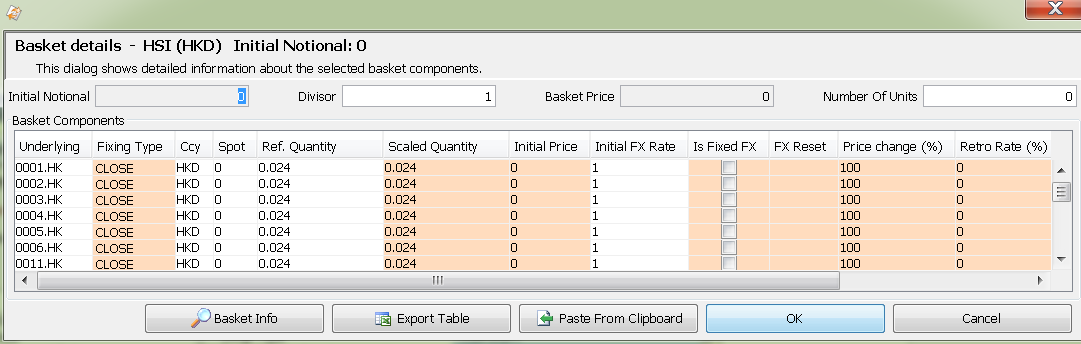

Equity Basket Leg Details

The equity basket details are the same as the equity details with the additional fields described below.

| Fields | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Reference Basket |

Select a basket. Baskets are defined using Calypso Navigator > Configuration > Basket - Help is available from that window. Ⓘ [Note: Only baskets weighted in quantity are supported] When you select a basket, it brings up the Basket Components window - See Basket Components below for details. You can double-click the reference Basket label to display some basket details:

|

|||||||||||||||

|

Basket Initial Notional |

Basket notional based on the basket components. You can double-click the Basket Initial Notional label to view some basket details:

|

Basket Components

Basket Components Details

| » | You can select the fixing type, set the initial price, set percentage of performance paid or received, and set the retrocession rate for each component. |

| – | Number Of Units: The quantity of the equity basket swap that is traded. This number is constant and does not change during trade life unless there is partial termination or notional increase. |

| – | Basket Price: |

Basket Price = (∑_(i=1)^nth〖Shares_i×Price_i 〗 ×FX_i ) / Divisor

Where

Shares_i = The weighting of an equity issue within the Basket

Price_i = The current price of each equity share

FX_i = The currency adjustment (for any equities quoted in a currency other than the Basket currency)

The basket notional is defined as:

Basket Notional = (∑_(i=1)^nth〖Shares_i×Price_i 〗 ×FX_i )

| – | Divisor: A fixed basket-level constant. |

| – | Fixing Type: Fixing types are defined in the Equity Definition window. If not selected, the default is CLOSE, indicating that the fixing is done using the spot quote. |

See Equity Definition for details.

See Equity Definition for details.

| » | You can click Basket Info to bring up the Basket Definition window - Help is available from that window. |

Equity Leg Details

Definition

| Fields | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Direction |

Direction of the leg from the book’s perspective. Click the field to select either Pay or Receive. |

||||||||||||

|

Start Date End Date |

Enter the start and end dates. You can double-click the Start Date and End Date labels to specify fixing start and end dates. |

||||||||||||

|

Underlying |

Select the underlying: equity or equity index. You can also type in the underlying's name. You can double-click the Underlying label to display some underlying details:

You can view details about equity resets in the Resets panel.

|

||||||||||||

|

Initial Quantity |

Enter the initial number of shares that are exchanged. |

||||||||||||

|

Initial Price |

Enter the initial price. This price will be used to calculate the first payoff. You can double-click the Initial Quantity label to view the quote type and currency of the initial price. |

||||||||||||

|

Quote Type |

The type of quote is displayed. |

||||||||||||

|

Currency |

The asset's reference currency. |

||||||||||||

|

Spot (Current Level) |

Displays the current market price if any (current quote retrieved from the quote set). You can double-click the Spot label to display the quote type of the market price. |

||||||||||||

|

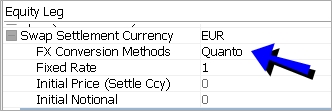

Swap Settlement Currency |

Select the settlement currency. If the settlement currency is different from the underlying currency, you can select the FX Conversion Method. The choices are Quanto / Compo and Local as defined below. Quanto

Quanto corresponds to current behavior when “Is Fixed FX” is checked. The following fields will be available: Fixed Rate, Initial Price (Settle Currency), Initial Notional. The system displays the initial price / notional in settlement currency. Compo Compo corresponds to current behavior when “Is Fixed FX” is unchecked. The following fields will be available: Initial FX Rate, FX Reset, FX Reset Date Lag, Initial Price (Settle Currency), Initial Notional. When the FX Conversion method is Compo, Only Performance flow “FX Reset Date” is derived from FX Reset Date Lag. FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions. The system displays the initial price / notional in settlement currency. Local The following fields will be available: FX Reset and FX Reset Date Lag. The system displays the initial price / notional in underlying currency. In the case of Local FX conversion method, both Performance and Funding flow FX Reset Dates are derived from FX Reset Date Lag. Ⓘ [Notes: You can view settlement currency details in the cashflows by adding the following columns: Pay Start Price, Pay End Price, Pay Proj. Start Price, Pay Proj. End Price] FX Reset Date LagFX Reset Fixing will be used to derive the FX Reset Date on Performance and Funding flow. The default value of FX Reset Fixing is set to CashflowPaymentEndDate.

|

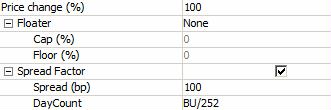

Performance – Only applies to TotalReturn and PriceReturn swaps.

| Fields | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Price Change % |

Enter the percentage of performance that the equity leg receives or pays. You can double-click the Price Change label to define limits and a spread factor as applicable.

PRICE_CHANGE = Quantity * Spread Factor * Price Change (%) * (End Price * End FX – Start Price * Start FX) + Spread Factor * Quantity * Start Price * Start FX |

||||||||||||||||||

|

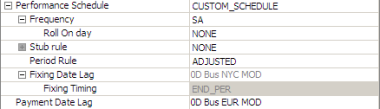

Performance Schedule |

Select the performance payoff schedule.

Select a payoff frequency, a roll day for weekly and monthly frequencies, stub rule if any, and period rule. The period rule can be ADJUSTED or UNADJUSTED to determine if the end date of a payoff period is adjusted or not when it falls on a non-business day (applicable with BUS lag payment), or select FRN or MAT_UNADJUSTED.

The fixing date lag defaults to zero, and the fixing calendar defaults to the holiday calendar of the exchange for the stock/index. You can specify a different fixing lag as needed if the Date Calculation Method is not "Fixing -> Payment Date". Shortcut – You can enter for example 2b to specify 2 business days. Under fixing to payment date calculation method, cashflows generated on equity leg based on stub rule selection would drive the cashflow generation of funding leg. Under the independent Date Calculation method, stub rules from equity leg and funding leg will be independently used to generate cashflow periods for equity and funding legs. |

||||||||||||||||||

|

Payment Date Lag |

The payment lag defaults to the spot days of the reference stock/index: number of days between the payoff date and the actual payment date. You can specify a different payment lag as needed if the Date Calculation Method is not "Payment -> Fixing Date". The holiday calendar defaults to the calendar specified for the payment currency in the currency definition. Payment Holiday calendar will be used for period generation and Settle Holiday calendar will be used for payment date calculation. Shortcut – You can enter for example 2b to specify 2 business days. |

||||||||||||||||||

|

Apply Roll Lag on Cmp Cashflows |

When Apply Roll Lag on Cmp Cashflows checkbox will be checked, lag will be applied on the compounded cashflow dates calculated based on Roll On Day and Roll on Day Lag (derived from payment date lag on equity leg) field to get desired / adjusted dates. |

Dividend – Only applies to TotalReturn and Dividend swaps.

| Fields | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Schedule |

Select the payment schedule associated with the equity:

You can double-click the 0 Bus label in the Date Lag field to set a payment lag between the dividend date and the payment date.

For the last flow of the schedule, dividend ownership is also driven by ex-div date: divPay date > startDate, divPay <= end date.

Dividend Ownership Does not apply to schedule NONE or ASIAN_SCHEDULE. You can select one of the following options:

|

||||||||||||||||||||||||

|

Dividend Currency |

Dividend currency of the underlying. |

||||||||||||||||||||||||

|

Dividend Settlement Currency |

Select the dividend settlement currency. If the dividend settlement currency is different from the dividend currency, you can set the initial FX rate in the field Initial FX Rate. You can then specify if the FX rate is fixed or not. If it is not fixed, you can select the FX Rate Definition that will be used to fix the FX rates. FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions.

FX Reset Fixing: Dividend Record Date - In this case, the dividend record date will be used to derive the FX Reset date. Dividend Payment Date - In this case, the original dividend payment date will be used to derive the FX Reset date. Cashflow Payment End Date - In this case, the original cashflow payment end date will be used to derive the FX Reset date. Cashflow Payment Date - In this case, the original cashflow payment date will be used to derive the FX Reset date. |

||||||||||||||||||||||||

|

Retrocession Rate (%) |

Enter the percentage of dividend to be received or paid. |

||||||||||||||||||||||||

|

Tax Refund |

Check this checkbox to indicate a refund for the taxes attached to the dividend. This is for information purposes only. This information is available in the Trade Browser. The system does not use this information to generate any cashflows or fees. |

Funding Leg Details (Interest Rate)

Definition

| Fields | Description |

|---|---|

|

Direction |

Direction: Pay or Receive. It is set based on the other leg's direction. |

|

Effective Date |

Effective date. It is set based on the trade's start date. |

|

Termination Date |

Termination date. It is set based on the trade's end date. You can double-click the Termination Date label to display the duration of the trade as a tenor, and the remaining days as of the valuation date. |

|

Initial Notional |

Initial trade amount in settlement currency. The amortization type is set by the system. Initial Notional Currency field is non-editable in Equity Linked Swap trade and is populated from the underlying security currency. |

|

Currency |

Settlement currency. |

Funding Rate

| Fields | Description | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Leg Type |

Select Fixed or Float. |

|||||||||||||||||||||

|

Fixed Rate % |

For a fixed leg, enter the fixed rate. You can click |

|||||||||||||||||||||

|

Rate Index |

For a floating leg, select the rate index: currency, reference index, tenor, and source. You can also set the following parameters:

Use Observation Shift Period - When checked, it includes an Observation Shift that allows shifting the whole Sample Period in addition to the Reset Dates, such that the weights of any given daily fixing remains the same.

|

|||||||||||||||||||||

| Compounding |

Check Compounding to enable compounding and specify the following fields as needed. Frequency - Select the compounding frequency. For WK/BIWK/LUN, you can select Original or Regular. Difference between Original and Regular (Example for a 3M swap paying MONTHLY compounding WEEKLY):

Cutoff Lag - Only available for DLY frequency. You can enter a number of days for the cutoff lag, bus / cal days and holidays. Sample Timing - Only available for DLY frequency. Select BEG_PER / END_PER. Method - Select the compounding method:

Diff. Reset Date - Check to generate the reset dates based on the coupon frequency. It uses the index tenor otherwise. Multiplicative Spread - Check "Multiplicative Spread" so that the spread over the rate index is multiplicative rather than additive. |

|||||||||||||||||||||

|

Averaging Reset |

Check Averaging Reset to enable averaging reset and specify the following fields as needed. Averaging Method - Select the averaging method:

Frequency - Select the reset frequency to sample resets at a frequency different from the coupon frequency. Otherwise, the resets are sampled at the coupon frequency. For Cutoff Days, you can enter the number of days, select bus / cal and the holidays. Averaging Period Rule - Select the period rule:

|

|||||||||||||||||||||

| Different Reset Dates per Coupon |

Check to generate the reset dates based on the coupon frequency. It uses the index tenor otherwise. |

|||||||||||||||||||||

| DayCount |

Specify the day-count convention. Daycount defaults to the day count of the Rate Index. See Calypso Navigator > Help > Day-Count Conventions for descriptions of the day-count conventions. |

|||||||||||||||||||||

|

Frequency |

The payment frequency and stub rule are set based on the selected performance schedule. |

|||||||||||||||||||||

|

Roll On Day |

Roll On Day to be set by user to generate desired compounded cashflows dates. |

|||||||||||||||||||||

|

Coupon Schedule |

The coupon schedule is set based on the selected performance schedule. |

|||||||||||||||||||||

|

Stub Rule |

The stub rule is set based on the selected performance schedule. |

|||||||||||||||||||||

|

Period Rule |

The period rule is set based on the selected performance schedule. |

|||||||||||||||||||||

|

Payment Date Lag |

The payment date lag is set based on the selected performance schedule. |

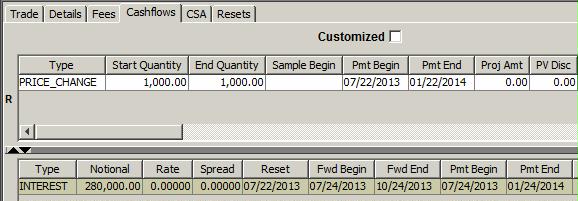

2. Cashflows Details

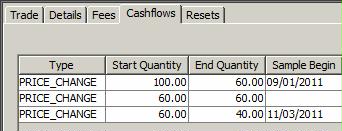

2.1 Performance Cashflows

Performance cashflows have the type PRICE_CHANGE. The columns calculated for performance cashflows are described below.

| Columns | Description |

|---|---|

|

Start Quantity End Quantity |

Start Quantity and End Quantity are identical for the ELS equity leg. |

|

Pmt Begin Pmt End |

Start and End period. Usually End Date corresponds to the payment date and matches the Start Date of the following period. |

|

Fixing Date |

The date when a price fixing has occurred. |

|

Start Price End Price |

The Start Price and End Price correspond to the asset price observed to calculate the performance on asset. By definition Start Price corresponds to the End Price of the previous period. |

|

Start FX Rate End FX Rate |

If the reference currency does not match the pay currency, then the Start Price and End Price will be converted into the pay settlement currency using the FX rates available on the Start Date and End Date. The performance amount will be calculated as: Amount = Quantity * (endPrice*EndFXRate - startPrice*StartFXRate) * Performance% |

|

Pay Start Price Pay End Price |

The start price in the pay currency = Start Price * Start FX Rate. The end price in the pay currency = End Price * End FX Rate. |

|

Amount |

The payoff is calculated according to the ELS definition: Simple Payoff Amount = Quantity * (endPrice - startPrice) * Performance% Cap: If Perf > CapPerf then EndPrice = (startPrice* capPerf) + startPrice Floor: If Perf < FloorPerf then EndPrice = (startPrice * floorPerf) + startPrice RangeFloater: Cap and Floor cases mixed. Ⓘ [Note: if the equity currency does not match the ELS currency, Calypso converts the Start Price and End Price into the ELS currency using the Start FX Rate and the End FX Rate] |

2.2 Dividend Cashflows

Dividend cashflows have the type DIVIDEND.

When there is FX translation and:

- The FX rate is explicitly specified on the trade (flag “Is Fixed FX” checked, FX rate specified in “Initial FX Rate” field) – The proceeds will be known on the "ex-date". There will be a known payment. The Start FX Rate and any projected values are not required. The End FX Rate should equal the value on the trade.

- There is an FX Reset – The start FX Rate is not required. The amount of the flow is known on the "ex-date". The end FX Rate be calculated by the pricer when the valuation date < known date.

If the equity swap cashflows are customized, you can display the dividends added to the underlying equity product provided the domain "Equity.customCFDividend" contains the value EquityLinkedSwap.

The columns calculated for dividend cashflows are described below.

| Columns | Description |

|---|---|

|

Proj Amt Interest Amt |

Projected dividend amount paid or received. |

|

Div Unit Amount |

The dividend unit amount is based on the projected dividend of the dividend curve associated with the trades. Important Note – In order to generate projected dividends, the dividend curve associated with the trade must be a discrete dividend curve. |

|

Div Qty |

Number of shares negotiated at transaction level. |

|

Div Retro Rate |

Retrocession Rate negotiated at transaction level. Final Dividend Amount adjusted by this coefficient. |

|

Div Tax Refund |

Not supported. |

|

Div Ex-Date |

Projected dividend ex-date based on the dividend rule associated with the trade. |

|

Div Record Date |

Projected dividend date based on the dividend curve associate with the trade. |

|

Div Ratio |

100% |

|

Pmt Date |

Payment date according to the dividend rule associated with the trade. |

2.3 Interest Rate Cashflows

Interest rate cashflows have the type INTEREST.

Compared to a standard interest rate swap leg, the ELS notional automatically adjusts if you select Adjust Funding Notional = On Pay Date or On Fixing Date.

According to the number of equities, initial price, and ELS settlement currency, Calypso calculates the initial notional as:

InitialNotional = StartPrice * Quantity * StartFXRate

In this case, at each price fixing, Calypso recalculates the next notional using the new price fixing (the start price of the next period).

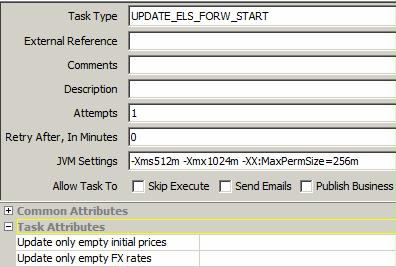

3. Processing Forward Starting Trades

The initial price and quantity of forward starting trades is only known on the trade start date.

You need to use the scheduled task UPDATE_ELS_FORW_START to update the initial price and quantity.

You can select the following attributes:

| • | Update only empty initial prices – true/false. If true: the trade field Initial Price will only be modified with a new value if it is empty. If false: it will be modified with a new value even if it already has a value. This will serve for corrections (for example the quote was incorrect and the scheduled task needs to be run again to correct the trades values). |

| • | Update only empty FX rates – true/false. If true: the trade field Initial FX Rate will only be modified with a new value if it is empty. If false: it will be modified with a new value even if it already has a value. |

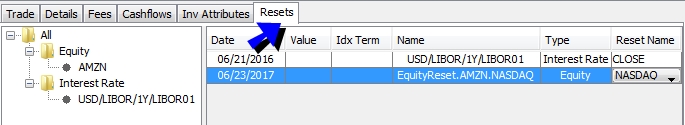

4. Resets Details

You can select the Resets panel to display Resets details for the various legs.

You can select an equity reset from the Reset Name field. The fixing quote should be set for the quote name in the form "EquityReset.<equity name>.<reset name>". If you do not select an equity reset, CLOSE is selected by default. The fixing quote is the spot quote in that case.

You can also select "Specific Reset" and enter a manual fixing quote in the Value field.

Equity resets are defined in the Equity Definition or Equity Index Definition.

to open the Quantity Amortization window.

to open the Quantity Amortization window.