Capturing Dividend Swap Trades

A Dividend Swap is an OTC agreement between two counterparties to exchange Realized Dividends versus a Fixed Strike on one or more Future Dates.

| • | The Fixed Strike is stated in units of the underlying. |

| • | A Dividend Swap is always cash settled. |

Note that if you want to capture a dividend swap against an interest rate or another asset instead, you can use the Equity Swap worksheet.

See Capturing Equity Swaps for details.

See Capturing Equity Swaps for details.

Choose Trade > Equity > Dividend Swap to open the Dividend Swap worksheet, from Calypso Navigator or from the Trade Blotter.

|

Dividend Swap Quick Reference

When you open a worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. Once saved, a description appears in the title bar of the trade worksheet, a Trade ID is assigned to the trade, and the status of the trade is modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

1. Dividend Swap Payoff Methodology

A dividend swap will either define its payoff in return or in quantity, depending on whether the swap is stated in notional or quantity.

The following formula components are used in the Payoff sections.

t=1,…,T – Denotes the periods of the swap.

i=1,…,N – Denotes the component of the baskets.

Striket,i – Dividend Strike for period t and component i.

Currency – The payment currency of the swap.

FX Reset – If the Payment Currency of the Swap differs from the asset currency, an FX Reset is used to locate the appropriate FX Fixing on the End Date of the relevant period.

RealizedDIVt, i – RealizedDIVt is the Realized Dividends, based on Dividend Ownership over period T.

1.1 Notional Swap Payoff

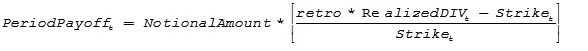

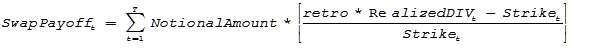

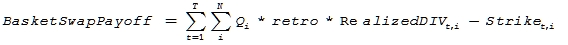

For a Notional Swap, the Dividend Swap payoff for given period t is:

1.2 Quantity Swap Payoff

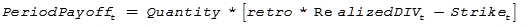

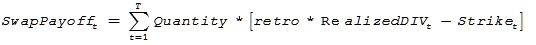

For a Quantity Swap, the Dividend Swap payoff for a given period is:

1.3 Basket Swap Payoff

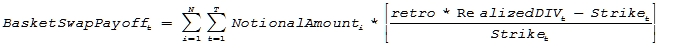

In the case of baskets, the swap is represented as a basket of swaps; so the payoff would simply be the sum of the payoffs for the various components.

For quantity based trades

For notional based trades the notional I split over the components according to the weights in the basket. In this case the basket has to be defined in weights.

1.4 Dividend Ownership

The dividend per share is the amount paid by the Underlying Share, if any, to the holders of the shares during the relevant yearly period before any deduction for withholding tax, and exclusive of any "avoir fiscal" or other imputation tax credit.

Dividends per share only include ordinary cash dividends and do not include extraordinary or special dividends.

Dividend ownership is typically determined based on the ex-dividend date. A dividend can be realized in a Dividend Swap if the ex-dividend date of the dividends falls between the start and end dates of the trade.

Dividend ownership between a Start and End Date is inclusive of the start date and exclusive of the end date.

In summary, a dividend can be realized for a period t= [t1 ,t2 ] if  .

.

1.5 Dividend Periods Methodology

A Dividend Swap is set up as one or more Dividend Periods governed by the Start Date, End Date, and Frequency attribute. Each Period represents a cashflow that is based on the Payoff methodology.

Each Period has a cashflow that is paid with a lag based on the Pay Lag attribute.

The Period generation algorithm begins at the End date and moves backwards to the Start Date. The first period may end up Short.

For example,

Start Date: Jan-01-2009

End Date: Jan-11-2010

Frequency: PerAnnum(PA)

The generated Periods are:

| Start Date | End Date |

| Jan-01-2009 | Jan-11-2010 |

| Jan-11-2010 | Jan-11-2011 |

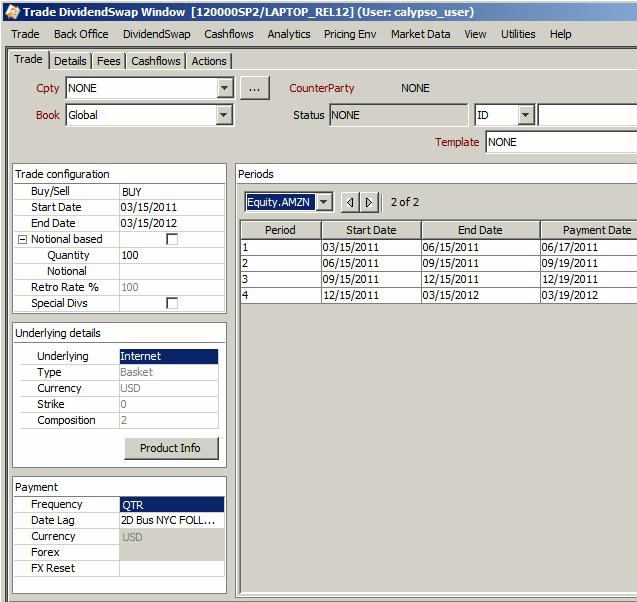

2. Sample Dividend Swap Trade

Dividend Swap Trade Window - Sample Trade

| » | Enter the fields described below as needed. |

2.1 Fields Description

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

Trade Configuration Details

| Fields | Description |

|---|---|

|

Buy/Sell |

Select the direction of the trade from the book's perspective: BUY or SELL. If you are buying the dividend swap, you are receiving the realized dividend, and paying the fixed strike. |

|

Start Date |

Enter the start date of the first dividend period. |

|

End Date |

Enter the end date of the last dividend period. |

|

Notional based |

Check to book the trade in notional. You can enter the notional amount in the Notional field. The payoff will be reflected in Return. Or clear to book the trade in quantity. You can enter the quantity in the Quantity field. |

|

Retro Rate% |

Enter the percentage of dividend to pay / receive. For Baskets, the Retro Rate is set at the component level. Click Product Info to set the Retro Rate for each component.

|

|

Special Divs |

Check to include special dividends. |

Underlying Details

| Fields | Description |

|---|---|

|

Underlying |

Select the underlying: It can be an equity, an equity index or a basket. You can also type in the underlying's name. Ⓘ [NOTE: Only baskets weighted in quantity are supported] You can click Product Info to bring up more details pertaining to the underlying. |

|

Type |

Displays the type of underlying. |

|

Currency |

Displays the underlying currency. |

|

Strike |

Enter the dividend strike. For Baskets, the Strike is set at the component level. Click Product Info to set the Strike for each component.

|

|

Composition |

Displays the number of components in the basket. |

Payment Details

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Frequency |

Select the payment frequency. |

||||||

|

Date Lag |

Enter the number of days between the dividend date and the actual payment date. |

||||||

|

Currency |

Select the payment currency. |

||||||

|

Forex FX Reset Fixed Rate |

Select the type of FX rate you want to use if the settlement currency is different from the underlying currency:

For Baskets, it is the type of FX rate set at the component level. FX Rate Definitions are created using Calypso Navigator > Configuration > Foreign Exchange > FX Rate Definitions. |

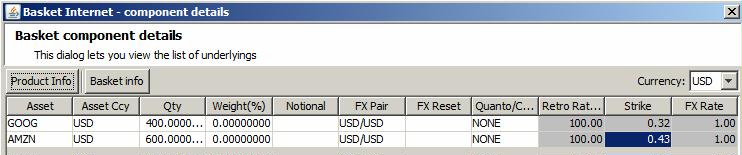

2.2 Basket Components

When you select a basket as the underlying instrument, you can click Product Info to view the basket components.

Basket Components Details

| » | You can set the retrocession rate and strike for each component. |

| » | You can click Basket info to bring up the Basket Definition window - Help is available from that window. |

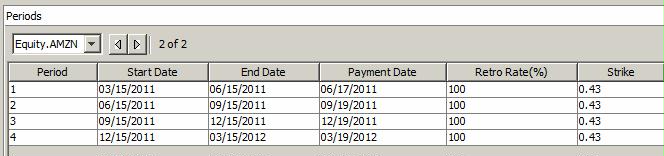

2.3 Viewing Dividend Periods

The dividend periods are based on the payment frequency.

Select the equity from the drop-down menu to display the periods for that equity.

The system generates a cashflow for each period.