Capturing Structured Note Trades

Structured Notes are a type of instrument based on the resale of notes issued by an entity. The notes can also be issued by the seller. A sales desk would profit by taking a margin between the prices of the purchase and the sale.

In parallel with the sale of notes to investors, the issuer hedges against the equity risk and obtains a financial rating for its liquidity. The trading desk can either retain a residual position or fully hedge the risk.

Notes are typically sold to investors on or just prior to the issue date and held until the Maturity Date unless a redemption event occurs or the investor requests a sell back.

Choose Trade > Equity > Structured Note to open the Structured Note worksheet from Calypso Navigator or from the Calypso Workstation.

|

Structured Note Quick Reference

When you open a trade worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

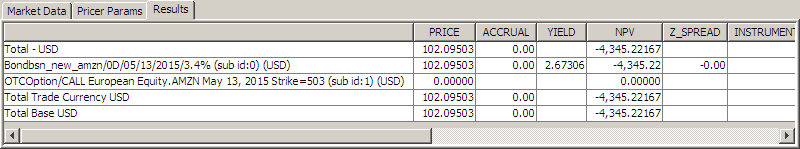

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

You will need to define a Dividend Curve and Volatility Curve for the underlying Equity asset. A Discount Curve is required for the settlement currency.

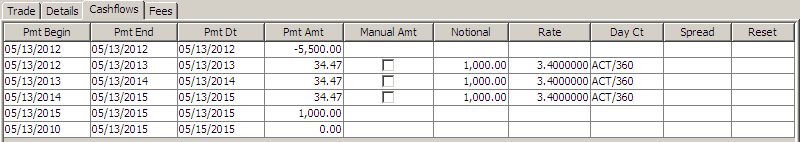

Trade Lifecycle

|

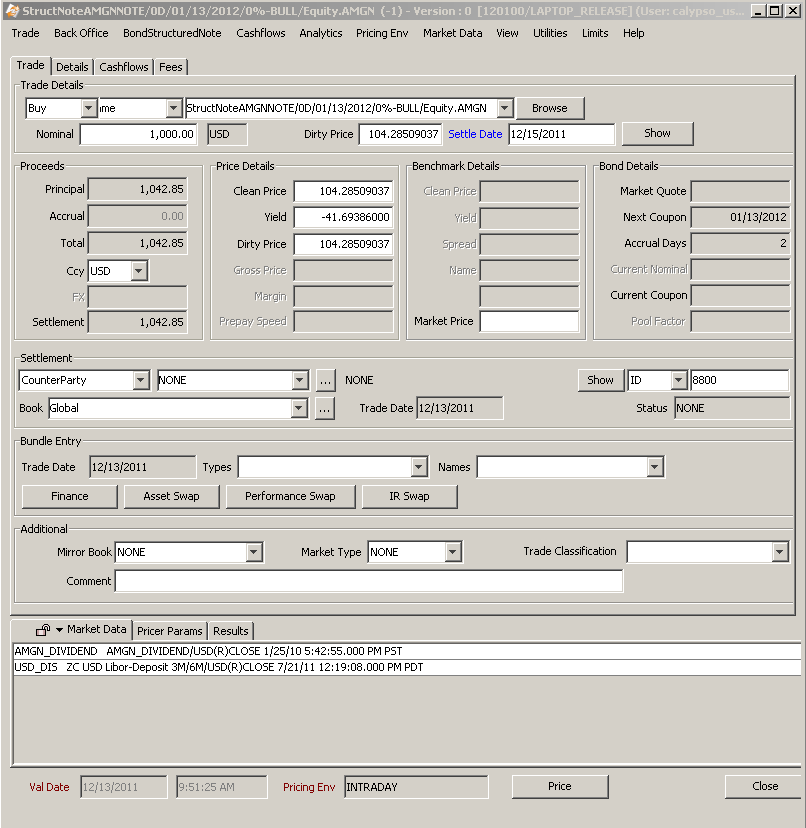

1. Sample Structured Note Trade

Structured Note Trade Window - Sample Trade

| » | Select the trade type (Buy/Sell/Issue/Upsize/Re-Open/Close). |

| » | Enter the unique Identifier or click ... to select the Bond Structured note using the Product Chooser. |

| » | Enter the Nominal Amount, Dirty Price, Settle Date, and Yield. |

| » | Click Price. |

.

2. Fields Details

Trade Details

|

Fields |

Description |

||||||

|

Buy / Sell / Issue / Upsize / Re-Open / Close |

Select Buy or Sell as applicable to indicate the direction of the trade from the book’s perspective. You can switch between the trade directions using the space bar (note that the space bar is not active in the Speed Entry Panel). Issue, Upsize / Re-Open / Close apply to activity related to bond issues from the processing org. Ⓘ [NOTE: Close can only be used if issuance has been performed on the product]

|

||||||

|

Product code Product description |

You can select a structured note using one of the following methods:

The system searches all the structured notes defined in the system, and those that satisfy the request are displayed in a list. Select a structured note from the list. Note that the product code defaults to the Security Code selected in the User Defaults.

Once you have selected a structured note, you can click Show to view the product details in the Structured Note Product window. |

||||||

|

Nominal |

Enter the amount of nominal that is traded. This is the original nominal. The adjacent field displays the product’s currency. |

||||||

|

Dirty Price |

The label actually displays the quote type of the product. Defaults to the market quote as of the trade date if any. Modify as applicable. See Clean Price, Yield and Dirty Price below for details. If there is no market quote and BOND_FROM_QUOTE is false, we price the product from curve to produce an initial price for trading. |

||||||

|

Settle Date |

The settlement date defaults to the trade date + the number of settle days specified in the product. The settlement date uses the holiday calendar of the product to identify business days. If you change the trade date in the Details panel, double-click the Settle Date label to update the settlement date accordingly. |

Proceeds Details

|

Fields |

Description |

|||

|

Principal |

The principal amount is calculated as Nominal * Clean Price |

|||

|

Accrual |

The amount of accrued interest is calculated based on the Accrual Days. |

|||

|

Settlement |

The settlement amount is calculated as principal + accrual |

|||

|

Ccy |

The settlement currency defaults to the product’s currency. Modify as applicable from the drop-down menu. |

|||

|

FX |

The FX field is enabled when the settlement currency is different from the product’s currency.

|

Price Details

|

Fields |

Description |

|

Clean Price Yield Dirty Price |

Enter the clean price, yield, or dirty price, and the other fields will be calculated accordingly. The dirty price is clean price + unit accrual. For structured notes quoted using Price32, you can enter the trade’s price with two, three, or four digits after the dash. The first two digits represent the number of thirty-seconds (between 1 and 31). If the price contains 3 digits, the third digit represents the number of eighths of a thirty second (or 1/256, between 1 and 7). A price entered as "99-022" will be read as [99 + 2/32 + 2/8(1/32)], or 99.0703125. The third digit can also be +, indicating 4/8 of a thirty second. If the price contains 4 digits, the last two digits represent the number of sixteenths of a thirty second (or 1/512, between 1 and 15). Note that the four-digit logic only applies to notes with the tick size 512. |

|

Gross Price |

Not used. |

|

Margin |

Not used. |

|

Prepay Speed |

Not used. |

Benchmark Details

|

Fields |

Description |

|

Clean Price |

Not used. |

|

Yield |

Not used. |

|

Spread |

Not used. |

|

Name |

Not used. |

|

Market Price |

Specify the market price. |

Bond Details

|

Fields |

Description |

|

Market Quote |

Displays the latest quote as of the trade date, if any. If there is no quote, and BOND_FROM_QUOTE is false, we do not try to calculate a quote from curve. |

|

Next Coupon |

Displays the next coupon date. |

|

Accrual days |

Displays the number of days between the last coupon date and the settlement date. |

|

Current Nominal Pool Factor |

Not used. |

|

Current Coupon |

Displays the current coupon rate. |

Settlement Details

|

Fields |

Description |

|

Legal entity |

The first field identifies the legal entity role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type Ctrl-F to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. Click Show to display the details of the selected legal entity. You can also choose Utilities > Selected Counterparty Info. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. You can also type in a character to display the favorite books that start with that character. Click ... to specify favorite books or Utilities > Configure Favorite Books. The processing org of the book identifies the processing org of the trade. |

|

Trade Date |

Displays the trade date specified in the Details panel. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

Bundle Entry Details

You can associate the trade with a bundle. Bundles are created under Calypso Navigator > Configuration > Books & Bundles > Trade Bundle.

You can also finance the trade, capture an asset swap, capture a performance swap. or capture an interest rate swap by clicking on the corresponding buttons.

|

Fields |

Description |

|

Trade Date |

The Trade Date is displayed from the Details panel. |

|

Types |

Select a bundle type. |

|

Names |

Select a bundle. |

Additional Details

|

Fields |

Description |

|

Mirror Book |

Select a mirror book if you want to mirror the current trade. You can select the mirror trader from the Details panel. A mirror trade will be saved with the current trade to the selected book, and you can view the mirror trade id from the Details panel. |

|

Market Type |

Defaults to the market type selected in the User Defaults. You can modify as applicable. Market types are created in the marketType domain. |

|

Trade Classification |

You can select a classification for the trade as applicable. This classification is for information purposes only. It is stored in the trade keyword "TradeClassification", and available values can be set in domain keyword.TradeClassification. It can be used in filters to filter trades for various processes, and can be viewed in reports throughout the system. |

|

Comment |

Enter a free comment as applicable. |

|

Commission (%) |

For Issue, Upsize, Re-Open, and Close trades, you may specify the commission. |