Structured Note Definition

Prior to trading structured notes, you need to create the Structured Note product.

Structured Notes are a type of bond where the coupon amount, the redemption amount, or both, are contingent upon an underlying equity structured option based on an equity, an equity index, or a basket.

1. Defining a Structured Note

To define a structured note, from Calypso Navigator choose Configuration > Equity > Structured Note (menu action product.BondStructuredNoteWindow).

1.1 Loading an Existing Structured Note

You can load an existing structured note into the Structured Note window using one of the following methods:

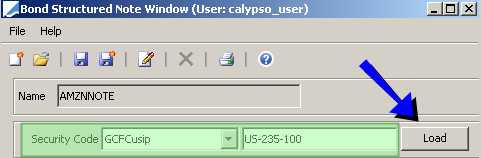

| » | Select a security code from the Security Code list, and enter the actual code value in the adjacent field. |

Then click Load to load the corresponding structured note.

Structured Note window - Loading a structured note by security code

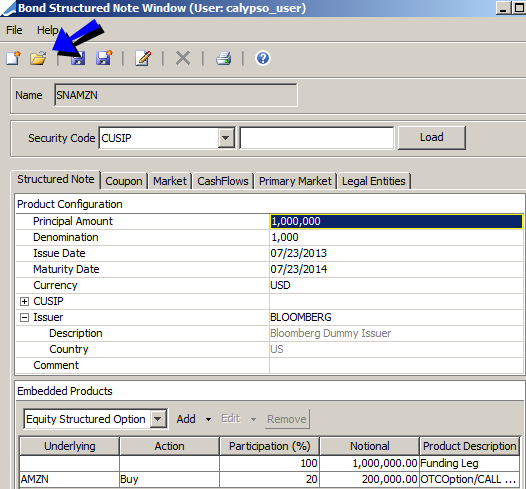

| » | You can click  near the top of the window to open the Product Chooser window - Help is available from that window. near the top of the window to open the Product Chooser window - Help is available from that window. |

Structured Note window - Loading a structured note

Then modify the fields described below as needed.

1.2 Creating a New Structured Note

| » | Click  and enter the fields described below. and enter the fields described below. |

1.3 Renaming a Structured Note

| » | Click  to modify the structure note’s name. You will be prompted to enter a new name. to modify the structure note’s name. You will be prompted to enter a new name. |

1.4 Saving a Structured Note

| » | Click  to save your changes. You will be prompted to enter a structured note name. to save your changes. You will be prompted to enter a structured note name. |

The system also saves a quote name for the product that is used to enter / retrieve market quotes.

You can also click  to save the structured note as a new product. You will be prompted to enter a new name.

to save the structured note as a new product. You will be prompted to enter a new name.

Product Configuration Fields Details

| Fields | Description |

|---|---|

|

Principal Amount |

Enter the amount of the note. |

|

Denomination |

Enter the face amount of each note – Minimum tradable unit. |

|

Issue Date |

Enter the date the note was issued. |

|

Maturity Date |

Enter the date the note matures. |

|

Currency |

Select the currency of the note. |

|

CUSIP |

Expand this label to view all the security codes defined for structured note products. You can enter a value for each security code as applicable. You can create new security codes using Calypso Navigator > Configuration > Product > Code. |

|

Issuer |

Select the issuer of the note. The issue is a legal entity of role Issuer. You can expand the Issuer label to view the issuer's full name and country. |

|

Comment |

Enter a free-form comment as needed. |

Embedded Products Details

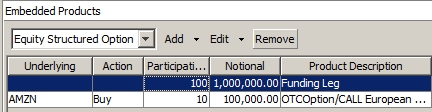

This area allows specifying the underlyings of the structured note.

An underlying is created by default for the structured note itself, the funding leg.

Structured Note window - Underlying Products

| » | Click the down arrow next to Add and click Add Advanced to bring up the Equity Structured Option Trade window - Help is available from that window. |

Enter the characteristics of the option and click Close.

The equity structured option trade is added to the list of embedded products.

The participation is the percentage of option with respect to the principal amount of the structured note.

The cashflows on the note are based on the bond coupon schedule (INTEREST, PRINCIPAL) and the payout flow of the embedded option.

| » | You can select an underlying option and click Edit to modify its characteristics. Or click the down arrow next to Edit and click Edit Advanced to bring up the Equity Structured Option Trade window. |

2. Specifying the Coupon

The coupon can either be pre-determined or contingent upon values of the note's underlying. Even in the case of coupon contingent, Calypso only considers cases in which the coupon value is determined at the beginning of the period (no reset in arrears).

Coupon types:

| • | Zero Coupon |

| • | Fixed Rate |

| • | Floating rate: aIndex + b |

| • | Digital Coupon – A digital coupon can only take two values, either a% or y%. The value taken is contingent on certain price(s) of the note underlying at pre-specified dates i.e. observation dates. |

Each component of the underlying has a defined “strike price”.

Example: If at the considered observation date, the closing price of each component of the underlying is equal to or greater than the Coupon Strike, then value a is used to compute the next coupon otherwise, value b is used.

Value Coupon Strike a: 5.0% 220 b: 0.2% For example, if on the Observation Date:

Closing Price < Coupon Strike, then the next note coupon is fixed at 0.2%.

Closing Price > Coupon Strike, then the next note coupon is fixed at 5%.

It is necessary to know precisely which coupon type applies to any interest period of the note. In most cases, the note pays a high fixed coupon for the initial, and sometimes second interest period, and then the coupon payment is determined by a digital formula.

Select the Coupon panel to define the coupon.

See Bond Definition for complete details on the Coupon panel.

See Bond Definition for complete details on the Coupon panel.

3. Specifying Additional Characteristics

Select the other panels to set additional characteristics and generate the cashflows.

Ⓘ [NOTE: In order to ensure proper functionality, please do not modify the characteristics of the Market panel]

See Bond Definition for complete details on the other panels.

See Bond Definition for complete details on the other panels.