Capturing ETO Equity Trades

Prior to capturing ETO equity trades, you need to specify ETO equity contracts using Calypso Navigator > Configuration > Listed Derivatives > Option Contracts. The system will create the actual ETO equity product on the fly when the contract is selected in the trade worksheet, unless TRADE_ETO_READ_ONLY is true.

If TRADE_ETO_READ_ONLY is true, the actual ETO equity products have to be generated from the Option Contracts window, or they can be imported using a custom mechanism.

See Creating ETO Contracts for details.

See Creating ETO Contracts for details.

Choose Trade > Equity > Listed Options to open the ETO Equity worksheet, from Calypso Navigator or from the Trade Blotter.

|

ETO Equity Quick Reference

When you open a worksheet, the Trade panel is selected by default. Underlying Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below, see Field Description. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also press F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

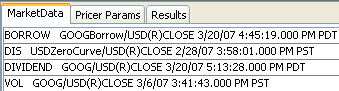

An ETO equity trade requires the following market data: a discount curve, a dividend curve for the equity, an EQUITY volatility surface for the equity, and quotes for the equity and ETO equity. You can also use a borrow curve, but it is not required.

When pricing from quotes, the volatility depends on the pricing parameter USE_IMPLIED_VOL. If USE_IMPLIED_VOL is set to true, the system computes the implied volatility of the price. In this case, you do not need a volatility surface to price the trade. The system uses an upper boundary and a lower boundary to find a solution for the price: pricing parameters MAX_IMPLIED_VOL (default is 1000%) and MIN_IMPLIED_VOL (default is -1000%). If USE_IMPLIED_VOL is set to false, the volatility is retrieved from the volatility surface. Trade Lifecycle

|

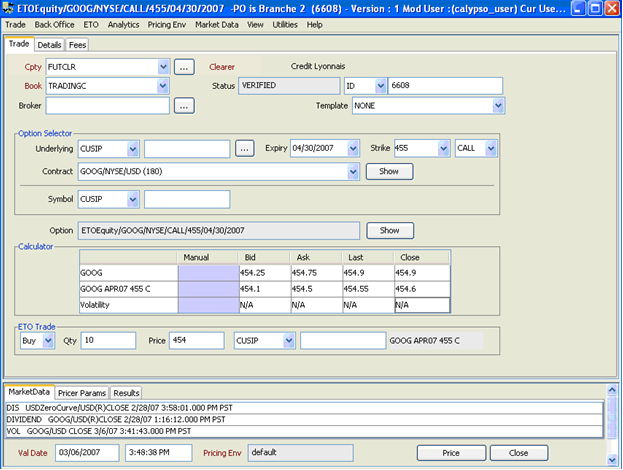

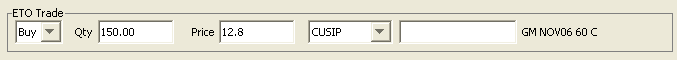

1. Sample ETO Equity Trade

ETO Trade Window - Sample Trade

| » | Enter the fields described below as needed. |

2. Fields Description

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields in the worksheet identify the trade counterparty. You can select a legal entity of specified role from the first field provided you have setup favorite counterparties. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Alternatively, double-click the Cpty label to set the list of favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. The second field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. Alternatively, double-click the CounterParty label to change the role. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Alternatively, double-click the Book label to set the list of favorite books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference of external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. |

|

Broker |

Select a legal entity of role Broker as needed. It adds a fee of type BRK to the Fees panel. Please select the Fees panel to modify the fee as needed. |

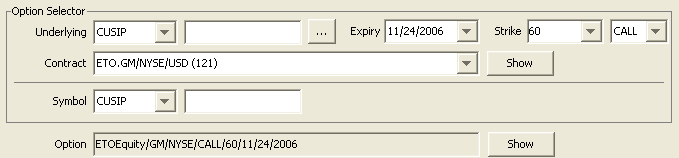

Option Selector Details

| Fields | Description |

|---|---|

|

Underlying |

You can select a security code, and type in a few characters in the adjacent field to display all equities starting with those characters. You can select an equity from the list. You can also click ... to bring up the equity product chooser. Once you have selected an equity, the first ETO equity product that exists in the system will be automatically selected. You can change the expiration date, strike, and option type to select a different ETO equity product. If there is no existing product and TRADE_ETO_READ_ONLY is False, you can select a contract, an expiration, an option type, and enter a strike. The system will create the corresponding ETO equity product on the fly. |

|

Expiry |

You can select an available expiration date, based on the expiration date rule selected in the ETO contract. |

|

Strike |

Select a strike if available, or enter a strike to create a new ETO equity product. |

|

Option Direction |

Select the option’s direction from the book’s perspective: CALL or PUT. |

|

Contract |

If a contract exists for the selected underlying, it will be automatically selected. You can select another one as needed. You can click Show to view the contract details. |

|

Symbol |

You can select a security code of the ETO equity product, and the corresponding value will be displayed in the adjacent field. The actual ETO equity product is shown in the Option field. |

|

Option |

Displays the actual ETO equity product that has been selected, based on the contract, expiration date, strike, and option direction. You can click Show to view the product details. You can view the actual ETO equity products from Calypso Navigator > Configuration > Equity > Stock Options. |

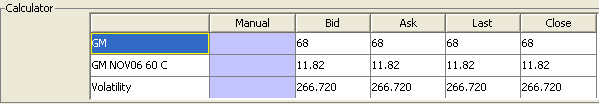

Calculator Details

The calculator displays the current quotes of the underlying equity and ETO equity, and the current volatilities.

You can enter a manual value for the underlying equity and volatility, and it will calculate the quote of the ETO equity.

ETO Trade Details

| Fields | Description |

|---|---|

|

Buy / Sell |

Select the direction of the trade from the book’s perspective: Buy or Sell. |

|

Qty |

Enter the number of options that you are buying or selling. |

|

Price |

Enter the unit price of the option. |

|

Security Code |

You can select a security code of the option, and the corresponding value will be displayed in the adjacent field. |

NPV = Contract Size * Price * Quantity

3. ETO Transfers

By default ETO transfers for ETO Equity Index trades are DFP.

You need to add the domain “ETODAPSupport” with Value = true to create DAP transfers for ETO Equity Index trades if the same SDI applies to Cash and Security.