Exchange Traded Option Contract

An exchange traded option (ETO) contract is a collection of ETO products traded on a given exchange at a given expiry month. The ETO products can be traded, and used as underlying instruments for curves and volatility surfaces.

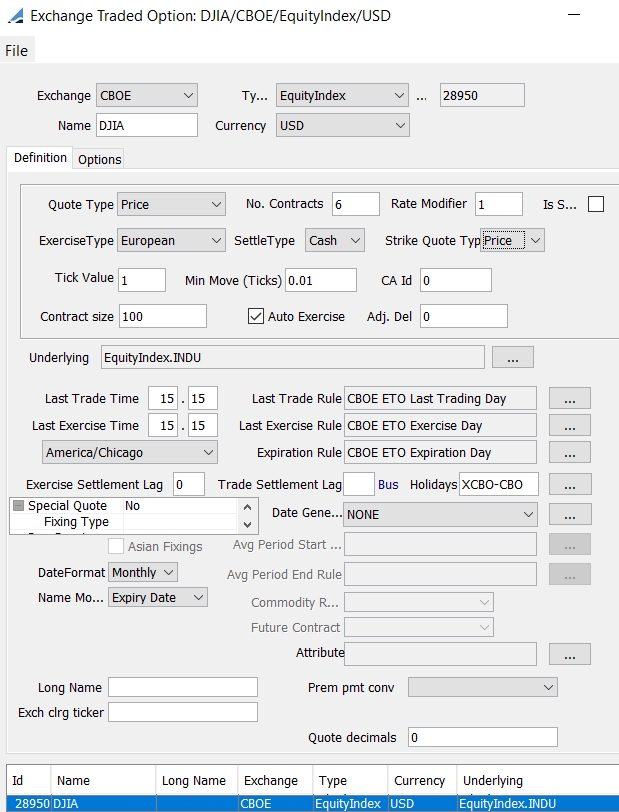

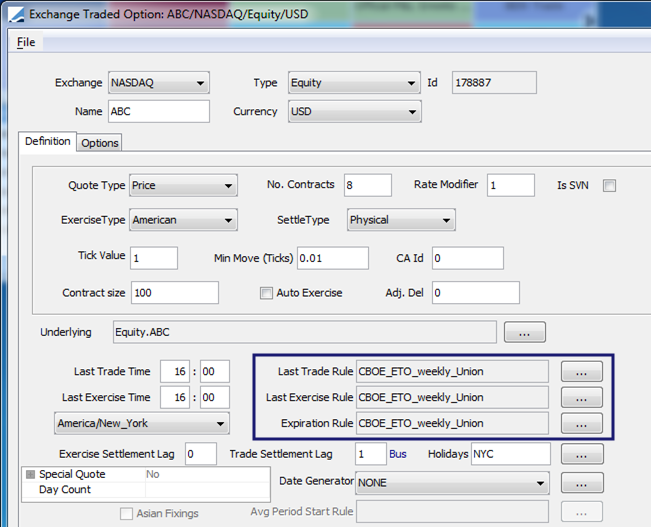

From Calypso Navigator choose Configuration > Listed Derivatives > Options Contracts (menu action refdata.ETOContractWindow) for creating ETO contracts as shown below.

Exchange Traded Option window

The Definition panel is selected by default.

| » | To load existing contracts, click Load and modify the fields described below as applicable. |

| » | To create a new contract, click New and enter the fields described below. |

| » | Then click Save to save your changes. You can also click Save As New to save a contract as a new one. |

Once a contract is saved, you can select the Options panel to create the actual ETO products.

Fields Details

| Fields | Description | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Exchange |

Select the exchange where the contract is traded. An exchange is a legal entity of role MarketPlace. |

|||||||||||||||||||||||||||

|

Type |

Select the type of ETO: Commodity, Equity, Equity Index, FX, IR, or Volatility. |

|||||||||||||||||||||||||||

|

Id |

Contract id given by the system when the contract is saved. |

|||||||||||||||||||||||||||

|

Name |

Enter the contract name. Note that a unique contract is defined by its combination of Name, Exchange and Currency, so that you cannot have an Equity ETO contract and an EquityIndex ETO contract with the same name and currency on the same exchange. |

|||||||||||||||||||||||||||

|

Currency |

Select the currency in which the contract is traded. |

|||||||||||||||||||||||||||

|

Quote Type |

Select the quote type of the underlying’s price. |

|||||||||||||||||||||||||||

|

No. Contracts |

Enter the total number of ETO products traded in the contract. For example, for an ETO contract there are five years worth of tradable expiry months, for a total of twenty tradable ETO products. |

|||||||||||||||||||||||||||

|

Rate Modifier |

Only used in the Pricing Sheet field "Modified Strike". Modified Strike = Strike * Rate Modifier |

|||||||||||||||||||||||||||

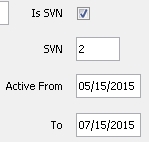

| Is SVN |

Selecting the checkbox expands the SVN number field and Active From and To fields, which allow the user to apply a version number to the contract and specify a span of time in which the change was effective. Series Version Numbers (SVN) identify adjustments to a listed series of the ETO product, such as changes to the exercise price of the contract, the number of deliverable shares on the contract, or the multiplier of the contract.

|

|||||||||||||||||||||||||||

|

Exercise Type |

Select American or European. |

|||||||||||||||||||||||||||

|

SettleType |

Select Cash or Physical. |

|||||||||||||||||||||||||||

|

Strike Quote Type |

Select the quote type of the strike: Price or PriceC (number of cents). | |||||||||||||||||||||||||||

|

Tick Value |

Enter the one-tick move in the contract’s price. The tick value is for information purposes only. |

|||||||||||||||||||||||||||

|

Min Move (Ticks) |

Enter the minimum price movement, in ticks. |

|||||||||||||||||||||||||||

|

CA Id Adj. Del |

These fields are populated when split corporate actions are applied to ETO products. A new adjusted contract is created, linked to the underlying equity and linked to the corporate action. For reverse splits, the field “Adj. Del” reflects the split ratio for adjusting the delivery of the underlying.

|

|||||||||||||||||||||||||||

|

Contract Size |

Enter the number of the underlying product represented by one ETO. |

|||||||||||||||||||||||||||

|

Auto Exercise |

Check the “Auto exercise” checkbox to automatically exercise the option if applicable. ETOs can be automatically exercised using the AUTOMATIC_EXERCISE scheduled task. |

|||||||||||||||||||||||||||

|

Underlying |

Click ... to select the underlying instrument. |

|||||||||||||||||||||||||||

|

Custom Date Generator |

You can select date rules from the following fields to generate the contract’s dates, or you can implement a custom date generator.

Click ... to select a custom date generator as applicable. |

|||||||||||||||||||||||||||

|

Last Trade Time |

Enter the time limit to trade the option on the last trade date. |

|||||||||||||||||||||||||||

|

Last Exercise Time |

Enter the time limit to exercise the option on the last exercise dates. |

|||||||||||||||||||||||||||

|

Last Trade Rule Last Exercise Rule Expiration Rule |

Click ... to select a date schedule for generating the last trade dates, last exercise dates, and expiration dates (optional). The last exercise date and the last trading date will be equal to the expiry date if the rule is not specified. A date schedule can be a date rule or a manual date schedule. Date rules are created using Configuration > Definitions > Date Schedule Definitions > Date Rule from the Calypso Navigator - Help is available from that window. Manual date schedules are created using Configuration > Definitions > Date Schedule Definitions > Manual Date Schedule from the Calypso Navigator - Help is available from that window. |

|||||||||||||||||||||||||||

|

Exercise Settlement Lag |

Enter a number of days lag to adjust the last exercise day. The Bus label indicates that the adjusted days are business days. Double-click the Bus label to change to Cal as applicable, for indicating that the adjusted days are calendar days. The settle date of the linked equity trade is driven by the “Exercise Settlement Lag” attribute on the ETO contract. |

|||||||||||||||||||||||||||

|

Trade Settlement Lag |

Enter the lag to calculate the settlement date. By default, the lag is calculated using business days. Double-click the Bus label to toggle to Cal to use calendar days. By default, the system uses the spot days provided by the MarketPlace. |

|||||||||||||||||||||||||||

|

Holidays |

Click ... to select holiday calendars for the contract’s dates. |

|||||||||||||||||||||||||||

|

Special Quote Fixing Type |

Only applies to ETOs of type Equity that are settled in cash.

Fixing Types The following fixing types are supported in addition to CLOSE, OPEN, HIGH, LOW, and LAST:

|

|||||||||||||||||||||||||||

|

Day Count |

Only applies to ETOs of type Volatility. The volatility surface derived from ETOs is used to price future volatility instruments but the surface can have a different daycount from the future. Thus the necessity to be able to specify this daycount on the ETO. |

|||||||||||||||||||||||||||

|

Custom Date Generator |

You can select date rules from the fields above to generate the contract’s dates, or you can implement a custom date generator. Click ... to select a custom date generator as applicable.

|

|||||||||||||||||||||||||||

|

Asian Fixings Avg Period Start Rule Avg Period End Rule Commodity Reset |

Only applies to ETOs of type Commodity whose final underlying price is calculated as an average of daily fixings. Checking the "Asian Fixings" checkbox enables the averaging period and commodity reset fields. Click ... to select a date rule for generating the averaging period start and end dates. Date rules are created using Calypso Navigator > Configuration > Definitions > Date Rule Definitions. Select the commodity reset whose daily price will be referenced in the calculation of the average. Commodity resets are defined in Calypso Navigator > Configuration > Commodities > Commodity Reset. |

|||||||||||||||||||||||||||

| Attributes |

Optional Click ... to add attributes to the contract definition. |

|||||||||||||||||||||||||||

| Date Format |

Select the date format for the quote names of the option products:

Ⓘ [NOTE: So called "Flex" options - bespoke products allowed by some exchanges for trading and clearing by the clearinghouse, and which sometimes have multiple expiration dates - are referenced by a day, month, and year to conform to date formatting conventions in quotes. To match formats, you can use the Daily setting for the Date Format and then specify the appropriate day/month/year arrangement by adding a DateFormat contract attribute. See Attributes above.] |

|||||||||||||||||||||||||||

| Name Month |

Select the reference date to identify the contract name:

|

|||||||||||||||||||||||||||

| Long Name |

Contract long name. |

|||||||||||||||||||||||||||

| Exchange clrg ticker |

For ETD Clearing - Market standard contract symbol used by the exchange and trade interface. |

|||||||||||||||||||||||||||

| Prem pmt conv |

Type of premium:

If an exchange is defined in the FutureLiffeModel domain, then the variation margin method is used. Following are the possible combinations and the pricing model that is used.

|

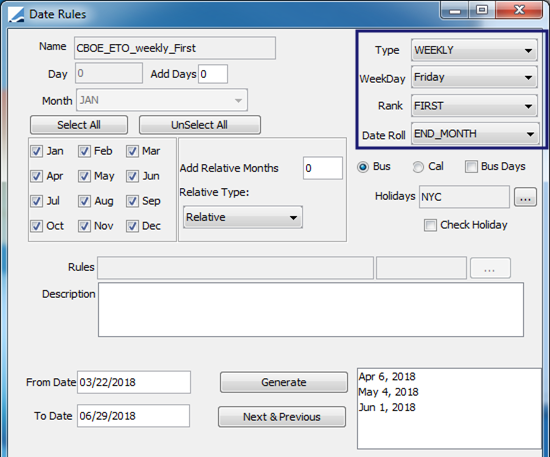

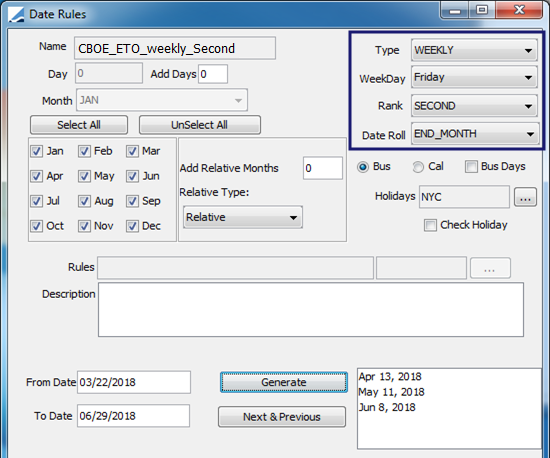

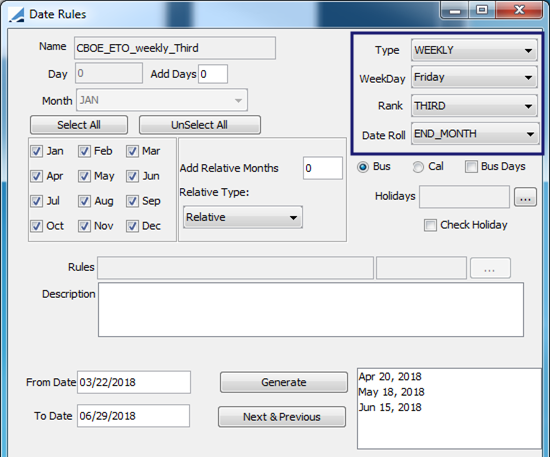

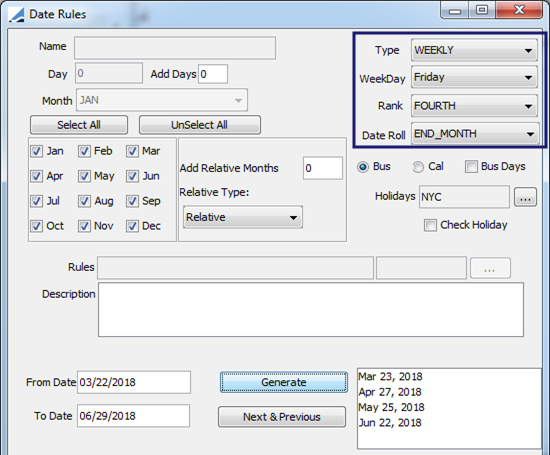

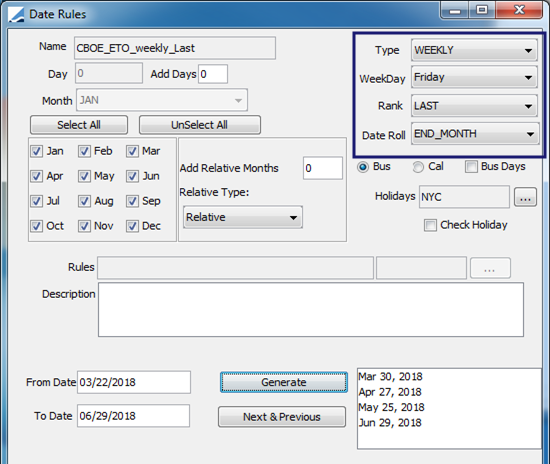

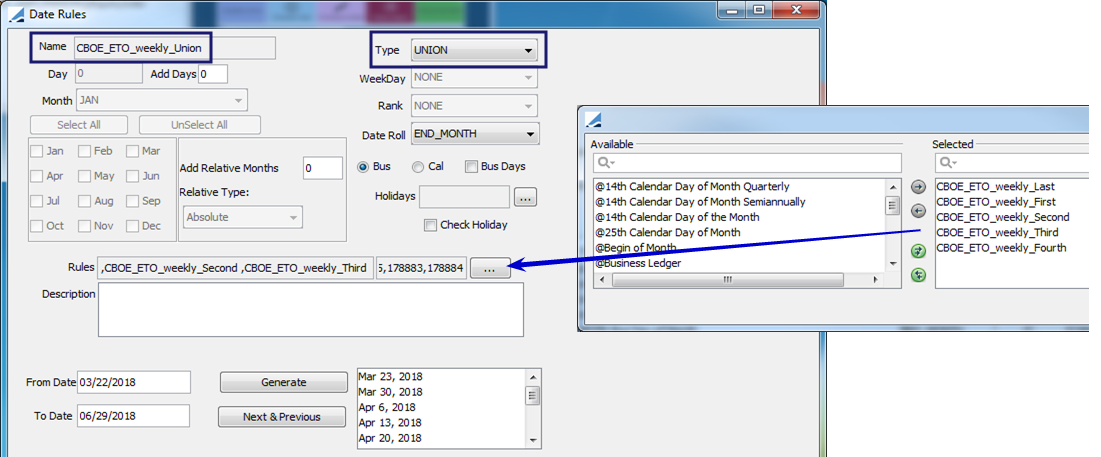

1. Sample WEEKLY Date Rules

Date rules are configured in Calypso Navigator > Configuration > Definitions > Date Rule Definitions. Below is an example of a special date rule configuration scenario with a weekly date rule configuration.

Specific date rules can be configured for quote names with a certain day of the month for weekly expiration. The steps for creating this type of date rule are as follows:

Step 1 - Create all needed WEEKLY date rules.

First Day Rule

Second Day Rule

Third Day Rule

Fourth Day Rule

Last Day Rule

Step 2 - Create date rule of type Union.

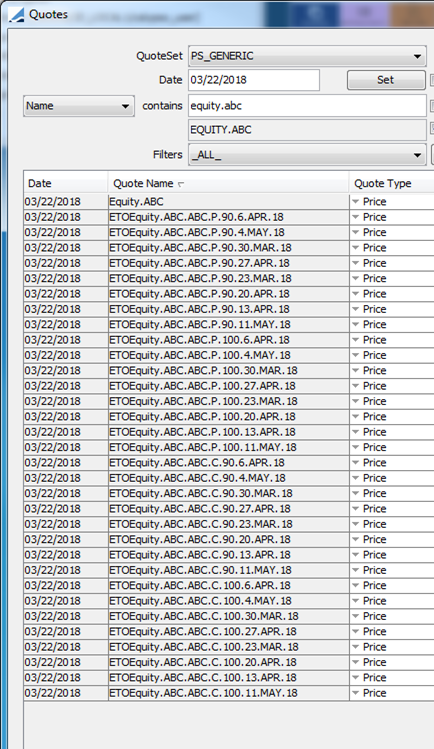

Step 3 - Create an Exchange Traded Option using the Union Date Rule.

Step 4 - After you generate the options and save the products, you can search the Quote Names and see that the Weekly Exp Quote names have been created.

Step 5: The Weekly Exp Date Quote Name can be used in Contract Quote Name.

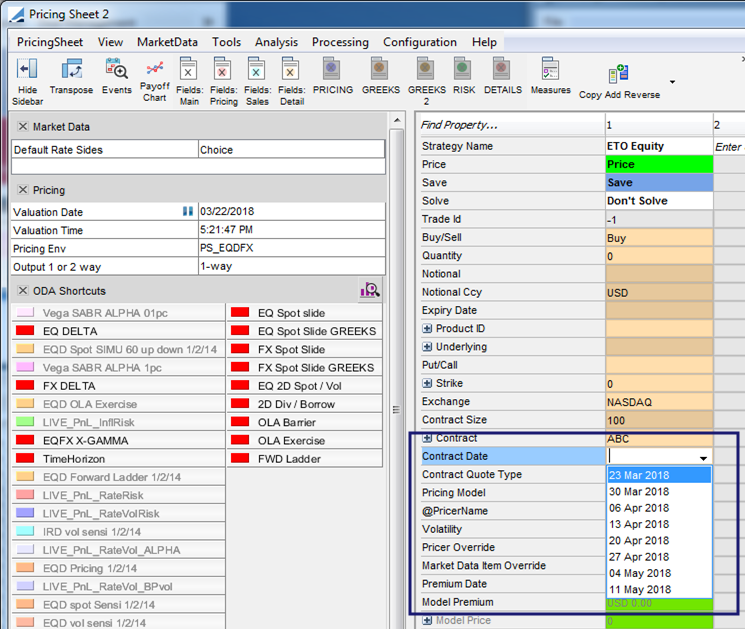

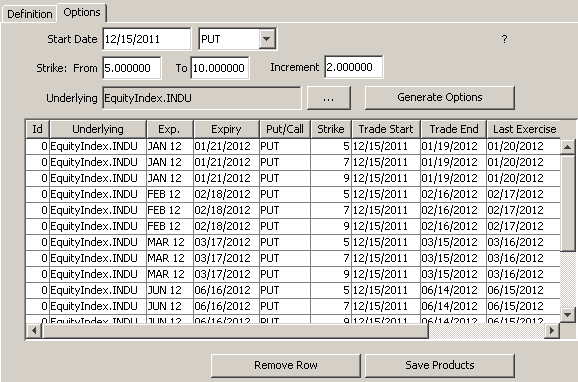

2. Creating the ETO Products

Once a contract has been saved, select the Options panel to create the actual ETO products that can be traded, and used as curve underlying instruments.

Exchange Traded Option window - Options panel

| » | Enter a start date and select an option type. |

| » | Enter the strike range and the increment. You do not need to select an underlying product if you have selected it in the Definition panel. |

| » | Click Generate Options. An option is created for each option type, strike price, and expiration date. You can modify each option as applicable. |

The product code Prompt Month is populated by the Comments of the manual expiration schedule if Name Month = "Prompt Month".

| » | Then click Save Products to save the actual options. Once the options are saved, you cannot modify them from this window anymore, but you can modify them using Calypso Navigator > Configuration > Equity > Listed Equity Options, or Calypso Navigator > Configuration > Equity > Listed Index Options. |

| » | Click  to display information about the window. to display information about the window. |

3. Viewing the ETO Equity Products

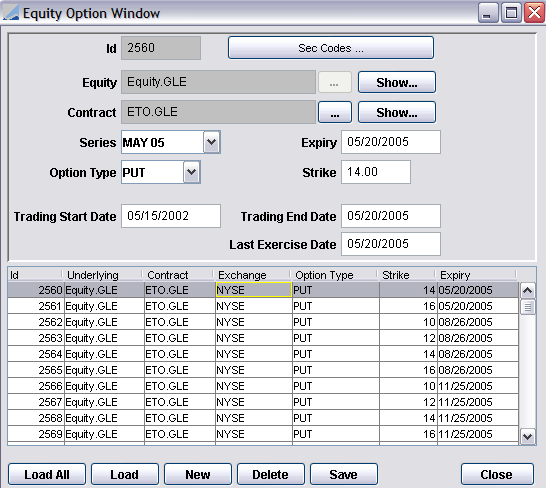

You can view the ETO equity products using Calypso Navigator > Configuration > Equity > Listed Equity Options (menu action product.ETOEquityWindow) as shown below.

Equity Option window

| » | Click Load All to load all ETO equity products, or click Load to load the ETO equity products of a given equity. You will be prompted to select an equity. |

Select an ETO equity product to display its details in the upper portion of the window. You can modify the product as applicable.

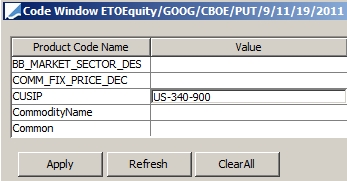

| » | Click Sec Codes to enter the actual code values of the selected ETO equity product as shown below. |

Equity Option window - Security codes

| – | Double-click the Value field corresponding to a code and enter its value. |

| – | Then click Apply. |

| » | You can click Show next to the Equity field to display the details of the equity. |

| » | You can click Show next to the Contract field to display the details of the contract. |

| » | Click New to create a new ETO equity product. Enter the fields as applicable. |

| » | Then click Save to save your changes. You can also click Save As New to save a product as a new one. |

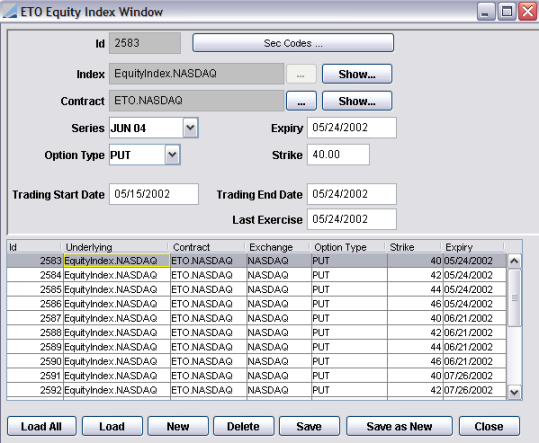

4. Viewing ETO Equity Index Products

You can view the ETO equity index products using Calypso Navigator > Configuration > Equity > Listed Index Options (menu action product.ETOEquityIndexWindow) as shown below.

Equity Index Option window

| » | Click Load All to load all ETO equity index products, or click Load to load a given ETO equity index product. You will be prompted to select an ETO equity index. |

Select an ETO equity index product to display its details in the upper portion of the window. You can modify the product as applicable.

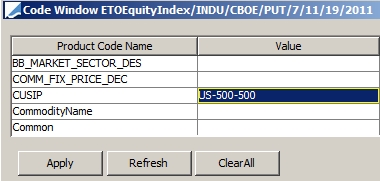

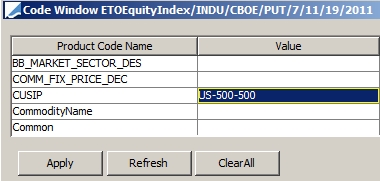

| » | Click Sec Codes to enter the actual code values of the selected ETO equity index product as shown below. |

| – | Double-click the Value field corresponding to a code and enter its value. |

| – | Then click Apply. |

| » | You can click Show next to the Index field to display the details of the equity index. |

| » | You can click Show next to the Contract field to display the details of the contract. |

| » | Click New to create a new ETO equity index product. Enter the fields as applicable. |

| » | Then click Save to save your changes. You can also click Save As New to save a product as a new one. |

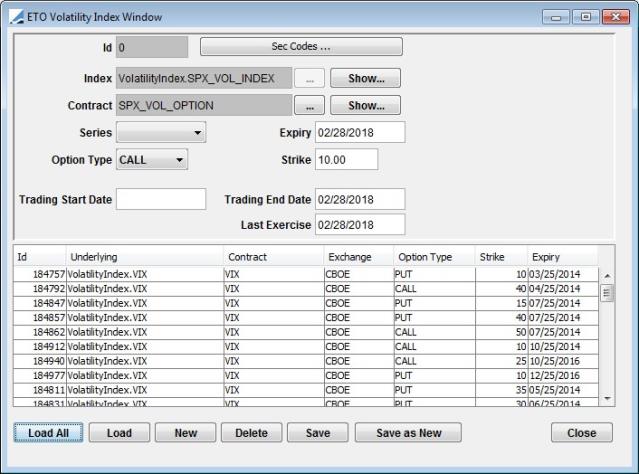

5. Viewing ETO Volatility Index Products

You can view the ETO volatility index products using menu action product.ETOVolatilityIndexWindow as shown below.

Volatlity Index window

| » | Click Load All to load all ETO volatility index products, or click Load to load a given ETO volatility index product. You will be prompted to select an ETO volatility index. |

Select an ETO equity index product to display its details in the upper portion of the window. You can modify the product as applicable.

| » | Click Sec Codes to enter the actual code values of the selected ETO volatility index product as shown below. |

| – | Double-click the Value field corresponding to a code and enter its value. |

| – | Then click Apply. |

| » | You can click Show next to the Index field to display the details of the volatility index. |

| » | You can click Show next to the Contract field to display the details of the contract. |

| » | Click New to create a new ETO volatility index product. Enter the fields as applicable. |

| » | Then click Save to save your changes. You can also click Save As New to save a product as a new one. |

Refer to Calypso Corporate Action documentation for details.

Refer to Calypso Corporate Action documentation for details.