Currency Exposure Analysis

This document describes how to configure the Currency Exposure analysis using an existing Investment Indicators analysis, and how to perform a manual currency exposure adjustment.

The Currency Exposure analysis allows viewing a breakdown of the currency exposure from assets and cash positions.

Before You Begin

In order to run a Currency Exposure analysis, you first need to configure the following:

| • | An Investment Indicators analysis. |

See Investment Indicators Analysis for details on configuring an Investment Indicators analysis and its prerequisites.

See Investment Indicators Analysis for details on configuring an Investment Indicators analysis and its prerequisites.

1. Configuring the Currency Exposure Analysis

In the Portfolio Workstation, select Configuration from the menu, then double-click Analysis Server Configuration.

| » | Click |

| » | Select the Currency Exposure analysis type. |

| » | Click ... next to the Analysis Parameter field. In the window that opens, click Add - You will be prompted to enter a name. |

Select an Investment Indicators analysis parameter. Click Save and then Close.

| » | Modify the remaining Analysis Server Configuration fields as needed and click Save when you are done. |

See Analysis Server Configuration for details.

See Analysis Server Configuration for details.

2. Running the Currency Exposure Analysis

You can view the results of the Currency Exposure analysis in the Portfolio Workstation.

See Portfolio Workstation for information on running the Portfolio Workstation.

See Portfolio Workstation for information on running the Portfolio Workstation.

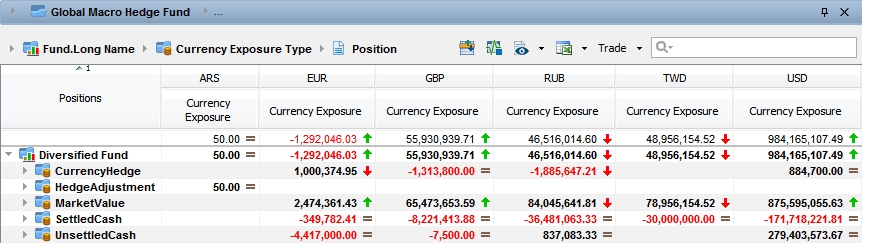

Sample Currency Exposure Results

Currency Exposure = Asset Value + Settled Cash + Unsettled Cash + Currency Hedge + Hedge Adjustment

Asset Value = CA_PV + Accrual (for bonds)

Settled Cash = CUMULATIVE_CASH

For OTC products, Settled Cash = Settled Proceeds

Unsettled Cash = (Unrealized MTM + Unrealized Accrual + Unrealized Accretion + Unrealized Other + Realized MTM + Realized Accrual + Realized Accretion + Realized Other) - Asset Value - Settled Cash

Currency Hedge = Asset Value of Spot FX and FX Forwards used as hedges for the currency exposure

Hedge Adjustment = A user-defined manual adjustment amount. The Currency Exposure analysis shows the total sum of adjustments from inception instead of each adjustment for each date.

Manual adjustment is detailed below.

3. Adjusting a Currency Exposure Amount

You can manually adjust a currency exposure amount when you would like to include an under/over hedge to account for things such as future expected P&L, etc.

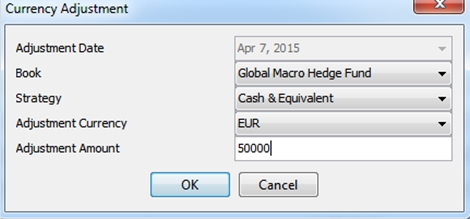

From the Currency Exposure analysis, right-click an exposure and select New Currency Adjustment. The Currency Adjustment window is opened.

| » | Select a book, strategy and currency, and enter an amount. |

| » | Click OK. |

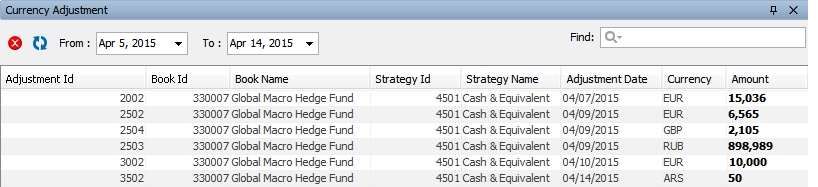

The Currency Adjustment widget displays the currency adjustment history. You can also amend the adjustment amount from here.

See Portfolio Workstation for information on configuring widgets.

See Portfolio Workstation for information on configuring widgets.