Defining Credit Tranches

Credit tranches are part of a credit facility. They may have a separate start or end date, and may be dependent upon a number of business outcomes to become available. Each tranche has its own limit, and the sum of the tranche limits must not exceed the Credit Facility limit.

See Credit Facility for details on defining credit facilities.

See Credit Facility for details on defining credit facilities.

| • | The only payments at tranche level will consist of Non-Use Commissions and other types of fees (upfront and ad-hoc fees, periodic fees, etc.) - Non-Use Commission conditions (fixed commission rate, daycount, and payment frequency) are defined at the tranche level. |

| • | There is no principal movement at the tranche level, which only materializes the agreement to make part of the facility amount available to the borrower. It is only when a drawdown occurs that a principal movement is created. |

| • | The tranche limit is only used to compute the non-used principal for the non-use commission. |

| • | A tranche principal reduction is handled by an action in the Actions panel. This reduces the tranche principal cashflow and affects the non-use commission computation. |

| • | It is also possible to fully close a tranche by anticipation by doing a Termination/Closing of the tranche. Consistency checks are implemented in order to avoid closing a tranche with outstanding drawdowns. When terminating a tranche, the system generates the appropriate commissions. The commissions – when the tranche can be closed (all related drawdowns being also terminated) – is paid on closing effective date. |

| • | Tranche currency can be different from the Credit Facility currency. When entering a tranche with a different currency, the system asks for an FX rate to be stored at tranche level to perform the limit checks with that rate. |

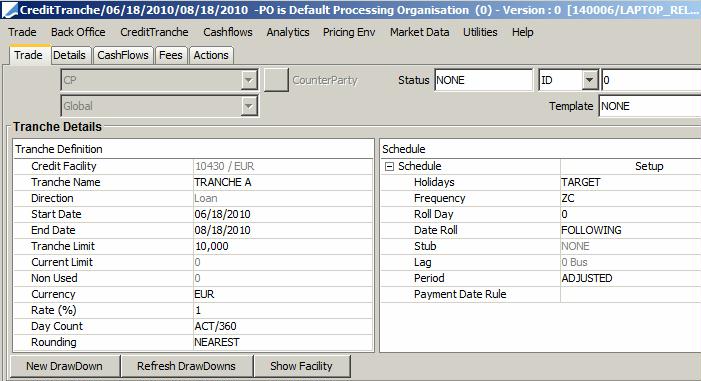

1. Sample Tranche

From the Calypso Navigator, navigate to Trade > Money Market > Credit Facility to bring up the Credit Facility window (menu action trading.TradeCreditFacilityWindow), and load a Credit Facility.

Then click Create Tranche to create a new tranche, or double-click a tranche from the Tranche Details to bring up the Credit Tranche window.

1.1 Trade Details

The counterparty and book come from the credit facility.

Tranche Details - Tranche Definition

| Fields | Description |

|---|---|

|

Credit Facility |

Credit Facility Trade Id to which the Tranche belongs. This is defaulted by the system when opening the Tranche window. |

|

Tranche Name |

Text Field. Tranche Name. |

|

Direction |

Loan/Deposit. Default is Loan. Deposit direction must only be used when the processing organization is user (and not provider) of the Credit Facility and, as such, must pay commission on non-used principal and interest on drawdowns. The Credit Facility Direction defaults the Tranche(s) and Drawdown(s) direction linked to that Facility. |

|

Start Date |

Start Date of the Tranche. When saving the tranche, the system checks that the Tranche Start Date is not smaller than the Credit Facility Start Date. |

|

End Date |

End Date of the Tranche. When saving the tranche, the system checks that the Tranche End Date is not greater than the Credit Facility End Date. |

|

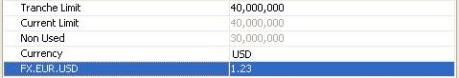

Tranche Limit |

Part of the Credit Facility amount available to the borrower. |

|

Current Limit |

The Tranche limit can vary over the life of the Tranche.

This field displays the remaining tranche limit taking into account any tranche amortization. This field is compute based on the trade ValDate. |

|

Non Used |

Non-Used principal for the Tranche. This is dynamically computed by the system on the Trade Valuation Date (Price button). The system computes on ValDate the Non-Used part of the Tranche based on Sum of the Drawdown(s) associated to that Tranche. The Non-Used principal at tranche level is used to compute the non-used commission to charge (when it is a loan) to the CounterParty. The daily calculation can be checked on the Tranche cashflows. By changing the ValDate you can price at different dates to simulate the future or check the past. |

|

Currency |

Tranche Currency. A Tranche can be set in a different currency than the Credit Facility. When a different Tranche currency is selected, the system asks for an FX rate to be entered to perform the limit check with the Credit Facility.

|

|

Rate (%) |

Non-Used Commission Rate. Only fixed rate is supported. |

|

Day Count |

Daycount for the calculation of the commission on the non-used principal. |

|

Rounding |

Rounding Method for the non-used commission. |

Tranche Details - Schedule

| Fields | Description |

|---|---|

|

Schedule |

Click Setup to bring up the Cash Details dialog - Help is available from that window. It allows setting specific payment conditions if needed. |

|

Holidays |

Select a payment holiday calendar. This calendar is used to determine the tranche End and Payment Dates, based on Frequency, RollDay, DateRoll, Stub and Lag conventions defined for that Tranche. |

|

Frequency |

Non-Used Commission Payment Frequency. You can select a payment date rule instead. See below. |

|

Roll Day |

Roll Day used for the cashflow generation. |

|

Date Roll |

Date Roll used for the cashflow generation. |

|

Stub |

Stub used for the cashflow generation. |

|

Lag |

Lag used to compute the Payment Date. |

|

Period |

Possible values are: ADJUSTED, FRN, UNADJUSTED, MAT_UNADJUSTED used to determined the tranche End Date. |

|

Payment Date Rule |

You can select a payment date rule instead of the frequency to generate the cashflows. |

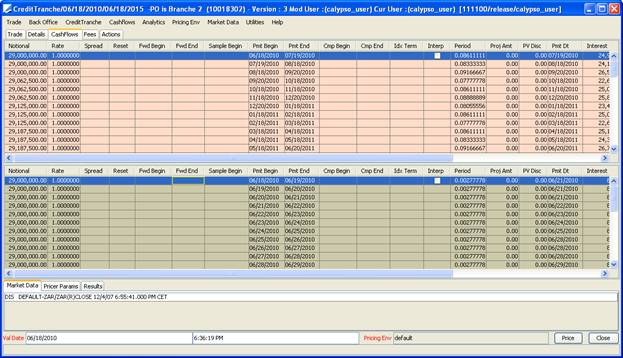

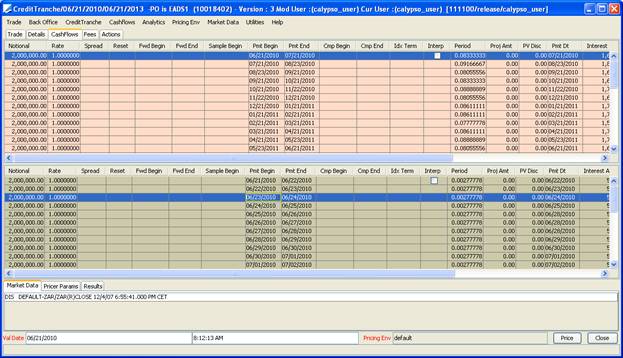

1.2 Credit Tranche CashFlows

Select the Cashflows panel to display the cashflows.

The Credit Tranche cashflows are made of two parts:

| • | The top panel shows the cashflow summary with the average non-used principal over the cashflow period. You can double-click a cashflow period to display its details in the bottom panel. |

| • | The bottom panel shows the daily non-used principal and computed daily non-used commission (interest) used to trigger the NON_USE_COMMISSION transfer generation at payment date (based on the Tranche payment characteristics). |

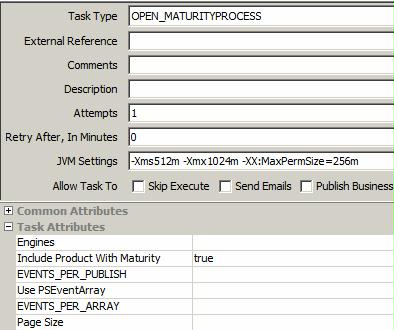

1.3 Credit Tranche Transfer Generation Process

NON_USE_COMMISSION transfers are associated to the tranche component of the Credit Facility.

The tranche product/trade is created to compute the non-used principal (see cashflows above) and, based on this (daily) non-used principal, calculates the non-used commission to be paid according to the tranche Payment Frequency.

As the tranche has a maturity, Calypso does not generate in advance the NON_USE_COMMISSION transfers for the complete life of the tranche. This avoids creating n NON_USE_COMMISSION transfers that are canceled and recreated as soon as the non-used principal of the tranche changes, following a drawdown action.

Thus, NON_USE_COMMISSION transfers are generated by the scheduled task OPEN_MATURITYPROCESS.

| • | 1 business day before the non used commission payment date |

| • | Provided the scheduled task attribute "Include Product With Maturity" is set to true |

Please note that the non-used commission generation process is based on system date (current date), not ValDate of the scheduled task.

Notice days can be added to the transfer generation of Credit Tranches using the pricing parameter TRANCHE_NOTICE_DAYS. Default is 1.

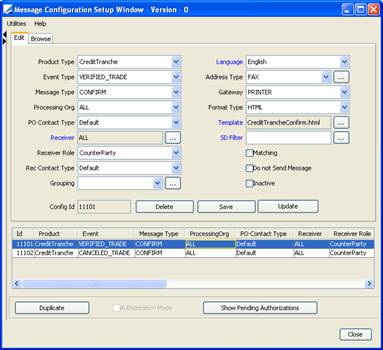

2. Generating Confirmations

You can generate a confirmation for a

Credit Tranche using the "CreditTrancheConfirm.html" template through the standard message engine process.

Message Setup

Sample Confirmation

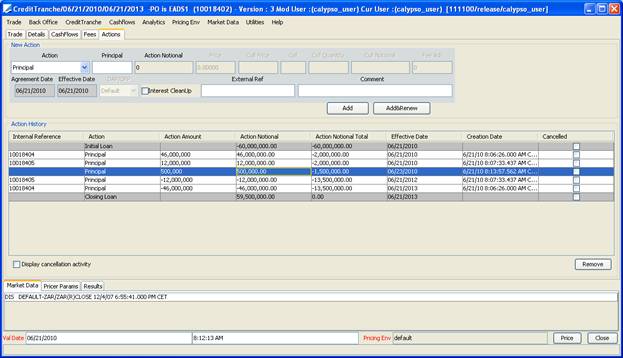

3. Applying Actions

3.1 Tranche Limit Reduction

It is possible to reduce the Tranche Limit Amount by applying an action type Principal on that Tranche. Depending on the direction (Loan/Deposit), the Tranche Reduction Amount will be entered as a positive or negative amount.

Select the Actions panel, and select the action type "Principal".

| » | Enter the Principal Reduction Amount (positive to reduce a Loan tranche, or negative to reduce a Deposit tranche). |

| » | Enter the Trade Date and Effective Date. |

| » | Click Add, then save the trade. |

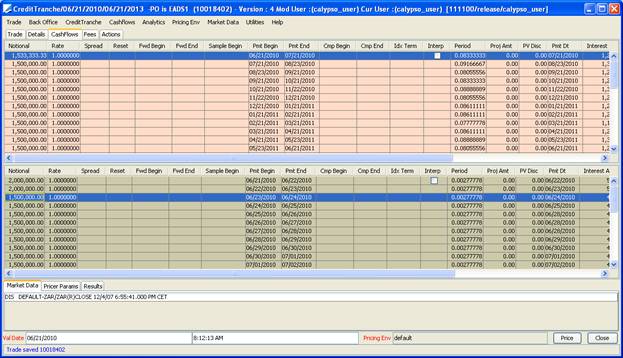

You can see the results of the Tranche reduction action in the tranche cashflows, or by pricing the trade using Valdate = Tranche Principal Action date.

An example is presented below: Tranche Limit Amount on June 23rd2010 is EUR 2,000,000.00 as shown in the tranche cashflows below.

Enter a Principal reduction of EUR 500,000.00 on June 23rd through a Principal action, as shown below:

Resulting cashflows take into account the principal reduction of the tranche limit amount from June 23rd, as shown below in the Tranche cashflows:

3.2 Tranche Early Termination

Choose Back Office > Termination - Help is available from that window.

When terminating a Credit Tranche, the system performs consistency checks in order to forbid a tranche closing if drawdowns are still active on the Tranche. The system applies a TERMINATE action on the Credit Tranche component with End Date = Termination Date, and cleaning all transfers and postings that could have been generated after that date.

4. Credit Tranche Accounting Events

The following accounting events are available for Credit Tranches.

| Accounting Events | Description |

|---|---|

|

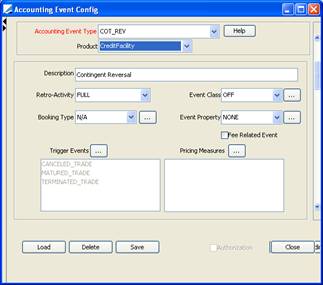

COT |

Book the Credit Tranche Limit Amount on Tranche Trade Date.

|

|

COT_REV |

Book the Credit Tranche Reduction of the Limit Amount on Action Date, when a drawdown action impacts the non-used amount of the tranche (booking of a new drawdown, partial termination, merge/split of drawdowns, rollover of drawdown, amortization, tranche reduction). COT and COT_REV, when used, allow booking the Credit Tranche non-used principal.

|

|

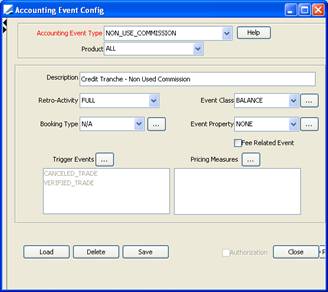

NON_USE_COMMISSION |

Book the amount of the Credit Tranche non-used commission. This is generated one business day before payment date by the scheduled task OPEN_MATURITYPROCESS.

|

|

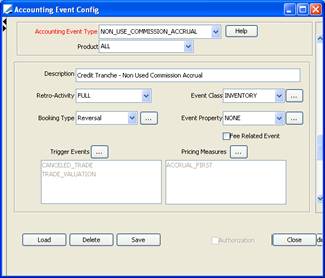

NON_USE_COMMISSION_ACCCRUAL |

Book the accrual part of the non-used commission. This is an Inventory Accounting Event, triggered by a Trade Valuation event generated by the scheduled task EOD_TRADE_VALUATION.

|

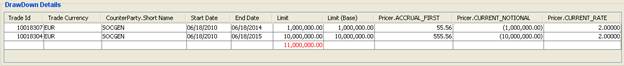

5. Viewing Drawdown Details

Once the Tranche is saved, click New DrawDown to create a drawdown- See Capturing DrawDowns for details.

The DrawDown Details panel shows the drawdowns associated with a tranche.

To display (or modify) an existing drawdown, double-click on a drawdown line from the drawdown details.

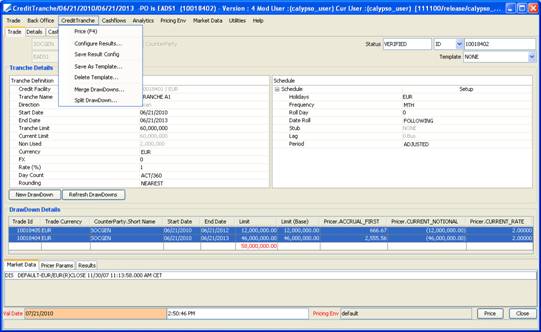

Reporting capabilities are included in the Credit Tranche trade screen, to give at any Val (Price) Date the details of the DrawDown(s) Amounts for that Tranche. This is also used to dynamically compute the Tranche Non Used displayed in the Tranche Definition panel.

As this part of the trade screen relies on the Calypso reporting framework, you can display any information/field which is available as a column. In the example above, we also display the pricing measure ACCRUAL_FIRST (drawdown accrual at ValDate), CURRENT_NOTIONAL (as principal of the drawdown can change over its life) and CURRENT_RATE (as drawdown rate can change over its life).

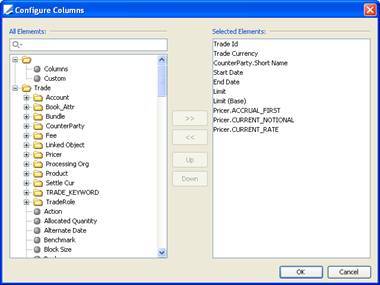

To configure that default report, go to the Drawdown Details panel, right-click and select Configure Columns. Then select the sort and save your template as default.

Choose the following columns:

Then, go to Sort and sort the columns as shown below:

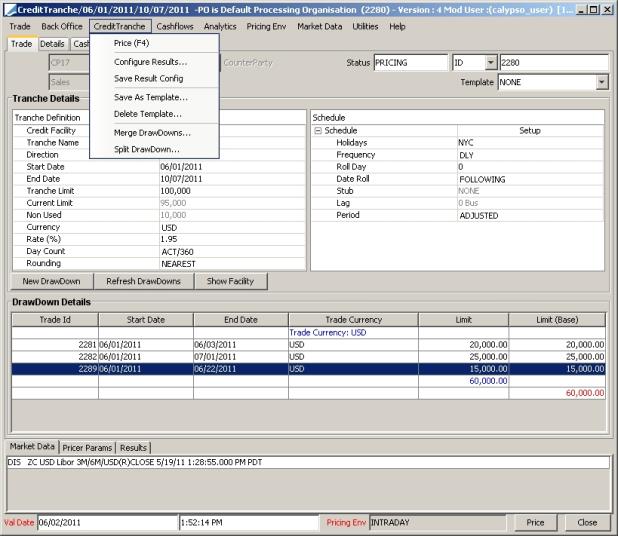

5.1 Splitting Drawdowns

You can split a drawdown into multiple drawdowns.

Select a drawdown from the Drawdown Details and choose Credit Tranche > Split Drawdown.

The system only allows splitting drawdowns on Credit Facility payment date. The Split Date is determined by the trade ValDate (07/21/2010 in the example below).

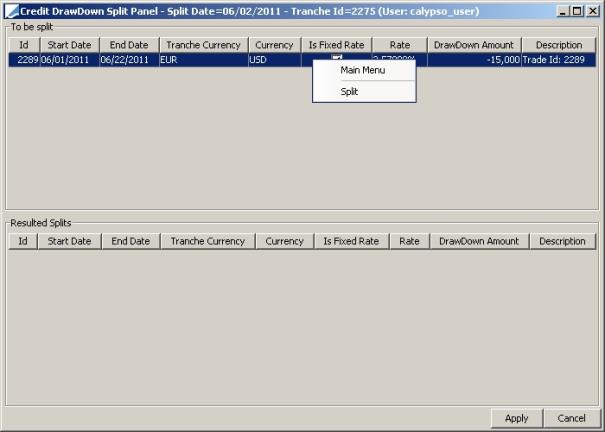

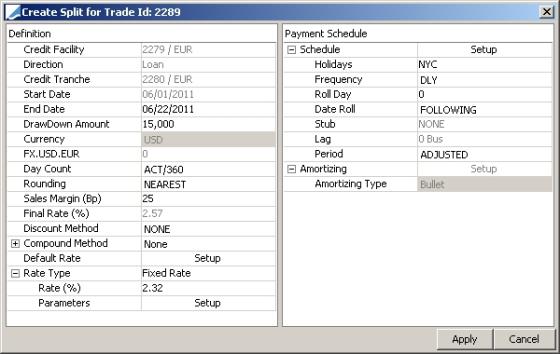

The Split window is displayed.

| » | Right-click the drawdown to split and choose "Split". |

The Create Split Window allows specifying the split amount, split rate (could change to a new fixed rate, a new floating/spread, or a fixed to floating, etc.).

Click Apply when you are done.

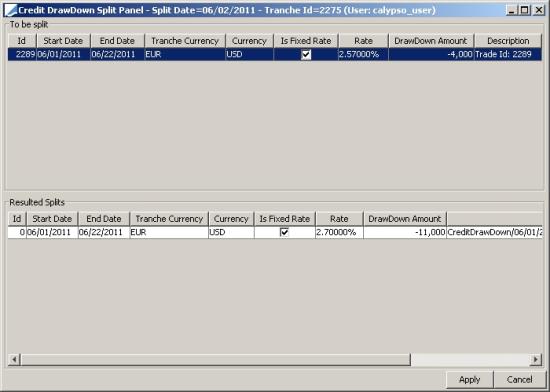

The system computes the remaining amount to split, as shown below:

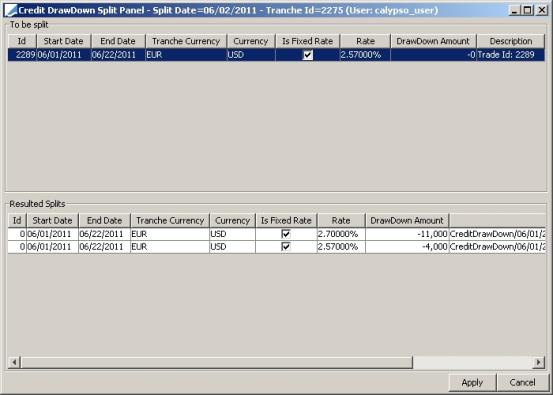

Repeat for other splits as needed.

| » | Click Apply when you are done splitting the full amount. |

The Split applies a Full Termination on the drawdown on split effective date, and creates new drawdown trades with the split characteristics. All these trades are linked.

5.2 Merging Drawdowns

You can merge multiple drawdowns into one.

Select multiple drawdowns from the Drawdown Details and choose Credit Tranche > Merge Drawdown.

The Merge Date is determined by the trade ValDate (07/21/2010 in the example below).

The system only allows merging drawdowns on Credit Facility payment date, having the same rate, amortization and start-end dates characteristics.

When merging drawdowns, the system fully terminates the merged drawdowns and create a new – linked – drawdown with the same financial terms and principal = sum of merged drawdown amounts.

5.3 Rolling Over a Drawdown

A drawdown can be rolled over from the DrawDown window by selecting CreditDrawDown > Rollover.

Rolling over a drawdown functions in the same way as rolling over any other type of trade.

See Rollover for detailed information.

See Rollover for detailed information.