Capturing DrawDowns

A drawdown is, in effect, a (flexible) loan within a tranche of a Credit Facility. It is the agreement to use part, or the totality of the tranche amount. All principal movements/transfers are attached to the drawdown and reported on the tranche.

See Credit Facility for details on defining credit facilities.

See Credit Facility for details on defining credit facilities.

A tranche can have several active drawdowns.

Each drawdown in the tranche can start or end on a different date (as long as it is within the start and end dates of the tranche); and have different interest rate, basis, rate set period or calculation rules. The sum of the drawdowns must not exceed the tranche limit.

A drawdown may also allow Principal Payments – either defined upfront as an Amortization Schedule, or made on an ad hoc basis throughout its lifetime (partial termination).

Similarly to other Calypso products, the interest options defined on the drawdown and the principal payments drive the cashflows which, in turn, are used to create transfers, for settlement of interest and principal.

Additional fees (withholding tax, drawdown upfront fee, drawdown periodic fees...) can also be attached to a drawdown and generate transfers.

Rate Conditions

| • | Possibility to choose between rate types: fix, floating (rate index and spread) |

| • | When choosing the currency, the system defaults the rate conditions to the default rate condition defined at facility level for that currency. The user can override it at drawdown level. |

| • | Possibility to apply a rate change action on a fixed rate. If a rate schedule exists and the user applies a rate change, the system will consider the new value set through the rate change as applicable for the remaining life of the loan/deposit, this value overriding the variable schedule. |

| • | On a floating rate, possibility to apply a spread change action. There again, if a spread schedule exists and the user applies a spread change, the system will consider the new value set through the spread change as applicable for the remaining life of the loan/deposit, this value overriding the variable spread schedule. |

| • | All standard rate conditions available today on the Cash product are available for a drawdown, except that there is no capitalization. |

Principal Movements

| • | Possibility to define an amortization schedule, when amortization rules are predefined. |

| • | Ad-hoc principal changes are handled as partial terminations. |

| • | Each time a principal movement impacts a drawdown (start date, end date, amortization, partial termination, etc.) a principal action is saved on the related tranche to compute the non-used principal impacted by this change. |

| • | For each principal change, the system performs the consistency checks again, and does not allow saving a change if the sum of existing drawdowns exceeds the new tranche limit. |

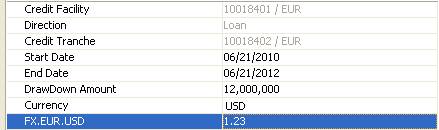

| • | A drawdown can be in a different currency than the tranche (and credit facility). |

1. Sample Drawdown

From the Calypso Navigator, navigate to Trade > Money Market > Credit Facility to bring up the Credit Facility window (menu action trading.TradeCreditFacilityWindow), and load a Credit Facility.

Double-click a tranche from the Tranche Details to bring up the Credit Tranche window.

Then click New DrawDown to capture a drawdown, or double-click a drawdown from the DrawDown Details to bring up the Credit Drawdown window.

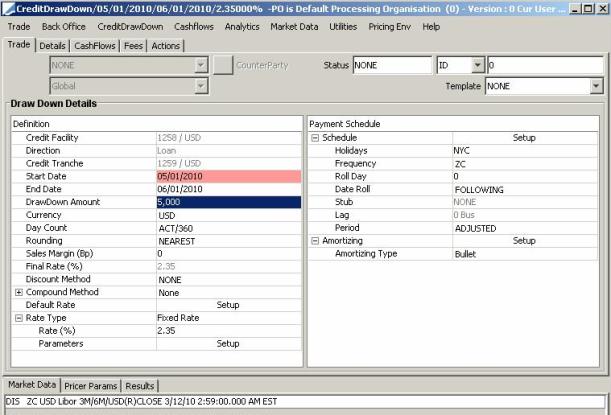

The Credit Drawdown is similar to the Cash product - The only difference is that it is attached to a tranche and to a credit facility.

1.1 Trade Details

The counterparty and book come from the credit facility.

Draw Down Details - Definition

| Fields | Description |

|---|---|

|

Credit Facility |

Credit Facility Trade Id to which the drawdown is attached. |

|

Direction |

Loan/Deposit. Default is Loan. Deposit direction must only be used when the processing organization is user (and not provider) of the Credit Facility and, as such, must pay interest on drawdowns. The Credit Facility Direction defaults the Tranche(s) and Drawdown(s) direction linked to that Credit Facility. It cannot be changed. |

|

Credit Tranche |

Credit tranche Trade Id to which the drawdown is linked. |

|

Start Date |

Start Date of the drawdown. When saving a drawdown, the system checks that the Deposit Start Date is not smaller than its Credit Tranche Start Date. |

|

End Date |

End Date of the drawdown. When saving a drawdown, the system checks that the drawdown End Date is not greater than its tranche End Date. |

|

Drawdown Amount |

Part of principal used by the borrower. |

|

Currency |

Drawdown currency. Drawdown currency can differ from its tranche currency. When a different drawdown currency is selected, the system asks for a FX rate to be entered to perform the Limit check with the tranche.

|

|

DayCount |

Daycount used for interest calculation. |

|

Rounding |

Rounding method used for interest calculation. |

|

Sales Margin (Bp) |

Sales Margin (expressed in Basis Point) to be added to the drawdown Rate to compute the Final Rate used for interest calculation. |

|

Final Rate (%) |

Final Rate = Rate % (including spread value for a floating index) + Sales Margin, used to compute the drawdown interest amount. |

|

Discount Method |

Allows saving a discount drawdown (Discount Method = DISC). Discount Method = EXP is also supported (see Cash products for details). Default is NONE (no discount). |

|

Compound Method |

Compounding Type for interest calculation. The system offers the possibility to compound the total rate (fixed) and – for floating rate – flat or spread included. |

|

Default Rate Rate Type |

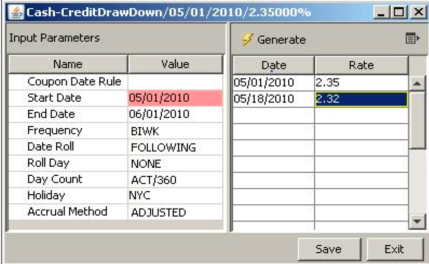

The system displays the default rate type as defined in the Credit Facility for the corresponding currency (Rates button). You can click Setup to select a different rate configuration. Or you can simply modify the rate conditions. Fixed You can modify the fixed rate as needed in the Rate (%) field. You can also click Setup in the Parameters field to define a variable schedule for the fixed rate.

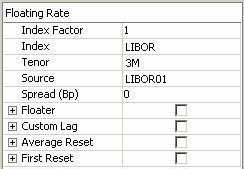

Floating An additional panel displays the details of the floating rate. You can modify as needed.

|

Draw Down Details - Payment Schedule

| Fields | Description |

|---|---|

|

Schedule |

Click Setup to bring up the Cash Details dialog - Help is available from that window. It allows setting additional parameters. |

|

Holidays |

Calendar used for the cashflow payment generation. |

|

Frequency |

Payment frequency. |

|

Roll Day |

Roll Day used for the cashflow generation. |

|

Date Roll |

Date Roll used for the cashflow generation. |

|

Stub |

Stub used for the cashflow generation. |

|

Lag |

Lag used to compute the Payment Date. |

|

Period |

Possible values are: ADJUSTED, FRN, UNADJUSTED, MAT_UNADJUSTED used to determined the drawdown End Date. |

|

Amortizing Amortizing type |

If you select an amortizing type different from Bullet, you can click Setup to specify additional parameters. |

2. Generating Confirmations

You can generate a confirmation for a Credit Drawdown using the "cashconfirm.html" template through the standard message engine process.

Message Setup

Sample Confirmation

3. Applying Actions

3.1 Credit Drawdown Ad-hoc Principal Reduction

It is possible to redeem partially a Credit Drawdown by anticipation, using the partial termination function of the drawdown.

Choose Back Office > Termination - Help is available from that window.

3.2 Credit Drawdown Early Termination

It is possible to fully terminate a Credit Drawdown by anticipation, using the termination function of the drawdown.

Choose Back Office > Termination - Help is available from that window.

The drawdown trade is put in a TERMINATED status and transfers are generated at Termination Effective date for PRINCIPAL redemption, INTEREST and – potentially – TERMINATION_FEE.

3.3 Credit Drawdown Rollover

It is possible

to roll a drawdown using the standard Rollover function available in the

back office menu of the trade.

Choose Credit Draw Down > Rollover - Help is available from that window.

3.4 Credit Drawdown Rate Change

It is possible to change a fixed rate value or a floating rate spread by applying the Rerate function available in the Credit Drawdown menu.

Choose Credit Draw Down > Rerate. You are prompted to set the reset rate.

| » | Enter the desired details and click Apply. The reset rate is applied. |

You can view the history of rerates on the trade, if any, using Credit Draw Down > Rerate History.

4. Credit Drawdown Accounting Events

The accounting events used for a credit drawdown are the same as for the existing Cash product.

| Accounting Events | Description |

|---|---|

|

COT |

Contingent principal amount on drawdown trade date. Triggered by VERIFIED_TRADE, CANCELED_TRADE, TERMINATED_TRADE. |

|

COT_REV |

Contingent reversal of the principal amount on drawdown start date. Triggered by VERIFIED_TRADE, CANCELED_TRADE, TERMINATED_TRADE. |

|

PRINCIPAL PRINCIPAL_LOAN PRINCIPAL_DEPOSIT |

Principal movement on Start/End and Amortization date of a drawdown. Triggered by VERIFIED_TRADE, CANCELED_TRADE, TERMINATED_TRADE. |

|

INTEREST |

Book the interest of the drawdown on interest payment date. Triggered by VERIFIED_TRADE, RATE_RESET, CANCELED_TRADE and TERMINATED_TRADE. |

|

ACCRUAL |

Book the interest accrued of a drawdown on valuation date. Triggered by TRADE_VALUATION and CANCELED_TRADE (scheduled task EOD_TRADE_VALUATION). |