Viewing Inventory Positions

![]() Download PDF - Inventory Position Report

Download PDF - Inventory Position Report

From the Calypso Navigator, navigate to Reports > Nostro/Custodian

Positions > Inventory Position (menu action reporting.ReportWindow$BOPosition) to review the inventory positions.

You can display real-time Inventory positions computed by the Inventory engine (nostro positions), or inventory snapshots generated by the INVENTORY_SNAPSHOT scheduled task.

| • | Transfer and Inventory engines should be running to compute inventory positions. |

| • | Liquidation engine should be running to perform Positions reconciliation. |

| • | Margin Call engine should be running for collateral positions. |

See Generating Inventory Positions for details.

See Generating Inventory Positions for details.

Refer to Calypso Collateral Management documentation for information on generating margin call positions.

Refer to Calypso Collateral Management documentation for information on generating margin call positions.

Menus common to all reports are described under Help > Menu Items.

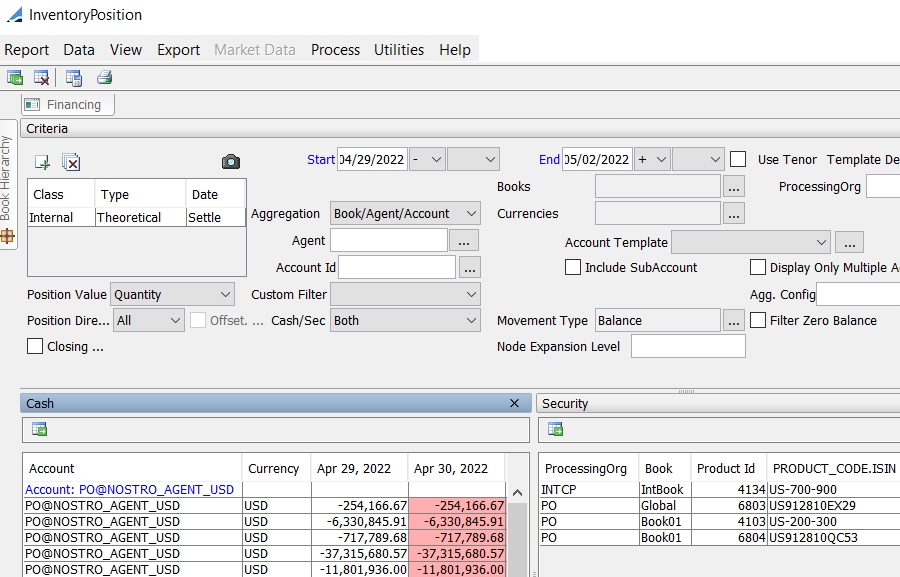

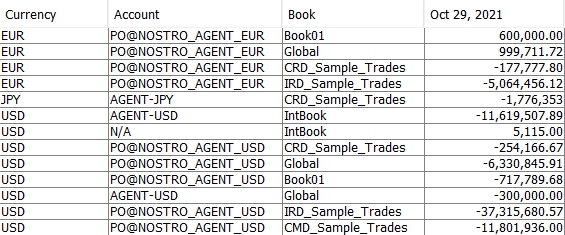

1. Report Example

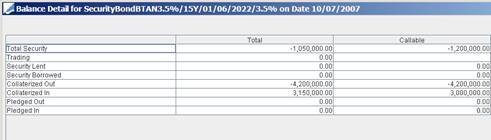

Partial picture of Inventory Position report

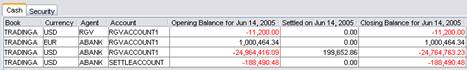

The report shows two panels: Cash for cash positions, and Security for security positions.

Use one of the following methods to run the report:

| » | You can check / uncheck View > Show Frame > Criteria to display / hide the search criteria. |

| » | Enter selection criteria at the top of the report window and

click |

When you select the Cash panel, you can view selection criteria specific to cash positions only.

When you select the Security panel, you can view selection criteria specific to security positions only.

You can also click ![]() in each panel to only load the corresponding positions.

in each panel to only load the corresponding positions.

You can configure the columns of the report. See Help > Menu Items for details.

| » | You can also choose Report > Load Template, select a template then click Load. |

| » | You can select a template and click |

| » | You can click |

Note that for the Pivot view and the Aggregation view, the print icon is disabled.

You can use [Ctrl+P] or [Ctrl+L] to print the report, or you can export the report to Excel and print it from there.

Criteria Details

|

Criteria |

Description |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

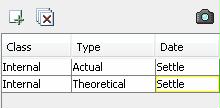

Class Type Date |

Click

You can select a combination of Internal, External and SnapShot positions (see Snapshot below for details on selecting snapshots). You can also select Client positions or Margin_Call positions. These positions cannot be combined with other positions as the display fields are not compatible. Position Class The following values are available:

Position Type Click ... to select a position type. The following values are available:

You can set the environment property KEEP_OPPOSITE_XFER_FROM_INVENTORY_DETAIL to true to display both legs of a repo when both the start and end legs are failed. Only one failed transfer is displayed otherwise. Default is False.

Position Date Select a position date. The following values are available:

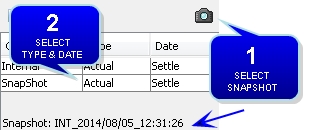

Snapshot To select an inventory snapshot:

1. Click

2. Then select the Type and Date of the snapshot.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Start Date |

Enter the start date from which you want to see the positions. You may input a date in the past or in the future. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

End Date |

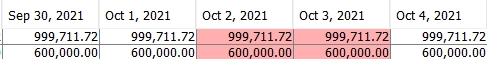

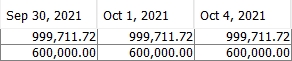

Enter the end date for the positions. When holiday calendars are selected under Data > Configure Holidays:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Use Tenor |

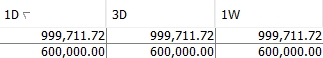

Check “Use Tenor” to use a tenor instead of an end date. The Tenors field will appear.

Click ... to select tenors for which you want to see the positions. You can now display the tenors as columns names by choosing Data > Tenors > Display columns by tenor name.

You can also choose the following menu items:

When selected and Calendar > Business is selected, the Tenors are rolled and shown as business days. Example - If Tenor 3D is a business day, the report will show 1D, 2D, 3D (which represents 3 business days), 4D (which represents 4 business days), etc.

When selected, 1W is the end of the week following the start date depending on Data > Calendar – Example Sept 27 + 1W = Oct 3 in Calendar days and Oct 1 in Business days. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Template Description |

Displays the template description if a template has been loaded, and a template description is set on the template. Template descriptions can be set using Configuration > Reporting & Risk > Report Templates from the Calypso Navigator. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Books |

Click ... to select a set of books as needed. You can also enter a comma-separated list of books. Ⓘ [NOTE: Book names are case-sensitive] |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ProcessingOrg |

Click ... to select a set of processing organizations as needed. You can also enter a comma-separated list of processing organizations. Ⓘ [NOTE: Processing organization codes are case-sensitive] |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Include Child POs |

When checked, the positions of the child POs are included in the report, if any, when a PO is selected. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Aggregation |

Select the aggregation level of the positions: Book/Agent/Account, Agent/Account, Agent, Book, Client, ProcessingOrg, Global, or Book/Agent. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Currencies Securities |

The Currencies label on the Cash panel switches to Securities when you select the Security panel. Click ... to select a set of currencies for cash positions, or click ... to select a set of securities for security positions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Account Template |

You can select an Account Selector template as needed. When selected, the underlying accounts are loaded. You can click ... next to the drop down list to define Account Selector templates. It opens the Account Selector Templates window where you can manage the templates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Security Template |

On the Security panel, you can select a type of security template to be loaded:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Sec Code |

On the Security panel, you can select a security code and enter a value in the adjacent field to select all securities with that security code value. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Include Issuances |

On the Security panel, you can check the "Include Issuances" checkbox to include issuance trades. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SD Filter |

On the Security panel, you can select a static data filter to filter the securities that can be loaded in the report. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Agent Cpty Id |

The Agent Id label switches to Cpty Id when the position class is set to Client or Margin_Call. Click ... to select an agent / counterparty as applicable to view the positions for that agent / counterparty only. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Account Id Contract Id |

The Account Id label switches to Contract Id when the position class is set to Margin_Call. Click ... to select an account / contract as applicable to view the positions for that account / contract only. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

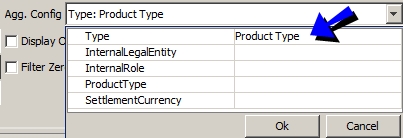

Agg. Config |

Select a custom aggregation config as needed. You can then specify the individual criteria.

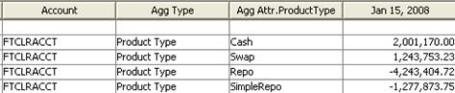

Ⓘ [NOTE: You can only select a custom aggregation config if you have configured the Inventory engine to compute custom positions – See Generating Inventory Positions for details] Sample Inventory Position Report with Positions computed by Product Type

You can configure aggregation related columns using Data > Configure Columns. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Position Value |

This only applies to security positions. Select a position display value. The following values are available:

You can select the default amount by setting ONE of the following environment properties to true: INV_QUANTITY, INV_NOMINAL, or INV_NOMINAL_UNFACTORED. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Custom Filter |

You can select a custom filter for filtering inventory positions. To create a custom filter, create a class named Sample in |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Display Only Multiple Agent |

Select this checkbox to display only those positions that are held at more than one Agent. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

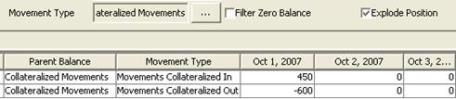

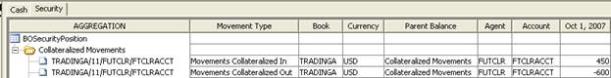

Explode Position |

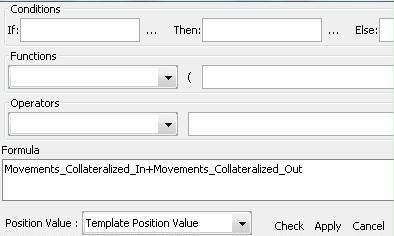

This only applies to security positions. If you have created custom movement types and balance types, you can view the details of the computation by checking the Explode Position checkbox. In this example, we choose to display “Collateralized Movements”, the created “parent” movement type, and check the Explode Position checkbox so that the details of the computation are shown.

Alternatively, you can display the "parent" movement type, like "Collateralized Movement", and clear "Explode Position". Then you right-click the position and choose Show > Explode Position to display the details of the position. The Explode Position report can use templates named "BOExplode_<template name>". |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Aggregate Agg. Config |

Check "Aggregate Agg. Config" to aggregate custom positions. For example, you have defined custom positions by product type, and selected the corresponding Aggregation Config. On the Security panel, you want to see the positions by product type, and on the Cash panel, you don't want to see the breakup by product type. You can check "Aggregate Agg. Config" on the Cash panel to aggregate the custom positions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

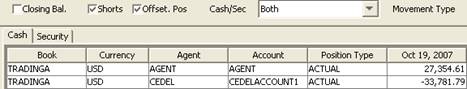

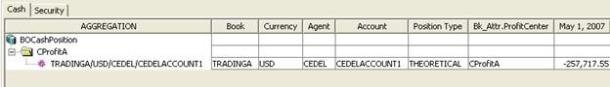

Position Direction |

Select All, Shorts or Longs. If you select Shorts, you can check “Offset Pos.” to only show short positions for which there is a long position available that can offset the short position. In this case, both the short position and potential offset position are shown.

In this example, you can transfer the position from agent AGENT to agent CEDEL to cover part of the short position on agent CEDEL. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cash / Sec |

The following values are available:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Movement Type |

Select the movement types you want to display. Cash Positions For Cash, the following values are available:

Security Positions For securities, movement types are more detailed based on the type of collaterals.

The Margin Call Rehypotheticable balance types will only be computed if the value MarginCallInventorySec is set in the "InventorySecBucketFactory" domain.

Same movement types as balance types for the actual transfers. Callable (Open) Positions The scheduled task PROCESS_CALLABLETRADE allow rolling callable trades every day. Substitutable Positions You also have the ability to identify whether the transfers that created the position are substitutable or not.

In the example above, of the total of this Security taken in as Collateral (3,150,000) only 3,000,000 can be substituted out by the counterparty. It is also possible to add custom movement types.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Filter Zero Balance |

Select this checkbox to exclude dates from the report that have a zero balance. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Propagate to Security Propagate to Cash |

When checked, which is the default behavior, the criteria saved in the template are the same for both the Cash and Security panels. When unchecked, both the criteria from the Security panel and the criteria from the Cash panel are saved in the template. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Closing Bal. |

When checked, the following columns will be populated on the start date:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Legal Ag. / Contract Id |

On the Security panel, you can select legal agreements and margin call contracts associated with the trades (repo, security lending) to display corresponding information. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Filter Matured Securities |

On the Security panel, you can check "Filter Matured Securities" to exclude matured securities. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Display Past Prepaid Transfers |

Only applies to Statement positions. On the Cash panel, you can check "Display Past Prepaid Transfers" to display transfers that were paid before their settlement date. For example, a transfer has a settlement date of 07/10/2014, and is paid on 07/09/2014. The transfer attribute "InitSettleDate" is set to the original settlement date 07/10/2014, so that it can be loaded in the Inventory Position on 07/10/2014 using this checkbox. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Pricing Env Valuation Date |

These selections will only appear if the column use_pricing_env = 1 in table report_win_def for def_name = BOPosition – Contact your database administrator to set this up. This allows converting cash positions into the base currency of the selected pricing environment. The base currency will appear next to the total amount if the FX quote is known, or an error will be displayed otherwise. The menu item Process > Check FX Quotes allows checking FX quotes only.

You need to configure grouping by Currency, and setup subtotals by Dates with the function SumFX (you can add it to the domain “REPORT.Functions” if it is not available for selection). |

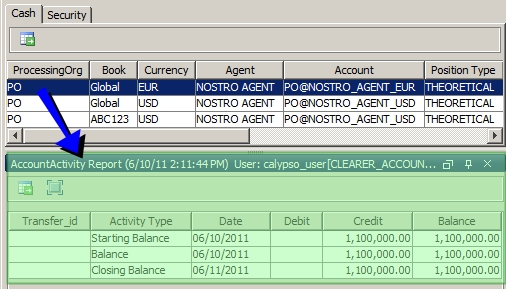

1.1 Drill Down Display Option

When you right-click a position and choose the Show menu, a number of drill down reports are available for selection.

You can view the selected drill-down report below the Inventory Position report, as shown in the example below.

1.2 Transfer Report Drill Down

When drilling down to the transfer report from a position, you can select a transfer report template that starts with “BOPosition”.

In particular, you can configure a transfer report that shows COLLATERAL transfers, and CollateralTrade columns to view the underlying collaterals of a given position.

To drill-down to the transfer report, right-click a position, and choose Show > Transfer Report. The list of BOPosition templates will be available for selection.

By default, you will only see the movements of the day for cash balances and security balances.

To see all movements, you need to add the balances for which you want to see all movements to the domains “BOPosition.DrillDown.Cash.Balance.ShowAllMovements” for cash balances, and “BOPosition.DrillDown.Securiy.Balance.ShowAllMovements” for security balances.

You can show archived transfers in the Transfers drill-down if the menu item Report > Include Archived Transfers to Drilldown is checked.

1.3 Navigating to Another Inventory Position Report

To open another Inventory Position report based on an existing template, create an Inventory Position report template that starts with “BOPosition”.

When you right-click a position, the template will be available for selection under Show > BOPosition Report.

1.4 Exploding a Position

If you have created custom movement types and balance types, you can view the details of the computation by exploding the position.

Right-click the position and choose Show > Explode Position to display the details of the position. The Explode Position report can use templates named "BOExplode_<template name>".

1.5 Interest Entries

In the cash panel, you can right-click a position and choose Show > Interest Entries to bring up the Interest Entries window.

This will display in the Inventory Position Report what Interest will be capitalized to the client accounts on the next payment date, and allow the Interest amounts to be broken down into the daily constituents.

This only applies if the cash account is configured for interest bearing.

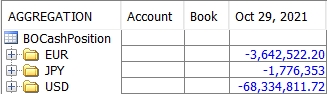

1.6 Aggregation Display Example

To aggregate based on any column (book attribute for example), select the book attribute as a sort column and column heading, then choose View > Set Table > Aggregation.

You can also check “Explode Position” and aggregate by Parent Balance to view the details of movement types that you have created.

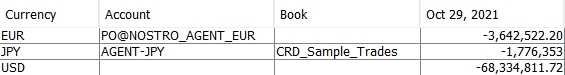

1.7 Positions Aggregation

You can also aggregate positions based on any criteria using Data > Configure Aggregation.

Select the criteria you want to use to aggregate positions and the positions are aggregated accordingly.

Example:

With no aggregation - Multiple rows are shown for each currency per account, book, etc.

With currency aggregation, only one row is shown per currency:

It does not show any details. Grouping by currency with a subtotal in Aggregation view would give similar results.

Ⓘ [NOTE: If you have multiple currencies, it is recommended to select the currency in the aggregation criteria as it will not aggregate positions across currencies]

2. Inventory Position - Process Menu

The menu items of the Process menu are described below.

|

Menu Items |

Description |

|

Create Movements Type |

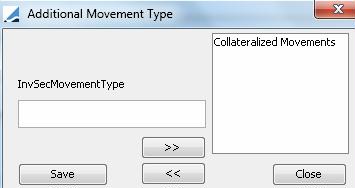

This only applies to security positions. Enter a movement type, for example “Collateralized Movements”.

It populates the domain “InvSecMovementType”. You then need to define the movement type using Process > Define Movement Type. See below. |

|

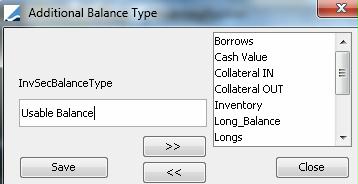

Create Balance Type |

This only applies to security positions. Enter a balance type, for example “Usable Balance”.

It populates the domain “InvSecBalanceType”. You then need to define the balance type using Process > Define Balance Type. See below. |

|

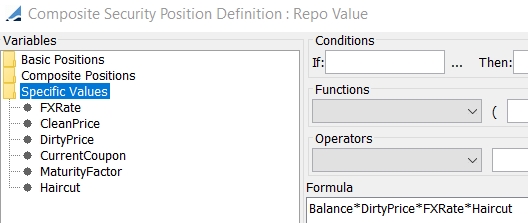

Define Movements Type |

This only applies to security positions. You first need to create a movement type using Process > Create Movement Type. Select a movement type and build the formula using basic position types, composite position types (existing custom movement types), and specific values. You can specify conditions as needed. Then click Apply. Example

This example will compute Collateralized Movements = Movements Collateralized In + Movements Collateralized Out.

|

|

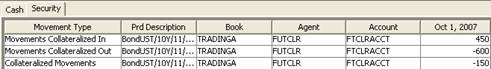

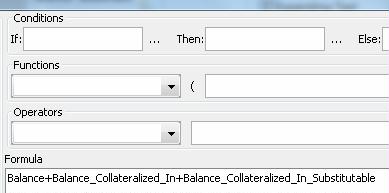

Define Balance Type |

This only applies to security positions. You first need to create a balance type using Process > Create Balance Type. Select a balance type and build the formula using basic position types, composite position types (existing custom balance types), and specific values. You can specify conditions as needed. Then click Apply. Example 1

Example 1 will compute Usable Balance = Balance + Balance_Collaterized_In + Balance_Collaterized_In_Substitutable. Example 2

Example 2 will compute Cash Value = Balance * DirtyPrice * FXRate. Example 3

Example 3 will compute the position with haircut: Repo Value = Balance * DirtyPrice * FXRate * Haircut. In this case, make sure to select a legal agreement or margin call contract to retrieve haircut information. Example 4 The MaturityFactor returns 0 if Position Date > Product Maturity Date; or 1 otherwise. It allows computing a zero balance after bond maturity using a formula like Balance*MaturityFactor. |

|

Check FX Quotes |

See search criteria Pricing Env and Valuation Date for details. |

3. Popup Process Menu

When you right-click a position, the following menu items are available in the Process menu.

|

Menu Items |

Description |

|||||||||||||||

|

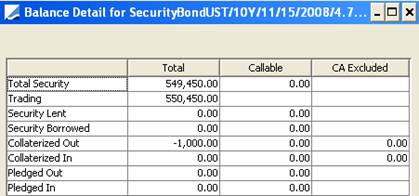

Details |

Displays the distribution of the security position.

|

|||||||||||||||

|

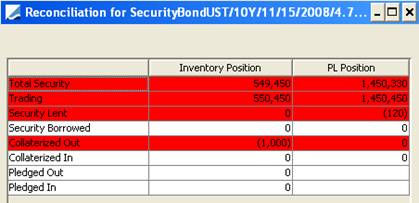

Reconcile Position |

Reconcile the selected position with the position computed by the Liquidation Engine. To use this feature, select the "Book" level aggregation in the Aggregation field.

Red rows indicate positions that are not reconciled. You can also use the scheduled task RECON_INV_PL_POSITIONS to reconcile inventory positions with PL positions.

|

|||||||||||||||

|

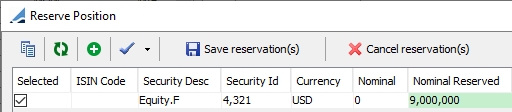

Reserve Position |

Select a security position, and choose Reserve Position to make the position unavailable.

You can set the default book for the reserved position. The default book is the book with book attribute Custody=True. You can click |

|||||||||||||||

|

Transfer Agent |

Select two security positions on the same security, and choose Transfer Agent to display the Transfer Agent window for entering a transfer between the selected agents. |

|||||||||||||||

|

Position Adjustment |

Select a security position, and choose Position Adjustment to display the Security Transfer window for entering a security transfer. |

|||||||||||||||

|

Unavailability Transfer |

Select a position (cash or security), and choose Unavailability Transfer to make this position unavailable by creating an unavailability transfer. You can specify an unavailability reason. Unavailability transfers populate the position types “Balance Unavailable” and “Movements Unavailable”. The system checks for a default trade template for the user. If no default template exists, then the Unavailability Transfer trade will be Open by default. If a default template exists, then the system will check to see if the default template is Open or Term. If the template is Term, then the system will insert the position start date plus 1D (next business date) as the end date of the trade. If the template is Open, then the trade will be Open. |

|||||||||||||||

|

Repo Sweeping |

With book aggregation selected in the Security panel, you can select a position and choose Process > Repo Sweeping to open the repo trade capture screen. It automatically completes the following details based on the position you have selected in the report: security, start date, book, and nominal. |

|||||||||||||||

|

Account Sweeping > On All Selected Positions |

To perform account sweeping on all selected positions.

|

|||||||||||||||

|

Account Sweeping > On Specific Date |

To perform account sweeping on a given position cell.

|

|||||||||||||||

|

Pool Consolidation |

To perform account sweeping on an account hierarchy.

|

|||||||||||||||

|

Financing |

Select a position and choose Process > Financing to capture financing repo trades. For a cash position, you will capture MONEY FILL trades.

Default values for these trades can be specified through a legal agreement between the processing organization (owner of the selected book) and the selected counterparty. Legal Agreements are defined using Configuration > Legal Data > Agreements from the Calypso Navigator, and default values for financing repo trades are defined in the Details panel. You can also set default values configurations (created using Configuration > Legal Data > Default Values from the Calypso Navigator) in the following domains:

Enter and modify the fields as needed. Add trades as needed. Click Save when you are done. The Default Values Configurations window is described in Calypso Fixed Income documentation. |

|||||||||||||||

|

Margin Call |

For a margin call position, creates a margin call trade. |

4. Environment Properties

The following environment properties apply to the Inventory Position report.

| Environment Properties | Description |

|---|---|

|

AGG_CONFIG_PLACEOFSAFEKEEPING |

True or false. Default is false. When true, it allows computing the external position by Book / Agent / Account / PlaceOfSafekeeping. When false, it allows computing the external position by Book / Agent / Account. |

| BO_POSITION_FORCE_TRANSACTION_SERIALIZABLE |

True or false. Default is false. Inventory positions are stored in multiple tables. If you are loading large past positions, there might be changes to those tables while the report is running, therefore causing inconsistent results. When true, it allows preventing changes in the inventory tables between different queries by increasing the isolation level to SERIALIZABLE (instead of TRANSACTION_READ_COMMITTED by default). In the case of Oracle, the parameter INITRANS (default is 1) should be increased for tables (and indexes) linked to inventory tables to allow multiple SQL queries running at the same time. inv_cash_movement inv_cash_balance inv_sec_movement inv_sec_balance inv_cust_cash_movement inv_cust_cash_balance inv_cust_sec_movement inv_cust_sec_balance inv_cash_query inv_sec_query inv_agg inv_temp_config_id inv_product_temp product_temp |

|

BO_POSITION_REPORT_ACCEPT_IN_DATASERVER |

True or false. Default is true. When set to true, it allows accepting the inventory positions inside the Data Server to prevent too many RMI calls. Set to false to disable (accepting done in Calypso Navigator in this case). Accepting corresponds to selecting the inventory positions based on the Inventory Position report criteria. |

|

BO_POSITION_REPORT_FILTER_IN_DATASERVER |

True or false. Default is true. When set to true, it allows filtering the inventory positions inside the Data Server to prevent too many RMI calls. Set to false to disable (filtering done in Calypso Navigator in this case). Filtering corresponds to removing applicable zero positions (based on date range). |

|

BO_POSITION_REPORT_CLEAR_POSITION |

True or false. Default is true. Allows reducing memory usage in Inventory Position report – Disabled in case of real-time updates. |

|

BO_POSITION_REPORT_CLEAR_DISPLAYABLE |

True or false. Default is true. Allows reducing memory usage in Inventory Position report – Disabled in case of real-time updates. |

|

BO_POSITION_REPORT_CLEAR_ROW_VECTOR |

True or false. Default is true. Allows reducing memory usage in Inventory Position report – Disabled in case of real-time updates. |

|

BO_POSITION_REPORT_PRELOAD_SECURITIES_IN_DATASERVER BO_POSITION_REPORT_PRELOAD_SECURITIES_MIN_IN_DATASERVER |

If set to true, preload the securities when a Custom Filter or a SD Filter is used in the Inventory Position Report. Default is false. Minimum number of securities to activate the preloading of the product cache (default is 10). Only applies when BO_POSITION_REPORT_PRELOAD_SECURITIES_IN_DATASERVER is true. |

|

BO_POSITION_REPORT_REALTIME_LOG_SIZE |

Size of the real-time logs (default value is 50000). If set to 0, the logs are not limited. |

|

BO_POSITION_LOAD_PRODUCT_BY_IDS |

True or false. Default is true. Allows loading the products by ID in the Inventory Position report. |

|

KEEP_OPPOSITE_XFER_FROM_INVENTORY_DETAIL |

Used in the Inventory Position report. True or false. Set to true to display both legs of a repo when both the start and end legs are failed. Only one failed transfer is displayed otherwise. Default is false. |

|

MAX_INVENTORYPOSITIONS_PER_USER |

Maximum number of inventory positions to be loaded. Default is 500000. Can also be set per user using User attribute Max.InventoryPosition. These limits do not apply to Admin users. |

|

PRODUCT_REPORT_CACHE_MAX_SIZE |

Max size of Secondary Market Products cache – Default is 50000. |

. You will be prompted to select a snapshot generated by the scheduled task INVENTORY_SNAPSHOT.

. You will be prompted to select a snapshot generated by the scheduled task INVENTORY_SNAPSHOT.