Rollover

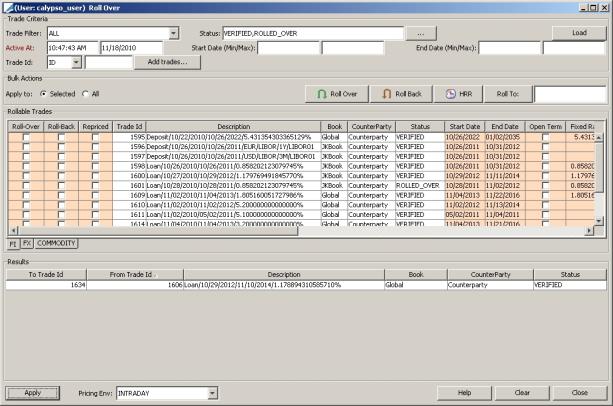

The Roll Over Window allows rolling trades over by extending the term.

From the Calypso Navigator, navigate to Trade Lifecycle > Rollover > Trade Rollover to bring up the Roll Over window.

Contents

- Extending Fixed Income Trades

- Extending Commodity Forward Trades

1. Setup Requirements

1.1 Workflow

Make sure that the transition VERIFIED - ROLLOVER - ROLLED_OVER is configured in the trade workflow with Create Task checked.

Ⓘ [NOTE: You can only rollover a trade in VERIFIED status (out-of-the-box)]

1.2 Domain Values

By default, the system copies all trade keywords to the trades generated from the rollover and rollback processes.

If you do not want to copy any trade keyword, add the value "NONE" to the domain "keywords2CopyUponRolloverAndRollback".

You can also add a list of trade keywords to that domain to copy only those trade keywords.

2. Extending Fixed Income Trades

Select the FI panel.

Ⓘ [NOTE: Structured Flows can be rolled over using the FI panel]

Ⓘ [NOTE: Repos and security lending trades must be rolled over using the Bulk Repo Roll Over window - Refer to the Calypso Repo Trading Guide and/or Calypso Security Lending Trading Guide for details]

| » | Enter selection criteria as applicable and click Load. |

Note that only trades that start on or before the valuation date, and end on or after the valuation date will be loaded.

The trades will be loaded in the FI panel.

A default rollover is applied with the following characteristics:

| – | The default rollover starts on the end date of the original trade and ends after the same length as the original trade. For example if the initial trade was 5 days long, then the rollover end date defaults to the original end date plus 5 days. |

| – | The default amount is equal to the principal amount plus the final interest amount. You can choose to remove the interest from that amount by checking the corresponding “Clean-Up Interest” checkbox. When checked, the interest amount will be paid at the end of the original trade. |

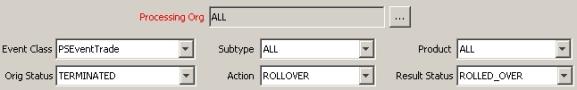

2.1 Loading Open Term Trades

Note that open term trades have to be terminated prior to being rolled over.

Also:

| • | You need to select the TERMINATED status from the Status list in order to load terminated trades. By default, only the VERIFIED status is selected. |

| • | Also, the ROLLOVER action must be configured on the TERMINATED status, in addition to the VERIFIED status, as shown below. |

2.2 Applying a Rollover

Follow the steps below for applying a rollover:

| » | You can either select a trade or multiple trades and click  OR you can select the Roll-Over checkbox for the trade or trades that you would like to roll over. OR you can select the Roll-Over checkbox for the trade or trades that you would like to roll over. |

Note that the Roll Back button only applies to FX trades.

| » | Modify all the fields that appear in pink as applicable. |

You can roll over a portion of a trade by modifying its quantity, therefore applying a partial termination to the original trade.

| » | Then click Apply. |

A new trade is created to reflect the rollover. You can double-click the trade to see its details.

The RolledOverFrom keyword shows the id of the original trade.

The original trade is changed to status ROLLED_OVER. The RolledOverTo keyword shows the trade id of the new trade.

The closing leg of the original trade and the opening leg of the new trade are netted.

Note that the new trade keeps all the actions that have been carried out on the rolled over trade.

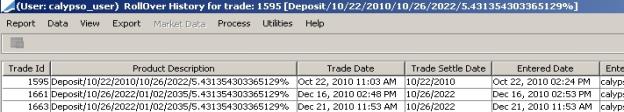

Rollover History

You can choose Back Office > RollOver history on either trade to view the history of rollovers as shown below.

You can save a report template named <product_type>RollOverHistory, for example CashRollOverHistory to customize the display for each product type.

Note on Cash Trades

When applying a Rollover on a Cash trade with null Margin Pips, we don't retrieve any Margin Pips and Margin Currency stored in the database. But the user has the possibility in the Rollover Window to change the Margin.

If the Margin is not changed on the Rollover (i.e. Margin remains = 0) and environment property MARGIN_USER_DEFAULT_CCY=true, no fee will be associated to the new trade. If environment property MARGIN_USER_DEFAULT_CCY=false, a fee is created with Margin Amount = 0 and Margin Currency = Trade Currency.

If the Margin is changed on the Rollover and environment property MARGIN_USER_DEFAULT_CCY=true, a fee will be associated to the new trade. This fee will use the Margin Amount entered in the Rollover window and Margin Currency = User Default Currency. If and environment property MARGIN_USER_DEFAULT_CCY=false, the fee is created with Margin Currency = Trade Currency.

In case of Notional Increase, the system adds the keywords "RolledOverToIncrease" and "RolledOverFromIncrease" on the trade.

The SDIs are selected in the following manner:

| • | When the netted amount is null the system takes the SDI of the initial principal flow. |

| • | When the netted amount is negative the system takes the "Pay" SDI. |

| • | When the netted amount is positive the system takes the "Rec" SDI. |

2.3 Undoing a Rollover

You can reject a rollover by applying the action REJECT (or the action of your choice) on a rolled over trade.

The workflow setup is as follows:

ROLLED_OVER – REJECT - VERIFIED (Create Task checked, Reject rule)

The action REJECT (or the action of your choice) must be specified in the domain TradeRejectAction.

In order to undo a rollover, apply the REJECT action from the Trade window or from the Trade Browser to the trades resulting from a rollover. The rolled over trades will be canceled and the original trades will move back to status VERIFIED.

2.4 Netting Configuration for Rollover

The RollOver netting type can be used to net together the rolled over trade and the new trade.

When environment property INCLUDE_INTEREST_INTO_ROLLOVER=true and InterestCleanUp=true, the interest transfer is included in the rollover netted transfer.

To exclude the interest transfer from the rollover netted transfer, set INCLUDE_INTEREST_INTO_ROLLOVER=false. Default is true.

For FX Forwards, the RollOver netting type should not contain the product type as for FX Forwards, the new trade is FX Swap. Otherwise, the rolled over trade and the new trade will not be netted together.

3. Extending FX Trades

To process trade rollovers for FX trades, please do so from the FX Deal Station, not through this window.

For information on this process, refer to FX Lifecycle.

For information on this process, refer to FX Lifecycle.

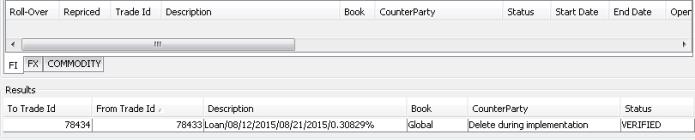

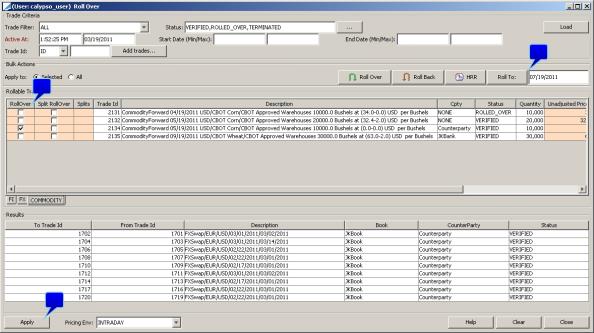

4. Extending Commodity Forward Trades

Select the COMMODITY panel.

For a Complete Rollover

Step 1 - Select the RollOver checkbox of the trade you would like to roll over.

Step 2 - Set the roll date for the rollover. The default roll date is set to the settlement date plus the number of trading days between the creation date and the settlement date. Therefore the new trade has the same duration as the original.

Step 3 - Click Apply.

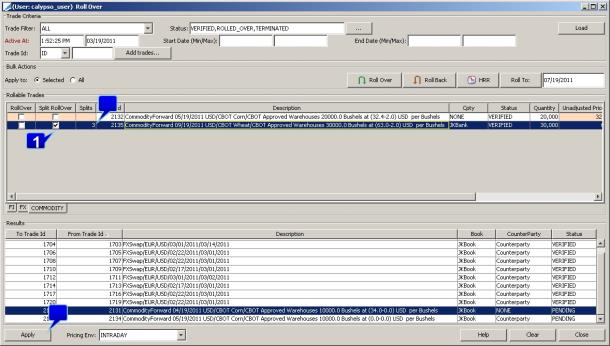

For a Split Rollover

Step 1 - Select the Split Rollover checkbox.

Step 2 - Enter the number of splits in the Splits column.

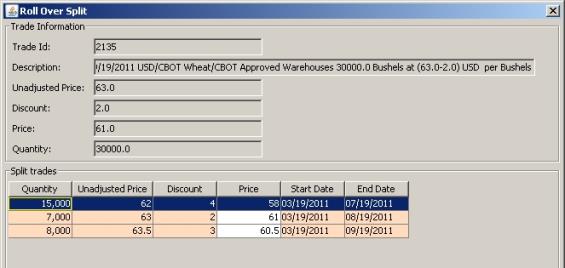

Step 3 - Click Apply. This displays the Roll Over Split window. In this window, you can edit any of the fields in pink that pertain to the rollover and click Roll Over.

The newly created trade ids are displayed in the results pane of the Rollover window.