FX Lifecycle

You may roll over, roll back or terminate an FX trade.

| • | Rollover trades - your corporate client may not want to deliver on the value date as specified in the contract. You can agree to a new value date to extend the contract for another term. When you rollover the original trade, a new trade is created, which is an FX Swap. For the FX Swap, you can use the current market rate when processing the rollover. You can also use the exchange rate on the original trade as the base for the exchange rate on the forward leg; this is a Historical Rate Rollover (HRR). |

| • | Rollback trades - your corporate client may want to deliver earlier than the value date specified in the contract. You can agree to a new value date to bring back the trade. When you rollback the original trade, a new trade is created, which is an FX Swap. You can use the current market rate or the historical rate. |

| • | The termination process for FX trades rolls back the forward position to the spot date through a roll back (HRB) trade. A spot trade window displays, allowing you to enter a spot trade to cancel out the spot position. |

1. FX Lifecycle Trade Keywords

The following trade keywords attach to the trades.

The Rollover or Rollback trade contains the following trade keywords:

| • | RolledOverTo or RolledBackTo (specifies the trade ID of the FX Swap extension trade) |

| • | NegotiatedCurrency |

Trade routing keywords can be copied from the parent trade during a rollover or rollback by entering them in the keywords2CopyUponRolloverAndRollback domain. For example, to copy the Trade Region, add TradeRegion to the domain. If values such as TradeRegion or TradePlatform are not added to this domain, trade routing will be based on book attributes.

The FX Swap trade contains the following keywords:

| • | FXRollOverFarFwdPt (the forward points for the far leg) |

| • | FXRollOverNearFwdPt (the forward points for the near leg) |

| • | OrigTrade (the trade ID of the rollover or rollback trade) |

| • | OrigTradeDt (the trade date of the rollover or rollback trade) |

| • | FXTerminationTradeDate |

| • | FXTerminationDate |

| • | TerminationReason |

| • | TerminationType |

When using a Historic Rate Rollover, additionally the following keywords are populated:

| • | FXHRRFundingIntRate |

| • | FXHRRFundingPtPips |

| • | FXHRRHistoricalRate |

| • | FXHRRFirstRollDt |

When terminating a trade, the following keywords are set on the rollback trade:

| • | FXRolloverFarFwdPt |

| • | FXRollOverNearFwdPt |

| • | FXHRRFundingIntRate |

| • | FXHRRFundingPtPips |

| • | FXHRRHistoricalRate |

| • | FXTerminatePosTo (on the swap trade, trade id of close out trade) |

| • | FXTerminatePosOrigin |

| • | FXTerminatePosFrom |

| • | NegotiatedCurrency |

| • | OrigTrade |

| • | OrigTradeDt |

| • | RatesPrecision |

| • | RolledBackFrom (the initial trade which has been rolled back) |

When terminating a trade, the following keywords are set on the initial trade:

| • | FXPricingEnv |

| • | FXTerminatePosDest (trade id of the closeout trade) |

| • | NegioatedCurrency |

| • | RatesPrecision |

| • | RolledBackTo (is the rollback trade, the spot position) |

| • | FXTerminationTradeDate |

| • | FXTerminationDate |

| • | TerminationReason |

| • | TerminationType |

NOTE: The keywords FXTerminationTradeDate, FXTerminationDate, TerminationReason and TerminationType are updated for FX termination related FX Swap and position offset FX Spot trades when they are being created. When multiple partial termination actions are applied on the same trade, the contents are stacked in these keywords of the original trade and the keywords are propagated to the associated FX Swap trade and the position offset FX Spot trade.

If an undo termination is applied, the related information is removed from the keywords in the original trade and the valid ones are left.

2. Workflow Setup

You need the following transitions on the trade workflow:

VERIFIED - ROLLBACK - ROLLED

ROLLED - ROLLOVER - ROLLED

ROLLED - ROLLBACK - ROLLED, Reject rule

Netting

The RollOver netting type can be used to net together the rolled over trade and the new trade.

It should not contain the product type as for FX Forwards, the new trade is FX Swap. Otherwise, the rolled over trade and the new trade will not be netted together.

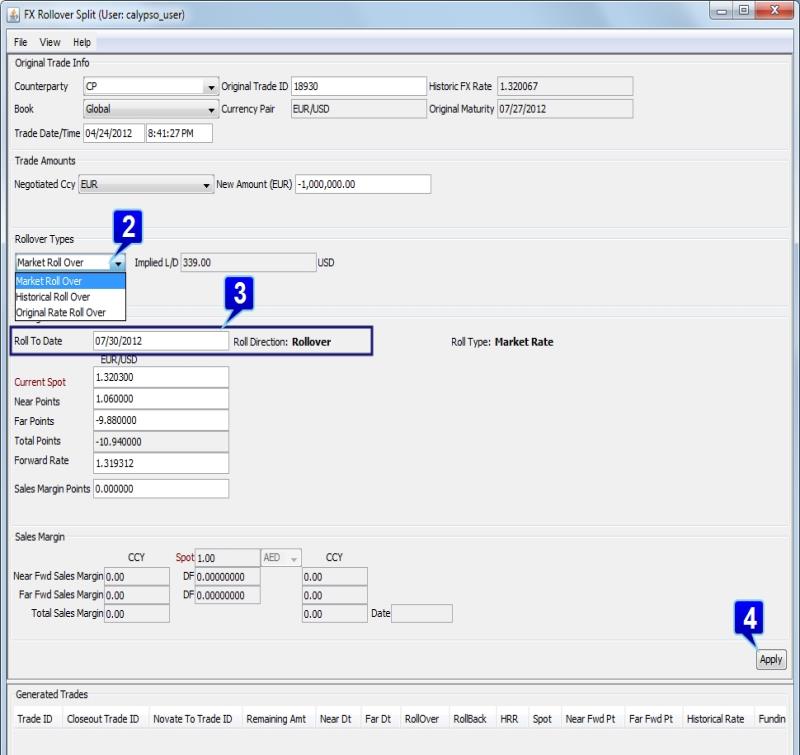

3. Processing Rollovers & Rollbacks

Follow these steps to extend a trade:

Step 1 - Open the trade that you would like to rollover or rollback.

Step 2 - Select the Rollover Type: Market Roll Over, Historical Roll Over or Original Roll Over.

| • | Market Roll Over - Use current market rate |

| • | Historical Roll Over - Use the exchange rate on the original trade as the base for the exchange rate on the forward leg |

| • | Original Rate Rollover - Pay just the forward points to rollover the trade |

Step 3 - Enter the value date for the new trade in the Roll To Date field. The date entered determines if you are doing a rollback or a rollover.

Step 4 - Modify any fields you wish to and click Apply.

Ⓘ [NOTE: The rollover amount in total cannot exceed the outstanding trade amount]

When performing partial rollovers, to prevent rolling over more than the outstanding amount, you can add the “rolled over” status to the domain “tradeRolloveredStatus” – For example ROLLED. Make sure that this corresponds to the status configured in the workflow.

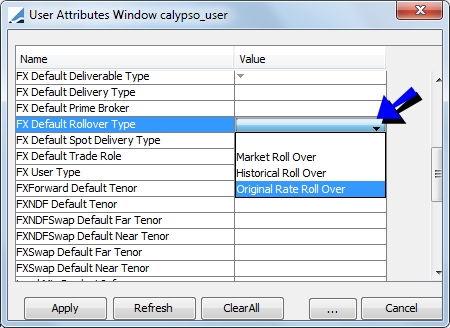

You may set the roll type in the User Defaults window so that the specific roll type is applied to the FX Rollover Split window whenever you open the Deal Station window (Configuration > User Access Control > User Defaults).

Ⓘ [NOTE: The Sales Margin Panel uses the Current Spot Rate for margin calculation and displays the Current Spot Rate only irrespective of Rollover or Rollback]

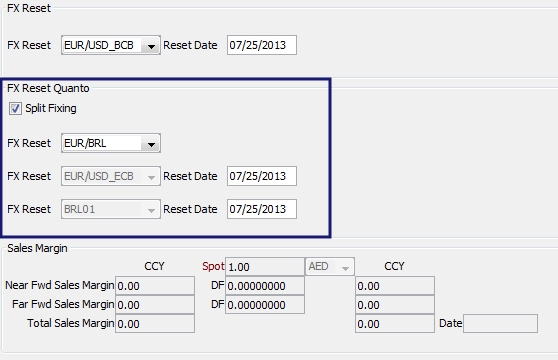

3.1 Third Currency Quanto Rollovers & Terminations

When a quanto currency is used for an FXNDF trade, an additional area is available on the Rollover or Termination window allowing you to edit reset information for the quanto currency.

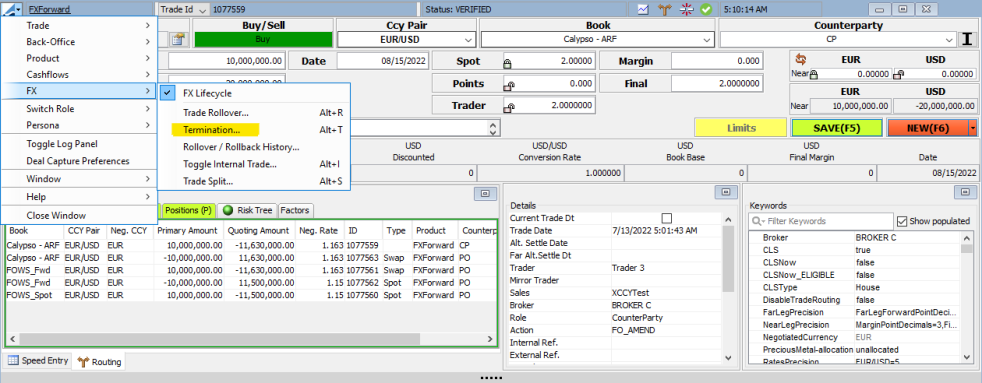

4. Terminating a Trade

An FX transaction may be terminated before the settlement date. The termination process for FX trades rolls back the forward position to the spot date through a roll back (HRB) trade. In order to handle the risk of terminating an FX trade and offsetting the appropriate positions, a spot trade window displays allowing you to enter a spot trade to cancel out the spot position. This is called a Termination - Buyback. There is also another process called Termination - Novation. Counterparty novation is a form of transferring the entire position from one counter party to another counterparty.

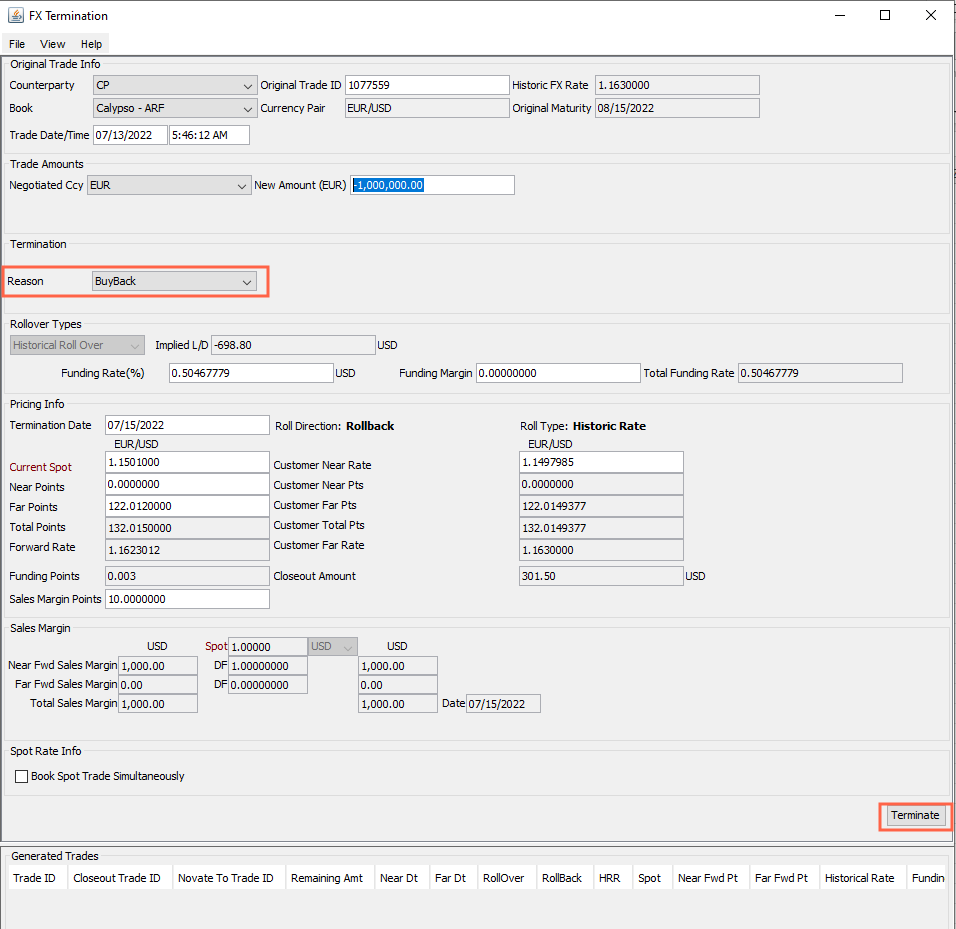

Below is an example of how to conduct a termination.

Step 1 - Open the trade that you would like to terminate.

Step 2 - Select a reason for the Termination:

| • | Buy Back - completely terminating the FX transaction. |

| • | Novation - transferring entire position from one counterparty to another. |

Enter any additional information for the termination and click Terminate.

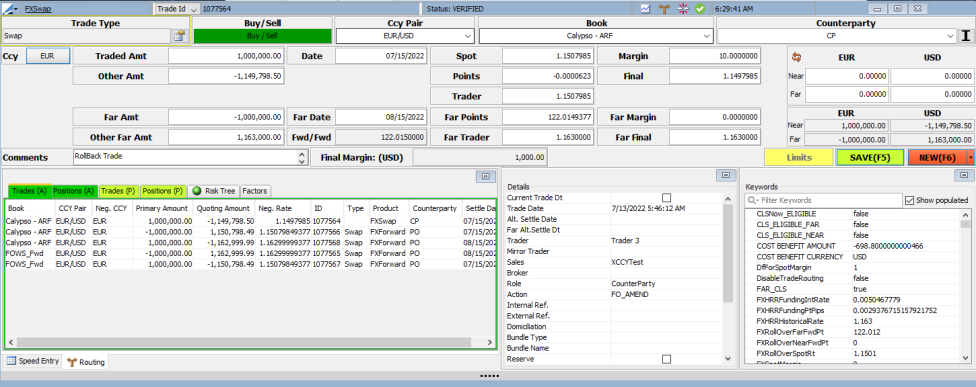

Step 3 - A new Swap trade is created. The far leg of the swap will offset the old forward trade. The near leg of the swap will offset the new Spot trade.

A new Spot trade is created. You are prompted to save the new Spot trade in order to offset the near leg of the Swap. Save the Spot trade in order to fully terminate the trade.

The status of the initial trade moves to ROLLED.

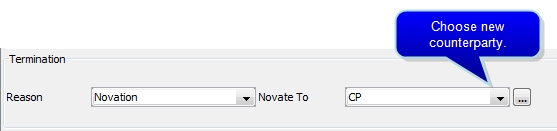

4.1 Novation - Termination

Novation is a form of transferring the entire position from one counterparty to another counterparty. Similar to a Buy Back Rollback, the full amount of the trade is terminated and the new trade has a new counterparty. When you select Novation as the termination reason, you may then select the new counterparty for the trade.

A new swap trade is generated from the termination and the original trade status moves from VERIFIED to ROLLED. A new spot trade is generated from the FX Termination that is known as the close out trade. The difference with a novation termination is that there is no warning message to save the spot trade. It is automatically saved.

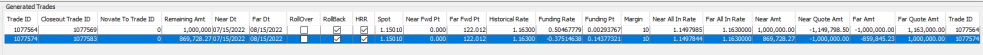

4.2 Summary of Trades

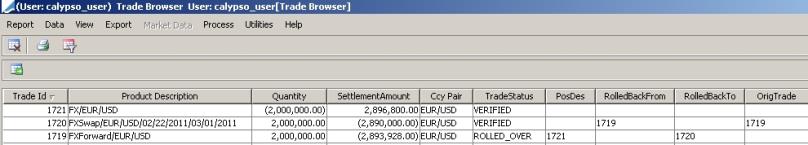

Below is an example of how a rolled over trade appears in the Trade Browser.

4.3 FX Rollover Field Descriptions

Original Trade Info

|

Field |

Description |

|

Counterparty |

Counterparty for the original trade |

|

Original Trade ID |

The trade Id for the original trade |

|

Historic FX Rate |

The rate used in the original trade |

|

Book |

The book for the original trade |

|

Currency Pair |

Currency pair for the original trade |

|

Original Maturity |

Settle date for the original trade |

| Trade Date / Time |

Current trade date and time for the newly rolled swap trade |

Trade Amounts

|

Field |

Description |

|

Negotiated Ccy |

The desired currency of the position to be rolled |

|

New Amount (neg ccy) |

Amount of the position, in negotiated currency, which is to be rolled |

Rollover Types

|

Field |

Description |

|||||||||

|

Rollover Types |

Select the desired rollover type:

|

|||||||||

|

Implied L/D |

The implied loss and gain for the customer if the rollover or rollback position is applied. |

Pricing Info

|

Field |

Description |

|

Roll to Date |

The date to which the original trade will be rolled. When this date is after the settle date of the original trade, the rollover action is applied. When this date is before the settle date of the original trade, the rollback action is applied. |

|

Roll Direction |

This displays either Rollover or Rollback, depending on the Roll to Date. |

|

Roll Type |

The calculation method used to roll the trade. |

|

Current Spot |

The spot rate generated from the market data when a rollover action is applied |

|

Near Points |

The near forward points of the original trade |

|

Far Points |

The far forward points generated from the market data |

| Total Points |

Far Points minus Near Points |

|

Forward Rate |

Customer Far Rate minus Customer Near Rate |

|

Near/Far Margin Points |

The sales margin from the original trade (Note: select View > Dual Sales Margin to view the Far Margin Points.) |

Sales Margin

|

Field |

Description |

|

Near Fwd Sales Margin |

The sales margin that is applied to the near leg of the newly rolled swap trade |

|

Far Fwd Sales Margin |

The sales margin that is applied to the far leg of the newly rolled swap trade |

|

Total Sales Margin |

The total sales margin that is applied to the newly rolled swap trade |

|

Date |

The date when the sales margin will be applied to the newly rolled swap trade |

Spot Rate Info

Book Spot Trade Simultaneously - When selected, the closeout trade will be saved automatically without manual intervention. This checkbox is false by default. It can be set to default to true using the FX Termination Book Spot Trade Simultaneously attribute in the User Defaults window.

Results

The following table describes the fields in the Rollover Window for the results. You cannot edit these fields.

|

Field |

Description |

|

Trade ID |

Specifies the Trade Id of the extension trade. Double-click to open the trade. |

|

Closeout Trade ID |

The trade ID of the trade to close out the position when the novation method is applied for termination action. Double-click to open the trade. |

|

Novate to Trade ID |

The trade ID of the novation trade when the novation method is applied for termination action. Double-click to open the trade. |

|

Remaining Amt |

The remaining amount of the neg ccy position of the original trade |

|

Near Dt. |

Settle date of the near leg of the newly created swap trade |

|

Far Dt |

Settle date of the far leg of the newly created swap trade |

|

RollOver |

When this box is checked, the trade is a rollover. |

|

RollBack |

When this box is checked, the trade is a rollback. |

|

HRR |

If this box is checked, the HRR method is applied to the trade. |

| Spot |

The spot rate generated from market data when the trade was rolled. |

|

Near Fwd Pts |

Forward points of the near leg of the newly created swap trade. |

| Far Fwd Pts |

Forward points of the far leg of the newly created swap trade. |

|

Historical Rate |

The final rate of the original trade |

|

Funding Rate |

Interest rate of the negotiating currency that is used to calculate HRR |

|

Funding Pt |

These points are calculated by the system. They absorb the gain and loss of the customer when the HRR method is applied. |

|

Margin |

The sales margin that is applied for the leg that is rolled in the newly created swap trade |

|

Near All In Rate |

The near all in rate in the newly created swap trade |

|

Far All In Rate |

Far all in rate in the newly created swat trade |

|

Near Amt |

Near leg amount of the negotiated currency in the newly created swap trade. |

|

Near Quote Amt |

Near leg amount of the non-negotiated currency in the newly created swap trade |

|

Far Amt |

Far leg amount of the negotiated currency in the newly created swap trade |

|

Far Quote Amt |

Far leg amount of the non-negotiated currency in the newly created swap trade. |

FX Swap Near and Far Leg Rate Calculation

The following tables describe when to add or subtract the funding points to/from the historical rate to get the rate for the far or near leg of the FX Swap in rollover and rollback trades, respectively. This is from the bank’s perspective. The original trade is an FX Forward.

|

Original Trade |

RO Trade Near Leg |

RO Trade Far Leg |

RO Trade Spot Rate |

Profit/Loss |

Interest |

Funding Points |

|---|---|---|---|---|---|---|

|

Bank Buy USD Sell JPY |

Bank Sell USD Buy JPY |

Bank Buy USD Sell JPY |

If Spot Rate > Historical Rate |

Bank Profit: RECEIVED MORE JPY

on RO Far Leg than JPY PAID in original trade.

Customer Loss: PAID MORE JPY on RO Far Leg than JPY RECEIVED in original trade. |

Customer settles Loss at a later date: PAY interest. | SUBTRACT FUNDING PT

Customer Receives JPY on RO Far Leg. Far Rate = Historical Rate - Funding Pt |

|

If Spot Rate < Historical Rate |

Bank Loss: RECEIVED LESS JPY on RO

Far Leg than JPY PAID in original trade.

Customer Profit: PAID LESS JPY on RO Far Leg than JPY RECEIVED in original trade. |

Customer settles Profit at a later date: RECEIVE interest. | ADD FUNDING PT

Customer Receives JPY on RO Far Leg. Far Rate = Historical Rate + Funding Pt |

|||

|

Bank Sell USD Buy JPY |

Bank Buy USD Sell JPY |

Bank Sell USD Buy JPY |

If Spot Rate > Historical Rate |

Bank Loss: PAID MORE JPY on RO Far

Leg than JPY RECEIVED in original trade.

Customer Profit: RECEIVED MORE JPY on RO Far Leg than JPY PAID in original trade. |

Customer settles Profit at a later date: RECEIVE interest. | SUBTRACT FUNDING PT

Customer Pays JPY on RO Far Leg. Far Rate = Historical Rate - Funding Pt |

|

If Spot Rate < Historical Rate |

Bank Profit: PAID LESS JPY on RO

Far Leg than JPY RECEIVED in original trade.

Customer Loss: RECEIVED LESS JPY on RO Far Leg than JPY PAID in original trade. |

Customer settles Loss at a later date: PAY interest. | ADD FUNDING PT

Customer Pays JPY on RO Far Leg. Far Rate = Historical Rate + Funding Pt |

|||

|

Bank Buy USD Sell JPY |

Bank Buy USD Sell JPY |

Bank Sell USD Buy JPY |

If Spot Rate > Historical Rate |

Bank Profit: RECEIVED MORE JPY

on RB Far Leg than JPY PAID in original trade.

Customer Loss: PAID MORE JPY on RB Far Leg than JPY RECEIVED in original trade. |

Customer settles Loss early: RECEIVE interest. | ADD FUNDING PT

Customer Receives JPY on RB Near Leg. Near Rate = Historical Rate + Funding Pt |

|

If Spot Rate < Historical Rate |

Bank Loss: RECEIVED LESS JPY on RB

Far Leg than JPY PAID in original trade.

Customer Profit: PAID LESS JPY on RB Far Leg than JPY RECEIVED in original trade. |

Customer settles Profit at a later date: RECEIVE interest. | SUBTRACT FUNDING PT

Customer Receives JPY on RB Near Leg. Near Leg = |

|||

|

Bank Sell USD Buy JPY |

Bank Sell USD Buy JPY |

Bank Buy USD Sell JPY |

If Spot Rate > Historical Rate |

Bank Loss: PAID MORE JPY on RB Far

Leg than JPY RECEIVED in original trade.

Customer Profit: RECEIVED MORE JPY on RB Far Leg than JPY PAID in original trade. |

Customer settles profit early: PAY interest. | ADD FUNDING PT

Customer Pays JPY on RB Near Leg: Near Leg = |

|

If Spot Rate < Historical Rate |

Bank Profit: PAID LESS JPY on RB

Far Leg than JPY RECEIVED on original trade.

Customer Loss: RECEIVED LESS JPY on RB Far Leg than JPY PAID on original trade. |

Customer settles Loss early: RECEIVE interest. | SUBTRACT FUNDING PT

Customer Pays JPY on RB Near Leg: Near Rate = Historical Rate - Funding Pt |

5. Extending FX Trades

Click the FX tab to bring the panel to the front of the window.

5.1 Extension Types

You can process the following types of trade extensions on FX trades:

| • | Rollover Trades — Your corporate client may not want to deliver on the value date as specified in the contract. You can agree to a new value date to extend the contract for another term. Rollover the original trade, creating a new trade, which is an FX Swap. |

For the FX Swap, you can use the current market rate when processing the rollover. You can also use the exchange rate on the original trade as the base for the exchange rate on the forward leg; this is a Historical Rate Rollover (HRR).

| • | Rollback Trades — Your corporate client may want to deliver earlier than the value date specified in the contract. You can agree to a new value date to bring back the trade. Rollback the original trade, creating a new trade, which is an FX Swap. You can use the current market rate or the historical rate. |

5.2 Processing Rollovers

Follow these steps to extend a trade:

1. Check the corresponding box: RollOver or RollBack.

2. If you want to rollover the trade using historical rates (rate captured in the trade), also check HRR.

3. Enter the value date for the new trade in the Roll To Dt field.

4. You can modify any of the fields that appear with a pink background.

5. Verify all information on the trade and click Apply.

FX Rollover Trade Keywords

The following trade keywords attach to the trades.

The RollOver or RollBack trade contains the following trade keyword:

| • | RolledOverTo — specifies the Trade Id of the FX Swap extension trade. |

The FX Swap trade contains the following trade keywords:

| • | FXRollOverFarFwdPt — specifies the forward points for the far leg. |

| • | FXRollOverNearFwdPt — specifies the forward points for the near leg. |

| • | RolledOverFrom — specifies the Trade Id of the RollOver or RollBack trade. |