Cash Settlement

![]() Download PDF - Cash Settlement

Download PDF - Cash Settlement

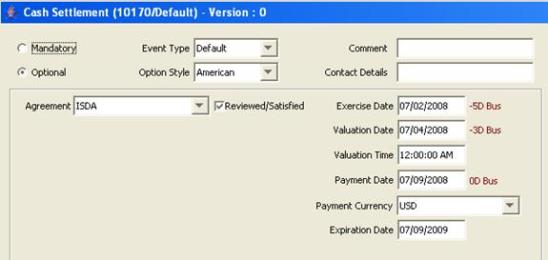

This document describes the settings of the Cash Settlement window (Product menu >Cash Settle Info in trade windows). It allows defining a termination schedule (or break clauses) for a trade.

You can specify default cash settlement values by agreement / rate index / currency using Configuration > Interest Rates > Cash Settlement Defaults.

See Cash Settlement Defaults for details.

See Cash Settlement Defaults for details.

You can review trades with break clauses using Trade Lifecycle > Termination > Cash Settlement.

Note that the definition and review of break clauses is for information purposes only. They do not control when a trade can actually be terminated. The termination process is manual in any case.

See Termination for details.

See Termination for details.

Environment Property

If the environment property CASH_SETTLEMENT_TRADE is set to True, and cash settlement details are defined for a trade, the trade status bar will display “Cash Settled Trade”.

Contents

- Entering Cash Settlement Details

1. Entering Cash Settlement Details

If cash settlement defaults have been created for the selected agreement / rate index / currency, the "Early Termination" section will be used as default values for Cash Settlement details.

| » | Enter the fields described below as needed then click Save. You can define multiple settlement details for different dates. |

Note that terminations are not enforced based on cash settlement details. The termination dates are for information purposes. However, if you terminate a trade at a specified date, the cash settlement details will be used to compute the settlement amount.

|

Fields |

Description |

|||||||||||||||||||||||||||||||||||||||

|

Mandatory / Optional |

Click the Mandatory or Optional radio button as needed. |

|||||||||||||||||||||||||||||||||||||||

|

Event Type |

Select the event type that triggers the cash settlement. The event type is populated for SwapsWire trades. Custom default values can be populated based on the event type. Refer to the Calypso Developer’s Guide for details. You can register new event types in the domain "cashSettleEvent". |

|||||||||||||||||||||||||||||||||||||||

|

Comment |

Enter a free form comment related to the event. |

|||||||||||||||||||||||||||||||||||||||

|

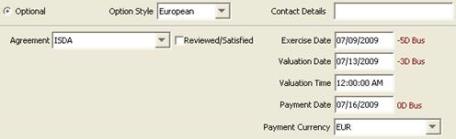

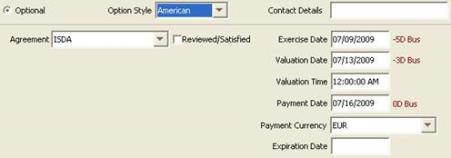

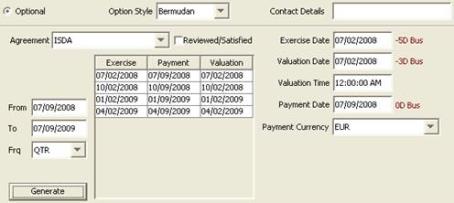

Option Style |

Only applies to optional cash settlements. Select the option style: European, American, or Bermudan. |

|||||||||||||||||||||||||||||||||||||||

|

Contact Details |

Enter free form contact information as needed. |

|||||||||||||||||||||||||||||||||||||||

|

Agreement |

You can select an agreement type, or ANY. It defaults to the agreement type defined in domain "CashSettleDefaultsAgreements". If Cash Settlement Defaults exist for the selected agreement, rate index and currency, they will be loaded. If a legal agreement of specified type is defined between the counterparty and the processing organization for the specified currency and product type, it can also drive default values on the settlement details. [NOTE: The legal agreement CANNOT be defined as "Master"] Attribute TERMINATION_APPENDIX_MID The attribute TERMINATION_APPENDIX_MID drives the following default values:

If TERMINATION_APPENDIX_MID = Yes or not set, it is set to MID. If TERMINATION_APPENDIX_MID = No, it is set to BID/ASK.

If TERMINATION_APPENDIX_MID = Yes or not set, it is set to False (unchecked). If TERMINATION_APPENDIX_MID = No, it is set to True (checked). Attributes CASH_SETTLE_MANDATORY_DATEROLL and CASH_SETTLE_OPTIONAL_DATEROLL The attributes CASH_SETTLE_MANDATORY_DATEROLL (mandatory agreement) and CASH_SETTLE_OPTIONAL_DATEROLL (optional agreement) drive the default value of the Date Roll conventions (Ex Date and Pay Date). You can create domains “laAdditionalField.CASH_SETTLE_MANDATORY_DATEROLL” and “laAdditionalField.CASH_SETTLE_OPTIONAL_DATEROLL” to hold the possible values. Attribute BermudanTradeDate The attribute "BermudanTradeDate" controls the Bermudan “From Date”. If true, the From Date is the Trade Date, otherwise, it is the start date of the swap. |

|||||||||||||||||||||||||||||||||||||||

|

Reviewed / Satisfied |

This checkbox appears checked when the trade has been reviewed in Trade Lifecycle > Termination > Cash Settlement (menu action For the Bermudan option style, the Reviewed/Satisfied checkbox can be set for each date.

|

|||||||||||||||||||||||||||||||||||||||

| Dates |

The label on the right-hand side of the dates defaults to Cash Settlement Defaults if any.

You can enter dates as “t<tenor>” to apply Trade Date + tenor, for example “t5d” is "Trade Date + 5 days". |

|||||||||||||||||||||||||||||||||||||||

|

European

|

||||||||||||||||||||||||||||||||||||||||

|

American

|

||||||||||||||||||||||||||||||||||||||||

|

Bermudan

Note that the values for the dates default from the trade’s start and end dates. If you enter a date shortcut (for example, 2y) in the To field, the application calculates the date from the value entered in the From field. See also legal agreement attribute BermudanTradeDate for defaults. The frequency and holiday calendars default to the payment details on the floating leg in the trade worksheet. The holiday calendars for the Exercise Date and Valuation Date also default to the floating leg payment details. |

||||||||||||||||||||||||||||||||||||||||

|

OptionCalcDialog

Days lag “D” can be business days or calendar days. Double-click the Bus label to switch to Cal as needed. For months lag “M” and years lag “Y”, the system uses calendar days only. The “No Tenor” checkbox only applies to days lag, when you enter more than 31 days. If you check the “No Tenor” checkbox, the offset will be not be converted to a tenor, as shown below for 35D.

Otherwise it will be converted to a tenor. Note that the conversion is for display only. The system always stores 35D.

For American and Bermudan options, you can enter the exercise fee in the Ex Schedule panel. For Bermudan options, select the frequency of the exercise dates. |

||||||||||||||||||||||||||||||||||||||||

|

Ex Date Convention |

Select the date roll convention to be applied when the termination date falls on a non-business day. Date roll conventions are described under Help > Date Roll Conventions. See legal agreement attributes CASH_SETTLE_MANDATORY_DATEROLL and CASH_SETTLE_OPTIONAL_DATEROLL for defaults. |

|||||||||||||||||||||||||||||||||||||||

|

Pay Date Convention |

Select the date roll convention to be applied when the payment date falls on a non-business day. Date roll conventions are described under Help > Date Roll Conventions. See legal agreement attributes CASH_SETTLE_MANDATORY_DATEROLL and CASH_SETTLE_OPTIONAL_DATEROLL for defaults. |

|||||||||||||||||||||||||||||||||||||||

|

Earliest Exercise Time |

Enter the earliest time on termination date when the option can be exercised. Defaults to Cash Settlement Defaults if any. |

|||||||||||||||||||||||||||||||||||||||

|

Expiration Time |

Enter the time at which the trade is terminated. Defaults to Cash Settlement Defaults if any. |

|||||||||||||||||||||||||||||||||||||||

|

Cash Settle Method |

Select a cash settlement method to compute the settlement amount. The cash settlement methods are:

(a) the amount payable by the Fixed Rate Payer as if the Fixed Rate were the Settlement Rate and (b) the amount payable by the Fixed Rate Payer under the relevant swap transaction. The discount rate will be equal to the Settlement Rate. The Cash Settlement Amount will be adjusted if the Optional Early Termination Date or the Mandatory Early Termination Date does not fall on the Fixed/Floating Rate Payer Payment Date.

|

|||||||||||||||||||||||||||||||||||||||

| MMV Applicable CSA | Select the MMV Applicable CSA. Options include No CSA, Existing CSA, and Reference VM CSA. Default is "Existing CSA" for OET, and blank for MET. This field is inactive unless one of the following cash settlement methods are selected: Mid-market Valuation (Indicative Quotations), Mid-market Valuation (Indicative Quotations) – Alternate method, or Mid-market Valuation (Calculation Agent Determination). | |||||||||||||||||||||||||||||||||||||||

| Cash Collateral Currency | Select the Cash Collateral Currency. Populated in the dropdown list is the CCY list from Domain Values. Default is blank. This field is inactive unless one of the following cash settlement methods are selected: Mid-market Valuation (Indicative Quotations), Mid-market Valuation (Indicative Quotations) – Alternate method, or Mid-market Valuation (Calculation Agent Determination). | |||||||||||||||||||||||||||||||||||||||

| Agreed Discount Rate | A Rate index can be selected from the dropdown list. For MMV, the default value is blank. This field is inactive unless one of the following cash settlement methods are selected: Mid-market Valuation (Indicative Quotations), Mid-market Valuation (Indicative Quotations) – Alternate method, or Mid-market Valuation (Calculation Agent Determination). | |||||||||||||||||||||||||||||||||||||||

|

Rate Source |

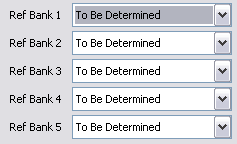

You can select a rate source or none (empty). You can add rate sources to the "RateSource" domain. If you select none, you have to select a set of reference banks.

If you select OTHER_SOURCE, you need to select a rate index from the Rate Index field.

|

|||||||||||||||||||||||||||||||||||||||

|

Quotation Rate |

Select the instance of the quotation rate that you want to use: MID, BID, or ASK. See legal agreement attribute TERMINATION_APPENDIX_MID for defaults. |

|||||||||||||||||||||||||||||||||||||||

| Calculation Agent |

The Calculation Agent is the party that calculates settlement amounts that are owed between participating parties under a particular transaction for purposes of invoicing. The following options are available.

Ⓘ [NOTE: To customize the list of options for the Calculation Agent field, add the domain name "cashSettleCalcAgent" and then other domain values under the new name.] |

|||||||||||||||||||||||||||||||||||||||

|

Exercise Party Pays |

Check to indicate that the exercising party pays the settlement amount, otherwise the exercising party receives the settlement amount. See legal agreement attribute TERMINATION_APPENDIX_MID for defaults. |

|||||||||||||||||||||||||||||||||||||||

| Protected Party | "Non-Exercising Party" is the default value when Optional early termination is selected. "Both" is the default balue when Mandatory is selected. This field is inactive unless one of the following cash settlement methods are selected: Replacement Value (Firm Quotations), or Replacement Value (Calculation Agent Determination). | |||||||||||||||||||||||||||||||||||||||

| Exercise Party | Select the exercise party: Processing Org, Counterparty, or Mutual (both). | |||||||||||||||||||||||||||||||||||||||

| Prescribed Doc. Adj. | Select either Applicable or Not Applicable (default). This field is inactive unless the following cash settlement methods is selected: Replacement Value (Firm Quotations). | |||||||||||||||||||||||||||||||||||||||

|

Location |

Select a location. Defaults to Cash Settlement Defaults if any, or to the currency’s location otherwise. |

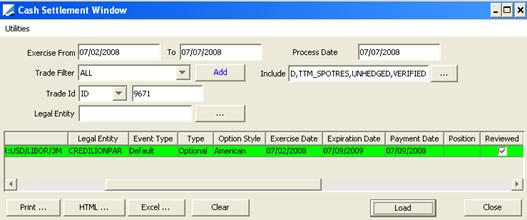

2. Reviewing Break Clauses

You can review trades with break clauses using Trade Lifecycle > Termination > Cash Settlement, before terminating a trade.

| » | Load and review break clauses as applicable. |

Enter search criteria and click Add to load break clauses.

Check the "Reviewed" checkbox, then click Load.

| » | When a break clause is reviewed, the Reviewed/Satisfied checkbox will appear checked on the Cash Settle Info window, and the trade is amended. |