Checking Collateral Sufficiency

You can check collateral sufficiency and process margin calls at the trade level. You can check collateral sufficiency using a scheduled task, and you can configure a sufficiency check to be automatically performed before a substitution or a security margin event is applied. The MARGIN_CALL exposure is checked and if it passes, then the collateral is sufficient.

Collateral sufficiency checks are supported on the following trades and sub-types:

| • | Repo - Standard |

| • | Repo - BSB |

| • | Repo - Triparty |

| • | SecLending - Sec Vs Sec |

1. Checking Collateral Sufficiency via Scheduled Task

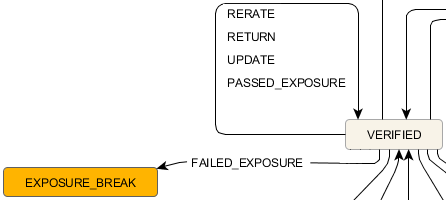

The SECFINANCE_EXPOSURE_CHECK scheduled task allows processing margin calls at the trade level. It can be run daily to calculate the MARGIN_CALL pricer measure on a selection of trades, and apply a Trade workflow action on each trade whose MARGIN_CALL is greater than 0, or the defined threshold, provided that you have an exposure check Trade workflow transition defined.

All trades that have failed, either for missing market data or for exposure break, are visible in the Task Station with the following event types and exception types:

Event types:

| • | EX_VALUATION_PROCESS |

| • | EX_VALUATION_PROCESS_FAILURE |

| • | EX_VALUATION_PROCESS_SUCCESS |

Exception types:

| • | VALUATION_PROCESS |

| • | VALUATION_PROCESS_FAILURE |

| • | VALUATION_PROCESS_SUCCESS |

Please refer to Calypso Task Station documentation for details on using the Task Station.

Please refer to Calypso Task Station documentation for details on using the Task Station.

Select a trade filter, a pricing environment, and a timezone.

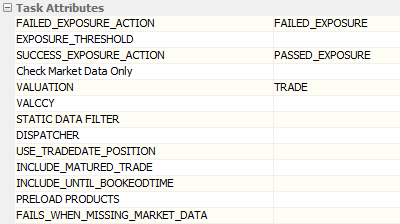

Select the MARGIN_CALL pricer measure, and select the task attributes as needed.

Task Attributes

| • | FAILED_EXPOSURE_ACTION – Select the mandatory action to be applied in case of exposure check failure. |

| • | EXPOSURE_THRESHOLD – You can enter an optional exposure break threshold amount. The absolute value of this amount will always be taken. Default is 0. |

| – | If the calculated (MARGIN_CALL - Exposure Threshold) ≤ 0, there is no exposure break and the workflow transition won't be triggered. |

| – | If the calculated (MARGIN_CALL - Exposure Threshold) > 0, there is an exposure break and the workflow transition will be triggered. |

| • | SUCCESS_EXPOSURE_ACTION – Select the optional action to be applied in case of exposure check success. |

| • | Check Market Data Only – You can set it to true to run the scheduled task only to check if market data are missing - Then set it to false to compute that actual valuation. |

| • | VALUATION – Mandatory currency to report results in. The choices are: TRADE, BASE, CURRENCY (currency specified by the VALCCY attribute), or CUSTOM (currency specified using Configuration > Books & Bundles > Book Valuation Ccy from the Calypso Navigator). |

| • | VALCCY – Enter a currency code if the VALUATION attribute is set to CURRENCY. Not used otherwise. |

| • | STATIC DATA FILTER – Optional static data filter for filtering trades. |

| • | DISPATCHER – Enter dispatcher config name to use. |

| • | USE_TRADEDATE_POSITION – When true, it loads the positions by trade date. When false, it loads the positions by settlement date (default). |

| • | INCLUDE_MATURED_TRADE – Set to true to include matured trades. |

| • | INCLUDE_UNTIL_BOOKEODTIME – Set to true/false. |

| – | If true, we include matured trades if Maturity Datetime is greater than Valuation Datetime. The Maturity Datetime is calculated using the Book EOD time. |

| – | If false, matured trades maturing on valuation date are not included. |

Ⓘ [NOTE: The Valuation Datetime is computed based on the timezone defined in the scheduled task. The Maturity Datetime is computed based on the book’s timezone]

| • | PRELOAD PRODUCTS – Set to true to pre-load the products. |

| • | FAILS_WHEN_MISSING_MARKET_DATA – Set to true to have the task fail when there is missing market data. Default is false. |

2. Checking Collateral Sufficiency on Substitution and Security Margin Actions

You can configure an exposure check to be automatically performed before a substitution or a security margin event is applied.

See Applying Repo Actions for details on these actions.

See Applying Repo Actions for details on these actions.

See Applying Repo Actions for details on these actions.

See Applying Repo Actions for details on these actions.

See "Applying Repo Actions" in Calypso Repo Trading documentation for details on these actions.

See "Applying Repo Actions" in Calypso Repo Trading documentation for details on these actions.

| » | Add the domain SecFin_Exposure_Check with value "true". |

| » | Add the domain SecFin_Action_Check and set the value as the Trade workflow action to applied in case of exposure check success. |

Ensure that you have a Trade workflow transition defined for this scenario.

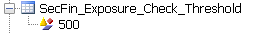

| » | You can enter an optional exposure break threshold amount. Add the domain SecFin_Exposure_Check_Threshold with the threshold amount as the value. The absolute value of this amount will always be taken. Default is 0. |

| – | If the calculated (MARGIN_CALL - Exposure Threshold) ≤ 0, there is no exposure break. |

| – | If the calculated (MARGIN_CALL - Exposure Threshold) > 0, there is an exposure break. |

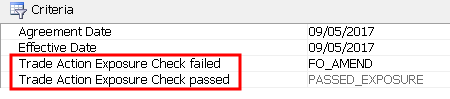

When the exposure check is configured, the "Trade Action" field in the Substitution Dialog window / Security Margin Dialog window is replaced by the "Trade Action Exposure Check failed" and "Trade Action Exposure Check passed" fields.

If the exposure check fails, then the action selected in the "Trade Action Exposure Check failed" field is applied.

If the exposure check passes, then the action defined in the "Trade Action Exposure Check passed" field is applied. This value is populated from the SecFin_Action_Check domain and is not editable in the action window.

In the case of applying a security margin decrease to a reverse repo only, if the exposure check fails, then the action will be blocked.