Scenario Analysis Overview

The Scenario analysis provides advanced configuration features, and it is recommended to use the Sensitivity analysis or the Simulation analysis instead.

Should you decide to use the Scenario Analysis, it is strongly recommended that you contact your Calypso representative for configuration advice.

The Scenario analysis allows users to define different market data scenarios (using any type of perturbation) to be applied to a set of trades, and calculates risk measures for those scenarios. Scenarios are specified using the Scenario Editor.

The Scenario analysis can be run using the following methods:

| • | Using the scheduled task RISK_ANALYSIS to save results to the database and/or to a file - Saved results can be viewed in the Calypso Workstation using the risk servers. |

| • | In real-time using the risk servers - The results are displayed in the Calypso Workstation. |

See Calypso Workstation for details.

See Calypso Workstation for details.

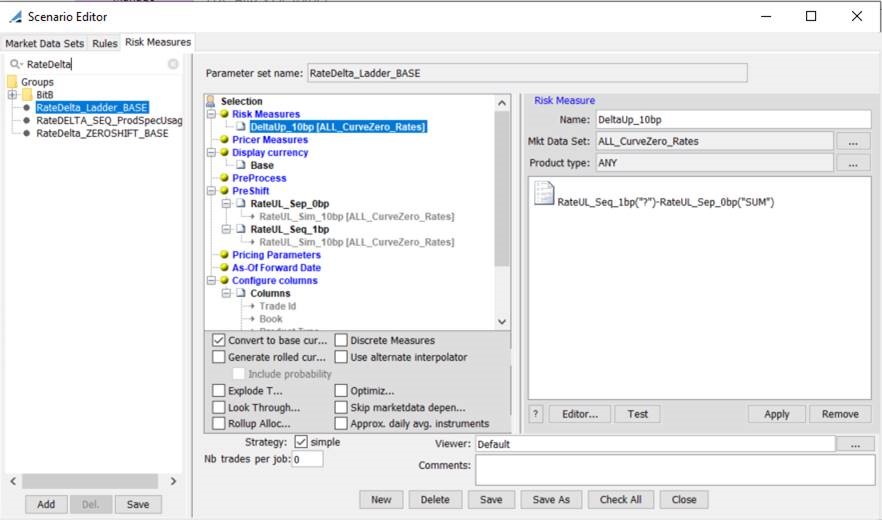

Scenario Editor

Scenario Editor allows defining scenarios for perturbing market data and applying the perturbations.

A scenario is comprised of a set of market data to be perturbed, a set of perturbation rules, and a set of risk measures that compute the results of perturbing the market data.

From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Scenario

Editor (menu action risk.ScenarioParamViewer)

to invoke the Scenario Editor window as shown below. The Risk Measure panel is selected by default.

| » | Select the Market Data Sets panel for defining market data sets that will be perturbed. |

See Defining Market Data Sets for details.

See Defining Market Data Sets for details.

| » | Select the Rules panel for defining perturbations rules. |

See Defining Perturbation Rules for details.

See Defining Perturbation Rules for details.

| » | Select the Risk Measures panels for defining risk measures. |

See Defining Risk Measures for details.

See Defining Risk Measures for details.

Executing Scenarios

See Sample Scenario Outputs to learn more about viewing results.

See Sample Scenario Outputs to learn more about viewing results.

Pricer Measures in Base Currency

All conversions happen in a cross-asset fashion, regardless of the pricer or product which produced the measures that are being converted. The pricing parameters and triangulation rules used for the conversion are taken for product type “ANY”: ADJUST_FX_RATE, INSTANCE_TYPE, CURVE_USAGE, QuoteUsage. If not specified for product type “ANY”, the default values are: ADJUST_FX_RATE = false, INSTANCE_TYPE = Last, CURVE_USAGE = MID, QuoteUsage = MID.

The pricing parameter FX_POINTS is always considered false.