Hedge Recommendation

![]() Download PDF - Hedge Recommendation Window

Download PDF - Hedge Recommendation Window

This function is currently off-catalog and requires a specific license agreement.

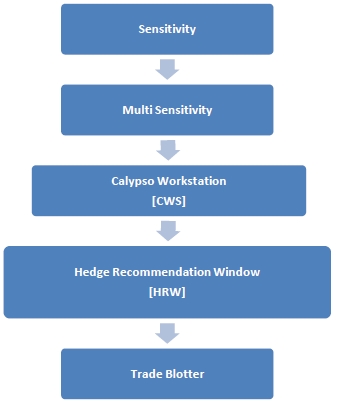

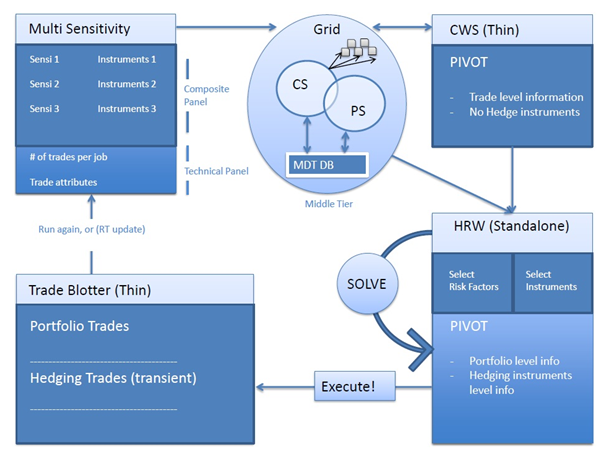

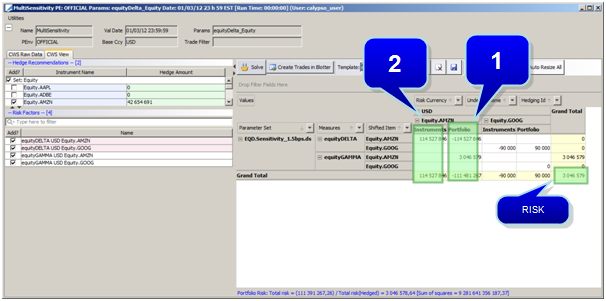

When you run the Multi Sensitivity analysis with a set of hedge instruments, you can bring up the Hedge Recommendation Window in the Calypso Workstation to add/remove hedging instruments on-the-fly and create the hedging trades.

1. Objectives and Contents

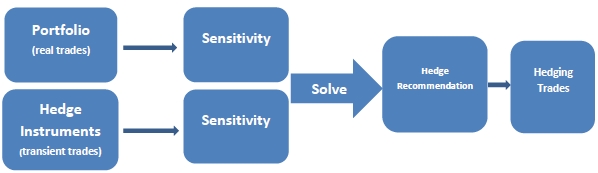

The Hedge Recommendation Window is designed to analyze the sensitivities of both a portfolio and an associated, user-defined, hedge instrument set in order to produce a hedge recommendation which effectively mitigates the portfolio’s risk.

Overview

Expanding upon the extensive and flexible Risk Analyses that Calypso already provides, a full Hedge Solution is now available. Through this solution, users can now not only view their risk to a variety of market variables, but view hedge recommendations for these risks as well – all in a custom pivot view.

Aligned with the flexibility of the underlying analyses, the hedge instruments used in these recommendations are completely user-defined and customizable. Users can also add custom risk measures and trade attributes into the reports for informational purposes.

Upon receiving a hedge recommendation, the trades and amounts can be fine tuned as needed then created directly into the Trade Blotter for quick pricing and booking. The Hedge Recommendation Window is integrated with the Calypso Workstation in order to provide a more fluid user experience.

| • | Global Hedge Recommendation Window with many sensitivities |

| • | Some sensitivities are to be hedged |

| • | Some sensitivities are information |

| • | Expected risk |

| • | Easy trade creation |

2. System Configuration

Global Picture

2.1 Sensitivity Analysis

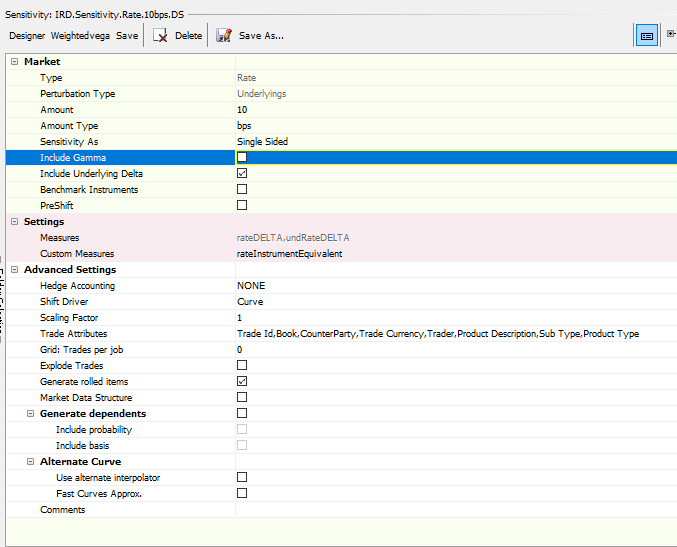

The first step is to define the parameters of one or more sensitivity reports. These parameters include, among others, analysis type, shift amount, shift type, and risk measures.

Sensitivity analyses can be configured using Configuration > Reporting & Risk > Analysis Designer.

Please see Sensitivity for general information on Sensitivity.

Please see Sensitivity for general information on Sensitivity.

2.2 Multi Sensitivity Analysis

The next step is to add one or more Sensitivity analyses into a single Multi Sensitivity, each with a unique set of hedging instruments.

Multi Sensitivity analyses can be configured using Configuration > Reporting & Risk > Analysis Designer.

Defining Hedge Instruments Sets

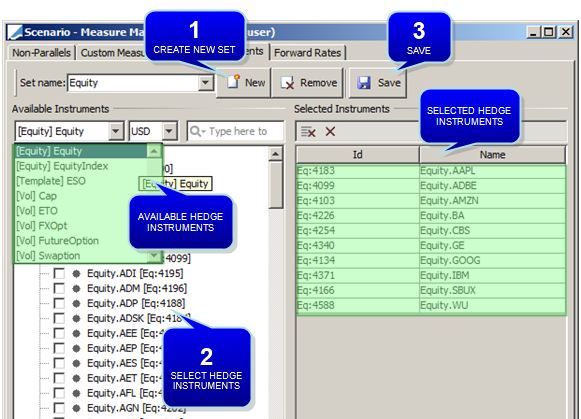

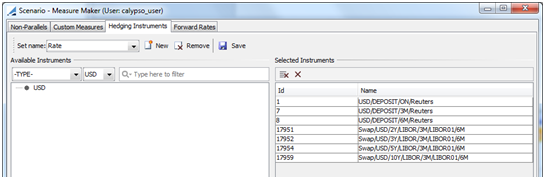

To hedge a portfolio’s risk, desired hedging instruments must be defined as a Hedge Instrument Set. This set is then specified to the relevant Sensitivity analysis in the Multi Sensitivity analysis parameters.

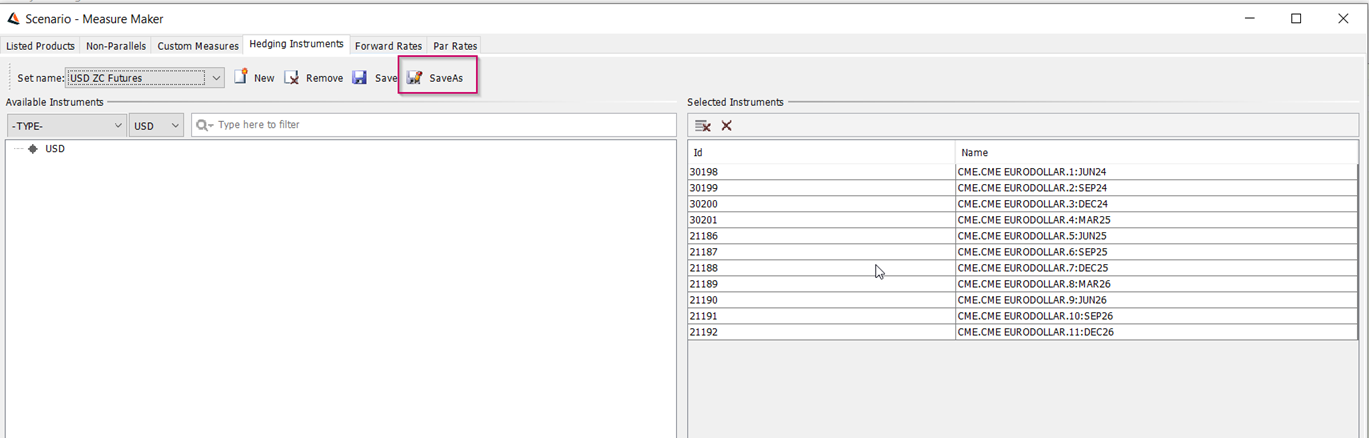

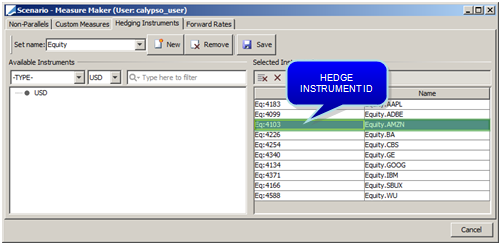

Hedge Instrument Sets are defined in the “Hedging Instruments” tab of the Measure Maker window. Available Hedging Instrument Sets can be selected in the Sensitivity Parameter List.

Click Designer to bring up the Measure Maker window.

Sample Hedge Instruments Set for "Equity"

Sample Hedge Instruments Set for "Rate"

New feature "Save as New" has been introduced for the Hedging Instrument Set in Scenario - Measure Maker.

Supported Hedge Instruments

| Where to Define Desired Hedge Instruments | Product |

|---|---|

| Currency Definitions | FX |

| Curve Underlyings | Bond |

| Curve Underlyings | Bond Future |

| Curve Underlyings | Cash |

| Curve Underlyings | Equity Index Future |

| Curve Underlyings | FRA |

| Curve Underlyings | FX Forward |

| Curve Underlyings | Future Money Market |

| Curve Underlyings | Future FX |

| Curve Underlyings | Swap |

| Curve Underlyings | Basis Swap |

Ⓘ [NOTE: For all option instruments except FX options, only absolute strikes are supported]

Also, an API allows defining custom Hedge Instruments - Please contact Calypso Helpdesk for details.

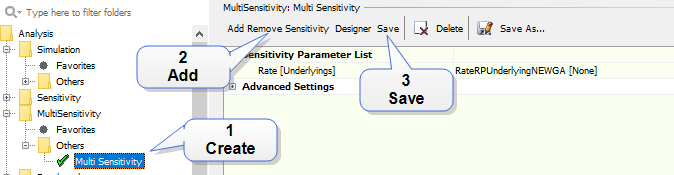

Defining Multi Sensitivity Parameters

Sample Multi Sensitivity Parameters

Step 1 - Right-click a MultiSensitivity folder in Analysis Designer, and choose "New Analysis" to add a parameter configuration. You will be prompted to enter a configuration name.

Step 2 - Click Add/Remove Sensitivity to add Sensitivity parameters as needed.

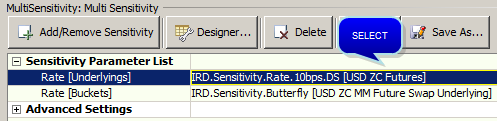

You can add a Hedge Instrument Set for a particular Sensitivity analysis in the Sensitivity Parameter List by clicking on the analysis name. The Hedge Instrument Set is optional and unique to each analysis component.

Sample Hedge Instrument Set Selection

| » | Click the Sensitivity parameters and select a Hedge Instrument Set. |

See Multi Sensitivity for information on Multi Sensitivity parameters.

See Multi Sensitivity for information on Multi Sensitivity parameters.

NOTES:

| • | The Hedge Instrument Set is optional for each line. |

| • | You can reuse the same Hedge Instruments Set in two or more lines |

| • | If there is no Hedge Instruments Set defined for a particular analysis, the risk factors calculated in that set will be considered as non-hedgeable. |

Step 3 - Save the parameters then add them to a calculation server so that the report can be displayed in the Calypso Workstation.

2.3 Calypso Workstation

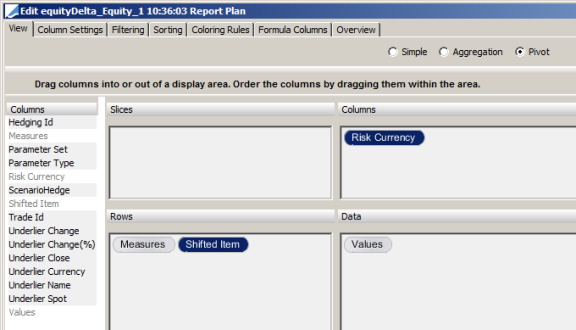

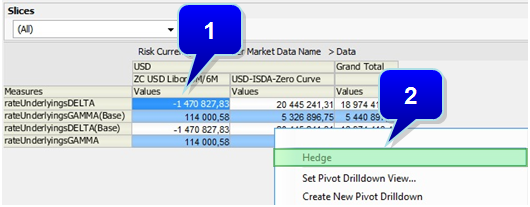

The option to launch the Hedge Recommendation Window from Calypso Workstation is available only when the current view is a pivot (with lines and columns) as depicted below.

Pivot View

Launch Hedge Recommendation Window

Step 1 - Right-click on any cell from Calypso Workstation.

Step 2 - Choose "Hedge" from the popup menu.

A message will indicate “Building Hedging Application."

NOTES:

| • | The “Hedge” option is available in Calypso Workstation only when the current view is a pivot. |

| • | A “Real Pivot” must be used (includes both lines and columns). |

| • | The Hedge Recommendation Window will pull data from the Presentation Server. |

3. Hedge Recommendation Window

You can produce the hedge recommendation on a cross-asset portfolio, fine tune the hedge recommendation, and create the trades in the Trade Blotter in one click.

3.1 Configuration

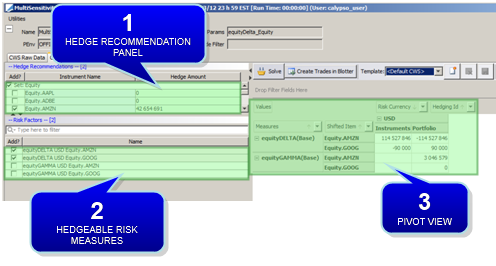

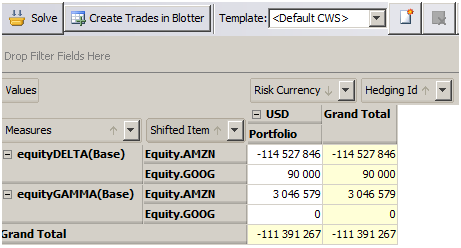

Pivot view

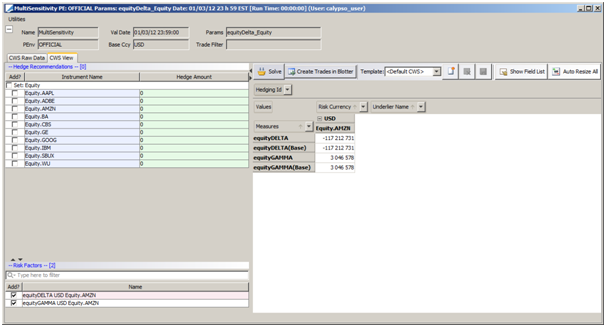

| • | Hedge Recommendation Panel: This panel allows the selection of hedge instruments, which is an aggregation of all instruments defined in the underlying Hedge Instrument Sets. |

| • | Risk Factors Panel: This allows the selection of the Risk Measures to be hedged by the Hedge Instruments. |

| • | Pivot Panel: This allows the user to see the sensitivities of the portfolio. |

All instruments for "Hedge Recommendations" and "Risk Factors" can now be "Select All" or "Unselect All."

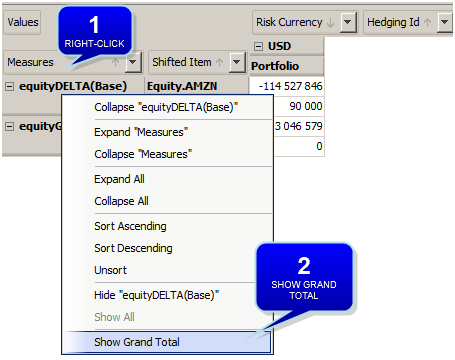

Show Grand Total

Right-click anywhere to add grand totals.

Sample Grand Total in Pivot View

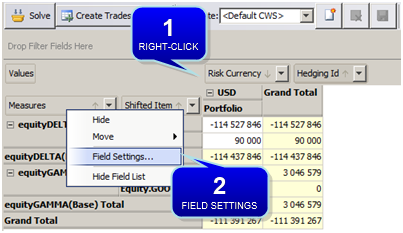

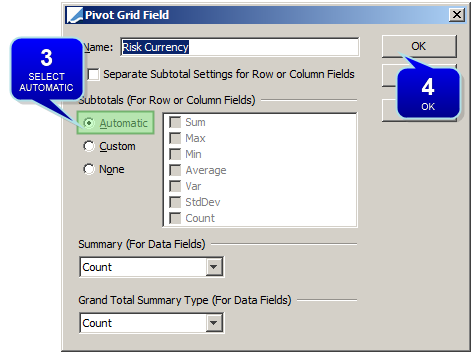

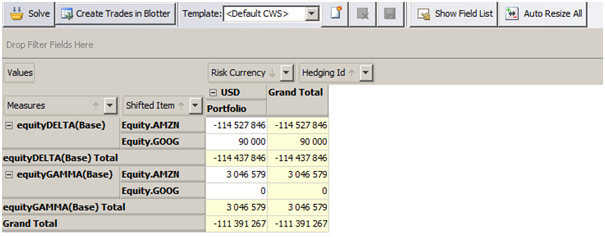

Subtotals

Right-click the field to which you want to add subtotals (for example Risk Currency).

Sample Subtotals by Risk Currency

NOTE: In order to specify the number of decimal places to display in the Hedge Recommendation Window, you can set the following environment property to the number of decimal places:

HRW_NUMBER_OF_DECIMALS = 2

Templates

Users can save a whole configuration layout consisting of:

| • | Hedge Instrument de-selection |

| • | Risk factor de-selection |

| • | Solver selection |

| • | Pivot panel view |

Click  to add/delete/save a template.

to add/delete/save a template.

Click on the dropdown list to select a previously saved template.

NOTES:

| • | The templates do not add/remove Hedge Instrument or Risk Factor selections. Rather, de-selections are applied to ensure that newly added variables (i.e. not a part of the initial template) are not mistakenly excluded. |

This is to ensure that if some instruments/risk measures that are not part of the template are added later, they will not be removed when the template is loaded.

| • | Hedge amounts and manually adjusted amounts of the Hedge Instruments are not saved as part of the template. |

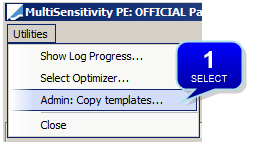

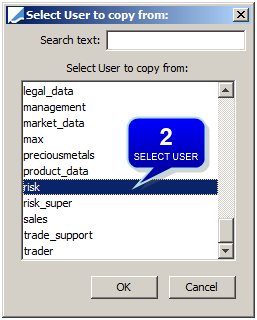

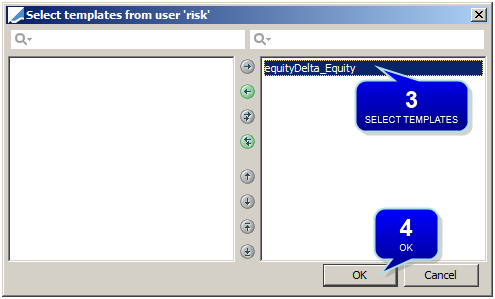

Copy Template

Choose Utilities > Admin: Copy templates.

Show Field List

Click Show Field List to show the list of item attribute fields as it exists in Calypso Workstation.

Auto Resize All

Click Auto Resize All to automatically adjust the cells to fit the content of the pivot grid.

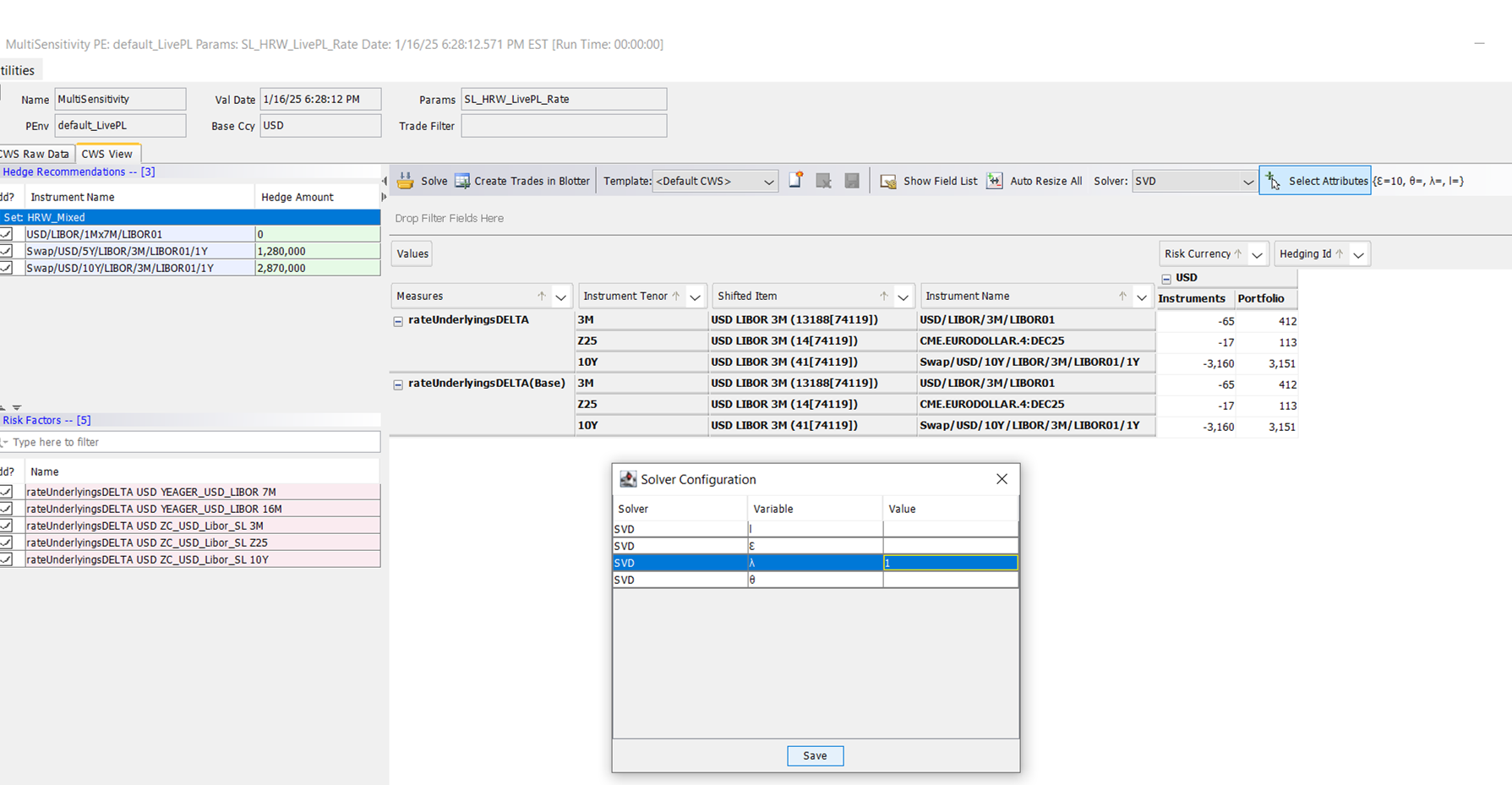

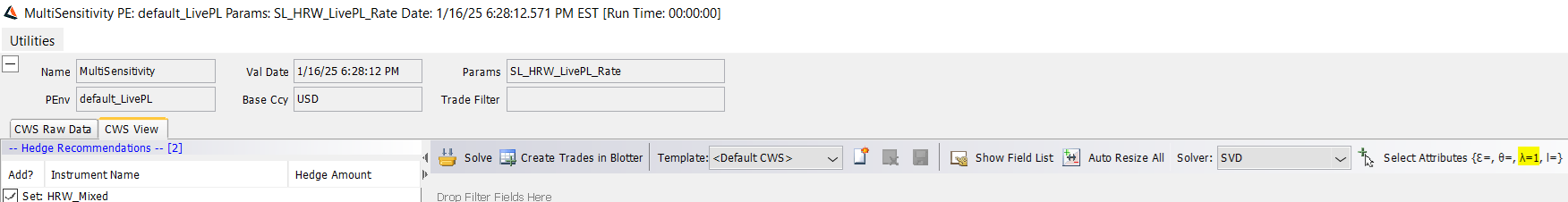

3.2 Solvers

Two Solvers are currently made available for solving the least squares problem to arrive at an optimal hedge: Levenberg-Marquardt (LM) and Singular Value Decomposition (SVD). The algorithm choice defaults to SVD since it is considered more stable and hence more suitable for solving the linear problem at hand compared to LM.

With the SVD solver, we also offer the following control variables that sophisticated users could use to influence solver behavior and arrive at a hedging solution that is more reasonable from their perspective.

3.2.1 Solver Variables

ι : Number of significant eigen values to be retained in order to reduce the dimensionality of the problem. Unit is an integer; default is 0, i.e., no truncation.

ϵ : Epsilon, restrict eigenvalues by specifying the cutoff relative to the highest eigenvalue.

Unit is % (10 is 10%, or 0.1); default is 0; i.e., no cutoff.

Recommend: ι=0, ϵ =10%, λ=0, θ=0

λ : Lambda, Tikhonov Regularization Threshold, reduce the complexity of a model by decreasing the importance of some variables; small regularization to avoid vastly uneven hedges.

Unit is bps (1 is 1 bps, or 0.0001); default is 0, i.e., no regularization.

Recommend: ι=0, ϵ =0, λ=1bps, θ=0

θ : Theta, setting Preprocessing Tolerance on elements of the Risk matrix relative to the highest risk value, such that smaller values do not impact the solver.

Unit is bps (1 is 1 bps, or 0.0001); default is 0, i.e., no preprocessing

Recommend: ι=0, ϵ=0, λ=0, θ=10bps

When SVD is chosen, variables ι, ϵ, λ, and θ can be specified by pressing the “Select Attributes” button, which opens the “Solver Configuration” window. After the user makes the desired inputs and hits “Save”, the configuration window closes, and the specified parameter values are displayed next to the “Select Attributes” button for easy reference. These choices persisted for the current session, i.e., as long as the HR Window is open, and used in all subsequent solving activity till the user chooses to update them.

3.2.2 Solver Mechanism and Limitations

The optimizers attempt to solve a mathematical problem of minimizing least squares of errors and refine the solution of hedge notionals down to machine precision to achieve this goal. As a result, the recommended results may not directly translate into actionable trades. For example, it would be hard to trade an interest rate swap with a precise notional of $1026809.27 as recommended by the solver. More importantly, the optimization techniques employed are highly sensitive to the problem inputs (i.e., risk profiles of the portfolio and candidate hedge trades). Depending on the input conditions, the solver may not converge to a proper solution and hence may show a hedge recommendation that does not make financial sense. Hence the users are expected to review and test the recommended solutions, modify them appropriately before accepting the same.

The solver is not optimized out of the box to take into consideration things such as trading fees, margin requirements. Also, if hedge instruments of the same type have the same, or relatively close expiry, the hedges will try to offset one another, and you can end up with unrealistic recommendations.

Please note it takes manual oversight, user calibration, or solver optimization to ensure recommendations make sense.

-

By default, the number of risk factors is limited to 1000

-

By default, the number of hedging instruments is limited to 1000

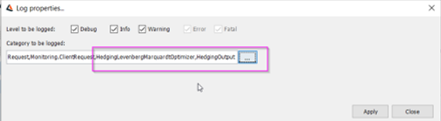

3.2.3 Logging for Troubleshooting

Use the HedgingSVDOptimizer, HedgingLevenbergMarquardtOptimizer & HedgingOutput log categories in debug mode (on Navigator) to get the details of solver input & output.

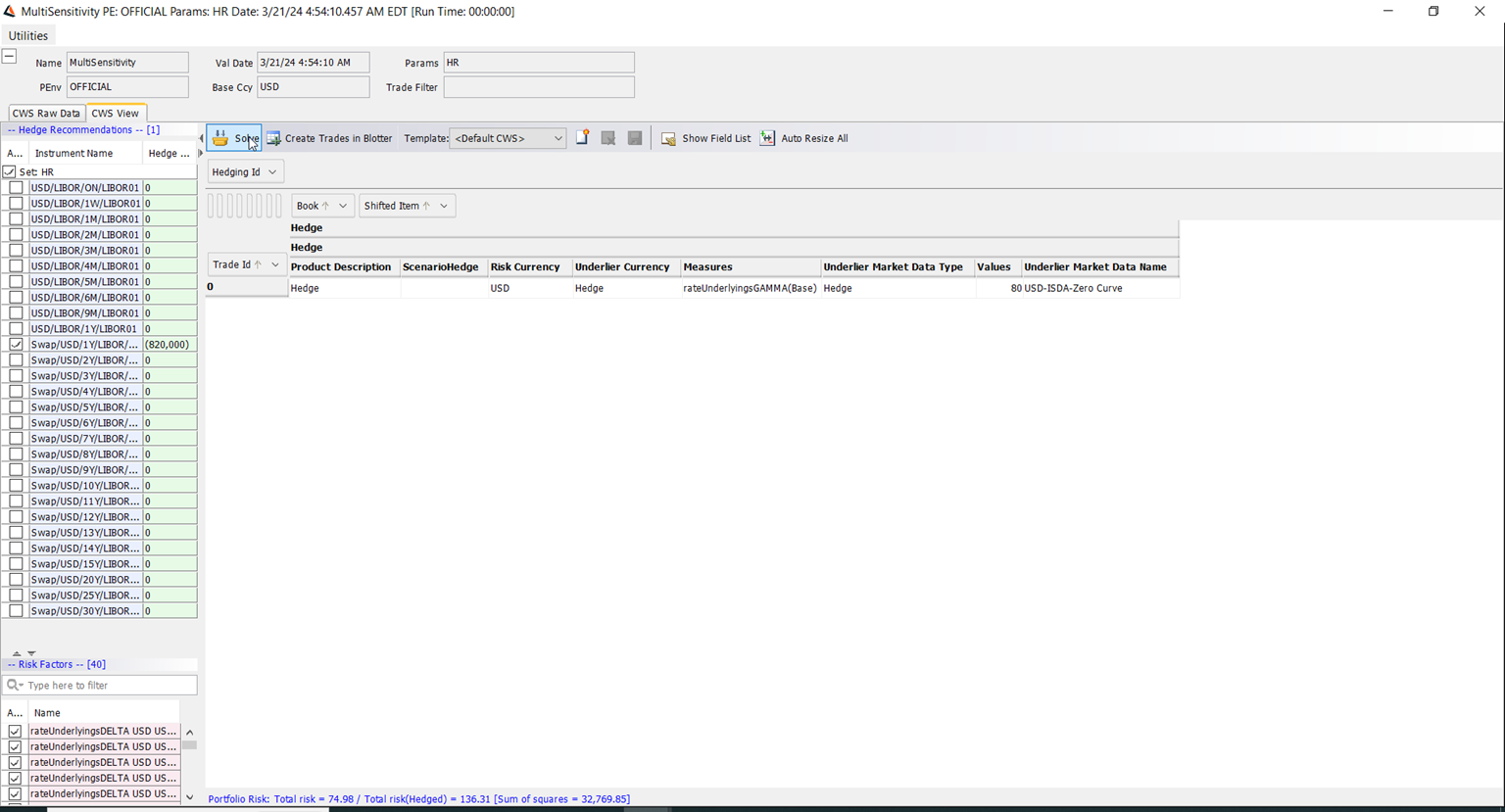

3.3 Request a Hedge Recommendation

Select Hedge Instruments

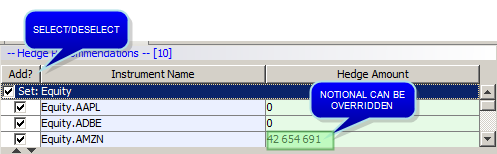

The Hedge Instruments panel displays all available hedge instruments. You can select / deselect hedge instruments individually or by group. The selected hedge instruments are used as inputs to the solver.

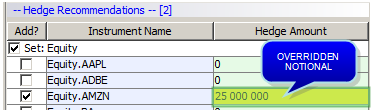

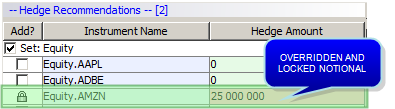

Sample overridden hedge notional

Ⓘ [NOTE: An overridden hedge notional will serve as an input to the solver]

Sample overridden hedge notional used as input

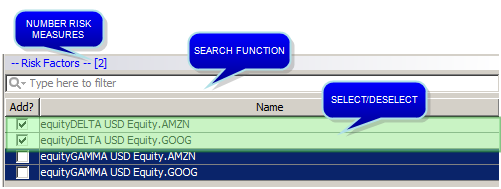

Select Risk Measures

The Risk Factor panel allows users to view, and select from, all hedgeable risk measures. The selected risk measures are used as inputs to the solver. Users can use the feature to search for a risk measure.

Launch the Solver

Click Solve to launch the solver in order to produce the hedge recommendation.

When COLLATERALIZED_PRICING is “On”, the transient hedging trades load the curves that correspond to the collateralized currency. This only applies to products defined in the domain “CollateralizedHedgingInstrument”, typically CapFloor, Swap, Swaption. “CollateralizedHedgingInstrument” assumes that the collateral policy's collateral currency matches the trade currency; the Pricer Config must be configured to reflect this.

Click "Turn live update of report data on/off" (F2) to ensure the “Hedge” selection is consistently shown in CWS; after clicking “Solve”.

3.4 Trade Blotter

Create Trades

Click Create Trades in Blotter to create the hedging trades in the Trade Blotter. The amounts used for creating these trades will come directly from the Hedge Amount field and include any changes that the user has made.

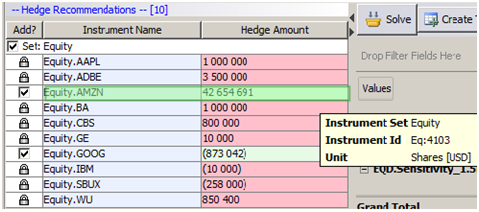

The Hedge Amount Units are dependent on the trade type and are denoted accordingly (i.e. Swaps are denoted as a notional amount, whereas Equities are shown as a rounded number of shares). The unit can be confirmed by hovering over this field.

Sample Hedge Instrument sent to the solver

Add in Workspace

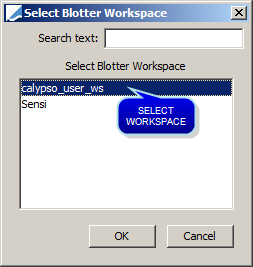

Users need to have a personal Blotter Workspace in order to directly create Hedging Trades from the Hedge Recommendation Window.

HedgeRecommendation Trade Keyword

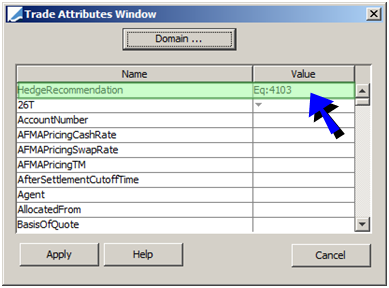

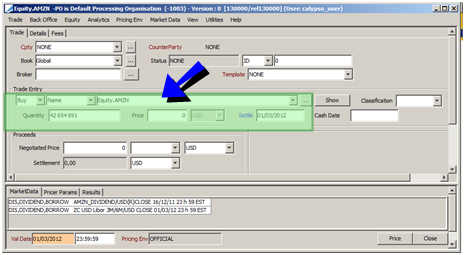

The hedging trades are created with the trade keyword HedgeRecommendation set to the ID of the corresponding hedge instrument.

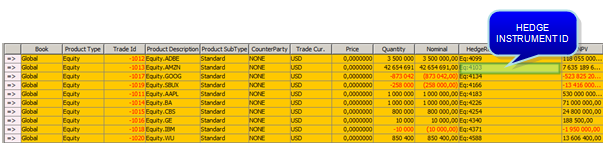

Sample hedge instruments created in Trade Blotter

Sample Hedge Instrument Set

Sample hedge trade launched from Trade Blotter

4. Hedge Analysis Process

4.1 Process

The hedge analysis will be executed as the illustration above describes:

| • | Same risk report on portfolio and hedging trades |

| • | Simulate hedging trades |

| • | Run risk reports on hedging trades |

| • | Solve |

| • | Show the expected risk after hedge |

| • | Create the hedging trades in one click |

4.2 Supported Risk Measures in Multi Sensitivity

| • | All Risk Measures are denoted in the Risk Currency |

| • | Hedgeable first order measures - Delta |

| • | Only spot risk is considered |

5. Output

You can output the Hedge Recommendation from:

| • | Ad-Hoc Reports |

| • | Real-Time Reports |

NOTES:

When launching the Hedge Recommendation Window, live updating is meant to automatically turn off so that users can compare Calypso Workstation values against those seen in the Hedge Recommendation Window.

Hedge Recommendation Window is not available from these frozen Real-Time Reports. Reactivating the Live Market Data Updating will also re-enable the ability to launch the Hedge Recommendation Window.

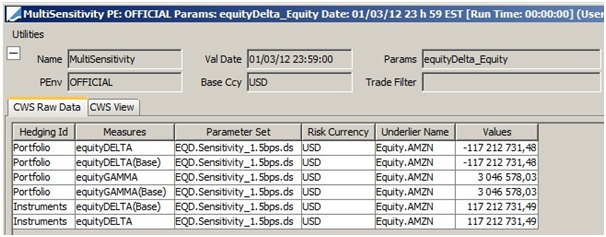

5.1 Calypso Workstation Raw Data Tab

The unformatted risk results remain available in Hedge Recommendation Window for investigation if needed. These values are pulled directly from Calypso Workstation when the report is launched.

Sample Hedge Recommendation window - Calypso Workstation Raw Data

5.2 Calypso Workstation View Tab

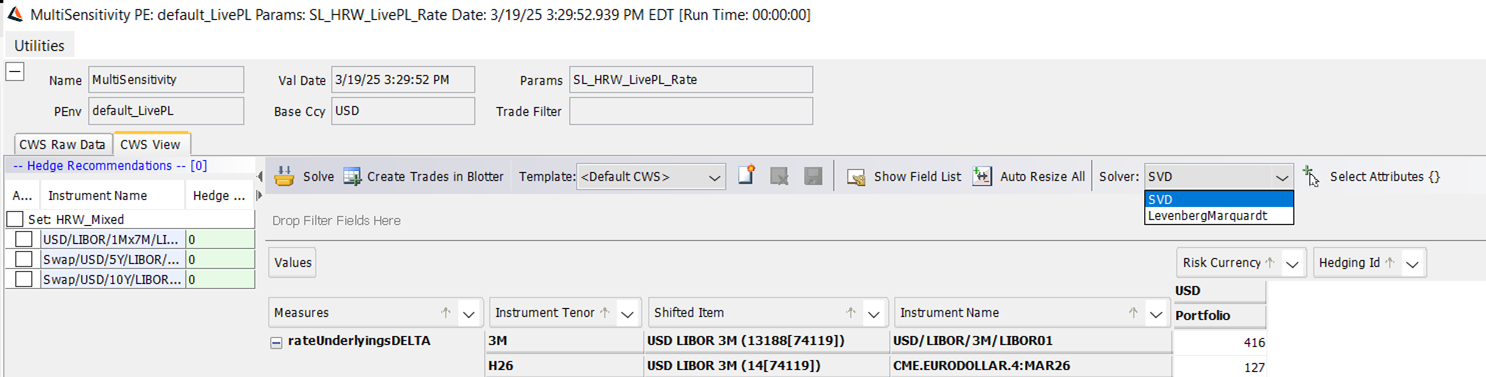

Sample Hedge Recommendation window - Calypso Workstation View

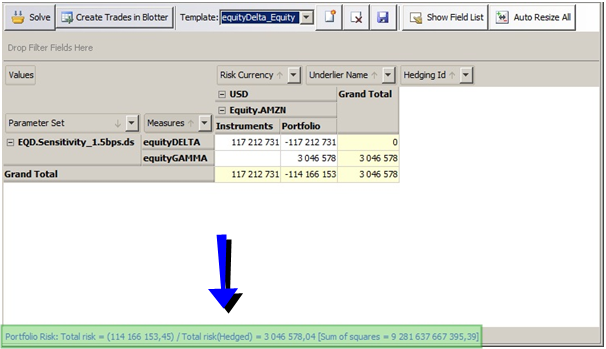

Information Strings

The information strings will appear in the bottom of the pivot view after a user has requested a recommendation from a solver by clicking Solve. It will be displayed as:

| • | Total portfolio risk |

| • | Total portfolio risk hedged |

| • | Sum of squares |

Hedging Id

The result is exploded in two parts:

| • | Portfolio: Risk of the entire portfolio, which represents the real risk. |

| • | Instruments: Risk of the recommended trades - Based on the Hedge Instruments selected and the respective notionals defined in the Hedge Recommendation Panel. |