Par Yield Curve

The Par Yield Curve window allows defining the following types of curves:

| • | Benchmark yield curves |

| • | Yield spread curves |

| • | Pricer configuration |

They can be used to price bonds (the convention is to price bonds at a spread to a yield to maturity along a benchmark yield curve that is constructed from some underlying bonds).

From the Calypso Navigator, navigate to Market Data > Interest Rate Curves > Par Yield Curve (menu action marketdata.CurveYieldWindow).

1. Defining a Benchmark Yield Curve

|

Benchmark Yield Curve Quick Reference Curve Generation 1. Click New to start a new curve. 2. Definition Panel — Select the following to define the curve: currency, Curve Type set to “Benchmark Yield Curve”, “Generate from Inst” checked, generator set to "Yield", interpolator, daycount. 3. Underlying panel — Select underlying bonds or benchmarks. 4. Quotes panel — Enter quotes and click Generate. 5. Graphs Panel — View the curve in graphical format. 6. Click Save, enter a name for the curve, and click OK. Pricer Configuration Assign the benchmark yield curve in the Credit panel of the pricer configuration for curve type "CreditRating" and usage "YIELD". |

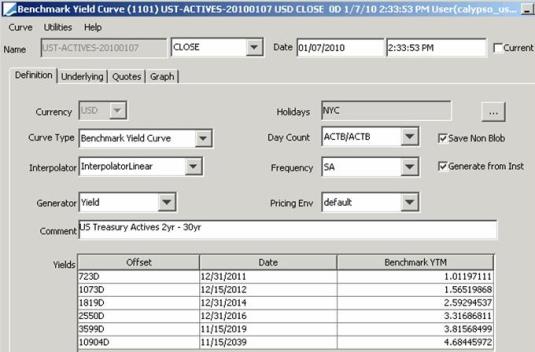

1.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: currency, Curve Type set to “Benchmark Yield Curve”, “Generate from Inst” checked, generator set to "Yield", interpolator, daycount.

| » | The yields are computed when the curve is generated. Select the Underlying panel to choose underlying bonds, bond benchmarks, or bond benchmark indices. |

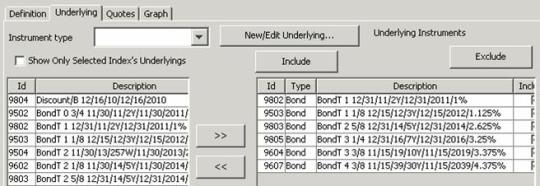

1.2 Underlying Panel

| » | Select the underlying bonds, benchmarks, or benchmark indices. |

See Bond Curve Underlying for details.

See Bond Curve Underlying for details.

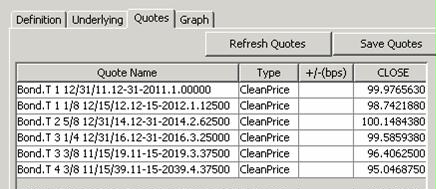

1.3 Quotes Panel

| » | Enter the quotes, and click Generate. You can view the curve in the Graph panel. |

| » | For bond benchmark indices, the yields can be directly retrieved from Bloomberg. |

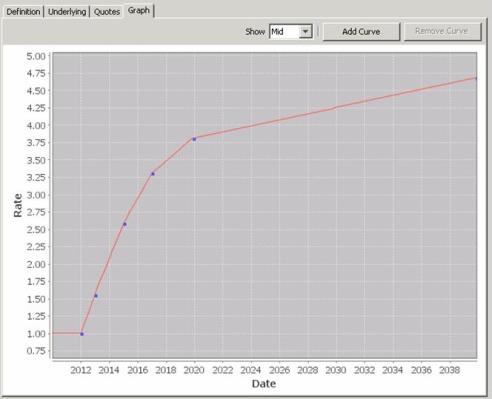

1.4 Graph Panel

1.5 Save Curve

Click Save at the bottom of the curve window. Enter a name for the curve, and click OK.

When you have the Current checkbox selected in the curve window, the system time stamps the curve with the current date and time.

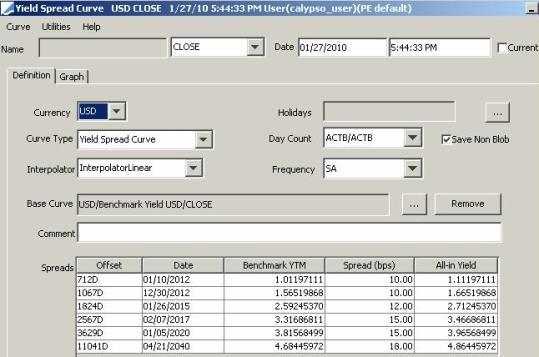

2. Defining a Yield Spread Curve

|

Yield Spread Curve Quick Reference Curve Generation 1. Click New to start a new curve. 2. Definition Panel — Select the following to define the curve: currency, Curve Type set to “Yield Spread Curve”, interpolator, daycount. The Base Curve should be a Benchmark Yield Curve: It will set the offsets and benchmark YTM. Enter the spreads in basis points. The curve is generated on-the-fly. 3. Graphs Panel — View the curve in graphical format. 4. Click Save, enter a name for the curve, and click OK. Pricer Configuration Assign the yield spread curve in the Credit panel of the pricer configuration for curve type "CreditRating" and usage "YIELD". |

2.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: currency, Curve Type set to “Yield Spread Curve”, interpolator, daycount.

| » | Select a Benchmark Yield Curve as the base curve - It sets the offsets and benchmark YTM. |

| » | Enter the spreads in basis points - The curve is generated on-the-fly. |

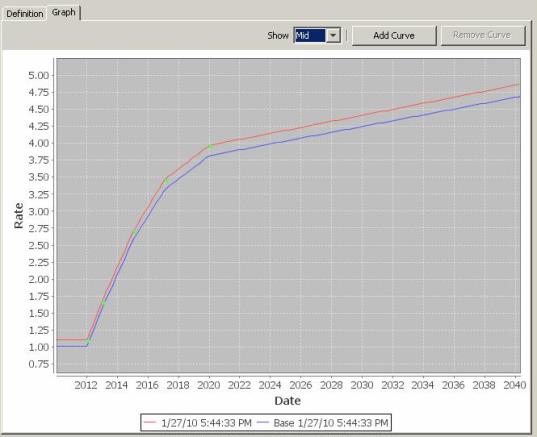

| » | Select the Graph Panel to view the curve. |

2.2 Graph Panel

2.3 Save Curve

Click Save at the bottom of the curve window. Enter a name for the curve, and click OK.

When you have the Current checkbox selected in the curve window, the system time stamps the curve with the current date and time.

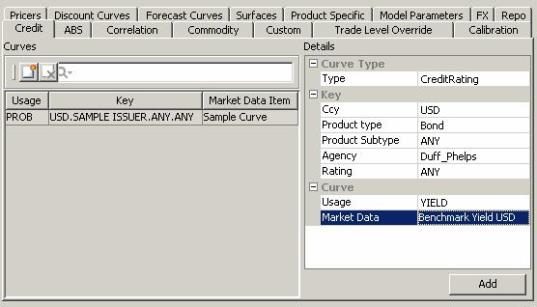

3. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Load a pricer configuration and select the Credit panel.

| » | Click  to add market data. to add market data. |

| » | In the Details area, select the curve type "CreditRating", then select the credit rating criteria: currency, product type, product subtype or ANY, rating agency, and rating value or ANY. |

| » | Select the usage YIELD, and select a par yield curve from the Market Data field. |

| » | Then click Add. |

| » | Click Save to save the changes. |