FX Curves

From the Calypso Navigator, navigate to Market Data > Foreign Exchange > FX Curve (menu action marketdata.CurveFXWindow).

This topic describes creating an FX curve:

| • | Generated from zero curves |

| • | Generated using forward points - FXPoints or FXForward |

| • | Calculated from cross-currency rates - FXCrossRate |

| • | Pricer configuration |

For precious metals, an FX curve can be generated from underlying zero curves in the precious metal currency and the settlement currency.

See FX Curves for Precious Metal for details.

See FX Curves for Precious Metal for details.

Ⓘ [NOTE: Curves can be updated in real-time using the Market Data Server]

See Market Data Server Documentation for information on configuring and running the market data server.

See Market Data Server Documentation for information on configuring and running the market data server.

1. FX Curve from Zero Curves

|

FX Curve from Zero Curves Quick Reference Pricing Parameters To use two underlying zero curves in pricing, set the following pricing parameters using Market Data > Pricing Environment > Pricing Parameter Set from the Calypso Navigator.

Zero Yield Curves Zero yield curves are required in the primary and secondary currencies. From the Calypso Navigator, navigate to Market Data > Interest Rate Curves > Zero Yield Curve to create the curves. Spot Quote A spot quote is required in the quote set associated with the selected pricing environment. For example, when generating a EUR/USD curve, set the FX.EUR.USD quote value. From the Calypso Navigator, navigate to Market Data > Market Quotes > Quotes to view or set the quote value. Curve Generation 1. Click New to start a new curve. 2. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 3. Definition Panel — Select the following to define the curve: primary currency, primary curve, secondary currency, secondary curve, “Generate from instruments” should NOT be checked, holiday calendars, pricing environment, interpolator. 4. Offsets Panel — Select the tenors and dates for which you want to generate points. 5. Points Panel — Click Generate to generate the points. You can modify the zero rates and spreads. 6. Click Save, enter a name for the curve, and click OK. Pricer Configuration An FX curve can be associated with a pricing environment under the FX panel of the pricer configuration. Ⓘ [NOTE: The selected zero curves must also be registered with the selected pricing environment] |

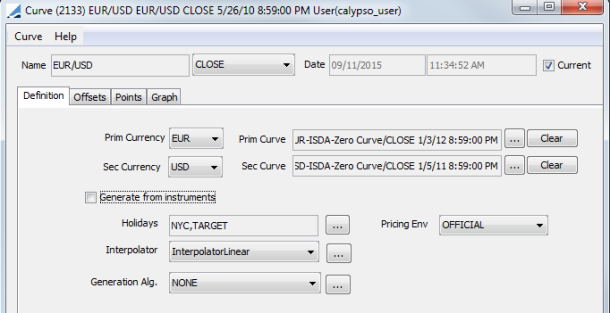

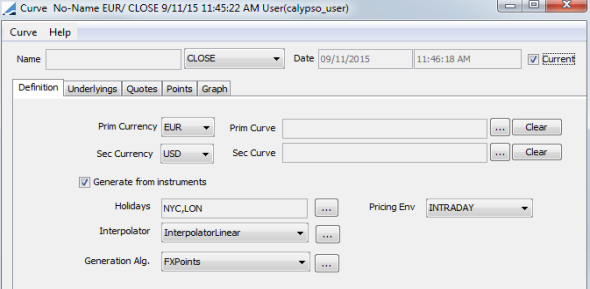

1.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: primary currency, primary curve (click ... to select the curve), secondary currency, secondary curve (click ... to select the curve), “Generate from instruments” should NOT be checked, holiday calendars, pricing environment, interpolator.

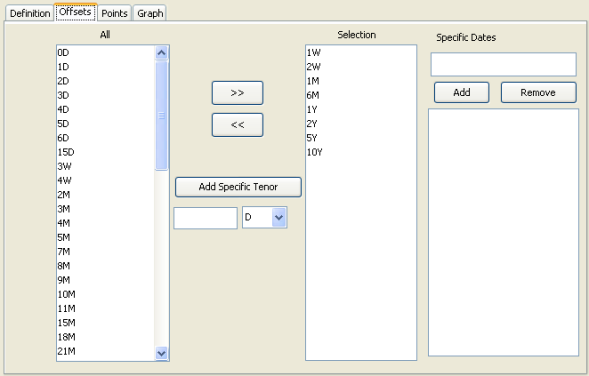

1.2 Offsets Panel

Click the Offsets tab. Select the tenors or dates.

| » | Select the offsets in the left panel, and click >> to add them to the Selection panel. |

| » | Specific Tenors — you can add specific tenors to the list. Enter the number, select the type of tenor, and click Add Specific Tenor. |

| » | Specific Dates — alternatively, you can enter specific dates for the offsets and click Add to list them in the panel below. |

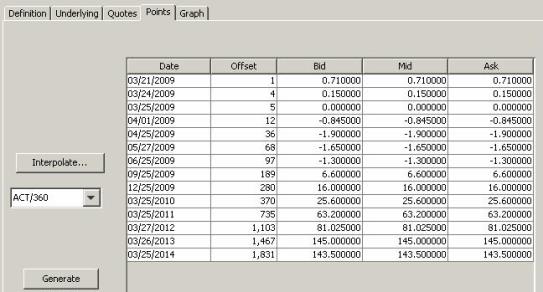

1.3 Points Panel

Click the Points tab.

| » | Select a daycount convention. From the Calypso Navigator, navigate to Help > Day-Count Conventions for descriptions. |

| » | Click Generate to generate the points. |

1.4 Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

2. FX Curve from Forward Points - FXPoints or FXForward

|

FX Curve from Forward Points Quick Reference Pricing Parameters To use forward points from an FX curve in pricing, set the following pricing parameters using Market Data > Pricing Environment > Pricing Parameter Set from the Calypso Navigator.

Zero Curve in Secondary Currency A zero curve in the secondary currency is required for discounting. This curve can be associated with a pricing environment under the Discount Curves panel of the pricer configuration. Spot Quote A spot quote is required in the quote set associated with the selected pricing environment. For example, when generating a EUR/USD curve, set the FX.EUR.USD quote value. From the Calypso Navigator, navigate to Market Data > Market Quotes > Quotes to view or set the quote value. Underlying Instruments You can use FX Forward Tenor, FX Forward Fixed and FX Forward Month End instruments in building the curve. From the Calypso Navigator, navigate to Configuration > Market Data > Curve Underlyings, or in the curve application’s Underlying panel, click New/Edit Underlying. Curve Generation 1. Click New to start a new curve. 2. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 3. Definition Panel — select the following to define the curve: primary currency, secondary currency, “Generate from instruments” should be checked, holiday calendars, pricing environment, interpolator, generation algorithm “FXPoints” or “FXForward”. 4. Underlyings panel — select the instruments. 5. Quotes Panel — click Refresh Quotes. 6. Points Panel — select a day-count convention. Click Generate to generate the points. 7. Click Save, enter a name for the curve, and click OK. Pricer Configuration An FX curve can be associated with a pricing environment under the FX panel of the pricer configuration. |

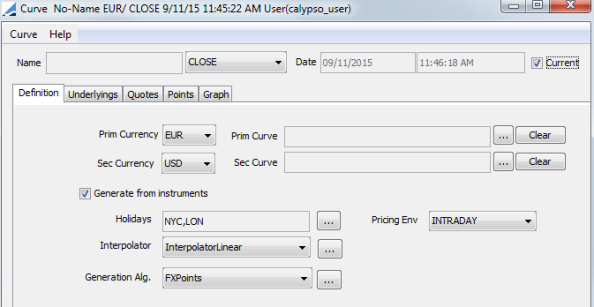

2.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: primary currency, secondary currency, “Generate from instruments” should be checked, holiday calendars, pricing environment, interpolator, generation algorithm “FXPoints” or “FXForward”.

Generation Algorithms

FXForward - To generate FX forward curves from outright FX forward rates.

FXPoints - To generate FX Curves from FX swap ("forward") points.

The difference between spot and forward rates given market-standard tenors "O/N", "T/N", "1W", "1M", etc. defined with respect to spot.

The resulting curve gives the points to be added to the spot FX rate to obtain the FX rate for delivery on a given date.

The generation is simple for points forward of the spot date, for which it is simply a matter of computing the appropriate business date for the given tenor and assigning the market-quoted points.

For quotes prior to the spot date more care is needed. Both O/N and T/N are one-day rates; O/N is the difference between an FX rate for delivery today and an FX rate for delivery tomorrow (the next business day), and T/N is the difference between the rates for tomorrow and the next business day (the spot date). To obtain the points for tomorrow one uses the T/N rate directly, but to obtain the forward points for today with respect to spot one sums the O/N and T/N rates to get a two-day rate from today to spot. Moreover, to handle the market convention for these quotes, the bid and ask of O/N and T/N are exchanged and signs may be changed before adding to spot.

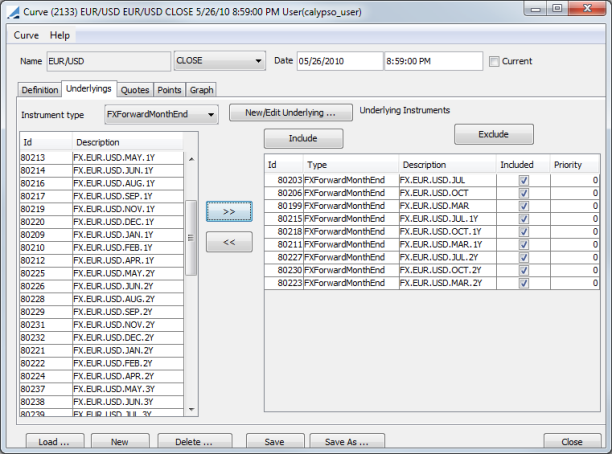

2.2 Underlying Panel

Click the Underlying tab. Select the underlying instruments to use in the curve.

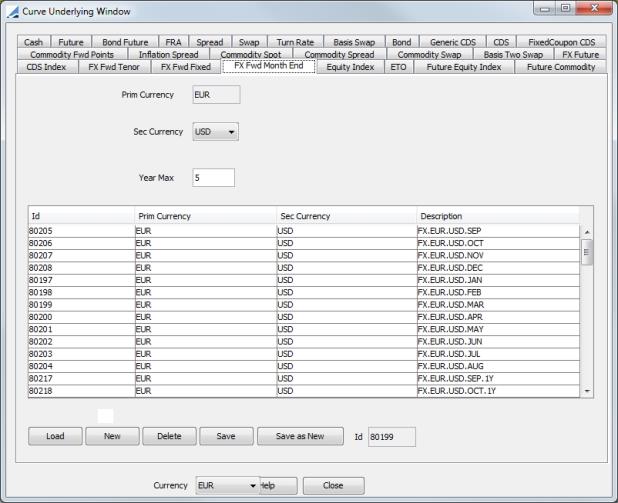

| » | Select the instrument type, and the panel below displays the list of available instruments. Instrument Types include FX Forward, FX Forward Fixed and FX Forward Month End. The panel is blank if you have not set up any instruments. |

| » | Click New/Edit Underlying to create new instruments. Clicking this button takes you to the panel of the chosen Instrument Type in the Curve Underlying Instruments window. |

| » | Select instruments and click >> to add them to the instrument list in the right panel. The Instruments will be automatically added in date order. |

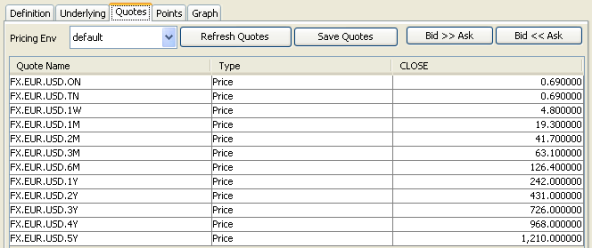

2.3 Quotes Panel

Click the Quotes tab. You can enter quotes and Save Quotes to the quote set associated with the selected pricing environment.

The quotes may be automatically populated if you are running a real-time feed, or they may be populated from the quote set associated with the selected pricing environment.

2.4 Points Panel

Click the Points tab.

| » | Select a daycount convention. From the Calypso Navigator, navigate to Help > Day-Count Conventions for descriptions. |

| » | Click Generate to generate the points. |

2.5 Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

3. Cross-Currency FX Curve - FXCrossRate

|

Cross-Currency FX Curve Quick Reference Pricing Parameters To use forward points from an FX curve in pricing, set the following pricing parameters using Market Data > Pricing Environment > Pricing Parameter Set from the Calypso Navigator.

Straight Pair FX Curves FX curves are required for the two straight pairs. For example, in a EUR/JPY cross-currency FX curve, EUR/USD and USD/JPY FX curves are required. The primary curve and the secondary curve can be created using forward points. These curves can be associated with a pricing environment under the FX panel of the pricer configuration. Spot Quotes Spot quotes are required for the two straight pairs. For example, when generating a EUR/JPY curve from EUR/USD and USD/JPY FX curves, the quotes FX.EUR.USD and FX.USD.JPY are required. From the Calypso Navigator, navigate to Market Data > Market Quotes > Quotes to view or set the quote value. Curve Generation 1. Click New to start a new curve. 2. The Current checkbox is selected by default, meaning that when you save the curve, the system timestamps the curve with the current date and time. Clear the Current checkbox to enter a back-dated curve. You can modify the date and time fields. 3. Definition Panel — select the following to define the curve: primary currency, primary curve, secondary currency, secondary curve, “Generate from instruments” should be checked, holiday calendars, pricing environment, interpolator, generation algorithm “FXCrossRate”. 4. Quotes Panel — click Refresh Quotes. 5. Points Panel — select a day-count convention. Click Generate to generate the points. 6. Click Save, enter a name for the curve, and click OK. Pricer Configuration The cross-currency, primary, and secondary FX curves can be associated with a pricing environment under the FX panel of the pricer configuration. |

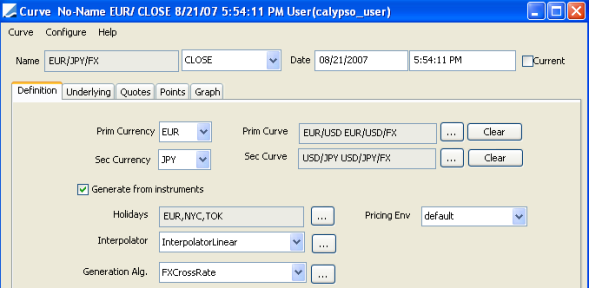

3.1 Definition Panel

Click New to start a new curve.

Select the following to define the curve: primary currency, primary curve (click ... to select the curve), secondary currency, secondary curve (click ... to select the curve), “Generate from instruments” should be checked, holiday calendars, pricing environment, interpolator, generation algorithm “FXCrossRate”.

Generation Algorithm

FXCrossRate - To generate FX forward curves for cross ccy pairs from two straight ccy pairs.

For each point after curve date on base Curve and quote Curve, it gets forward rates for those dates and calculates cross rates. The result curve then will be a collection of points that is a union of the base curve and quote curve.

3.2 Underlying Panel

Nothing is required in this panel as the underlying instruments are selected in the primary and secondary curves.

3.3 Quotes Panel

Click the Refresh Quotes button so that the curve loads the quotes. Nothing appears in this panel.

3.4 Points Panel

Click the Points tab.

| » | Click Generate to generate the points. |

3.5 Save Curve

Click Save in the bottom of the curve window. Enter a name for the curve, and click OK.

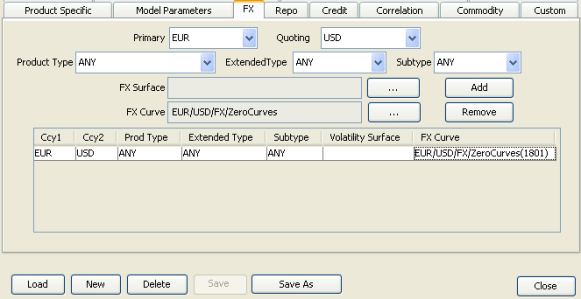

4. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Click Load, and select a pricer configuration.

Click the FX tab to bring it to the front.

| » | Click ... to select the FX curve. |

| » | Select the primary and quoting currencies, product type or ANY, extended type or ANY, subtype or ANY. |

| » | Click ... to select the FX Curve. |

| » | Select the curve in the Selection window and click Load to display the curve name in the pricer configuration. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |

Ⓘ [NOTE: If you are using zero curves, primary curves, secondary curves, etc to build the FX curves, they also need to be registered with the pricing environment]