Capturing Cross Currency Swap Trades

A cross-currency swap is a swap where each leg is expressed in a different currency.

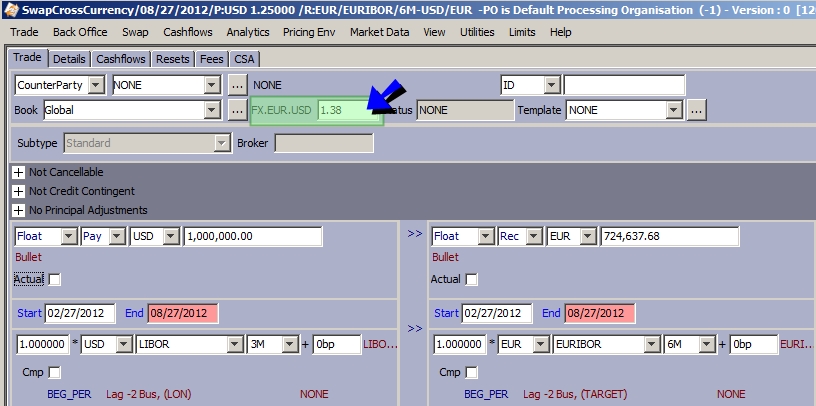

Choose Trade > Interest Rates > Swap to open the Swap worksheet, from the Calypso Navigator or from the Trade Blotter, and simply select two different currencies.

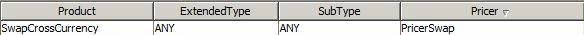

Pricer Setup

The product type is set to SwapCrossCurrency. It uses PricerSwap.

SwapCrossCurrency uses the the PL Display Ccy setting made for the currency pair's selected Pair Position Reference to determine which currency is expressed when displaying results for the trade.

For details on these settings, see "Creating a Currency Pair" in Defining Currencies and Currency Pairs.

For details on these settings, see "Creating a Currency Pair" in Defining Currencies and Currency Pairs.

1. Sample Cross-Currency Swap Trade

| » | Enter the fields described below as needed. |

| » | Then enter more trade details as described in Capturing Swap Trades. |

Ⓘ [NOTE: The trade is saved with product type SwapCrossCurrency]

Fields Details

| Fields | Description | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

FX Rate |

Enter the rate between both currencies in the field "FX.<currency>.<currency>". |

|||||||||||||||||||||

| Principal Adjustments |

If there is principal exchange (Actual checkbox checked), you can also specify principal adjustments at every coupon period based on FX rates.

Check the "Principal Adjustments" checkbox and specify the fields below.

If the pricing parameter FORECAST_FX_RATE = True, principal adjustments are forecasted upon pricing. An FX rate is projected at each payment reset using the zero curves of each currency, and the current FX quote. The current FX quote must bet set on the "Bid" side if the pricing parameter USE_FX_MID is not set to true.

The following columns have been added to the cashflows:

|

2. Forward Start Notional Adjustment Cross Currency Swap Trade

The Forward Start Notional Adjustment feature allows for projecting an FX rate from the Trade Date to the FX reset date and adjusting the notional of the selected leg whenever pricing.

This notional adjust feature can be used on any cross currency swap, including SwapNonDeliverable. When the feature is selected, the product Subtype becomes "NotionalAdj." Adjustments can be made on either the Pay or Rec leg notional.

From Calypso Navigator, point to Trade > Interest Rates > Swap to open the Swap trade window.

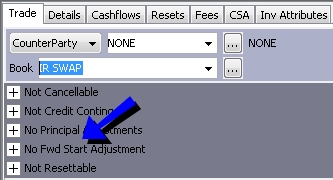

The Forward Start Notional Adjustment feature can be selected at the top of the Swap trade window. The trade is marked No Fwd Start Adjustment by default.

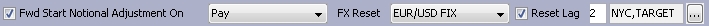

Click + to view the Fwd Start Notional Adjustment details.

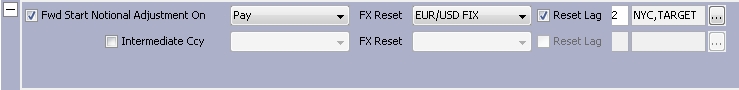

| » | Select the Fwd Start Notional Adjustment checkbox to enable a forward start for the cross currency swap, then enter details. Details are described below. |

| » | Once the forward start details are set, configure the swap trade as described generally in Capturing Swap Trades and in the Fields Details table above for SwapCrossCurrency. |

2.1 Forward Start Notional Adjustment Details

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

| Pay/Rec | Select either Pay or Rec to determine which leg will have the notional adjustment. | ||||||

| FX Reset |

Select the FX Reset to be used to fix the notional.

|

||||||

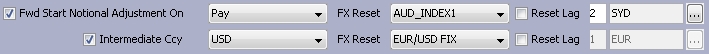

| Reset Lag | You can override the reset lag and holiday schedule by selecting the Reset Lag checkbox and making changes. | ||||||

| Intermediate Ccy |

Select the Intermediate Ccy checkbox to enable the intermediate currency list, FX Reset, and Reset Lag checkbox to the right. You can then select a third currency to calculate the FX Rate for the notional adjustment. The example in the following image represents a EUR/AUD swap split by USD.

|

2.2 About FX Resets

The FX Reset is required for the forward start notional adjustment. From the Trade Date to the Start Date the notional adjust leg will have a notional that varies according to fluctuations in the exchange rate. The notional, therefore, is re-calculated any time the trade is priced.

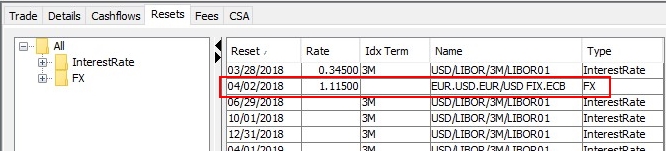

| » | The FX Reset(s) required for the notional adjustment is displayed on the trade window's Reset tab. Click Load Resets to show all resets associated with the trade. |

For further details on the trade window Resets tab, see "Displaying Resets" in the Front Office Tools documentation.

For further details on the trade window Resets tab, see "Displaying Resets" in the Front Office Tools documentation.

| » | On the FX rate fixing date, you can use either the FX Rate Reset Window or the FX_RATE_RESET scheduled task to set the FX reset fixing for the swap. |

For further details on using the FX Rate Reset Window, see "FX Rate Reset" in the Trade Lifecycle documentation.

For further details on using the FX Rate Reset Window, see "FX Rate Reset" in the Trade Lifecycle documentation.

For further details on scheduled tasks, see the Scheduled Tasks documentation.

For further details on scheduled tasks, see the Scheduled Tasks documentation.

| – | On the FX reset fixing date, the notional will be fixed on the trade by applying the RATERESET action. Ensure that this action is available for the appropriate trade status using trade workflows. |

See "Workflow Configuration" in the Workflow and Task Station documentation for details on trade workflows.

See "Workflow Configuration" in the Workflow and Task Station documentation for details on trade workflows.

| – | Once the FX reset fixes the notional on the adjustable leg, the trade becomes a regular cross currency swap. |

2.3 Projected Notional Amount

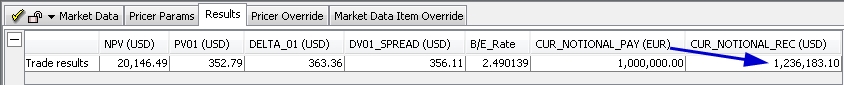

All cashflows are calculated off of the projected notional amount. After pricing the trade, the pricer measure CUR_NOTIONAL_REC/PAY displays the projected notional amount.

| » | Select the Results panel in the bottom of the trade window to see the CUR_NOTIONAL_REC/PAY measures. |

TIP: You can double-click the CUR_NOTIONAL_REC/PAY pricer measure result to open the PricerMeasure Viewer window, which shows the FX Reset Date, The FX Reset Name, and the projected FX Reset Rate being used to calculate the adjusted notional.

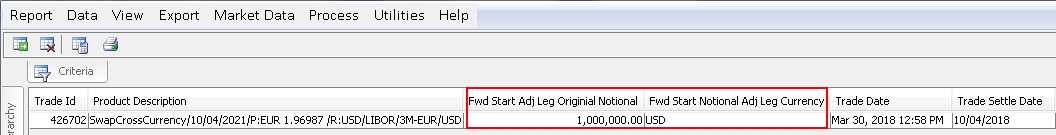

| » | You can also add columns to any of the trade reports - such as the Trade Browser and Trade Blotter - to show the currency and original notional of the adjusted leg. |

| – | Fwd Start Notional Adj Leg Currency: shows the currency of the notional adjusted leg. |

| – | Fwd Start Adj Leg Original Notional: shows the original notional of the leg before any adjustment. |