Updating Clearing Accounts (Corporate Action Method)

The legacy methods for computing variation margins will be deprecated in an upcoming release. It is recommended to use the scheduled task CLEARING_VM_CALC instead, along with the associated account structure, as described in the Calypso ETD Clearing Setup Guide.

The EOD_BROKER_VALUATION scheduled task allows updating clearing accounts with P&L and margin calls. It is based on positions computed by the Liquidation engine and it generates FUTURE corporate action trades for each Book/Product Id/Clearer/Account. The amounts are attached as fees to the corporate action trades.

1. Setup Requirements

Environment Property

Note that if the liquidation method is not manual, you have to set the environment property UseAccInFutureExplode to true to set the account number.

You can also set it to NEVER to support not setting the account number of trade open quantities for allowing manual liquidation between two PO accounts.

Clearer

Make sure that you have setup the market place and the clearer as described in the Futures Setup.

See Defining Clearers and Defining Market Places for details.

See Defining Clearers and Defining Market Places for details.

Fees

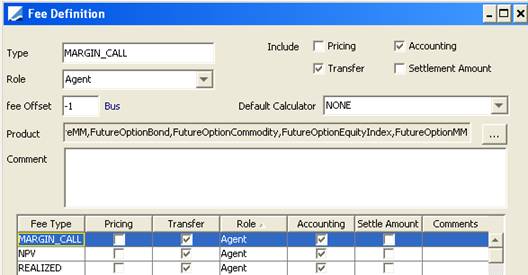

The following fees must be specified in the Fee Definition window.

| • | MARGIN_CALL — Variation Margin for all non-TSE, non-TIFFE Futures and non-LIFFE Options. |

| • | SUBST_MARGIN — Subtracted Margin for TSE and TIFFE Futures. |

| • | RENEWAL_MARGIN — Renewal Margin for TSE and TIFFE Futures. |

| • | NPV — Net present value of Option Premiums. |

Note that for NPV and MARGIN_CALL, the fees created are reversed the following business day.

The INITIAL_MARGIN is not computed and is not automatically reversed. Both the initial margin and initial margin reversal are input as a Simple Transfer. The reversal of the initial margin can be input at the same time as the initial margin.

These fees must be added using the Fee Definition window for the Agent role. There is no need to set a calculator, the scheduled task will compute the fees.

Quotes and Market Data

Make sure that you have quotes and market data for the futures, futures options, and underlying instruments.

2. Running the EOD_BROKER_VALUATION Scheduled Task

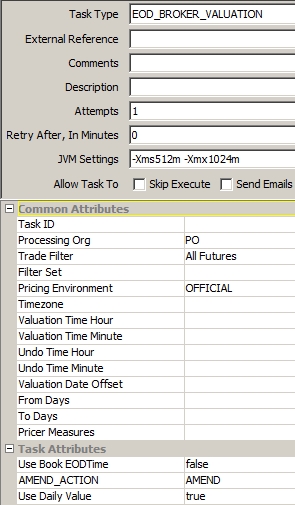

From the Calypso Navigator, navigate to Configuration > Scheduled Tasks (menu action scheduling.ScheduledTaskListWindow), and select the type EOD_BROKER_VALUATION.

Scheduled Task EOD_BROKER_VALUATION

| » | Select a Trade Filter, Pricing Env and a Processing Org. |

Note that the trade filter must contain product types.

| » | Set the attributes as needed. |

| – | Use Book EOD Time - If set to true, the "valDatetime" is set to the Book EOD Time when loading the positions. |

| – | AMEND_ACTION – Select the action to be applied in case of amendment. The AMEND action is applied by default. |

| – | Use Daily Value - If set to true, the fee RENEWAL_MARGIN is calculated based on the difference between yesterday's quote and today's quote. Otherwise, RENEWAL_MARGIN is calculated based on the difference between today's quote and the original trade price. |

| » | Save the task, and execute it. |

3. Viewing the Results

You have multiple possibilities to view the results.

You can view the corporate actions trades from the Trade Browser – The fees associated with the corporate actions in the Fee report – The transfers associated with the fees in the Transfer report.

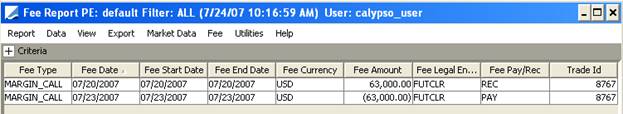

Sample Fee report - In this example, there is no realized P&L, only an open position.

The MARGIN_CALL fee is reversed the day after the fee date.