Capturing Issuance Trades

An issuance trade allows configuring issues offered by a processing org.

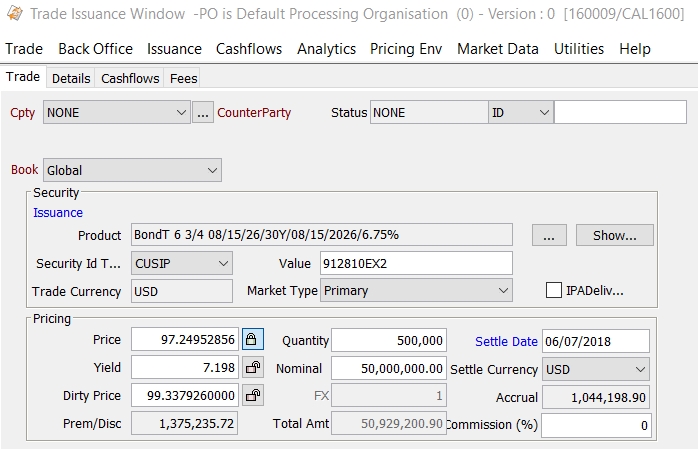

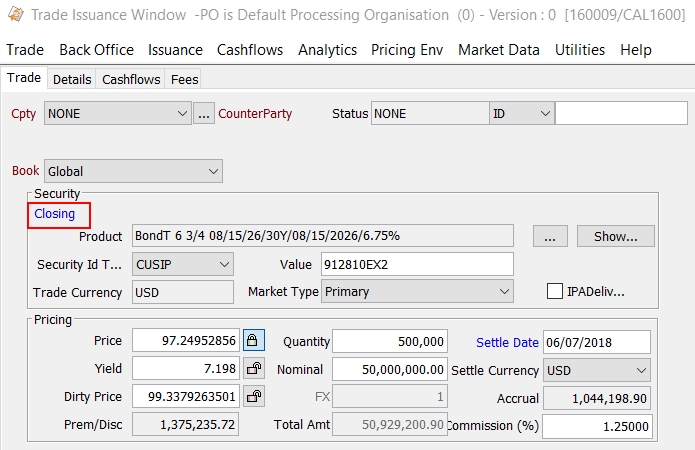

To configure an issuance trade, navigate to Trade > Fixed Income > Issuance (menu action trading.TradeIssuanceWindow).

|

Issuance Quick Reference

Entering Trade Details

Or you can enter the trade fields directly. They are described below. Note that the Trade Date is entered in the Details panel.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Trade Lifecycle

|

1. Sample Issuance Trade

Issuance Trade - Fields Details

|

Fields |

Description |

||||||

|

Cpty |

Trade counterparty. It will control the settlement and delivery instructions of the trade. The Trade counterparty is a Legal Entity. The default role is Counterparty, however, you can change this role as applicable. Double-click the Counterparty label to change the role. You will be prompted to select a role. You can select a legal entity of specified role provided you have set up favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type Ctrl-F to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. |

||||||

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. The processing org of the book identifies the processing org of the trade. |

||||||

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

||||||

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

||||||

|

Issuance / Closing |

Type of trade. Double-click the Issuance label to change to Closing as applicable. Closing actually corresponds to ending the Issuance. |

||||||

|

Product |

Click ... to open the Product Chooser window for selecting a bond. The bond should have the following characteristics:

You can click Show to display the bond’s details. |

||||||

|

Security Id Type Value |

Defaults to the product code selected in the User Defaults, and displays its value. You can select another product code as applicable. |

||||||

|

Trade Currency |

Defaults to the bond’s currency. You can select another currency as applicable. |

||||||

|

Market type |

Defaults to Primary. |

||||||

|

Price |

Enter the issue or closing clean price. The Dirty Price and Yield fields will be computed accordingly. |

||||||

|

Yield |

Displays the issue or closing yield. |

||||||

|

Dirty Price |

Displays the issue or closing dirty price (price + accrual as applicable). |

||||||

|

Prem/Disc |

Displays the issue premium discount (difference between the issue and the redemption price). |

||||||

|

Quantity |

Defaults to the issued quantity of the selected product. |

||||||

|

Nominal |

Defaults to the issued nominal of the selected product. The nominal should not be higher than the issued nominal. |

||||||

|

FX |

Only applies when the settlement currency is different from the trade currency. Enter the FX rate between the settlement currency and the trade currency as needed. |

||||||

|

Total Amt |

Displays the settlement amount in settlement currency. |

||||||

|

Settle Date |

Settlement date of the trade. The settlement date defaults to the trade date. Double-click the Start Date label to apply the number of settlement days specified in the selected product. The settlement date uses the holiday calendar selected in the User Defaults to identify business days. You can modify the settlement date as applicable. |

||||||

|

Settle Currency |

Defaults to the trade currency. You can modify the settlement currency as applicable. You can use the environment property USE_ISSUANCE_CCY. When true, transfers use the product currency regardless of the settlement currency. When false, transfers use the settlement currency. Default is false. |

||||||

|

Accrual |

Accrual amount. |

||||||

|

Commission % |

Percentage of issuance commission. This percentage will be applied to the position at the time of coupon. Use the Fee panel, if a commission has to be paid at the beginning of the issuance. |

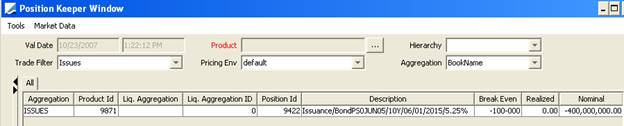

2. Issuance Position

From the Calypso Navigator, navigate to Position & Risk > Positions to view the open position of the issuance, provided the liquidation is running.

Note that the system creates an Issuance product linked to the bond, when the Issuance Trade is validated.

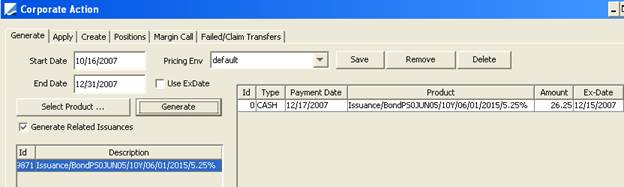

3. Issuance Corporate Actions

From the Calypso Navigator, navigate to Trade Lifecycle > Corporate Action > Corporate Action to generate corporate actions. The Corporate Action window will appear as shown below.

The characteristic of corporate actions on issuance trades is that they are generated on the Issuance product created by the system and not on the bond of the issuance trade.

| » | Enter the start and end dates as applicable. |

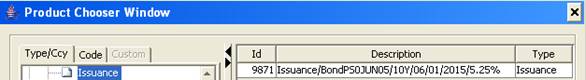

| » | Click Select Product and choose the Issuance product as shown below. |

| » | Then click Generate to generate the corporate actions. |

4. Closing an Issuance

You can close an issuance by entering a Closing trade on the bond using the Issuance window to buy back the bond.

The Closing trade will liquidate the entire open position of the bond.

See also -

See also -