Capturing Inflation Bond Trades

Navigate to Trade > Fixed Income > Bond to open the Bond Trade window, from the Calypso Navigator or from the Trade Blotter.

Prior to capturing an Inflation bond trade, you need to define an Inflation bond product.

See Defining Bond Products for details.

See Defining Bond Products for details.

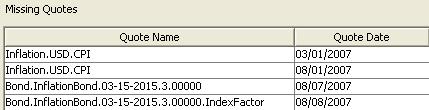

1. Quotes Specification

Prior to trading this type of bond, you need to check the quotes. Choose Pricing Env > Check to check the quotes. The Check Pricing Env window will appear as shown below.

You need quotes for the index “Inflation.Currency.Index” 3 months before and 2 months before, a quote for the bond, and a quote for the index factor.

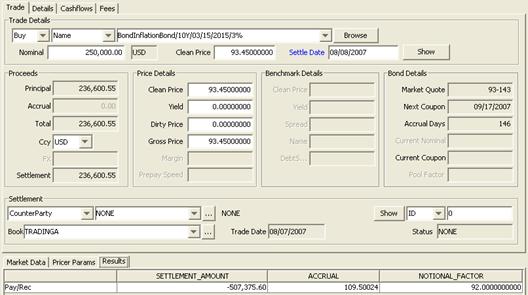

2. Sample Inflation Bond Trade

See Capturing Bond Trades for complete details on capturing trades.

See Capturing Bond Trades for complete details on capturing trades.

| » | Enter a gross price and a quantity. We consider that the gross price already takes the index factor into account. |

The yield, dirty price and clean price will be computed. The Clean Price in the Market Price (quote entered on the bond). The Accrual (%) is the accrual amount multiplied by the index factor on the settlement date.

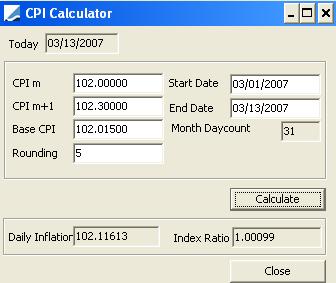

| » | Choose Market Data > Utilities > CPI Calculator to simulate the notional factor calculation as shown below. |

| – | Enter the CPI value 3 months ago (CPIm), the CPI value 2 months ago (CPIm+1), and the base CPI value (specified in the Special panel of the bond). Enter a number of decimal places in the Rounding field as applicable. Then click Calculate. |

2.1 CPI Pricer Measures

NPV = (Dirty Price on Val Date - Dirty Price of Buy Trade) * Nominal Amount

Notional Factor = Index Factor on Val Date (interpolation of the index values from 3 months and 2 months)

Price = Market Price on Val date * Index Factor on the settlement date

Dirty Price = Price + (Accruals * Index Factor on the settlement date)

2.2 RPI Pricer Measures

Index Ratio = (RPI figure 8 months prior to last coupon date) / (RPI figure 8 months before issuing date (base RPI))

English Market rounding rules:

| • | Interest and redemption payments for the 2% Index-linked Treasury Stock 2006 (ISIN GB0009061317) and 2.5% Index-linked Treasury Stock 2011 (ISIN GB0009063578) are rounded DOWN to 2 decimal places per £100 nominal. |

| • | For all other index-linked gilts with first issue dates before 2002 the Interest and redemption payments are rounded DOWN to 4 decimal places per £100 nominal. |

| • | For index-linked gilts with first issue dates of 2002 onwards, the Interest and redemption payments are rounded TO THE NEAREST 6 decimal places per £100 nominal. |

Interest Rate for each payment = Coupon rate (usually fixed rate) adjusted to the RPI movement = (Coupon rate / n)*( RPI 8cp / Base RPI)

where n = number of annuities /year (usually 2), Base RPI = RPI figure 8 months before issuing date (figure to be used for the calculations of interest payments during the bond life), and RPI 8cp = RPI figure 8 months prior to last coupon date.

Coupon = adjusted Coupon rate (rounded down to 4 decimals) * nominal

Accrued interests = Adjusted coupon rate * (number of days since last coupon date / number of days in coupon period) * nominal

Redemption Payment = Nominal holding * (RPI 8cp / Base RPI)

UK Gilt already has the indexation built into the quoted price. As a result, the indexation calculation applies only to accrued interests.

RPI values are published monthly, around the 17th of each month. It is entered into Calypso under the quote name: “Inflation.GBP.RPI.Tenor” every first of each month.

2.3 ABS Inflation Bonds

Inflated coupon = (RPI/CPI index relative to coupon end date) / Index value specified on bond * coupon rate / # periods per year (e.g. 2 for SA)

Accrual = Inflated coupon * [(accrued # of days / # of days in the period) * Trade Quantity] / 100 * Face Value (accrual date).

2.4 Valuation of Inflation Bonds

Note that TIPS should use PricerBondUST.

Example of valuation on 04/25/04, settlement date 04/26/2004.

| » | When pricing using index values, you only need the market price of the bond on 04/25/2004. |

| – | PRICE = Market Price of the bond on val date * Index Factor on settle date |

| – | ACCRUAL = Accrual as of settle date * Index Factor on settle date |

| – | NPV = (Dirty Price * Open Position) – Initial settlement amount |

| – | ACCRUAL_BO = Accrual as of the 05/29/02 * Index Factor 05/29/02 |