Capturing Floating Rate Notes Trades

Navigate to Trade > Fixed Income > Bond to open the Bond Trade window, from the Calypso Navigator or from the Trade Blotter.

Prior to capturing an FRN bond trade, you need to define an FRN bond product.

See Defining Bond Products for details.

See Defining Bond Products for details.

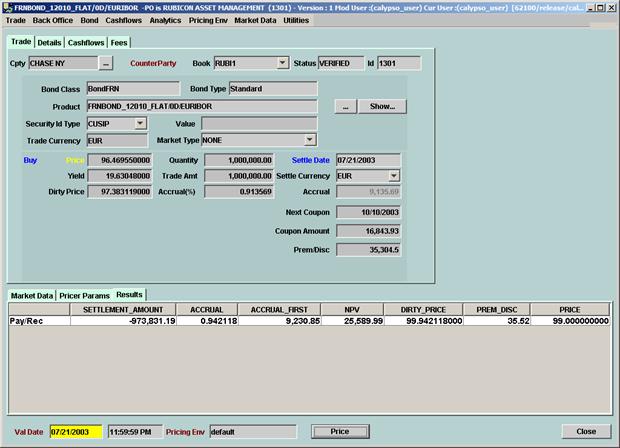

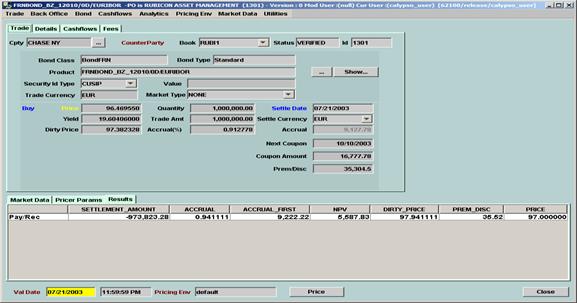

1. Sample FRN Bond Trade

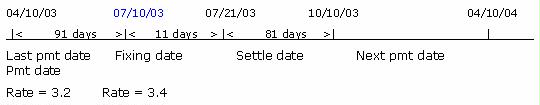

When trading the bond in between two coupon payment dates, the system calculates the accruals and coupon payment at settlement date based on the past fixing rates since last coupon payment.

Based on the bond definition, BOND_12010 (no compounding method), Selling 1,000,000 shares traded at a settlement date = 07/21/03.

See Capturing Bond Trades for complete details on capturing trades.

See Capturing Bond Trades for complete details on capturing trades.

At Settlement date:

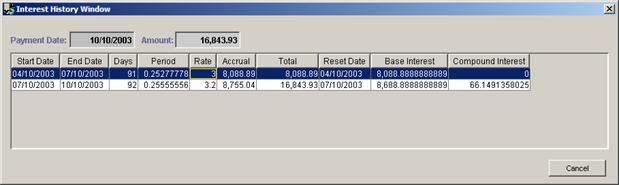

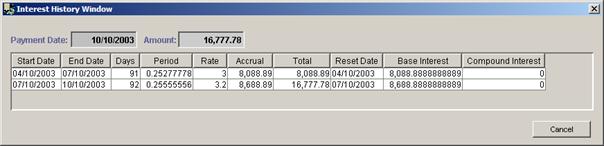

| • | Coupon Amount: 16,777.89 |

= ((91 * 3.2 * 1,000,000.00)/ 36000) + ((92 * 3.4 * 1,000,000.00)/36000)

| • | Accrual: 9,127.78 |

= ((91 * 3.2)/360 + (11 * 3.4)/360) * 1,000,000.00

| • | Accrual (%): 0.912778 |

= ((91 * 3.2%)/ 36000) + ((11 * 3.4%)/36000)

| • | Dirty Price: 97.382328 |

= Clean Price + accrual (%) = 96.46955 + 0.912778

| • | Prem/Disc: 35,304.5 |

= (Redemption Price - Clean Price) / 100 * Quantity

= ((100 - 96.46955)/100) * 1,000,000

At Value date:

| • | NPV: 5,587.83 |

Discounting the coupon amount calculated previously at value date (07/21/03)

= (Dirty Price at Settle Date * Quantity) – (Dirty Price at Value Date * Quantity)

= ((99.382328 – 97.941111) / 100) * 1,000,000

| • | PREM_DISC = 35.52 |

= (((96.46955 – 100) / 100) / 994) * 1,000,000

| • | ACCRUAL_FIRST = 9,222.22 |

= ((91 * 3.2)/360 + (12 * 3.4)/360) * 1,000,000.00

| • | DIRTY_PRICE = 97.941111 |

= 97 + 0.941111

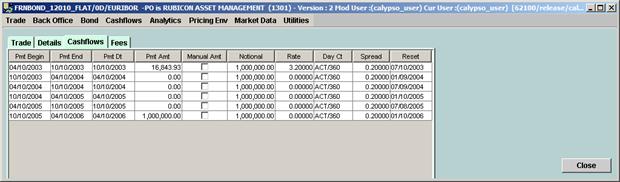

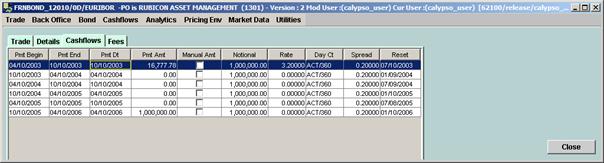

By looking at the cashflows of the trade, you have the option to see the internal flows from which the coupon is composed of.

On the same bond, if the compounding method = flat, the results become: