Capturing Danish Mortgage Bond Trades

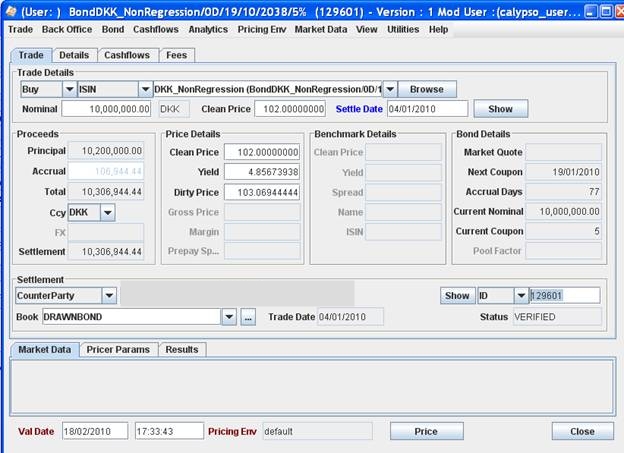

Navigate to Trade > Fixed Income > Bond to open the Bond Trade window, from the Calypso Navigator or from the Trade Blotter.

Prior to capturing a Danish Mortgage bond trade, you need to define a Danish Mortgage bond product.

See Defining Bond Products for details.

See Defining Bond Products for details.

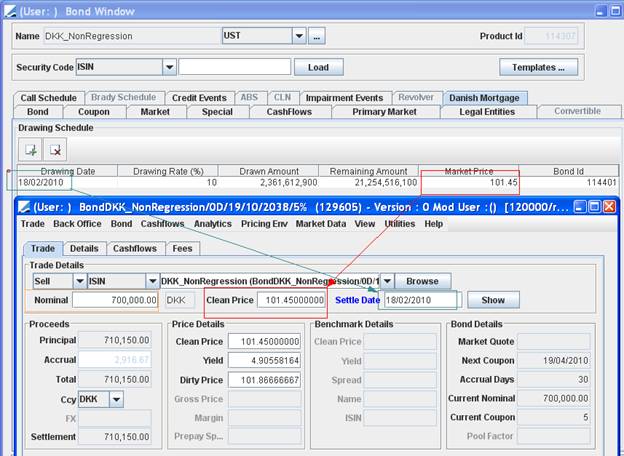

1. Sample Danish Mortgage Bond Trade

See Capturing Bond Trades for complete details on capturing trades.

See Capturing Bond Trades for complete details on capturing trades.

2. Drawing Corporate Action

If domain "DMBS_DrawsOnRepos" contains Value = True, include Repos in CA Trades against Processing Org (built from PL Position) on events with model/subtype REDEMPTION/DRAWING - If Value = false or empty, exclude Repos in CA Trades against Processing Org.

2.1 Legacy Drawing Corporate Action

To generate the Corporate Actions, navigate to Trade Lifecycle > Corporate Action > Corporate Action.

At drawing date, the position on the master bond is amortized by the drawn amount, and a drawn position is generated on the drawn bond. Both bonds can be traded.

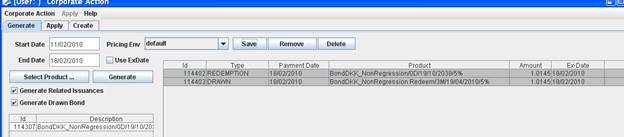

Generating the Corporate Action

Select the Generate panel, and generate the corporate action at drawing date on the master bond.

If "Generate Drawn Bond" is checked, the system will automatically create the drawn bond (in case it has not been created in the bond product definition).

If "Generate Drawn Bond" is clear, the system will not create the drawn bond but will stop the CA process in case the drawn bond does not exist.

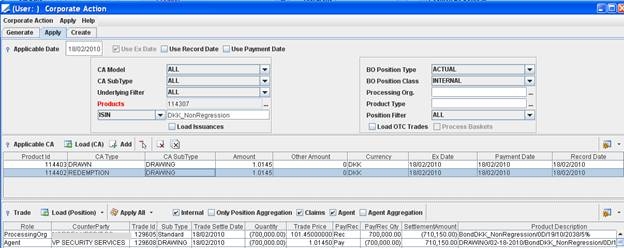

Applying the Corporate Action

Select the Apply panel.

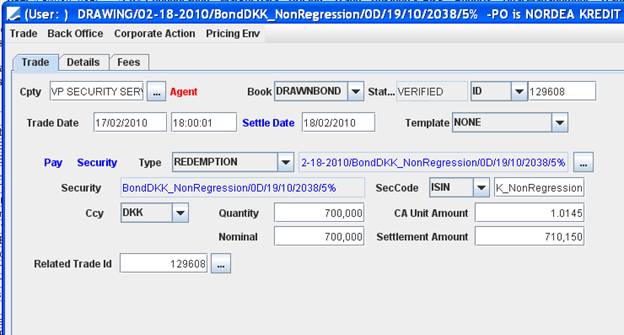

The master bond is amortized by the amount of the drawing (drawing rate applied to the open position) using a REDEMPTION corporate action.

It creates two CA trades:

| • | One CA trade type REDEMPTION / DRAWING between the book and the PO in order to update the P&L. Setting the environment property BOND_REDEMPTION_TRADE=true will generate a Sell trade instead. |

The clean price is computed using the market price of the drawing schedule.

| • | The other trade type REDEMPTION / DRAWING between the book and the Agent will carry out the SECURITY transfer to the agent as well as the message and accounting entries. |

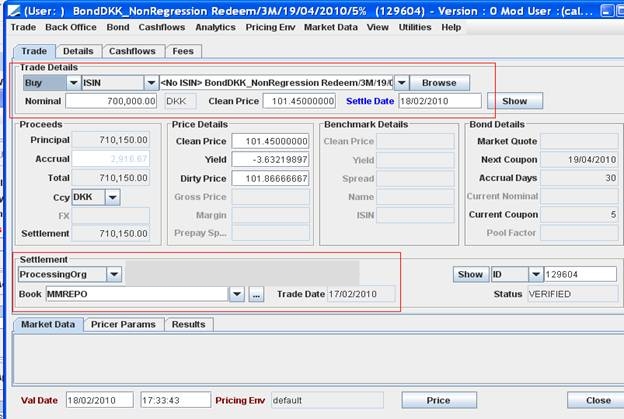

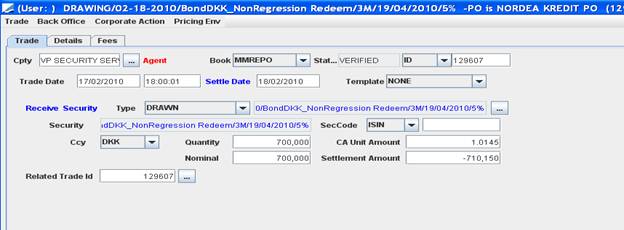

A position is created on the drawn bond through the DRAWING corporate action. Two CA trades are created:

| • | One CA trade type DRAWING / DRAWING between the book and the PO in order to update the P&L. Setting the environment property BOND_REDEMPTION_TRADE=true will generate a Buy trade. |

The trade is created on the same book as the "master" book by default, or on the book specified in book attribute "Drawn MM Book" on the "master" book.

| • | The other CA trade type DRAWING / DRAWING between the book and the Agent will carry out the SECURITY transfer from the agent as well as the message and accounting entries. |

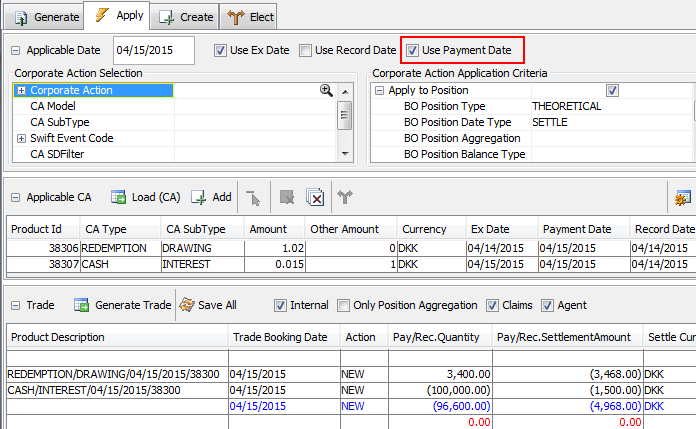

2.2 TARGET2 Compliant Corporate Actions

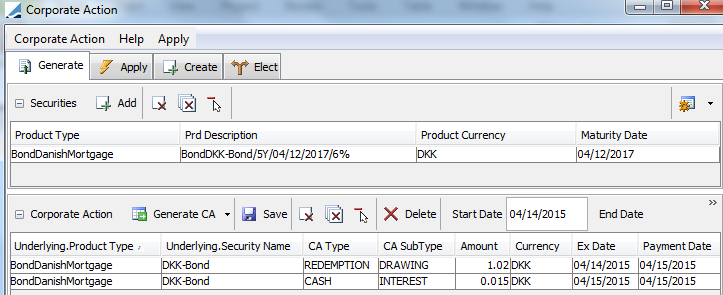

To generate the Corporate Actions, navigate to Trade Lifecycle > Corporate Action > Corporate Action.

The system creates two corporate actions for Danish Mortgage Bonds on the same payment date: REDEMPTION/DRAWING in order to amortize the bond by the drawn amount, and CASH/INTEREST in order to generate the coupon amount.

The corporate actions should be applied by payment date so that they can be created together.